FlyingTulip FT Raise Explained

Platform, Raise, and Tokenomics

Executive Summary

Raise Mechanics

Target & Pricing: Up to $1.0B at 10 FT per $1 (implied $0.10). If <$1B is raised, fewer FT are minted proportionally.

Principal protected through perpetual PUT (NFT-wrapped FT): Original raise buyers receive a transferable NFT that holds the FT they purchased in the raise; while the FT remain inside this NFT, the holder can redeem at par (same asset/amount) and redemption burns the FT, with the PUT bound to the NFT. If the FT are removed from the NFT (to sell or for any other use), the PUT for those tokens is forfeited; transferring the NFT passes along any FT still inside and the associated PUT rights.

Accepted Assets & Yield Use: USDC, USDT, USDS, USDe, ETH, SOL, AVAX, S. PUT backing is deployed to blue-chip, liquid yield sources; yield funds FT buybacks/burns (after covering OpEx when needed).

Revenue-Linked Team Allocations: All protocol-revenue funds FT buybacks that trigger a 40:20:20:20 distribution (Foundation/Team/Ecosystem/Incentives), with net supply held flat until the foundation tokens are fully unlocked, at 10B nominal tokens purchased by revenue, after which all buybacks are burnt.

What is Flying Tulip

Flying Tulip is an execution-aware on-chain platform that unifies AMM, CLOB, lending, a stablecoin, insurance, and derivatives under one venue. Founded by Andre Cronje, its core edge is execution-aware risk pricing: the system continuously measures real market depth (AMM reserves + orderbook liquidity) and estimates slippage for a target unwind size, then adjusts LTVs, borrow caps, and liquidation sizing accordingly. Short-horizon EWMA volatility adds a dynamic haircut—when volatility rises, limits tighten and maintenance buffers increase—so borrowers, LPs, and liquidations can exit through time-sliced, best-venue routing without toxic slippage.

Product Lines

Trading (Hybrid AMM + CLOB)

A unified trading venue that combines an AMM with integrated limit orders/CLOB. Orders can route to the AMM or to resting limit liquidity based on available depth and price, so users don’t have to choose a venue manually. The AMM’s pricing curve is designed to adapt to market regimes, while the UI emphasizes low-friction access (account abstraction, gas assists, multi-chain deposits).

Lending (Impact-Based + Generalized)

A money market that sets borrow limits using observable execution costs (estimated slippage to unwind) and recent volatility, then scales limits with utilization. It also supports borrowing in the same asset as the collateral for hedged strategies and connects to the ftUSD flow so yield/liquidity reinforce the broader system.

Perps

Perpetual markets that settle against opt-in LPs and the integrated AMM/CLOB rather than relying primarily on slow external oracles. This enables venue-native price discovery and permissionless asset listing, with funding, margin, and execution handled within the same exchange architecture.

ftUSD

A USD-equivalent asset backed by tokenized delta-neutral LP positions. It serves as the quote/settlement rail across the platform while its yield engine is intended to support liquidity and tighter pricing across markets.

Insurance & Options (Coming)

The team has confirmed that insurance and options are planned additions to the DEX product line. This section notes their inclusion for completeness. No further specifications (design, parameters, or timelines) are provided at this time.

Market Size

Leading incumbents’ current annualized revenue

Perps/CLOB — Hyperliquid: current 30-day fees annualize to ≈$1B.

Lending — Aave v3: revenue (annualized) ≈ $162M.

Delta-neutral stablecoin — Ethena (USDe/sUSDe): revenue (annualized) ≈ $30.6M.

AMM — Uniswap (fee switch hypothetically ON): Uniswap fee pool ≈ $1.48B/yr; if a protocol fee/take-rate were enabled, protocol revenue would scale with the setting—10% ⇒ ~$148M, 15% ⇒ ~$222M, 20% ⇒ ~$296M. (V3 governance supports ~10–25% ranges.)

