Bridge Activity: BTC.b's Present Picture

Introduction

For years, Bitcoin (BTC) has reigned as a cornerstone of the cryptocurrency world, with its monumental market cap underlining its significance. Despite this, BTC's participation in the rapidly expanding realm of Decentralized Finance (DeFi) has been limited due to its lack of smart contract capabilities. This limitation, however, is being circumvented with the BTC.b Bridge.

This bridge 'wraps' and transfers BTC onto the Avalanche blockchain, a platform well-geared for DeFi due to its native smart contract functionality. The BTC.b Bridge thus allows Bitcoin holders to gain access to DeFi on Avalanche, unlocking a whole new world of possibilities previously inaccessible to the BTC community.

This article will delve into this technology, detailing the operations of the BTC.b Bridge and how it's extending BTC's influence into the DeFi arena. However, this leap forward comes with its own set of risks inherent to the bridging process. As we unfold the story of the BTC.b Bridge, we will bring to light these associated risks, and how they balance against the benefits in the Avalanche ecosystem.

Security Trade-offs in the BTC.b Bridge

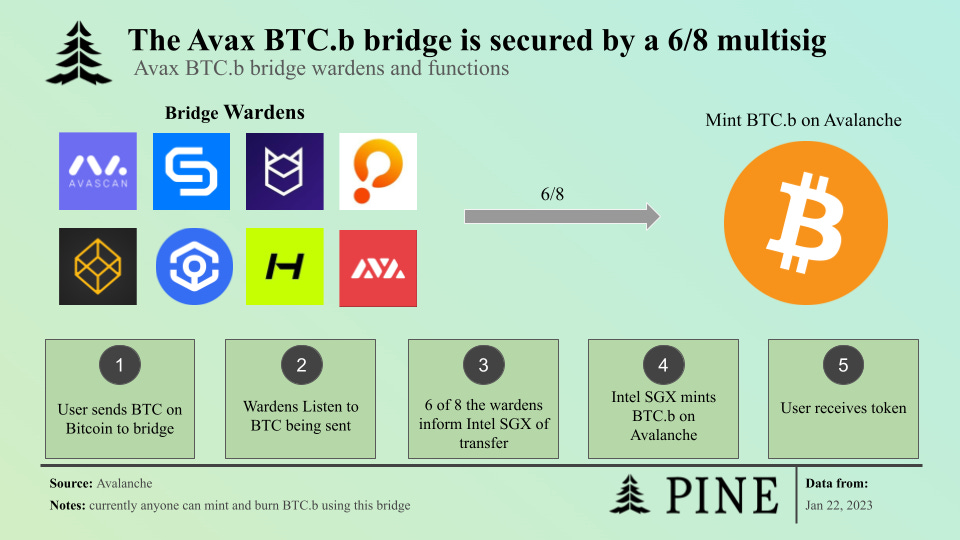

A pivotal part of our dashboard analysis revolves around the functioning of the BTC.b Bridge, specifically its implications for the security of the token. The Bridge operates on the principle of consensus among eight wardens, which include Halborn, Avascan, Bware Labs, Ankr, Chainstack, Protofire, Blockdaemon, and Ava Labs. This consensus-based security model, while a key enabler for interoperability between Bitcoin and Avalanche, poses distinct differences in security when compared to traditional Bitcoin transactions.

When users deposit BTC into the bridge on the Bitcoin network, the transaction is approved and processed by at least six out of the eight wardens. Consequently, the users receive an equivalent amount of BTC.b tokens on the Avalanche network. While this mechanism ensures the smooth operation of the bridge, it presents an inherent trade-off when it comes to security.

In stark contrast to the distributed nature of Bitcoin's security, secured by immense global hash power across a decentralized network, the security of the BTC.b token is essentially in the hands of the eight warden entities. While these wardens represent trustworthy and respected entities in the blockchain space, the concentration of power among a smaller group inherently increases the potential security risk when compared to the globally distributed, hash power-based security of Bitcoin.

Supply and Transfer Trends of BTC.b

The supply and transfer dynamics of BTC.b on Avalanche present an intriguing picture. Data reveals a surge in BTC.b supply at the end of 2022 and early 2023, followed by a decline to levels similar to the start of the year.

Simultaneously, BTC.b transfers spiked at the onset of 2023, interestingly without a significant increase in user count. Despite the declining BTC.b supply by April, user interaction surged dramatically, going from less than 10,000 to over 100,000 wallets in a week.

As of now, around 50,000 wallets are interacting with BTC.b, a considerable rise since the year's beginning. Despite the fluctuating supply, the sustained user interest points towards a persistent demand and a high engagement level with BTC.b on Avalanche, suggesting a maturing and dynamic ecosystem.

