Futarchy and The Meta-DAO

The Conception of Futarchy

Futarchy, conceived by economist Robin Hanson in "Futarchy: Vote Values, But Bet Beliefs," mixes democracy and the smart insights from betting markets to decide on government policies. Imagine a system where people vote on what goals we want to achieve as a society, like better health care or education. Then, instead of politicians deciding how to get there, we use betting markets—where people can bet on which policies they think will work best. These aren't ordinary bets, but rather predictions that help guide decisions. If the majority of bets favor a particular policy as the best way to meet our goals, that policy gets put into action. This method aims to use the knowledge and predictions of many to make better decisions, fixing the gap we sometimes see between what experts suggest and what governments do. In short, futarchy hopes to make policy decisions smarter, more informed, and better aligned with what people actually want, by using a mix of traditional voting to set goals and innovative betting to choose the best ways to reach them.

Meta DAO’s implementation of Futarchy

Meta DAO has taken the pioneering step of adapting the futarchy model, traditionally envisioned for governmental use, to suit the unique dynamics of an organizational setting. By applying futarchy at an organizational level, Meta DAO offers an intriguing case study in decentralized governance.

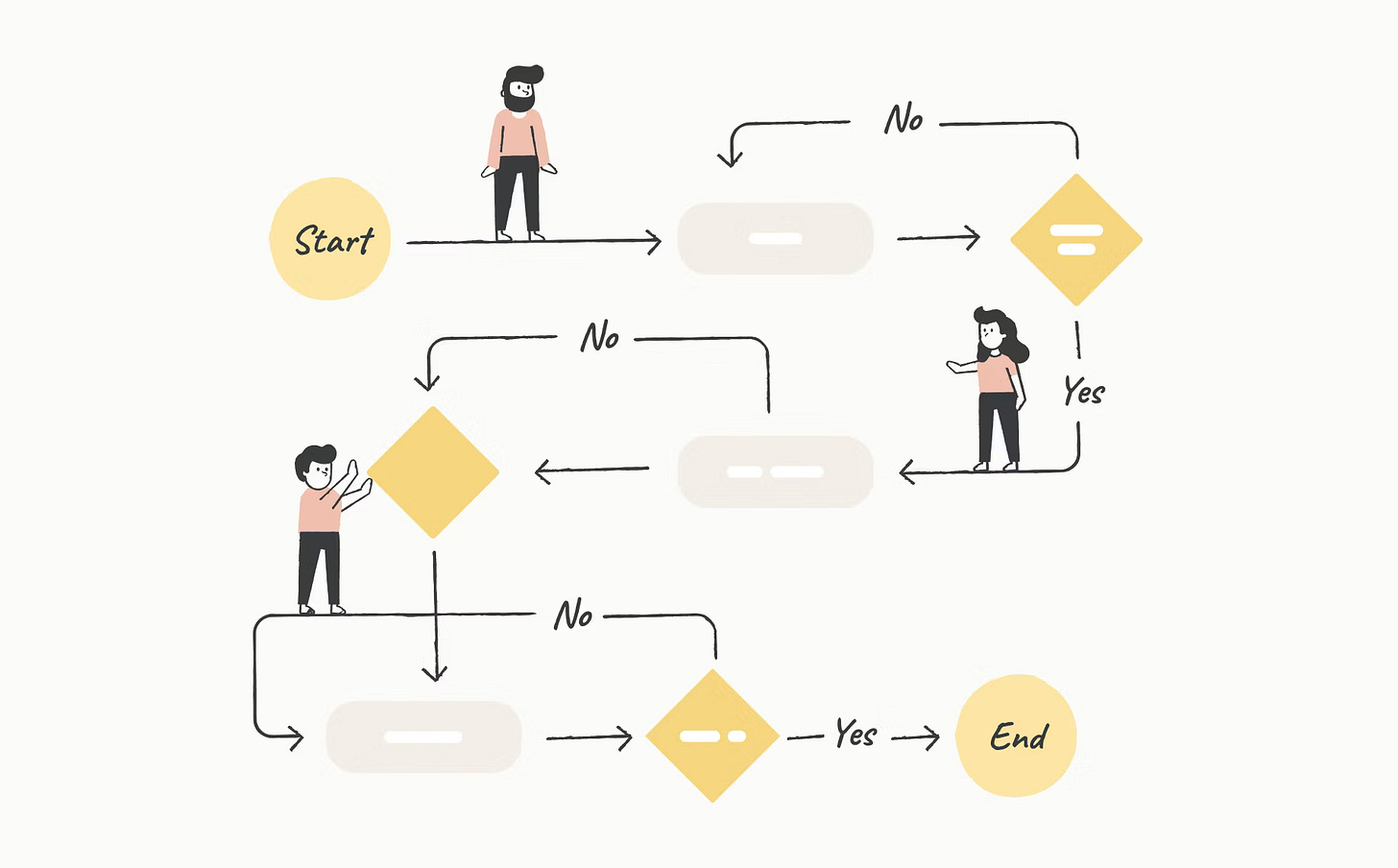

The process begins with the open submission of governance proposals by anyone. Upon the launch of a proposal, two distinct markets are created: one for passage ("pass market") and one for failure ("fail market"). Participants engage by trading Meta DAO's native token, META, within these markets, signaling their support or opposition.

A critical component of this system is the use of a Time-Weighted Average Price (TWAP) to gauge the collective sentiment toward the proposal over a specified period, currently five days. If the TWAP in the pass market exceeds that of the fail market by the end of this period, the proposal is deemed accepted. Consequently, trades in the fail market are reversed, while those in the pass market are finalized as they stand. Should the TWAP favor the fail market, the opposite occurs, with the proposal being rejected.

This methodology diverges from Robin Hanson's original futarchy concept, which primarily focuses on selecting policies based on their anticipated impact on a pre-defined metric. Instead, Meta DAO's adaptation leverages market dynamics as a predictive tool, allowing the DAO's actions to be guided by the direct financial implications of its token. This approach enables the collective preferences and speculative foresight of the community to steer the DAO's decisions, based on the premise that the actions leading to an increase in the token's value are in the organization's best interest.

By integrating the principles of futarchy, Meta DAO innovatively harnesses the wisdom and incentives of its community, aligning decision-making with the overarching goal of enhancing value and governance efficacy within the decentralized framework.