Aggregate across named incumbents

Using the mid-case Uniswap 15% scenario, the combined incumbent revenue pool across these verticals is ~$1.41B/yr ($1B + $162M + $30.6M + $222M). For sensitivity, the total ranges ~$1.36B–$1.49B/yr at 10%–20% Uniswap take-rates, respectively.

Revenue drivers within the suite

Flying Tulip’s revenue will primarily hinge on performance in perps/CLOB, and—to a lesser extent—spot swaps (AMM/CLOB routing). These two verticals account for the lion’s share of on-chain venue revenue among incumbents. Lending, delta-neutral stablecoins, and insurance are strategically important for liquidity, stickiness, and UX, but they are smaller direct revenue contributors relative to perps and swaps.

Near-term top-line sensitivity is most exposed to derivatives volumes, funding/spread capture, and swap flow/MEV-aware routing, while the other products serve as enablement layers that deepen liquidity and improve execution, indirectly supporting the core revenue engines.

Flying Tulip’s Key Differentiators

LTV set by actual exit costs (not static tables)

Borrow limits are computed from the real price impact to unwind a target position size across AMM + orderbook depth, then haircut by short-horizon volatility (EWMA). In calm, liquid markets, limits expand; in thin or volatile markets, they contract. This replaces fixed LTV matrices with execution-aware caps and maintenance buffers.

Liquidations that aim to not move the market

Closeouts are sized to best-bid depth and time-sliced across venues to keep impact within a target band; keepers are rewarded when they beat a VWAP threshold. The mechanism tightens automatically in liquidity shocks and reopens as depth returns.

AMM curve that adapts to volatility

Instead of a one-shape-fits-all invariant, short-term volatility feeds a smooth σ → n(σ) map: flatter curves in calm periods (lower slippage) and more product-like under stress (resilience). Pricing uses numerical solvers on convex invariants for stable execution across regimes.

Native limit orders via range liquidity, integrated in routing

Uniswap v3 range orders are used as on-chain maker limits (mint-rest-fill-withdraw), with TWAP guards/minimum tick widths to reduce adverse selection. A unified router chooses between AMM swaps, resting ranges, and external venues, giving CEX-like behavior without fragmenting liquidity.

Composite, path-aware impact modeling

Execution cost estimates combine AMM virtual reserves with resting orderbook liquidity and consider multi-hop routes when they materially lower impact—so risk controls and routing share the same market model.