BTC.b Holders and Distribution

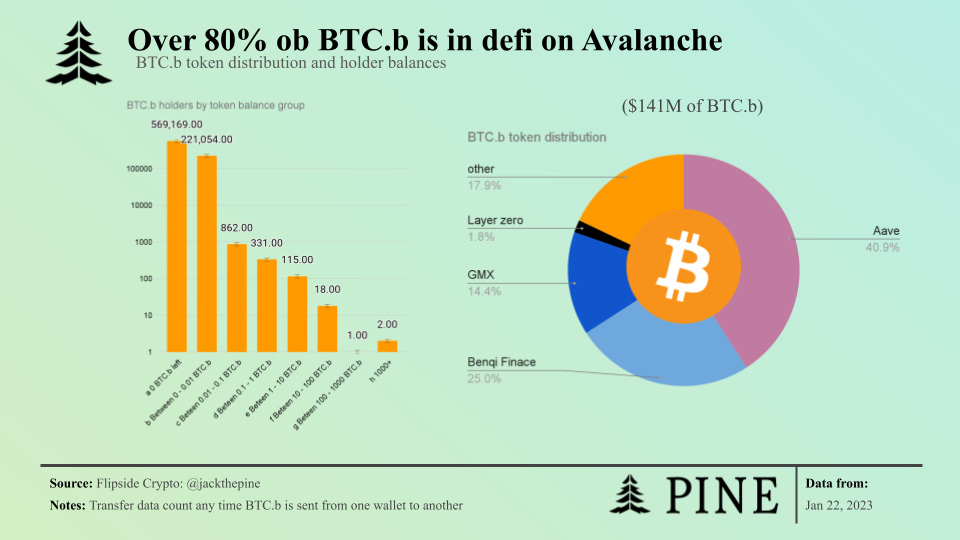

A deep dive into our dashboard data provides insight into the distribution of the BTC.b token across Avalanche. Remarkably, over 80% of BTC.b tokens are currently held in various DeFi protocols. This large concentration within DeFi signifies a strong inclination toward leveraging the potential of decentralized finance among BTC.b holders.

Further investigation into the holding patterns indicates a considerable number of users who have interacted with BTC.b but presently hold small amounts or none at all. One plausible explanation for this trend could be that users initially acquire BTC.b, only to deposit it subsequently into a DeFi protocol on Avalanche. This practice aligns with the previously noted dominance of DeFi protocols in holding BTC.b tokens.

Interestingly, the data suggest that a relatively small group of less than 1,500 users hold any significant amounts of BTC.b outside the DeFi space on Avalanche. the data paints a picture of a highly engaged community using BTC.b as a key to unlock the benefits of DeFi on Avalanche, alongside a smaller group maintaining holdings outside the DeFi ecosystem.

BTC.b’s Utilization in DeFi

A significant portion of BTC.b within Avalanche DeFi is found within Benqi Finance and Aave, where users earn a ~0.5% interest rate. Additionally, these tokens are also utilized as collateral for loans, thus offering dual utility to their holders.

A smaller yet significant fraction of BTC.b within DeFi resides within GMX's GLP. The GLP is an asset representing the collective liquidity provided on the GMX staking platform on Avalanche. Interestingly, GLP is composed of approximately 20% BTC.b, thereby giving its holders a 20% exposure to Bitcoin. The remaining portion of GLP is largely comprised of ETH and various stablecoins. The ownership of GLP offers its holders a return of approximately 10% APY, providing a substantial reward for liquidity providers.

However, it is crucial to note that while we analyze the usage patterns and potential rewards of these protocols, we do not delve into the inherent risks associated with each. These can range from smart contract vulnerabilities to platform-specific risks. Therefore, we strongly recommend users conduct due diligence and assess the risk-reward balance before engaging with these platforms.

BTC.b Bridging via Layer Zero

The next element of our dashboard analysis focuses on the amount of BTC.b being transferred to other EVM blockchains using the Layer Zero Bridge. Current data indicates approximately 80 BTC.b has been bridged to other blockchains using this method. This figure has been steadily increasing since the beginning of March this year, illustrating the growing utilization of Layer Zero Bridge for cross-chain transfers.

Among the EVM-compatible blockchains, Arbitrum has emerged as the most popular destination for bridged BTC.b tokens. Despite this, the overall usage of BTC.b on other EVM blockchains appears to be relatively limited at this point. However, this landscape could shift dramatically if BTC.b is adopted more widely within DeFi on these other blockchains.

In summary, while the cross-chain bridging of BTC.b is currently at a nascent stage, there is a potential for considerable growth if BTC.b becomes more integrated into DeFi platforms across various EVM-compatible blockchains. This development is worth monitoring for anyone interested in the cross-chain capabilities and future potential of BTC.b.

Conclusion

Our analysis of the BTC.b ecosystem uncovers significant trends and potential. BTC.b bridges Bitcoin to the DeFi sector on Avalanche, albeit with a shift towards a more centralized security model. Despite the fluctuating supply of BTC.b, consistent user engagement implies a strong and enduring demand for the token.

Moreover, the majority of BTC.b tokens are predominantly used within DeFi protocols on Avalanche, underscoring DeFi's growing role within the ecosystem. Meanwhile, BTC.b bridging activity to other EVM-compatible chains is at an early stage but signals the potential for wider cross-chain DeFi integration.

Interestingly, it's important to note the contrast with wrapped Bitcoin (WBTC), which currently boasts a market cap of nearly $5 billion, more than 30 times that of BTC.b, and is secured by BitGo rather than a 6-out-of-8 company multi-sig setup.

In conclusion, while BTC.b's evolution on Avalanche and beyond is ongoing, its future within the DeFi space is promising and certainly warrants close attention, particularly in comparison to its larger counterpart, WBTC.