A Moment in Time: Benqi's Present Picture

What is BENQI?

BENQI is a decentralized finance protocol constructed on the Avalanche blockchain. The protocol comprises two significant components: BENQI Markets and BENQI Liquid Staking.

BENQI Markets is designed to provide users with an effortless way to lend, borrow, and earn interest on their digital assets. By providing liquidity to the protocol, depositors can earn yield, while borrowers can access loans in an over-collateralized (secured) manner. This service is permissionless, which means any DeFi user can instantly supply and withdraw liquidity from a shared market. Borrowers can also use their supplied assets as collateral to access loans instantly. Furthermore, BENQI Markets offer a live, transparent view of interest rates that change based on the asset's market supply and demand dynamics.

On the other hand, BENQI Liquid Staking is an Avalanche liquid staking solution that tokenizes staked AVAX, the native token of the Avalanche network. This functionality provides users with increased flexibility by allowing their staked AVAX to be used, swapped, or collateralized within DeFi applications. Essentially, it transforms locked-up capital (staked AVAX) into a fungible, yield-generating asset that can be traded or used as collateral. Moreover, users can seamlessly stake their AVAX on the Avalanche Contract Chain (C-Chain) without having to deal with complicated cross-chain transfers or server hosting.

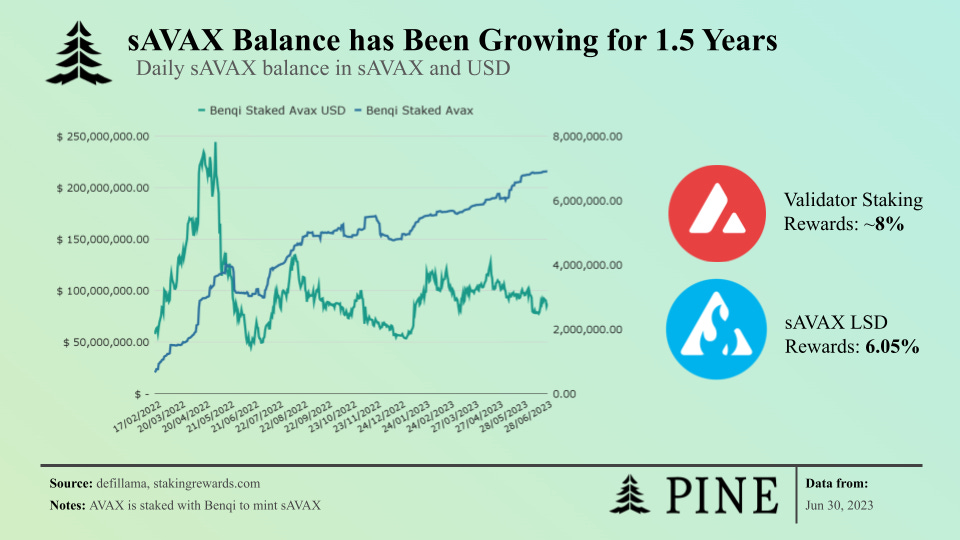

sAVAX Token Growth

Since the start of 2022, BENQI Finance's staked AVAX has grown significantly, symbolizing increased faith in the protocol. Approximately $100 million worth of AVAX is staked, with validators earning about 8% on their stakes. This creates a substantial flow of funds, with 6% going to the holders of the liquid staking derivative and a 2% spread going between BENQI Finance and the validators. Given current market conditions, this generates an annual cash flow of around $2 million.

BENQI’s governance structure gives decision-making power to holders of vote-escrowed QI (veQI). They can vote for specific Avalanche validators, enabling effective delegation of the staked AVAX. Based on the current take rate and volume, BENQI Finance earns about $200K annually from sAVAX's taker fee, and influeces the distribution of the remaining $1.8 million staking revenue among chosen validators.

The potential for growth within BENQI's financial structure is closely tied to market conditions. As the popularity of BENQI Finance and the Avalanche DeFi sector increases, cash flows - inherently linked to the price of AVAX and the amount staked - are expected to rise correspondingly. In a scenario where the adoption of Avalanche accelerates and sAVAX utility within the Avalanche DeFi ecosystem widens, this could lead to a notable surge in these cash flows. Conversely, should interest or adoption rates decrease, it could potentially stifle this cash flow growth for the sAVAX token.

sAVAX Token Use

Since the beginning of 2022, the sAVAX token on the Avalanche network has demonstrated significant traction, with nearly 250,000 wallets interacting with it in that year alone. This momentum continues into 2023, with an estimated 75,000 additional wallets coming into the fold. This surge in adoption suggests that sAVAX is rapidly becoming a key player in the Avalanche DeFi ecosystem.