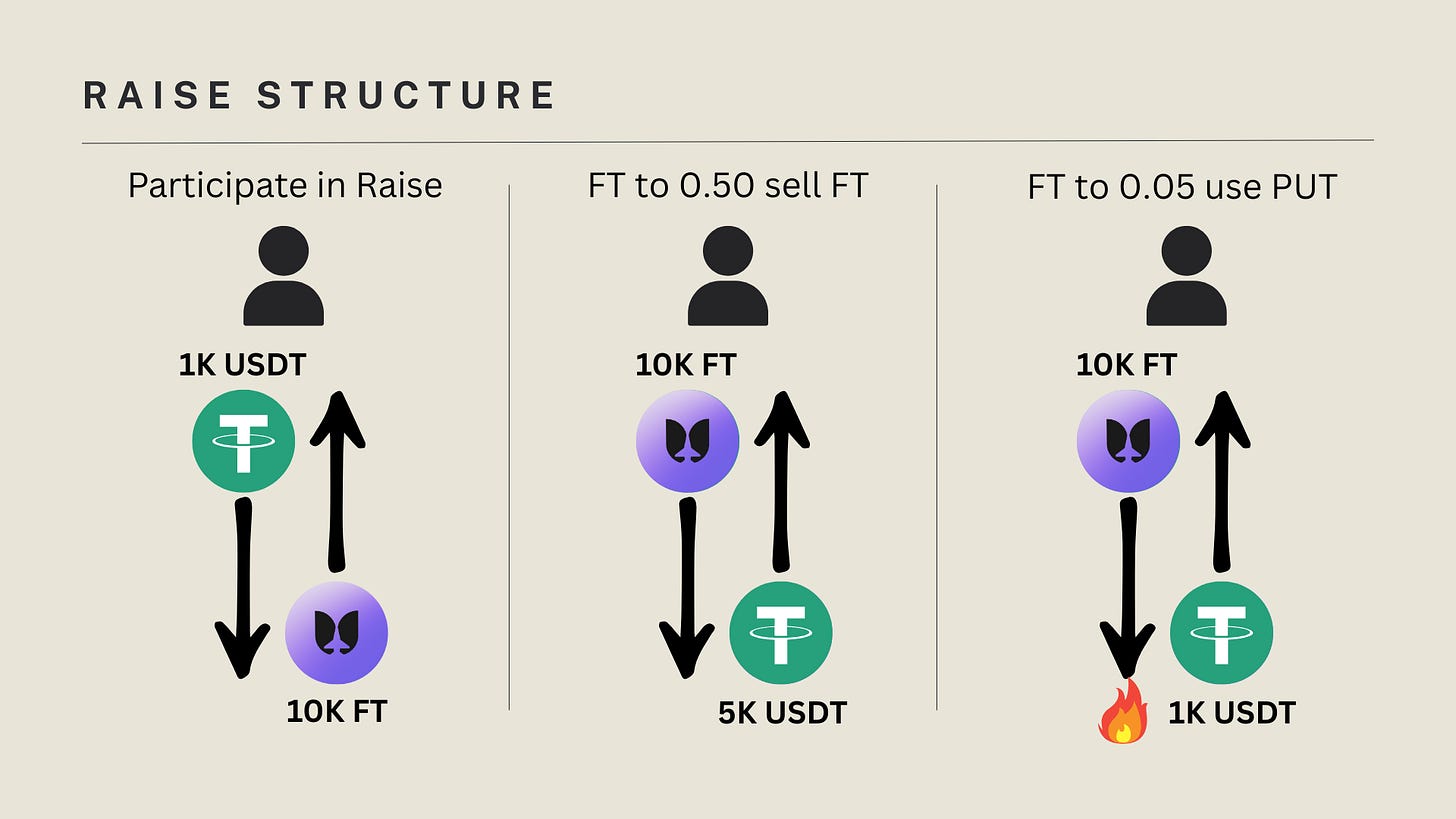

Raise Structure

How much is being raised and what’s the token price?

The project is aiming to raise $1 billion. Investors can contribute in a mix of assets — major stablecoins (USDC, USDT, USDS, USDe) and blue-chip tokens (ETH, SOL, AVAX, S). For every $1 invested, buyers receive 10 FT tokens. This means the starting price of FT is $0.10. If less than $1B is raised, fewer tokens are created (e.g., $500M raised → 5 billion tokens instead of 10 billion).

How the PUT option works

What is a PUT? Every investor gets a built-in safety net. If you put in 1,000 USDC and receive 10,000 FT, you can choose to trade those 10,000 FT back for your original 1,000 USDC.

When you participate in the raise, the FT you purchase are wrapped inside a transferable NFT issued to you. While your FT remain inside this NFT, you can redeem at par—the same asset and amount you originally deposited (e.g., 1,000 USDC in → 1,000 USDC out). Redeeming burns the FT, and the PUT stays bound to the NFT.

Scope: Applies only to FT that are still inside the NFT.

Par redemption: Same asset/amount as originally deposited.

Partial allowed: You can redeem pro-rata (some FT now, some later).

Forfeiture: If FT are removed from the NFT (to sell or use elsewhere), the PUT on those tokens is forfeited.

Transfer: Transferring the NFT passes along any FT still inside and the associated PUT rights.

Example use of the PUT option

Price down to $0.05 — PUT used:

You deposit 1,000 USDC and receive 10,000 FT (@ $0.10). FT later trades at $0.05 (market ≈ $500). Because your FT are still inside the NFT, you may redeem at par and receive 1,000 USDC by returning the NFT.

Price up to $0.50 — PUT forfeited:

Same start (1,000 USDC → 10,000 FT). FT trades at $0.50. You first remove the 10,000 FT from the NFT (this forfeits the PUT on those tokens), then sell the 10,000 FT at $0.50 for $5,000 USDC in proceeds.