Meta DAO’s Futarchy Proposal Walkthrough

Launching a Proposal

A member of Meta DAO initiates a proposal by paying SOL to the treasury, say, to fund a new project. This automatically creates two markets: one where members can bet on the proposal passing (the "pass" market) and another on it failing (the "fail" market).

Participating in a Proposal

When you decide to participate in a proposal, you deposit either META or USDC tokens into a conditional vault. This isn't just a simple deposit; it's where the magic of futarchy begins. Upon deposit, the system automatically generates two types of tokens for you: a "pass" token and a "fail" token. This means if you deposit 10 META, you'll get 10 passMETA tokens and 10 failMETA tokens. Each type of token represents a possible outcome of the proposal – success ("pass") or failure ("fail").

Trading Conditional Tokens

Now, with your pass and fail tokens in hand, you have the option to trade them. You might choose to sell failMETA tokens if you believe if the proposal does not pass it would be bad for the META price, or buy more passMETA with passUSDC tokens if you're confident the proposal's success will be beneficial for the META’s token price. This trading period allows participants to express their confidence in the outcome and potentially profit from their insights.

Proposal Outcome and Token Value

After the decision period ends and the proposal's fate is determined by the (TWAP) of the two markets, if the pass market has a 5% higher (TWAP) than the fail market then the proposal passes, and if not the proposal fails.

If the Proposal Passes: The pass tokens become valuable. They can be exchanged back into META or USDC, reflecting the successful outcome you bet on. Essentially, these tokens now act as your key to unlock the digital safe and retrieve your original deposit, potentially at a higher value due to the successful bet.

If the Proposal Fails: The fail tokens take center stage. They can be exchanged back into META or USDC, allowing you to recoup your bet on the unsuccessful outcome. Conversely, the pass tokens you held (if any) become worthless, as they represented a bet on a success that didn't materialize.

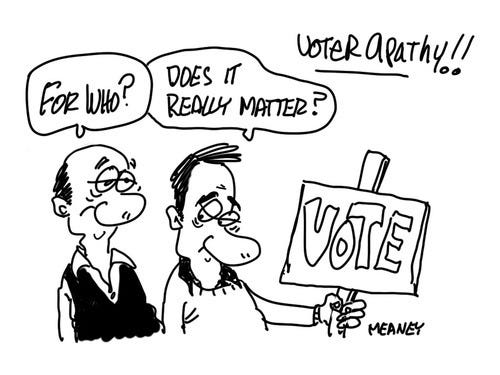

Solving Voter Apathy

In many Decentralized Autonomous Organizations (DAOs), the standard voting mechanism operates on a token-based system, where the number of votes one holds is directly proportional to the number of governance tokens one possesses. This model aims to align voting power with investment in the DAO, yet it often encounters a critical issue: voter apathy. Despite holding the means to influence decisions, many token holders remain disengaged, either due to a sense of insignificance in the face of larger token holders or a lack of sufficient information to make educated choices on complex proposals. Consequently, this apathy risks centralizing decision-making power, as disengaged members might simply go along with the choices made by active managers, thereby diluting the decentralized intent that defines DAOs.

