Competitive analysis of token launchpads on Solana

Executive Summary

Solana has become the testing ground for next-generation token launches. This analysis examines ten major launchpads—from Pump.fun's viral memes to MetaDAO's governance experiments—comparing their mechanics, trade-offs, and strategic fit.

Why This Matters

Launchpads now move billions monthly. Pump.fun processed over $4 billion in April 2025; Meteora powered Jupiter's $70 million raise. Platform choice determines token distribution, community formation, and development trajectory.

Key Findings

Most Platforms Are Pump.fun Variations: The majority of launchpads are incremental tweaks on Pump.fun's bonding curve model. Any advantages they offer—social features, staking rewards, fee sharing—are temporary attention captures that competitors can copy. For meme launches, use whichever platform has the most current attention unless your token has AI theming, which may benefit from specialized AI launchpads.

Meteora for Serious Projects: Meteora stands alone as the premier platform for thoughtful token launches. Any project with specific fundraising goals, custom tokenomics, or long-term vision should use Meteora's configurable infrastructure rather than accepting one-size-fits-all bonding curves.

MetaDAO for Fair Governance: MetaDAO represents the best available model for communities seeking fair launches with embedded self-governance from day one through futarchy prediction markets.

Vertical-Specific Curation: Bio Protocol demonstrates how specialized launchpads can connect crypto capital with quality projects from specific verticals outside crypto. Expect more curated launchpads in other sectors following this model.

Trade-offs

Three core decisions define platform selection:

Attention vs. Infrastructure: Chase current hype on trending platforms or build on proven, configurable infrastructure

Permissionless vs. Curated: Accept anyone launching anything or require quality standards and sector expertise

Founder Control vs. Community Governance: Maintain traditional control or embed governance from launch

Bottom Line

No single platform dominates—each optimizes different variables. Success requires strategic alignment with appropriate infrastructure and momentum chasing. The ecosystem has matured from uniform bonding curves to specialized tools for distinct use cases.

Pump.fun – The Speed-First Memecoin Factory

Launch Time: Under 60 seconds | Fees: 1% pre-graduation, 0.3% post | Graduation: $69K market cap | Creator Revenue: 0.05% of trading volume | Volume: $14.6B (April 2025)

What Makes It Unique

Pump.fun pioneered one-click token launches on Solana, removing every barrier between idea and tradeable token. While other platforms require technical setup, capital, or waiting periods, Pump.fun lets anyone deploy a memecoin in under 60 seconds with no coding knowledge required. This approach made it the dominant force in Solana's token ecosystem, at one point powering over 98% of all new launches.

How the Launch Process Works

The platform uses a constant-product bonding curve system where tokens start trading immediately upon creation. Each token begins with a fixed supply of 1 billion units, priced near 0.000000028 SOL based on virtual reserves. As buyers purchase tokens, the price increases incrementally along the curve, creating instant liquidity and price discovery without requiring upfront capital from creators.

When a token reaches approximately $69,000 in market capitalization, it automatically "graduates" to PumpSwap, Pump.fun's integrated exchange. During this graduation, roughly 79 SOL and 200 million tokens migrate to a locked liquidity pool where the LP tokens are permanently burned to prevent rug pulls. This mechanism provides some security assurance while maintaining the platform's permissionless nature.

The fee structure supports both platform sustainability and creator incentives. During the bonding curve phase, all trades incur a 1% fee. After graduation, PumpSwap applies a 0.3% fee split between liquidity providers (0.25%) and the platform (0.05%). Since May 2025, creators receive 50% of the platform's post-graduation revenue, earning them 0.025% of all trading volume. This model has proven lucrative, with over $7.3 million in SOL distributed to creators in April 2025 alone.

Who Should Use Pump.fun

For Founders: Pump.fun excels for meme creators and community builders who prioritize viral speed over structural sophistication. It's designed for quick experiments, social movements, or community token distribution where the goal is rapid deployment and organic growth rather than structured fundraising. The platform suits creators comfortable with high-risk, high-reward dynamics who can generate attention through social channels rather than traditional marketing.

For Investors: The platform attracts high-risk traders seeking early exposure to viral tokens. Most successful participants treat Pump.fun like a fast-moving casino where timing and social signal reading matter more than fundamental analysis. Investors typically discover opportunities through Twitter, Telegram, or on-chain monitoring tools, expecting most investments to fail while hoping for occasional outsized returns.

Strengths and Critical Limitations

Pump.fun's greatest strength lies in its frictionless deployment and instant liquidity provision. The bonding curve mechanism ensures immediate tradability while the graduation system provides eventual liquidity security. Creator revenue sharing aligns incentives between platform and users, while the massive user base offers unparalleled distribution potential for viral content.

However, these benefits come with significant trade-offs. The permissionless model creates a flood of low-effort or fraudulent tokens, making discovery challenging and reputation risks high for serious projects. The platform offers no governance infrastructure, compliance guidance, or utility development tools. Most tokens launched fail quickly, and the environment remains largely speculative despite some notable success stories like $FARTCOIN, which sustained over $1 billion in market capitalization, and $GOAT, which stabilized after initial volatility.

Strategic Recommendations

Use Pump.fun when viral potential and speed matter more than credibility or structure. It's ideal for testing meme concepts, building rapid community momentum, or distributing tokens without traditional fundraising constraints. However, teams seeking serious investor backing, regulatory compliance, or long-term protocol development should consider it only as an initial distribution mechanism before transitioning to more structured platforms.

The platform works best for creators who can generate organic social media traction and investors comfortable with high-frequency, high-risk trading strategies. Success requires understanding social momentum, on-chain activity patterns, and the ability to move quickly on opportunities that typically last hours rather than days.

Success Examples

$FARTCOIN: Sustained $1B+ market cap for months

$GOAT: Stabilized after initial volatility spike

$MOODENG: Gained sustained community traction

Reality check: Most tokens die within hours. Success stories are rare exceptions.

Meteora – The Multi-Product Launch Ecosystem

Products: DLMM, DAMM, DAMM V2, Dynamic Bonding Curves | Features: Alpha Vault, Stake2Earn, Fee Suite | Integration: Native Jupiter/DEX

What Makes It Unique

While Pump.fun prioritizes speed above all else, Meteora has evolved into a comprehensive launch ecosystem offering multiple products for different strategies. Rather than one-size-fits-all bonding curves, teams can choose DLMM pools for maximum customization, DAMM pools for reliable price discovery, DAMM V2 for hybrid liquidity options, or Dynamic Bonding Curves for simplified deployment. This product suite, combined with community-first features like Alpha Vault and day-zero staking, has made Meteora the platform of choice for serious DeFi projects seeking institutional-grade infrastructure.

How the Launch Process Works

Meteora's core innovation lies in its one-sided liquidity approach where teams deposit only their tokens while buyers provide SOL, USDC, or other quote assets. Teams can customize virtually every parameter through four distinct products. DLMM Launch Pools offer zero-slippage bins with custom price ranges and distribution curves. DAMM pools provide reliable price discovery from zero to infinity with permanent liquidity burning. DAMM V2 adds hybrid single-sided or full-range options with quote-token-only fee collection. Dynamic Bonding Curves bridge simplicity with sophistication for smaller teams.

Alpha Vault revolutionizes fair access by enabling communities to frontrun bots through coordinated deposits. All participants receive the same purchase price regardless of timing, with optional vesting to align long-term interests. Stake2Earn addresses day-zero utility by directing trading fees from permanently locked liquidity toward stakers, creating immediate value accrual from launch day.