PUT Forfeited — Price Falls to $0.05:

You pull FT out of the NFT (PUT forfeited) and hold them. FT later trades at $0.05. With no PUT, your position is worth market value only (≈ $500); you cannot redeem at par.

PUT backing yield

While FT remain inside the transferable NFT (PUT active)—the backing assets are staked if they are L1 tokens, or placed into blue-chip, liquid yield sources if they are stablecoins. The yield generated is used to buy back FT and to cover OpEx while protocol fees are below OpEx. This yield strategy introduces a small additional smart-contract risk to the PUT.

Depositor Pros & Cons (vs. a typical raise)

Pros: You get uncommon downside protection via the standing PUT (redeem at par while you hold), plus full liquidity from day one.

Cons: You take small smart-contract/venue risk on the yield strategies backing the PUT and incur opportunity cost versus using your assets elsewhere.

Net take: If backing assets earn up to ~10% annually, this can be +EV, provided you believe there’s at least a ~10% probability that FT trades above $0.20 within a year, since you keep the floor yet retain upside.

PUT backing yield details

Yield generated

Flying Tulip’s expectation for the breakdown of tokens deposited into the raise is: 50% stables (USDC, USDT, USDS, USDe) divided evenly at 12.5% each, 30% ETH, 10% SOL, 3% AVAX. These tokens will generate yield in the following ways, with the 12-month backtest yields of these strategies:

USDC → Aave v3 USDC 1y avg supply APR ≈ 5.26%

USDT → Aave v3 USDT 1y avg supply APR ≈ 4.83%

USDS → Aave v3 USDS (new): 30d ≈ 4.12%, 6m ≈ 2.63% → proxy 3.50% used for 12m modeling (USDS launched in 2025; 1y N/A).

USDe → sUSDe average APY ≈ 7.54%

ETH → stETH APR currently ≈ 2.7%

SOL → jupSOL (Solana LST) ≈ 6.7% APY

AVAX → native staking reward ≈ 7.18%

If $1B of assets are deposited into the raise at the expected ratio, and yields match the 12-month backtest, the protocol will generate yield at a rate of $44.27M per year.

FT Buybacks

At the expected $44.27M/year in yield, Flying Tulip would buy back FT at ~2.2%–8.8% of total supply per year when the token trades between $0.05 and $0.20, with a higher portion repurchased at lower prices.

While Flying Tulip is earning less revenue than its operating expenses (~$500k/year), yield will first cover OpEx and the excess yield will go to buying back the token. At the projected yield generation rate, OpEx is just over 1% of yield and will not meaningfully change the magnitude of FT token buybacks.

