DAO Dynamics:

Marinade Finances' Present Picture

Introduction

As the landscape of decentralized finance (DeFi) continuously evolves, we are exposed to an array of diverse projects, each with its own intricacies. Today, we take a look at one such project that is making waves in the DeFi world -Marinade Finance and delve into the inner workings of its native token, MNDE. Central to our exploration is the mSOL token - a liquid staking token, a novel financial instrument that's paving a new path in the world of DeFi. Before we dive into the depths, it's crucial to first understand the fundamentals.

Solana

Solana is a high-performance blockchain platform designed to facilitate decentralized applications and crypto-currencies. The Solana ecosystem has seen rapid growth, and within it, Marinade. finance and its mSOL token have emerged as prominent players.

Proof of stake

Proof of Stake (PoS) is a consensus mechanism used in blockchain networks where validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to 'stake' as collateral. In contrast to Proof of Work (the mechanism used by Bitcoin), PoS is more energy-efficient, as it removes the need for intensive computational work and instead relies on an economic commitment to secure the network.

Liquid Staking Tokens

Liquid staking tokens, like mSOL, represent a novel solution to the problem of capital efficiency in staking. They allow users to stake their tokens and yet remain liquid, enabling participation in the wider DeFi ecosystem without losing staking rewards.

Liquid staking token market analysis

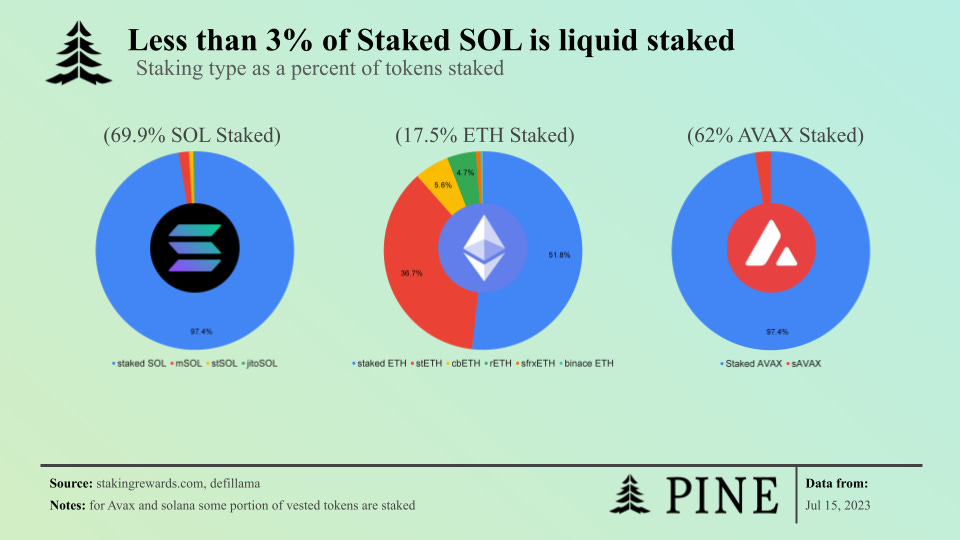

In this comparative analysis, we unpack a revealing graphic that delineates the distribution of staked tokens across Ethereum, Solana, and Avalanche. The graphic showcases Ethereum's mature DeFi landscape, where nearly 50% of staked tokens are within liquid staking tokens. This starkly contrasts with Solana and Avalanche, where liquid staking tokens encompass only 2-3% of staked tokens. The discrepancy here is both a testament to Ethereum's established DeFi infrastructure and a hint at the untapped potential on these other platforms.

Furthermore, the percentage of total tokens staked shows a substantial disparity across the networks. Solana and Avalanche significantly outperform Ethereum with 60-70% of tokens staked, compared to Ethereum's 17.5%. However, this doesn't tell the full story. In terms of the total supply, Ethereum has approximately 9% of its tokens in liquid staking tokens, while Solana and Avalanche are only at around 2%.