Futarchy proposes an engaging alternative to this challenge by integrating economic incentives and market predictions into the governance process. Rather than simply casting votes based on token quantity, participants in a futarchy-driven DAO express their confidence in the outcomes of various proposals by placing bets on their expected success or failure. This method transforms passive voting into an active investment decision, leveraging the collective wisdom and financial stakes of the community.

This approach has several advantages in addressing voter apathy:

Incentivization: By tying financial incentives to the accuracy of predictions, futarchy motivates participants to actively research and understand proposals, leading to more engaged and informed participation.

Diversifying Participation: Futarchy levels the playing field by valuing the insights of all community members, not just those with large token holdings. This inclusivity invites a wider range of perspectives, combating voter apathy by making everyone feel their contribution is valuable.

Reducing Voter Fatigue: Members are not pressured to vote on every proposal but can choose to allocate their conviction to the issues most important to them, reducing burnout and focusing energy where they can contribute the most.

Enhancing Decision Quality

Futarchy introduces a governance model for Decentralized Autonomous Organizations (DAOs) that leverages market predictions for higher quality decisions, distinguishing itself from slower bureaucratic approaches. This model's effectiveness is supported by notable instances where market mechanisms outperformed traditional decision-making systems. Historical examples from various fields further illustrate the efficacy of market mechanisms in accurately forecasting outcomes and identifying issues faster than conventional methods.

HP's Decision Markets for Printer Sales

Hewlett-Packard (HP) utilized internal prediction markets to forecast printer sales, which consistently outperformed their official corporate forecasts. This example demonstrates how leveraging collective wisdom through market mechanisms can provide more accurate predictions, enabling better inventory and production planning than traditional hierarchical decision-making processes.

Prediction Markets vs. Voting Polls

Across multiple elections, prediction markets have shown a remarkable ability to forecast election outcomes more accurately than polls. While polls gauge current opinions, prediction markets aggregate beliefs about future outcomes, incorporating information about potential changes in public sentiment and unforeseen events. This ability to dynamically reflect collective intelligence makes futarchy a compelling model for DAO governance, potentially leading to more informed and adaptive decisions.

Market Response to the Challenger Explosion

The rapid market reaction to the Challenger space shuttle disaster in 1986 is a striking example of the market's efficiency in processing information. Within minutes of the tragedy, stock prices for Morton Thiokol, the manufacturer of the faulty O-ring, significantly declined, long before official investigations pinpointed the O-ring as the cause. This incident underscores how markets can quickly synthesize available information to identify problems, a process that bureaucratic investigations can take months to complete.

Futarchy stands out in DAO governance by utilizing market-based decision-making to bypass the delays, inefficiencies, and biases inherent in bureaucratic systems. By incentivizing participants with financial stakes tied to the accuracy of their predictions, it taps into the collective intelligence of the community, fostering decisions that are both well-informed and aligned with the collective good. This approach not only streamlines decision-making but also significantly enhances the quality and responsiveness of governance. The success stories of HP's internal prediction markets, election outcomes forecasted by prediction markets, and the immediate market reaction to the Challenger disaster underscore futarchy's superiority over traditional systems. These instances collectively advocate for integrating futarchy into decentralized organizations to leverage its benefits for more dynamic and effective governance.

Final Thoughts

Futarchy represents a groundbreaking shift in DAO governance, combining democratic voting with the efficiency of betting markets. This model, first proposed by economist Robin Hanson, aims to enhance decision-making by aligning it with the collective intelligence and financial incentives of the community. Meta DAO's application of futarchy showcases its potential to overcome voter apathy and bureaucratic inefficiencies by allowing members to bet on Proposals’ effect on the DAO, thereby ensuring that governance decisions are both community-driven and aligned with organizational interests.

The success of markets in other domains, such as HP's internal prediction markets and the rapid market response to historical events, underscores their effectiveness in harnessing collective wisdom for superior decision accuracy and speed. By incentivizing active participation and rewarding insightful contributions, futarchy offers a promising avenue to address challenges in DAO governance, fostering a more engaged, informed, and dynamic community. As DAOs evolve, adopting futarchy could significantly enhance their governance processes, making them more responsive and equitable in meeting the demands of the digital future.

Sources

https://mason.gmu.edu/~rhanson/futarchy.html

https://flipsidecrypto.xyz/pine/meta-dao-metrics-yG-0MP