The Fee Suite provides sophisticated anti-manipulation tools including dynamic fees that increase during volatility, fee schedules that impose higher costs on early transactions to deter snipers, and the ability to collect fees exclusively in quote tokens. Unlike standalone platforms, all Meteora launches integrate natively with Jupiter and Solana DEXs for immediate liquidity access without separate listing processes.

Who Should Use Meteora

For Founders: Meteora suits DeFi protocols, DAOs, and utility token projects that prioritize transparency and customization over pure speed. Teams willing to invest time in proper configuration can create launches that support sustainable growth rather than purely speculative trading. The platform excels for projects seeking community alignment through fair access mechanisms and day-zero utility rather than viral social media tactics.

For Investors: The platform attracts sophisticated participants who value predictable mechanics and visible parameters. Unlike meme-focused platforms where social signals dominate, Meteora enables fundamental analysis of launch configurations, fee structures, and team commitments. Investors can preview bonding curves, assess anti-sniping protections, and evaluate tokenomics before participating, making it suitable for larger allocations and longer-term positions.

Strengths and Critical Limitations

Meteora's greatest strength lies in its flexibility and proven track record of handling large-scale launches with institutional-grade infrastructure. The multi-product ecosystem enables teams to align launch mechanics with long-term tokenomics while community-first features like Alpha Vault and Stake2Earn create fair access and immediate utility. Native DEX integration ensures sustainable liquidity without additional setup requirements.

However, this sophistication comes with meaningful complexity costs. Teams must choose between four products, configure multiple parameters correctly, and coordinate features like Alpha Vault settings and fee schedules appropriately. The learning curve is substantially steeper than one-click alternatives, and poor configuration can result in failed launches or suboptimal price discovery. Projects requiring speed over structure may find the setup process too intensive.

Strategic Recommendations

Use Meteora when transparency, customization, and community alignment matter more than viral speed. It's ideal for structured fundraising, long-term protocol development, or projects requiring sophisticated tokenomics and fair distribution mechanisms. However, teams seeking pure meme virality or rapid social media momentum should consider simpler alternatives that prioritize attention over infrastructure.

The platform works best for teams that can articulate clear value propositions and back them with thoughtful mechanism design. Success requires treating launch product selection and feature configuration as core strategic decisions rather than technical afterthoughts, combined with sustained community engagement throughout the launch period and beyond.

Success Examples

Jupiter ($JUP): Most popular router on Solana with $2.8B FDV

Sanctum ($CLOUD): Large LST protocol on Solana with 128M FDV

Trump ($TRUMP): huge memecoin the reached over 70B FDV in 1 day.

Reality check: Success requires sophisticated planning and community coordination. Not suitable for quick experiments or low-effort launches.

LaunchLabs – Raydium's Configurable DEX-Native Launchpad

Curves: Linear, exponential, logarithmic | Quote Assets: SOL, USDC, USDT, jitoSOL | Graduation: Auto-LP creation on Raydium | Revenue: Customizable fee splits, Fee-Key NFT rewards | Instance: Let'sBonk.fun (BONK ecosystem)

What Makes It Unique

LaunchLabs bridges the gap between Pump.fun's simplicity and Meteora's complexity by offering configurable bonding curves with built-in Raydium integration. Developed as Raydium's flagship launchpad framework, it provides more control than one-click platforms while maintaining accessible setup for non-technical teams. The platform's modular design enables white-label instances like Let'sBonk.fun, allowing ecosystem partners to create branded launch experiences with customized fee structures and community alignment mechanisms.

How the Launch Process Works

Teams configure their launch by selecting from linear, exponential, or logarithmic bonding curves to control price response to demand. Linear curves provide steady growth, exponential curves deter bots with steep early pricing, and logarithmic curves offer high initial prices with slower increases. Projects can raise in SOL, USDC, USDT, or jitoSOL, giving teams flexibility in treasury composition and volatility exposure.

During the live sale period, participants purchase tokens directly from the bonding curve at incrementally increasing prices. Once the funding goal is reached or the time limit expires, Raydium automatically creates a liquidity pool using the raised funds and remaining token supply. This seamless DEX integration eliminates manual LP setup while ensuring immediate post-launch tradability.

The platform supports customizable fee splits that can be distributed among liquidity providers, project treasury, and burn addresses. For example, Let'sBonk channels 1% of launch volume into BONK buybacks and burns, creating ecosystem value while rewarding participants. Teams can also lock liquidity via Raydium's Fee-Key NFT system, which grants access to long-term trading fee rewards and provides additional security assurance for investors.

Who Should Use LaunchLabs

For Founders: LaunchLabs suits meme coin creators and experimental projects seeking more control than Pump.fun without Meteora's complexity. It's ideal for teams building within existing ecosystems like BONK that can leverage branded instances for community alignment. The platform works well for projects raising in stablecoins to avoid SOL volatility or teams needing customized fee structures to support long-term tokenomics.

For Investors: The platform attracts high-risk traders familiar with Raydium's ecosystem and BONK-aligned speculators looking for early exposure to community-driven projects. The configurable parameters and liquidity lock options provide more transparency than pure meme platforms, appealing to participants who want some structure without institutional-grade complexity. Most discover opportunities through Raydium dashboards, Telegram channels, or ecosystem-specific communities.

Strengths and Critical Limitations

LaunchLabs' greatest strength lies in its balance of flexibility and accessibility, offering configurable bonding curves and multi-asset support while maintaining straightforward setup for non-technical teams. The automatic Raydium integration ensures immediate liquidity and DEX compatibility, while Fee-Key NFT locking provides additional security without sacrificing ongoing revenue potential. Ecosystem branding through instances like Let'sBonk creates community alignment and built-in distribution channels.

However, the platform inherits the risks of permissionless launches without meaningful quality controls. Like Pump.fun, there's no vetting process or investor protections, and the additional configuration options can be overwhelming for inexperienced teams or ignored entirely by low-effort projects. The reliance on ecosystem branding limits appeal outside specific communities, and the extra complexity doesn't guarantee better outcomes than simpler alternatives.

Strategic Recommendations

Use LaunchLabs when you need more control than Pump.fun but less complexity than Meteora, especially if operating within compatible ecosystems like BONK or Raydium. It's ideal for teams raising in stablecoins, requiring custom fee structures, or seeking branded launch experiences that align with existing communities. However, teams focused purely on viral memes may find the additional configuration unnecessary, while serious protocols might need more sophisticated features.

The platform works best for creators who can leverage ecosystem relationships and investors comfortable with moderate complexity. Success requires thoughtful curve selection, appropriate liquidity locking decisions, and effective use of community branding rather than relying solely on organic discovery or social media virality.

Success Examples

Let'sBONK (SZN): BONK-branded launch hit ~$38M market cap

BONK Community Tokens: Multiple ecosystem-aligned launches via Let'sBonk rails

Raydium Ecosystem Projects: Various DeFi and meme tokens leveraging Fee-Key rewards

Reality check: Success depends heavily on ecosystem alignment and community support. Independent launches face discovery challenges without built-in distribution.