This data points towards a significant potential growth trajectory for Solana and Avalanche LSTs if the blockchains continue to develop their DeFi ecosystems. Should Solana and Avalanche follow Ethereum's path towards a more mature DeFi ecosystem, the percentage of tokens in liquid staking tokens could multiply by four or more. This would bring these networks closer to parity with Ethereum's ratio of tokens in liquid staking tokens, marking an important milestone in their growth and development.

mSOL supply dynamics

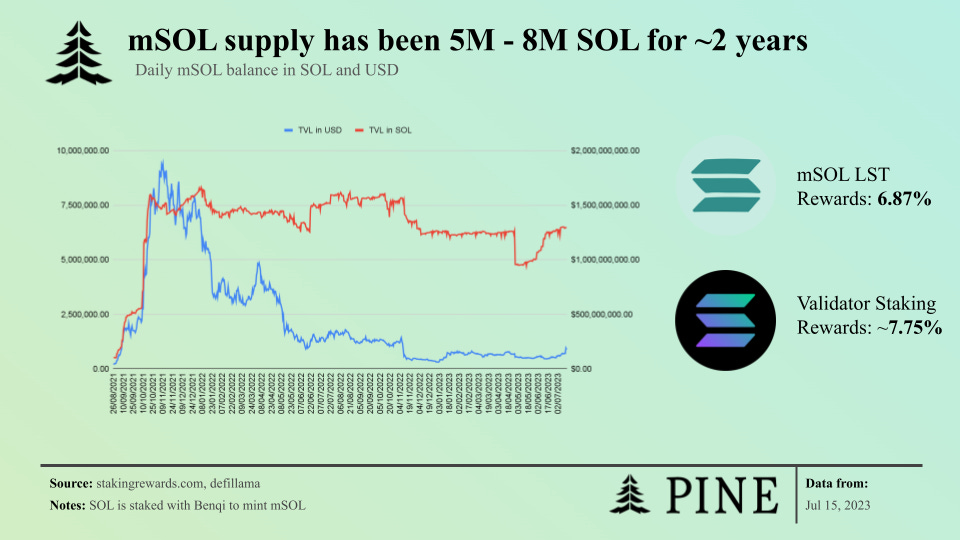

Currently, Marinade.finance manages an impressive portfolio of roughly $180 million in mSOL, generating a net yield of 0.92%, derived from a 7.75% validator staking reward minus a 6.87% mSOL liquid staking token reward. This dynamic creates a lucrative opportunity for validators, with the platform presently churning out an estimated annual revenue of around $1.65 million for validators leveraging its system. It's noteworthy that these rewards exhibit a direct correlation with the SOL price and the volume of SOL staked within Marinade.finance. This revenue generation presents a significant consideration not only for validators but also for the underlying DAO. Currently, the DAO has the power to direct 20% of the protocol's stake to the validator of their choice, enabling them to potentially extract 20% of the validator's revenue, but this value capture method is subject to change.

An essential gauge for the protocol's vitality is the trajectory of the number of SOL staked. To ensure the protocol's continued resilience and progress, there is a need for an upward or flat trend in this metric. This trend acts as a fundamental measure of the protocol's long-term viability, as it offers a clear reflection of the protocol's growth within the Solana ecosystem, devoid of the usual noise associated with Solana price movements. In recent months, the quantity of staked SOL has been breaching the upper segment of its typical range, indicating a positive momentum. Should this trajectory persist, it would serve as a strong signal for the protocol's promising future.