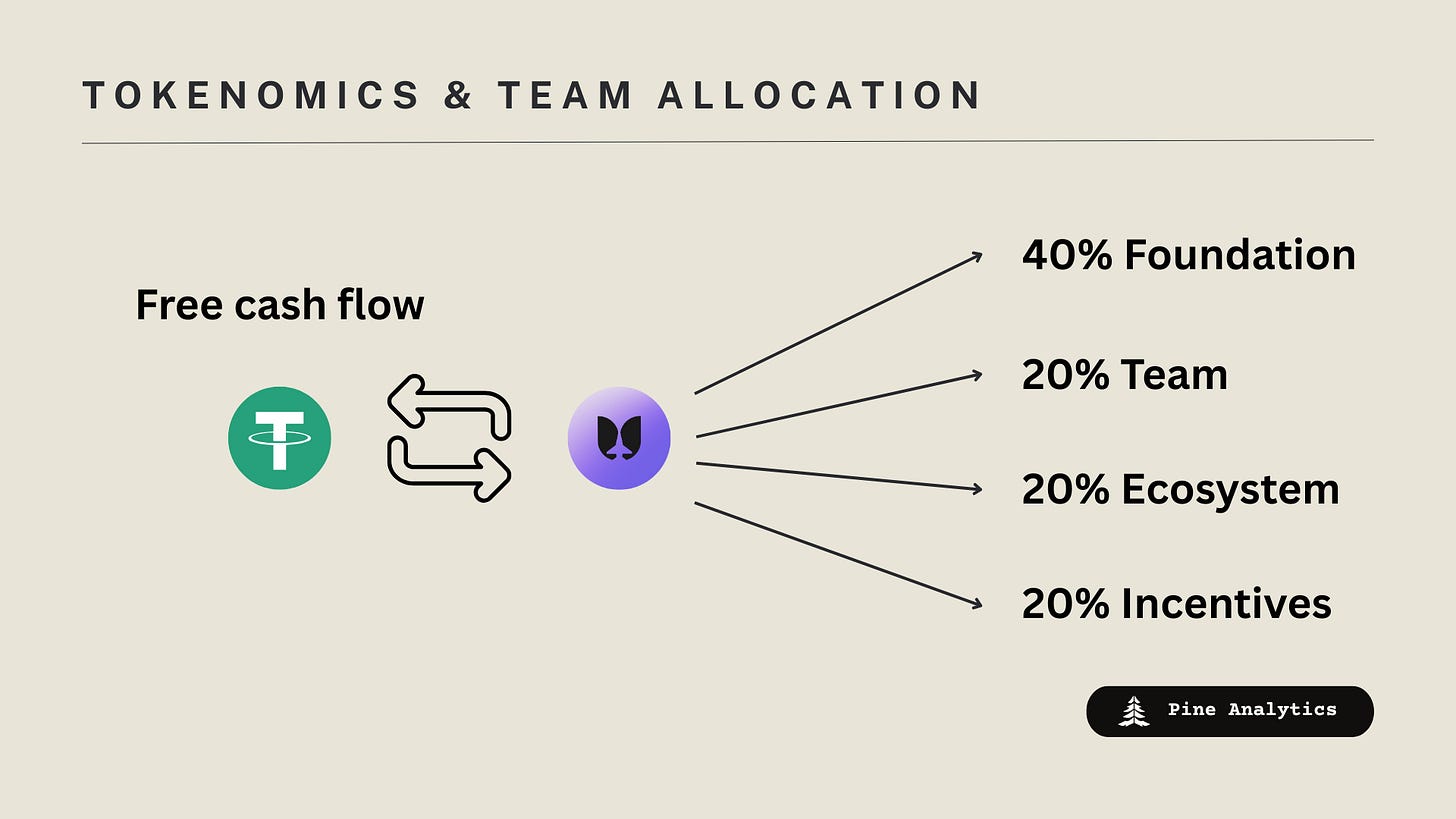

Tokenomics & Team Allocation

The FT token supply is capped at 10 billion, with the initial distribution determined by the raise amount. If $1 billion is raised, all 10 billion tokens are issued at $0.10 each. If less is raised, fewer tokens are minted (e.g., a $500 million raise results in 5 billion tokens). All tokens sold in the raise are fully liquid and backed by the PUT option, while unsold tokens remain unminted.

What differentiates FT from most projects is how the team and foundation allocations are distributed. The team and foundation start with zero tokens at launch. Instead of time-based vesting, insider tokens are gained through buyback from protocol free cash flow. Each $1 of free cash flow is split:

First, it is used to buy back FT from the market.

Then, for every token bought back with revenue, those tokens are distributed in a fixed 40:20:20:20 ratio (40% Foundation, 20% Team, 20% Ecosystem Growth, 20% Incentives).

From an investor’s perspective, this design offers two key benefits. First, the team only wins if the protocol succeeds, unlike most raises where teams are paid upfront. Second, the ongoing buybacks—funded by both yield on deposited assets and protocol revenues—help maintain deflationary pressure.

Final Thoughts

Flying Tulip is a new project that compresses four major crypto verticals—exchange, lending, perps, and a dollar rail—into one execution-aware platform that aims to unlock real synergies. The raise design gives participants meaningful upside while mainly putting opportunity cost at risk via a standing PUT. In a market where new venues are launching and their tokens are running hard, this integrated approach, if executed well, looks like a compelling opportunity to consider.

Impressive work. Thank you for the insights and alpha.