Believe.app – The Tweet-to-Launch Social Launchpad

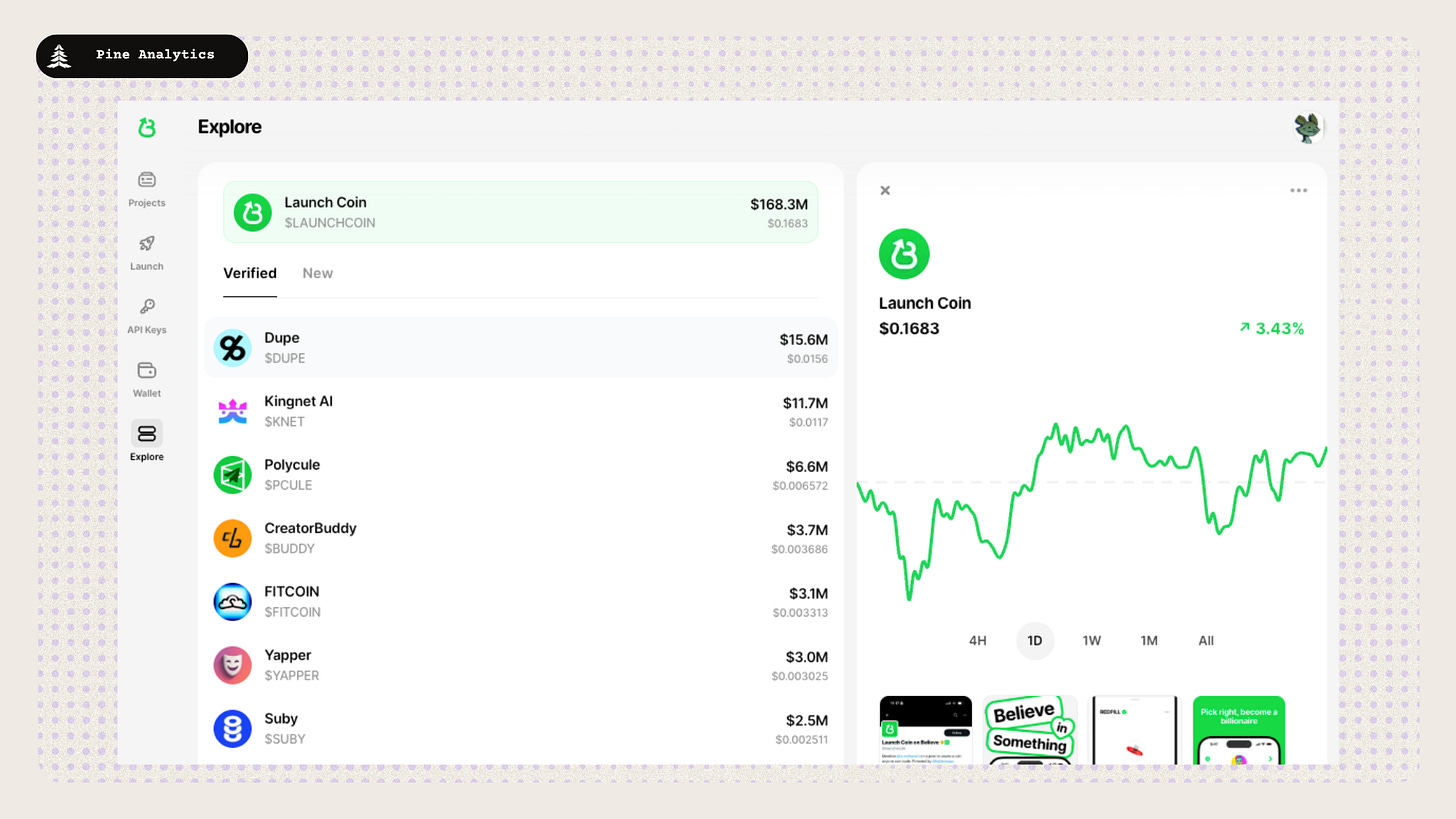

Launch Method: Tweet @launchcoin with ticker | Barrier: Zero (no wallet, dApp, or coding) | Graduation: ~$100K market cap to Meteora | Fees: 2% split 50/50 platform/creator | Growth: $13M+ creator fees in first week

What Makes It Unique

Believe.app eliminates every friction point in token creation by enabling launches through simple Twitter interactions. Originally launched as "Clout" by Ben Pasternak, the platform exploded in popularity by turning token deployment into a viral social experience that requires no technical knowledge, wallet setup, or dApp interaction. Users simply reply to any @launchcoin tweet with a ticker name, and the platform's backend automatically deploys an SPL token with bonding curve mechanics, making it the most accessible entry point into Solana token creation.

How the Launch Process Works

The launch process begins with a single tweet reply to @launchcoin containing the desired token ticker. Believe's automated backend immediately deploys an SPL token with standard bonding curve mechanics, creates a public trading page, and enables on-chain purchases without any user intervention. Early buyers benefit from lower prices on the curve, with gradual price increases designed to deter front-running while maintaining organic price discovery.

Once a token reaches approximately $100,000 in market capitalization, it automatically migrates to a Meteora liquidity pool for standard DEX trading. This graduation process moves the token from the platform's bonding curve environment to broader Solana ecosystem liquidity, enabling integration with Jupiter and other aggregators for sustained trading activity.

The fee structure splits 2% of bonding curve trading volume equally between the platform and token creators. Creators receive their 1% share through vesting mechanisms over time, aligning long-term incentives while providing immediate revenue streams. This model generated over $13 million in creator fees during the platform's explosive first week, demonstrating the potential for social-native token distribution at scale.

Who Should Use Believe.app

For Founders: Believe.app excels for influencers, content creators, and Twitter-native personalities who can generate organic social media traction without technical barriers. It's designed for viral meme concepts, fan tokens, or community experiments where speed and social momentum matter more than sophisticated tokenomics. The platform suits creators comfortable with high-variance outcomes who prioritize reach and accessibility over structured fundraising or governance features.

For Investors: The platform attracts social media natives and high-frequency traders who monitor Twitter for emerging trends and viral content. Most successful participants treat Believe.app as a fast-moving attention economy where social signals and timing matter more than fundamental analysis. Investors typically discover opportunities through Twitter feeds, influencer activity, or platform monitoring tools, expecting high volatility and quick resolution of most positions.

Strengths and Critical Limitations

Believe.app's greatest strength lies in its frictionless social-native launch flow that can transform viral tweets into tradeable assets within minutes. The platform's integration with Twitter's existing social graph provides unmatched distribution potential for creators with established audiences, while the automatic backend deployment removes all technical barriers that typically limit token creation to crypto-native users.

However, this accessibility comes with significant quality control challenges. The platform's permissionless nature creates a flood of low-effort launches driven purely by social media virality rather than underlying value or utility. Most tokens launched through tweet interactions lack serious development teams, roadmaps, or long-term vision, making the environment highly speculative and unsuitable for investors seeking sustainable projects or governance participation.

Strategic Recommendations

Use Believe.app when social virality and immediate attention matter more than technical sophistication or long-term sustainability. It's ideal for testing viral concepts, capitalizing on social media moments, or distributing fan tokens to existing audiences without requiring crypto knowledge from participants. However, teams seeking structured fundraising, investor relations, or protocol development should view it only as an initial distribution experiment rather than a comprehensive launch strategy.

The platform works best for creators who can generate authentic social media engagement and investors comfortable with lottery-style speculation based on social momentum. Success requires understanding Twitter dynamics, viral content creation, and the ability to convert social attention into trading volume during narrow time windows when interest peaks.