Solana LST users

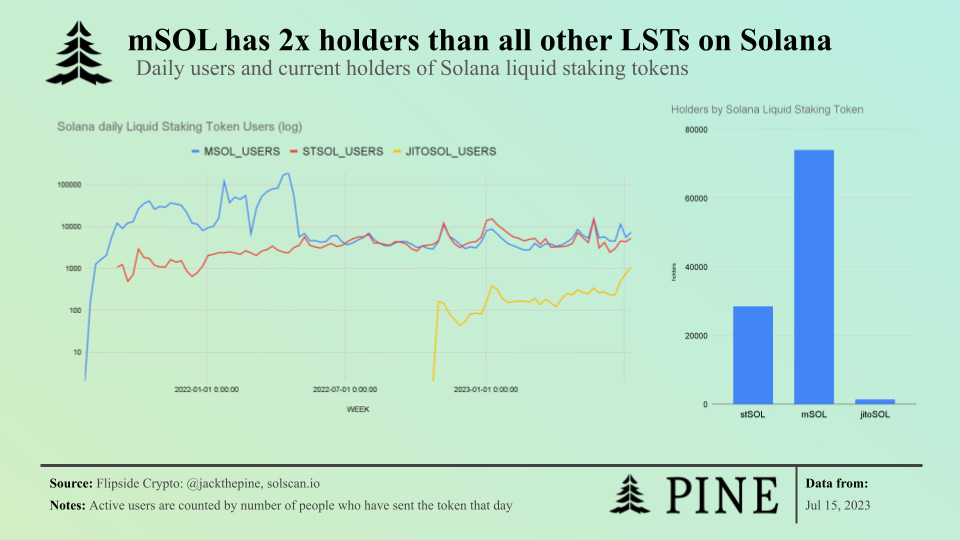

In this section, we examine a graphic that presents a comparison of the daily users and holders of the top three staking tokens on Solana: mSOL, stSOL, and jitoSOL. What is immediately striking is that mSOL leads the pack in terms of total holders, boasting nearly 80,000, while stSOL trails with about 30,000 holders. jitoSOL falls significantly behind both.

However, the historical analysis of daily users paints a different story. At the outset of 2021 and continuing into early 2022, mSOL outpaced stSOL by an order of magnitude in terms of daily users. However, there was a significant drop-off in mSOL's daily user activity around this period, which brought it down to par with stSOL. Since about May 2022, there has been an equilibrium in the number of daily users between mSOL and stSOL.

This data reveals a dichotomy in the usage patterns of these staking tokens. While mSOL is currently dominant in terms of the total number of holders within the Solana ecosystem, it does not hold the same dominance in terms of the number of daily users interacting with the token. This discrepancy suggests that while mSOL might have broader distribution, the level of active engagement is similar for both mSOL and stSOL.

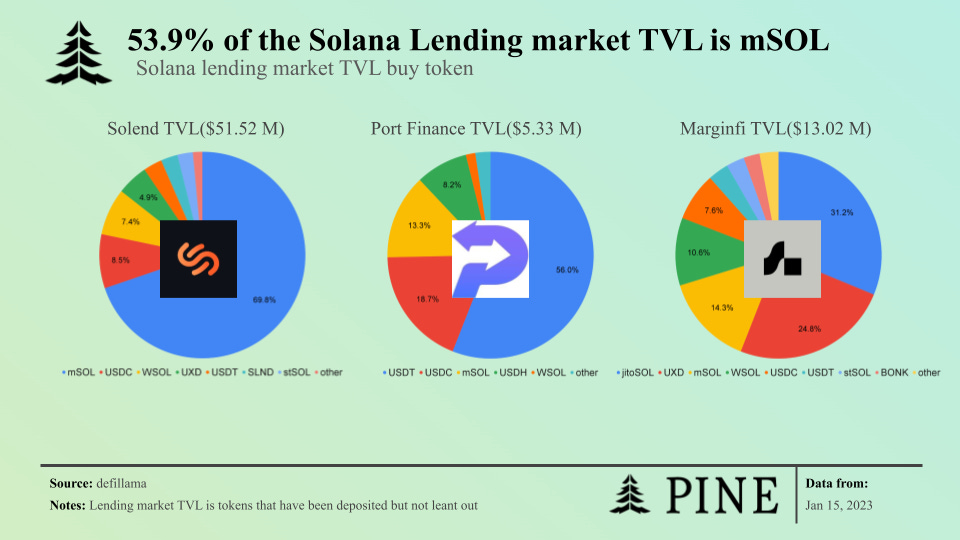

Solana LST in lending markets

In our analysis of the total value locked (TVL) in Solana lending markets, we find that mSOL, the liquid staking token of Marinade Finance, plays a crucial role. The data reveals that mSOL constitutes a staggering 53% of all assets held within Solana's lending protocols. This places mSOL as the largest token on Solend, and the third-largest on Port Finance and Marginfi. Another noteworthy token in the Solana lending ecosystem is jitoSOL. Particularly, it leads in terms of TVL on Marginfi’s, making up about 31% of MMarginfi's total value locked.

The significant presence of these liquid staking tokens in Solana's lending markets underscores their utility in the DeFi landscape. One of the key use cases for these tokens is using them as collateral to borrow other tokens. This offers the benefit of earning yield on the underlying staked SOL while also leveraging it to participate in other DeFi activities.