A deeper examination of the sAVAX token distribution brings to light a compelling trend: a whopping 88% of these tokens are staked in the money markets Aave, Benqi, and Platypus Finance. This pattern indicates that users are primarily utilizing these tokens as a vehicle to secure loans while earning a yield on their holdings. This broad utilization of sAVAX tokens in such a manner reinforces its utility and attractiveness in the Avalanche DeFi ecosystem.

Benqi Lending Market Dynamics

The present status of the assets within Benqi Finance provides a fascinating outlook. There is approximately $150 million worth of assets deposited into the platform, while about $33.9 million worth is being lent out. At the current pace, the market dispenses around $2.8 million annually to supply liquidity, while it receives approximately $1.4 million from borrowers. This scenario indicates a potential shortfall of about $1.4 million annually, which warrants consideration.

The platform is experiencing an outflow where it's paying more to the sAVAX depositors than it's gaining from the borrowers. This imbalance is causing an annual loss of over a million dollars at the current rate, a situation that raises significant sustainability and profitability concerns for Benqi Finance's lending market. Interestingly, this could be one of the reasons why we're observing a substantial proportion of sAVAX tokens being deposited into Benqi Finance. It seems that the protocol's current incentive structure might be inadvertently promoting the concentration of sAVAX within its platform.

However, for a healthier and more sustainable ecosystem, it would be beneficial for Benqi Finance to consider strategies that encourage the integration of sAVAX into other protocols. By fostering its token's wider usage in the DeFi landscape, the platform could potentially mitigate the current loss on its lending market. Moreover, it would diversify the utility and application of sAVAX, reinforcing its value proposition within the broader DeFi sector. This strategic pivot calls for an insightful understanding of market dynamics and a proactive approach to protocol governance.

Benqui Lending Market Users

When analyzing Benqi's lending market's user activity, a notable pattern emerges from the data. Despite boasting a broad base of depositors, around three-quarters of these users have less than $10 deposited into the protocol. In fact, of the current 40,000 depositors, only about 7,500 users have over $100 deposited. These figures suggest that Benqi's lending market is characterized by a small, highly engaged user base that contributes significantly to the platform's total deposits.

Moreover, since the start of this year, there's been an influx of new users, with approximately 35,000 new wallets interacting with the lending market. Cumulatively, Benqi Finance has engaged with 125,000 wallets, marking an impressive reach within the DeFi space. This steady influx of new users interacting with the lending market since the end of 2021 signifies a positive growth trend for Benqi Finance. However, it's important to underline that despite the significant growth in user numbers, the lending market is heavily skewed towards a small cohort of active, high-value users.

QI Token Activty

Analyzing the performance of the QI token from mid-2021 reveals a consistent downtrend in its price on a. Currently, the token is hovering near its lowest point. Around August 2022, the token's supply witnessed a substantial increase. This surge resulted in an uptick in the token's market cap, while the price of the QI token experienced depreciation.

Interestingly, the primary factor driving the token's price appears to be changes in its supply. These supply increments have been systematically leading to price reductions. However, it's worth noting that despite half the tokens being put into supply (and a larger supply in circulation than before), the market cap of the token has remained relatively stable. This stability suggests that the overall project valuation hasn't been declining as rapidly as the token price would indicate.

Conclusion

In the context of Avalanche's liquid staking business, it is projected to generate approximately $6.75 million annually if it manages to capture 12.5% of the AVAX tokens at the current market capitalization of AVAX. If AVAX manages to appreciate to $50, this potential revenue could increase to an impressive $25 million annually. Assuming sAVAX can secure a third of this market share, its cash flow from liquid staking could range from $2.25 million to $7.5 million.

BENQI’s current supremacy in the liquid staking derivative market on Avalanche testifies to its successful maneuvering. Should Avalanche increase in value, thereby prompting an augmented demand for loans, BENQI is well-positioned to reap the benefits of two significant growth drivers: the cash flow from its liquid staking tokens being worth more, and Increased demand for yeaild bearing colateral. These twin sources of revenue could lay a strong foundation for BENQI's continued expansion within the Avalanche DeFi arena.