Success Examples

$LAUNCHCOIN: Platform's unofficial token surged 900% in May 2025

Influencer Fan Tokens: Various Twitter personalities launched community tokens

Viral Meme Concepts: Social media trends converted to tradeable assets within hours

Reality check: Most launches are driven by fleeting social attention rather than sustainable value. Success depends entirely on social media virality and timing.

Boop.fun – The Community-Driven Staking Launchpad

Launch Methods: Tweet @beeponboop or web interface | Graduation: 86 SOL raised (~75% sold) | Staker Benefits: 60% of fees + 5% of all tokens | Day 1: 10,000+ tokens launched, 154 graduated | Peak: $BOOP hit $500M market cap in 90 minutes

What Makes It Unique

Boop.fun combines viral token launches with staking incentives, creating a community-driven ecosystem where $BOOP holders benefit from every new token created. Unlike pure launch platforms, Boop.fun distributes 5% of each graduated token's supply to $BOOP stakers while sharing 60% of trading fees, effectively turning the platform token into a diversified meme portfolio. This model aligns platform growth with community rewards, encouraging both token creation and long-term ecosystem participation through the playful "Boop and Beep" mascot branding.

How the Launch Process Works

Token creation happens through two methods: clicking "Create" on the website or tweeting at @beeponboop with desired token details. The platform immediately deploys an SPL token with bonding curve mechanics, enabling instant trading without upfront capital requirements. Tokens trade via the bonding curve until reaching approximately 86 SOL in raised funds, representing roughly 75% of supply sold to the community.

Upon reaching the graduation threshold, Boop.fun automatically creates a Raydium liquidity pool using the remaining SOL and approximately 20% of the token supply. The graduated token becomes tradable on standard DEXs through Jupiter and other aggregators, while 5% of the total supply is distributed to $BOOP stakers as an automatic airdrop. This mechanism ensures stakers receive exposure to every successful project launched through the platform.

The fee structure channels 60% of all trading fees to $BOOP stakers, creating ongoing revenue sharing that scales with platform activity. Combined with the 5% token distributions, this model transforms $BOOP holdings into a passive income stream that benefits from both platform growth and individual token success. The remaining fees support platform operations and development.

Who Should Use Boop.fun

For Founders: Boop.fun suits influencers, meme creators, and community builders who can leverage viral social media tactics while benefiting from built-in distribution to $BOOP stakers. The platform works well for projects that thrive on cult-like community dynamics and playful branding rather than serious utility or governance. Teams comfortable with giving up 5% of supply in exchange for immediate exposure to an engaged staking community will find natural alignment.

For Investors: The platform attracts two distinct groups: high-risk speculators chasing individual token launches and $BOOP stakers seeking diversified exposure to the meme economy. Stakers benefit from every successful graduation regardless of which specific tokens perform, making it appealing for participants who want meme exposure without picking individual winners. Active traders monitor launches through dashboards and bots for early entry opportunities.

Strengths and Critical Limitations

Boop.fun's greatest innovation lies in aligning platform success with community rewards through automatic token distributions and fee sharing. The $BOOP staking mechanism creates a built-in audience for every launch while providing passive diversification across the meme ecosystem. The dual launch methods (web and Twitter) maximize accessibility, while Raydium integration ensures graduated tokens inherit real liquidity infrastructure.

However, the platform's explosive early growth has slowed significantly, and the continuous token distributions dilute staker rewards as more projects launch. The 5% automatic allocation reduces founder control while potentially flooding the market with tokens that lack genuine community support. Quality remains inconsistent due to permissionless access, and many launches fail to reach graduation, providing no benefits to stakers despite platform activity.

Strategic Recommendations

Use Boop.fun when community engagement and viral potential matter more than token control or serious fundraising. It's ideal for meme creators who can benefit from automatic distribution to engaged stakers and don't mind sharing 5% of supply for built-in exposure. However, teams requiring precise tokenomics or serious investor backing should consider platforms that don't enforce automatic allocations to third parties.

The platform works best for creators comfortable with cult-like community dynamics and investors seeking diversified meme exposure through $BOOP staking rather than individual token picking. Success requires understanding both viral social media tactics and the staking community's preferences for playful, engaging projects over utility-focused protocols.

Success Examples

$BOOP Platform Token: Hit $500M market cap within 90 minutes of launch

Day 1 Performance: 10,000+ tokens created, 154 successfully graduated to Raydium

KOL Community Tokens: Various influencer-launched fan tokens like $XCOIN and $DEEZNUTZ

Reality check: Platform activity has significantly decreased from peak levels. Staker rewards dilute as more tokens launch, and most individual tokens still fail despite the community alignment model.