The dominance of mSOL within Solana's lending markets has strategic implications. Being the leading liquid staking token means it has established extensive integrations across different DeFi protocols, which in turn fosters greater adoption. This sets up a virtuous cycle where increased adoption further paves the way for more integrations with new DeFi protocols, thus bolstering mSOL's position in the market.

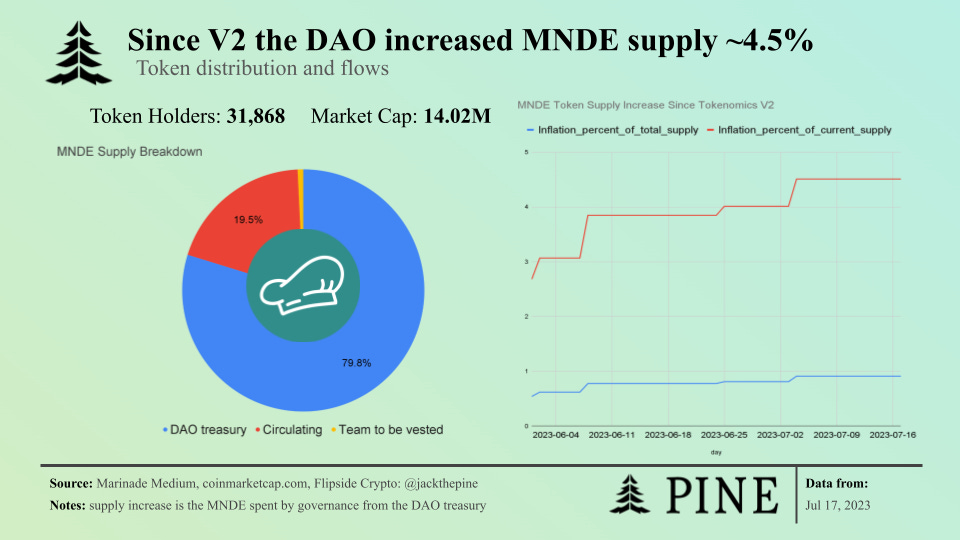

MNDE tokenomics

Our examination of the MNDE token distribution, as depicted in the graphic, reveals a noteworthy breakdown. Approximately 19.5% of the total supply is currently in circulation, with a minor percentage allocated for team vesting, while a substantial 79.8% is retained in the DAO Treasury. This distribution implies that any future dilution of the token will be a result of decisions made through DAO voting.

It's notable that since the tokenomics was adjusted at the end of May, the governance has dispensed tokens equivalent to 4.5% of the existing supply, or roughly 1% of the maximum supply. If this rate of token distribution from the DAO Treasury were to persist, we could see the circulating supply increase at an annual pace of 40% to 50%.

However, as a token holder, you have the privilege of participating in these critical decisions. You can cast your vote on governance proposals, including those related to token distribution, which means the rate of expenditure from the DAO Treasury is not fixed and can be modified according to the collective will of the token holders. This dynamic underscores the importance of active participation in DAO governance to shape the token's economic trajectory.

Conclusion

Taking into account the current market capitalization of the MNDE token, which stands at $14.02 million, it's crucial to observe the potential value that token holders can derive. Currently, the DAO can direct 20% of the protocol's stake to the validator of their choice. This implies that the $1.65 million yearly cash flow from staking, as mentioned before, can potentially yield around $330,000 annually for MNDE token holders.

Interestingly, the DAO is currently following a strategy of dilution to secure a larger market share in the Solana staking market. It's prioritizing growth over immediate cash flow extraction. Should this strategy continue to be effective, and should DeFi on Solana evolve akin to Ethereum, there's a significant potential for growth.

In a scenario where Marinade manages to grow to control 24 million SOL(that would be equivalent to Lido’s portion of Ethereum’s staking market), the yearly cash flow generated for the DAO could fall within a range of 120K - 360K SOL. Given the current SOL prices, this equates to an estimated $3M - $9M, representing a substantial increase from current levels. Such a situation would further underscore the strategic value of the DAO's approach, particularly if Solana continues its growth trajectory and DeFi expansion.