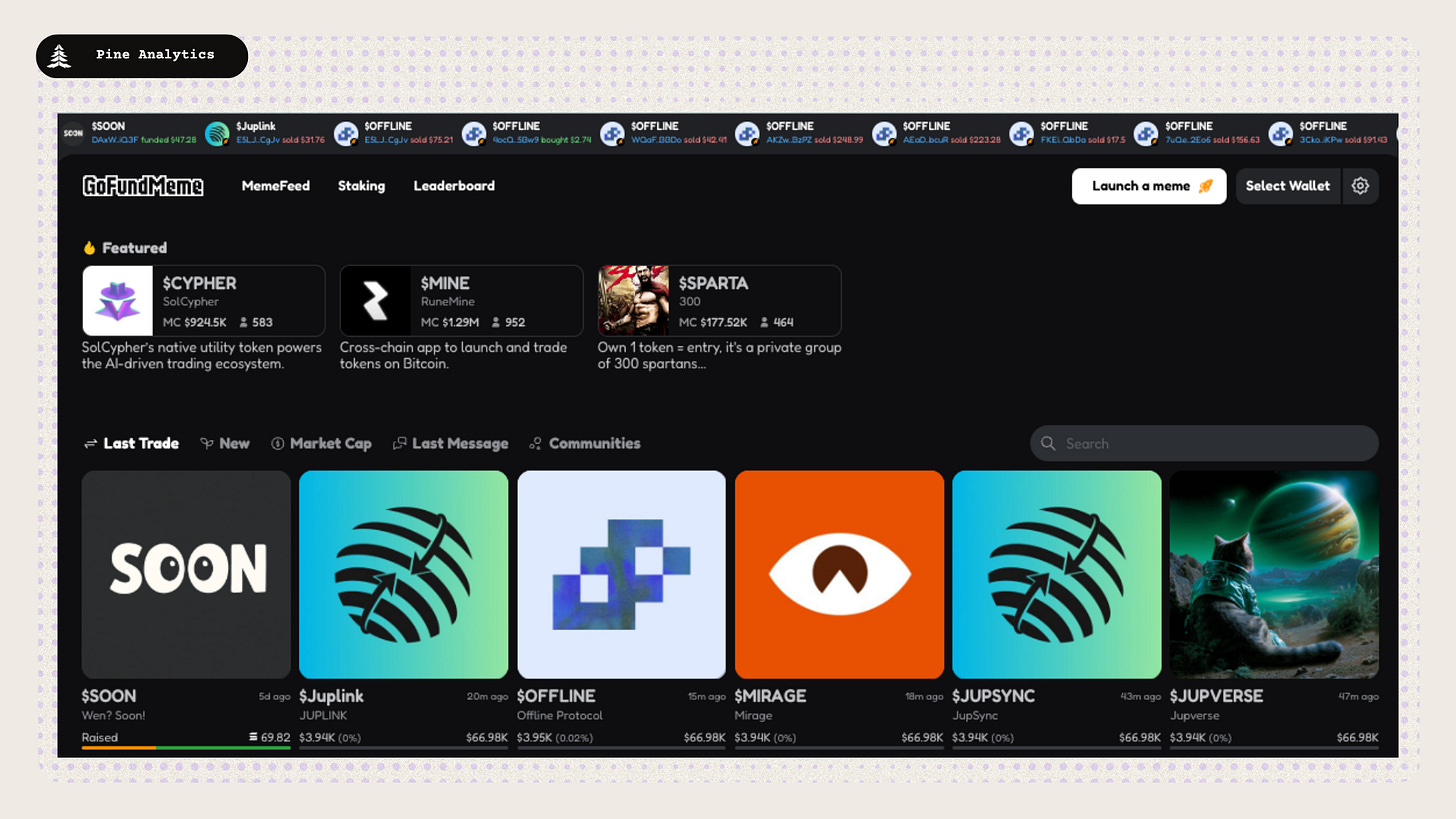

GoFundMeme – The Zero-Fee Community Launchpad

Launch Types: Bonding Curve, Flat Launch, Alpha Vault | Platform Fee: 0% (all fees redistributed to users) | User Base: 500,000+ users | Graduation: 425 SOL (~$32K market cap) | Rewards: $GFM staking, leaderboard points, creator bonuses

What Makes It Unique

GoFundMeme positions itself as a public good by redistributing all protocol fees back to users rather than capturing value for the platform. This zero-fee model, combined with three distinct launch types and gamified participation through leaderboards and staking rewards, creates the most user-aligned incentive structure in the Solana meme economy. The platform treats token creation as community infrastructure rather than a profit center, scaling to over 500,000 users through referral systems and point-based rewards that benefit participants across the entire ecosystem.

How the Launch Process Works

GoFundMeme offers three launch mechanisms for different strategies. Bonding Curves provide instant launches with rising prices that graduate to Meteora at 425 SOL market cap. Flat Launches enable fixed-price sales with capped supply, where tokens become claimable post-sale before DEX listing. Alpha Vaults offer the most sophisticated option with sniper protection, supporting both first-come-first-serve and pro-rata modes, optional vesting schedules, and whitelist capabilities.

All launch types conclude with automatic DEX listing, primarily on Meteora, ensuring graduated tokens inherit real liquidity infrastructure. The platform's no-code tools allow teams to configure supply, pricing, whitelists, and vesting parameters without technical expertise, while integrated social features enable one-click sharing and community engagement throughout the launch process.

The fee redistribution model operates through the $GFM token ecosystem. Bonding curve launches incur a 0.25% pre-DEX fee split equally between $GFM stakers and leaderboard points. Flat and Alpha launches apply a 0.5% post-DEX swap fee, with creators earning 1 SOL upon graduation. The leaderboard system rewards risk-taking behavior by giving later buyers on bonding curves more points, creating incentives for community participation rather than pure front-running.

Who Should Use GoFundMeme

For Founders: GoFundMeme suits creators prioritizing community alignment over speed, offering flexible launch types without platform fee extraction. The three-tier system accommodates different strategies from simple meme experiments (Bonding Curve) to sophisticated fundraising with anti-bot protection (Alpha Vault). Teams benefit from automatic $GFM ecosystem integration, leaderboard exposure, and creator reward programs that provide ongoing incentives based on trading volume and community metrics.

For Investors: The platform attracts participants seeking user-aligned fee structures and gamified engagement through $GFM staking and leaderboard competition. Stakers receive 90% of staking rewards from platform activity, while leaderboard participants earn weekly $GFM and $SOL airdrops based on trading activity and risk-taking behavior. The diverse launch types enable different investment strategies from quick speculation to longer-term community participation.

Strengths and Critical Limitations

GoFundMeme's greatest strength lies in its user-aligned fee structure that redistributes all platform value back to participants rather than extracting profit. The three launch types provide genuine flexibility for different project needs, while the $GFM ecosystem creates sustainable incentives for long-term community engagement. The gamified leaderboard system and creator reward programs drive ongoing participation beyond individual token launches, supported by sophisticated features like Alpha Vault's anti-bot protection.

However, the zero-fee model creates sustainability questions about platform development and maintenance funding. The permissionless nature generates significant noise with many low-effort tokens, while the complex reward systems may confuse casual users. The multiple launch types and gamification features add complexity that can overwhelm teams seeking simple deployment, and success still depends heavily on community engagement and social media traction rather than platform mechanics alone.

Strategic Recommendations

Use GoFundMeme when community alignment and fee redistribution matter more than platform simplicity or pure speed. It's ideal for creators comfortable with slightly more complex setup in exchange for user-aligned incentives and flexible launch options. Teams should leverage the Alpha Vault for sophisticated anti-bot protection or choose Bonding Curves for quick experiments while benefiting from automatic $GFM ecosystem integration and ongoing creator rewards.

The platform works best for participants who can engage with the gamified ecosystem through staking, leaderboard participation, and referral systems rather than treating it as a one-time launch tool. Success requires understanding which launch type fits your strategy and actively participating in the community-driven reward mechanisms that differentiate GoFundMeme from pure extraction-based platforms.

Success Examples

$GFM Platform Token: Powers staking rewards, leaderboard points, and referral systems across 500,000+ users

DWTF: Creative community token with art studio and charitable goals showcasing Alpha Vault capabilities

RAV, Lulu, Shawarma: Viral community meme coins featured on trending lists and leaderboard systems

Reality check: Success requires active community engagement and understanding of complex reward systems. Zero-fee model creates sustainability questions despite user-aligned incentives.

MetaDAO – The Futarchy-Governed Launch Platform

Governance Model: Prediction markets replace traditional voting | Launch Style: Equal-access token sales, no insider allocations | Curation: Reviewed project approval process | DAO Creation: Automatic treasury and governance setup | Notable Raise: mtnCapital $5.7M+ futarchy-governed investment DAO

What Makes It Unique

MetaDAO replaces traditional governance and fundraising with futarchy—a system where prediction markets guide decision-making instead of token voting. Unlike other platforms that focus on speed or viral distribution, MetaDAO creates fully functional DAOs from day one with market-driven governance mechanisms. Projects launch through equal-access token sales without preferential treatment, automatically receiving treasury setup and governance infrastructure that aligns community participation with transparent, on-chain prediction markets rather than subjective voting or founder control.

How the Launch Process Works

Projects undergo a curation process before launching on MetaDAO, ensuring alignment with the platform's governance-first mission and technical requirements. Approved teams conduct open token sales where all participants receive tokens at the same rate during specified contribution periods, with no insider allocations, discounts, or preferential access for VCs or early supporters.

MetaDAO automatically distributes tokens and bootstraps a fully functional DAO complete with treasury setup and futarchy governance modules. From launch day, token holders participate in prediction markets that determine project direction by speculating on proposal outcomes rather than traditional voting mechanisms. This market-based approach theoretically surfaces better information and aligns incentives around actual project success.

The futarchy governance system enables token holders to trade on the conditional outcomes of different proposals, with market prices determining which decisions get implemented. Rather than campaigning and voting, participants express preferences through financial positions that directly impact their returns based on whether proposals succeed or fail, creating skin-in-the-game alignment between governance participation and project outcomes.

Who Should Use MetaDAO

For Founders: MetaDAO suits serious, DAO-first teams committed to transparent governance and equal community access from day one. It works best for DeFi protocols, investment DAOs, and mission-driven projects that can articulate clear success metrics and benefit from market-driven decision-making. Teams must be comfortable with curation requirements, equal token distribution, and relinquishing traditional founder control in favor of community-guided futarchy governance.

For Investors: The platform attracts sophisticated participants who want meaningful governance influence and believe in prediction market efficiency over traditional token voting. Contributors become active DAO members rather than passive token holders, earning returns through correct prediction market participation alongside token appreciation. The curation process appeals to investors seeking vetted projects with serious governance commitments rather than speculative meme plays.

Strengths and Critical Limitations

MetaDAO's greatest strength lies in its principled approach to governance and fundraising, creating genuine community ownership through equal access and futarchy-based decision-making. The automatic DAO bootstrapping provides complete governance infrastructure from day one, while prediction markets theoretically improve decision quality by aggregating information through financial incentives. The curation process ensures higher baseline project quality compared to permissionless alternatives.

However, the platform requires significant user education since futarchy governance is unfamiliar to most crypto participants. The curation and equal-access requirements limit launch speed and scale compared to viral alternatives, while the complex prediction market mechanics may discourage casual participation. The model works best for governance-focused communities rather than teams seeking rapid fundraising or viral token distribution, making it unsuitable for most meme projects or speed-driven launches.

Strategic Recommendations

Use MetaDAO when transparent governance and community ownership matter more than fundraising speed or viral potential. It's ideal for projects that can define clear success metrics, benefit from market-driven decision-making, and commit to equal access principles from launch. However, teams seeking quick capital, insider funding rounds, or maintaining founder control should consider more traditional platforms that don't enforce community governance from day one.

The platform works best for founders comfortable with educational overhead and investors who want active governance participation rather than passive speculation. Success requires embracing futarchy principles, engaging with prediction market mechanics, and treating the community as genuine partners in project direction rather than just token holders or trading participants.

Success Examples

mtnCapital: Futarchy-governed investment DAO raised $5.7M+ through MetaDAO's equal-access mechanism

Governance Innovation: Pioneering prediction market-based decision making in live DAO environments

Reality check: Requires significant commitment to governance education and community participation. Not suitable for quick fundraising or teams preferring traditional founder control structures.

Virtuals – The AI Agent Token Launchpad

Launch Paths: Genesis (24h presale) or Prototype-to-Sentient (bonding curve) | Peak Activity: 40,000 daily wallets (late 2024) | Current Activity: ~12,000 daily wallets (80% decline) | Revenue: $50M platform fees over 7 months | Notable Launches: AIXBT, Zerebro, AVA

What Makes It Unique

Virtuals specializes in AI agent token launches through its Agent Commerce Protocol, Tokenization Platform, and GAME Framework. While the platform captured early "crypto AI" narrative momentum with over 10,000 agents created and 40,000 daily wallets at peak, activity has declined over 80% since late 2024. The platform's strength lies in packaging agent deployment with tokenomics rather than groundbreaking AI innovation. Most successful agents like AIXBT, Zerebro, and AVA have outgrown Virtuals' framework, building independent systems while using the platform primarily as a launchpad for initial community building and token distribution.

How the Launch Process Works

Genesis Launches operate as 24-hour presales where users pledge Virgen Points and commit up to 566 $VIRTUAL tokens for proportional allocation of 37.5% of the project's token supply. Unused commitments are automatically refunded, while 12.5% of supply funds an immediate liquidity pool and 50% goes to teams with customizable vesting. Trading incurs a 1% tax split between creators (70%), referrers (20%), and ecosystem development (10%), creating sustainable revenue streams from day one.

Prototype-to-Sentient launches follow a simpler bonding curve model where creators pay 100 $VIRTUAL to deploy immediately tradeable tokens without initial liquidity pools. Tokens trade via platform aggregators until reaching 42,000 $VIRTUAL in depth, at which point they upgrade to "Sentient" status with automatic Meteora LP deployment and DEX integration. Post-Sentient, creators earn 70% of trading fees while 30% funds ACP incentives, aligning creator rewards with sustained trading activity.

Who Should Use Virtuals

For Founders: Virtuals suits AI-focused teams seeking quick deployment and early community building rather than long-term technical infrastructure. The platform excels as a launchpad for gaining initial traction and token distribution, but serious projects typically outgrow the framework as they develop more sophisticated capabilities. Teams benefit from narrative alignment with crypto AI trends and access to speculative capital, though sustained success requires building beyond Virtuals' modular system.

For Investors: The platform attracts participants interested in AI narrative plays and early-stage speculation around agent tokens. However, the 80% decline in activity from peak levels demonstrates the highly cyclical, speculation-driven nature of most launches. While Genesis presales offer structured access and Prototype curves enable dynamic entry, most value creation happens when successful agents graduate from the platform entirely, limiting long-term platform dependency.

Strengths and Critical Limitations

Virtuals' primary strength lies in capturing early "crypto AI" narrative momentum and providing accessible agent deployment tools that lower barriers for experimentation. The platform generated $50 million in fees over seven months during peak activity, demonstrating significant transactional volume when AI agent interest peaked. The modular framework enables quick launches and community building around agent concepts, while integration with Solana DEXs provides liquidity infrastructure.

However, the fundamental limitation is that Virtuals functions more as a launchpad than sustainable infrastructure. The 80% decline in daily active wallets from 40,000 to around 12,000 illustrates the speculative nature of most activity. Top agents consistently outgrow the platform, building independent technical capabilities while using Virtuals only for initial token distribution. The framework lacks proprietary depth or technological moats that would create lasting platform dependency, making it vulnerable to narrative shifts and competitive pressure from both AI-focused and general launchpad alternatives.

Strategic Recommendations

Use Virtuals when seeking exposure to AI agent narratives and early-stage community building around agent concepts. The platform works best for initial token distribution and capturing speculative interest during AI-focused market cycles. However, teams with serious long-term ambitions should view Virtuals as a stepping stone rather than permanent infrastructure, planning to develop independent capabilities as projects mature.

The platform's cyclical, speculation-driven activity patterns make it suitable for traders comfortable with high volatility and narrative-based investments rather than fundamental value creation. Success requires timing market interest in AI agents and understanding that most platform value comes from initial hype rather than sustained utility or technical innovation.

Success Examples

AIXBT: Started on Virtuals before developing independent data pipelines and market analysis models, now operates as standalone intelligence platform

Zerebro: Launched as AI content generator, evolved into autonomous system with proprietary retrieval-augmented generation methods

AVA: Began as multimodal digital persona, now leads Holoworld AI with specialized video and visual content creation

Reality check: Top agents consistently outgrow Virtuals' framework, using it primarily as a launchpad for initial community building before building independent technical capabilities.

Auto.fun – The No-Code AI Agent Launchpad

Developer: Eliza Labs (elizaOS framework) | Launch Model: Hybrid fair launch with bonding curve | Team Reserve: Up to 50% allocation | Fee Structure: 10% LP fee for $ai16z buybacks | Integration: Raydium liquidity, NFT fee sharing | Focus: Autonomous AI agents with DeFi operations

What Makes It Unique

Auto.fun enables non-technical users to deploy autonomous AI agents and associated tokens without coding, built on Eliza Labs' elizaOS framework. Unlike general AI launchpads, Auto.fun specializes in agents capable of performing actual DeFi operations, social media engagement, and automated tasks rather than just trading speculation. The platform combines no-code agent design with hybrid tokenomics that allow teams to reserve up to 50% of supply while selling the remainder via bonding curves, creating a middle ground between fair launches and traditional fundraising models.

How the Launch Process Works

Auto.fun uses a hybrid launch model where teams can reserve up to 50% of their token supply while distributing the remainder through bonding curves with dynamic pricing to discourage sniping. There are no private funding rounds—only public, transparent pricing that increases with demand. Tokens launch paired with SOL, then automatically rebase to $ai16z through buyback mechanisms that support the broader ecosystem.

After launch, liquidity is automatically provisioned on Raydium with creators receiving NFTs representing their share of ongoing swap fees. This revenue-sharing model aligns long-term incentives between creators and platform success while ensuring sustainable funding for continued agent development. The 10% LP fee captured during launches funds $ai16z buybacks, creating value for the ecosystem token while supporting platform operations.

The platform provides over 300 agent templates and modular components through its no-code builder, enabling creators to design agents for specific use cases like DeFi yield farming, social media management, or automated trading. All agent logic and token contracts are fully open-source and auditable, providing transparency while enabling customization for advanced users who want to extend basic functionality.

Who Should Use Auto.fun

For Founders: Auto.fun suits AI-focused creators and developers without smart contract expertise who want to monetize functional AI agents rather than pure speculation. The platform works best for teams building agents with real utility in DeFi, social media, or automation rather than meme-focused projects. The hybrid tokenomics model appeals to founders seeking some upfront allocation while maintaining fair public distribution and long-term revenue sharing through NFT-based swap fees.

For Investors: The platform attracts participants interested in utility-driven AI agents within the $ai16z ecosystem rather than pure narrative speculation. The bonding curve mechanics limit early arbitrage while ensuring fair pricing, while the focus on functional agents appeals to investors seeking tokens tied to actual use cases. The automatic $ai16z integration provides exposure to the broader AI agent ecosystem beyond individual token performance.

Strengths and Critical Limitations

Auto.fun's greatest strength lies in its no-code approach to functional AI agent deployment combined with fair bonding curve pricing and sustainable revenue sharing through NFT-based swap fees. The integration with elizaOS provides a robust technical foundation for actual agent functionality, while the $ai16z ecosystem alignment creates network effects beyond individual launches. The open-source architecture ensures auditability and enables advanced customization for technical teams.

However, the platform's success depends heavily on $ai16z ecosystem demand and the sustained utility of deployed agents rather than speculative trading dynamics. The hybrid tokenomics model with team reservations may reduce appeal for fair launch purists, while the focus on functional utility limits viral potential compared to meme-focused alternatives. Agent quality varies significantly based on creator technical understanding, and many launches may lack meaningful functionality despite the no-code tools available.

Strategic Recommendations

Use Auto.fun when building AI agents with genuine utility that can benefit from tokenization and community ownership rather than pure speculation. The platform works best for creators comfortable with the $ai16z ecosystem who can design agents that provide ongoing value through DeFi operations, automation, or social engagement. However, teams seeking pure meme virality or quick speculation should consider platforms better aligned with narrative-driven rather than utility-focused launches.

The platform requires creators to think beyond token distribution toward sustainable agent functionality and long-term community value. Success depends on building agents that justify ongoing token holding through utility rather than relying solely on launch momentum or speculative interest in AI narratives.

Success Examples

FightFi: Suite of social media AI agents with "battle" mechanics and token-gated training features

Kryptonite's $CZAI: Trading bot agent providing signals and revenue sharing to token holders

Comput3: Decentralized compute network where tokens serve as credits for AI processing tasks

Reality check: Success requires genuine agent utility and sustained $ai16z ecosystem participation. Platform sustainability depends on functional value creation rather than speculative trading dynamics.

Bio Protocol – The Curated DeSci Launchpad

Focus: Decentralized Science (DeSci) and biotech DAOs | Launch Method: Auction-based (Dutch, batch, fixed-price) | Curation: Reviewed project approval process | Platform Token: $BIO (multichain via Wormhole) | Notable Launch: Curetopia (CURES) Dutch auction for rare disease research | Backing: Binance Labs support

What Makes It Unique

Bio Protocol operates as a curated launchpad exclusively for decentralized science initiatives, enabling researchers, biotech founders, and scientific institutions to fund projects through "BioDAOs"—decentralized organizations that manage and govern real-world research. Unlike meme-focused platforms, Bio Protocol bridges crypto capital with legitimate scientific research, offering both philanthropic impact and potential financial returns through tokenized intellectual property. The platform's expansion from Ethereum to Solana in late 2024 provides access to lower fees and faster execution while maintaining rigorous curation standards.

How the Launch Process Works

Bio Protocol uses auction-style mechanisms to ensure fair and transparent token distribution without insider advantages. Projects can choose from Dutch auctions where prices decrease over time, batch auctions that clear at uniform prices, or fixed-price sales depending on their fundraising strategy and community size. All participants receive equal access during specified windows, with no pre-sales or preferential allocations for VCs or early supporters.

After successful auctions, a portion of raised funds pairs with tokens to seed liquidity on Solana DEXs like Meteora or Raydium, enabling immediate post-launch trading. Token holders can participate in BioDAO governance to guide research decisions, milestone approvals, and resource allocation. Some projects tokenize research intellectual property through NFTs, giving holders potential future revenue streams from scientific breakthroughs, licensing deals, or successful drug development.

The $BIO platform token serves as the ecosystem connector across launches and chains, made multichain through Wormhole integration. Holding $BIO may provide access rights, governance privileges, or rewards across new BioDAO launches, creating network effects that benefit long-term ecosystem participants rather than individual project speculators.

Who Should Use Bio Protocol

For Founders: Bio Protocol suits scientists, academics, and research entrepreneurs with legitimate biotech or scientific research initiatives that can benefit from decentralized funding and community governance. Teams must present vetted roadmaps, clear research goals, and credible scientific backgrounds to pass the curation process. The platform works best for projects seeking patient capital and community involvement in research direction rather than quick fundraising or speculative token distribution.

For Investors: The platform attracts DeSci supporters, crypto-philanthropists, and long-term investors interested in backing real-world scientific research with potential societal impact. Participants are typically patient with longer development timelines and focused on research outcomes rather than short-term trading gains. The curation process appeals to investors seeking vetted projects with genuine scientific merit and transparent use of funds for actual research activities.

Strengths and Critical Limitations

Bio Protocol's greatest strength lies in its credible approach to funding legitimate scientific research through crypto mechanisms, providing access to patient capital and community governance that traditional funding sources may not offer. The auction-based distribution ensures fair access without insider advantages, while tokenized IP creates potential long-term value beyond speculative trading. Binance Labs backing and multichain $BIO integration provide ecosystem credibility and cross-chain participation opportunities.

However, the platform's highly curated approach creates significant barriers to entry and slower launch timelines compared to permissionless alternatives. The focus on legitimate science limits appeal to broader crypto traders seeking quick speculation or viral narrative plays. Research timelines are inherently long and uncertain, making most projects unsuitable for participants expecting rapid returns or frequent trading activity. The niche DeSci community remains small relative to broader crypto markets.

Strategic Recommendations

Use Bio Protocol when leading legitimate scientific research that can benefit from decentralized funding, community governance, and tokenized IP structures. The platform works best for established researchers or biotech teams with credible track records who can navigate the curation process and engage effectively with crypto-native communities interested in science funding. However, teams seeking quick capital, viral distribution, or pure trading speculation should consider platforms better aligned with speed and speculation rather than scientific rigor.

The platform requires long-term commitment to research transparency, community engagement, and educational outreach since participants expect regular updates and meaningful involvement in research direction. Success depends on genuine scientific merit, clear communication of research goals, and building trust with communities that may lack deep scientific expertise but want to support meaningful research initiatives.

Success Examples

Curetopia (CURES): Solana's first BioDAO launched in February 2025 via Dutch auction to fund rare disease research

VitaDAO (VITA): Ethereum-based longevity research DAO that raised over $15M through Gnosis auction, demonstrating scaled DeSci funding

$BIO Platform Token: Multichain ecosystem connector providing governance and access across BioDAO launches

Reality check: Success requires genuine scientific merit, patient capital, and long development timelines. Not suitable for quick speculation or teams without credible research backgrounds and institutional relationships.

Choosing the Right Launchpad: Builders vs. Buyers

The Solana launchpad ecosystem in 2025 spans a spectrum from chaotic virality to institutional rigor. Success depends on matching your project type, timeline, and risk tolerance to the right platform infrastructure. Each category optimizes different variables—speed versus structure, speculation versus utility, narrative versus governance—and understanding these trade-offs is more valuable than chasing the trending platform of the moment.

Fast-Launch Meme Coin Platforms

Platforms: Pump.fun, Believe.app, Boop.fun, GoFundMeme, LaunchLabs, and many others

These platforms prioritize instant deployment and social momentum over everything else. One-click launches, bonding curves, and permissionless access create environments where tokens can explode or die within hours. The infrastructure supports reflexive trading dynamics rather than structured fundraising or long-term development.

For Builders: Use when viral potential matters more than credibility. Ideal for meme creators, social experiments, and community tokens where attention drives value. Success requires social media fluency, timing market cycles, and accepting that most launches fail quickly. The platform with current momentum typically offers the best distribution.

For Buyers: High-frequency, high-risk speculation where information edge matters more than fundamental analysis. Monitor social signals, wallet flows, and bonding curve dynamics for early entries. Treat it like scalping—get in fast, take profits faster, and expect most positions to fail. Success comes from superior information sources and execution speed rather than holding conviction.

AI Launchpads

Platforms: Virtuals, Auto.fun

Specialized for AI-themed tokens and agent deployment, these platforms blend speculation with utility narratives. They're not for serious AI infrastructure but excel at launching agent-branded tokens that can capture AI narrative cycles. Virtuals functions primarily as a launchpad with most successful agents eventually building independent systems, while Auto.fun focuses on functional utility within the $ai16z ecosystem.

For Builders: Choose when you can leverage AI narratives and build agents with some functional utility. Virtuals works for community building and initial traction, while Auto.fun suits creators focused on DeFi automation or social media agents. Success requires understanding AI trends and building beyond pure speculation.

For Buyers: Focus on agents with sticky mechanics or novel functionality that can sustain attention beyond launch hype. The window for pure narrative plays is shorter than traditional memes, but agents with genuine utility can develop longer-term communities. Edge comes from evaluating actual functionality versus AI branding and timing narrative cycles effectively.

High-Effort, Structured Fundraising Platforms

Platform: Meteora

The institutional-grade option offering maximum customization through DLMM technology, Alpha Vault fair access, and sophisticated anti-sniping tools. Used by serious DeFi projects like Jupiter for precision fundraising with transparent, configurable parameters. Multiple launch products (DLMM, DAMM, DAMM V2) accommodate different strategies and complexity levels.

For Builders: Use when transparency, community alignment, and sophisticated tokenomics matter more than viral speed. Requires technical understanding and strategic planning but enables sustainable launches that support long-term development. Best for DeFi protocols, DAOs, and utility tokens with clear value propositions.

For Buyers: Research-driven investing where fundamental analysis and configuration evaluation provide edge. Slower upside but more defensible floors due to transparent mechanics and serious teams. Treat like venture investing—evaluate teams, tokenomics, and launch parameters for positioning ahead of broader recognition. Suitable for larger allocations and longer time horizons.

Governance-First Launch Platforms

Platform: MetaDAO

Embeds futarchy governance from day one, using prediction markets instead of traditional voting to guide project decisions. Creates genuine community ownership through equal-access launches and market-driven decision-making. Suited for experimental governance and mission-driven projects rather than pure speculation.

For Builders: Choose when committed to transparent governance and community ownership from launch. Requires education overhead and relinquishing traditional founder control in favor of prediction market guidance. Best for DAO-first projects with clear success metrics and communities interested in active governance participation.

For Buyers: Long-term value accrual through governance participation and prediction market accuracy. Edge comes from understanding governance structures and making effective decisions within futarchy systems. Ideal for users seeking more than financial exposure—those who want meaningful influence over project direction and believe in market-driven decision quality.

Science & Research Launchpads

Platform: Bio Protocol

Curated exclusively for legitimate scientific research and biotech initiatives. Uses auction mechanisms for fair distribution while focusing on real-world research outcomes rather than speculative trading. Connects crypto capital with scientific funding through tokenized IP and research governance.

For Builders: Use when leading genuine scientific research that can benefit from decentralized funding and community governance. Requires credible scientific background and ability to pass curation review. Best for researchers, academics, and biotech teams seeking patient capital and transparent use of funds for actual research activities.

For Buyers: Technical evaluation and domain expertise provide significant edge over general crypto investors. Suitable for those who can assess scientific merit, research team credibility, and real-world impact potential. Long development timelines and uncertain outcomes make this suitable only for patient capital and impact-oriented investors with relevant knowledge.

Final Thoughts

Solana's launchpad ecosystem has matured into distinct categories with clear winners. Most platforms are variations on Pump.fun's bonding curve model, competing for temporary attention rather than building lasting advantages. For meme launches, use whichever platform currently has momentum unless you have AI theming.

For serious projects, Meteora stands alone. Any token with specific goals, custom tokenomics, or structured fundraising needs should choose configurable infrastructure over one-size-fits-all curves. MetaDAO offers the best model for fair community governance, while Bio Protocol demonstrates how specialized curation can connect crypto capital with quality projects from specific sectors.

The strategic choice is simple: chase attention on trending platforms or build on proven infrastructure. Temporary advantages are copyable—sustainable differentiation requires choosing platforms aligned with your actual needs rather than following hype cycles.

Momentum matters for memes. Structure matters for everything else.

Sources

https://whitepaper.virtuals.io

https://virtuals.io

https://99bitcoins.com

https://docs.meteora.ag

https://decrypt.co/resources/what-is-pump-fun-the-solana-meme-coin-factory

https://phantom.com/learn/crypto-101/believe-app-solana

https://www.kucoin.com/learn/web3/what-is-meteora-transforming-solana-s-memecoin-ecosystem

https://docs.raydium.io/raydium/protocol/developers

https://phantom.com/learn/crypto-101/believe-app-solana

https://www.coingecko.com/learn/what-is-believe-token-launchpad#:~:text=Coin%20Creator%20Revenue%20Sharing

https://medium.com/coinmonks/boop-fun-0ffbc52d3b7d

https://medium.com/coinmonks/gofundmeme-828a8a04b188

https://solanafloor.com/news/base-loses-big-ai-agent-launchpad-virtuals-expands-solana

https://github.com/elizaOS/auto.fun

https://medium.com/coinmonks/auto-fun-e2ed2675113e

https://docs.bio.xyz/bio/introduction/bio-protocol-v1/launchpad