Injective Network Overview

A 2023 Overview of Growth and Token Dynamics

Introduction

Injective (INJ) serves as a specialized financial blockchain, setting itself apart with features that include auto-executing smart contracts. These smart contracts allow for the automatic operation of decentralized applications (dApps), removing the need for human intervention. This functionality is especially advantageous for developers aiming to establish intricate financial operations and adaptive dApps.

Operating as an open and interoperable Layer-1 blockchain, Injective is engineered to facilitate the future landscape of DeFi applications. Its scope isn't limited to decentralized exchanges for spot and derivatives; it also extends to prediction markets, lending mechanisms, and more. The platform incorporates a fully decentralized on-chain order book that is resistant to Miner Extractable Value (MEV), enhancing the integrity and effectiveness of financial transactions.

Leveraging the capabilities of the CosmWasm smart contract framework, Injective offers an environment that promotes high levels of interoperability among dApps, enabling fluid interactions among various smart contracts. In summary, Injective provides a comprehensive and adaptable set of tools for financial developers, paving the way for efficient and groundbreaking decentralized applications.

Explosive User Growth in 2023

In 2023, Injective experienced an explosive surge in user adoption, transforming it into a prominent player in the blockchain landscape. At the start of the year, there were roughly 10,000 wallets on the Injective network holding INJ tokens. As of today, that number has skyrocketed to approximately 80,000 wallets. This remarkable growth can be attributed to the steady increase in active wallets between the beginning of the year and June 2023. However, the platform witnessed a significant spike in new active users between June and September, further fueling its growth. This mid-year acceleration, while not as rapid as before, still reflects a substantial increase in active users.

App Ecosystem on Injective

Injective boasts a vibrant ecosystem of nearly 200 projects and applications, catering to various financial needs. Here, we'll delve into three standout apps within the Injective ecosystem.

Helix - The Decentralized Orderbook Exchange

Helix takes the spotlight as the premier decentralized order book crypto exchange on Injective. It offers users the advantage of zero gas fees, an intuitive user interface, and access to specialized interchain markets. Helix empowers traders to engage in spot and perpetual market trading with advanced order types. Its ability to facilitate seamless asset transfers between Ethereum and Cosmos networks opens up opportunities in both popular and unique markets.

Mito - Revolutionizing Automated Trading

Mito is a game-changer, revolutionizing automated trading on Injective. It introduces smart contract-powered strategies that were traditionally reserved for sophisticated institutions and hedge funds. Mito's user-friendly interface enhances liquidity and accessibility, making advanced trading algorithms available to everyday users. By democratizing access to these strategies, Mito empowers users to supercharge their earnings and simplifies the Web3 trading experience.

FrontRunner - A Decentralized Sports Prediction Market

FrontRunner is making waves in the sports prediction market by offering users a unique experience. It allows individuals to buy and sell shares of sports propositions, similar to trading stocks. What sets it apart is the ability to dynamically buy and sell positions based on real-time information. FrontRunner's transparent markets and liquid positions minimize counterparty risk. Built on Injective's efficient blockchain infrastructure, it ensures lightning-fast trades, zero gas fees, and maximum security.

Staking and Governance

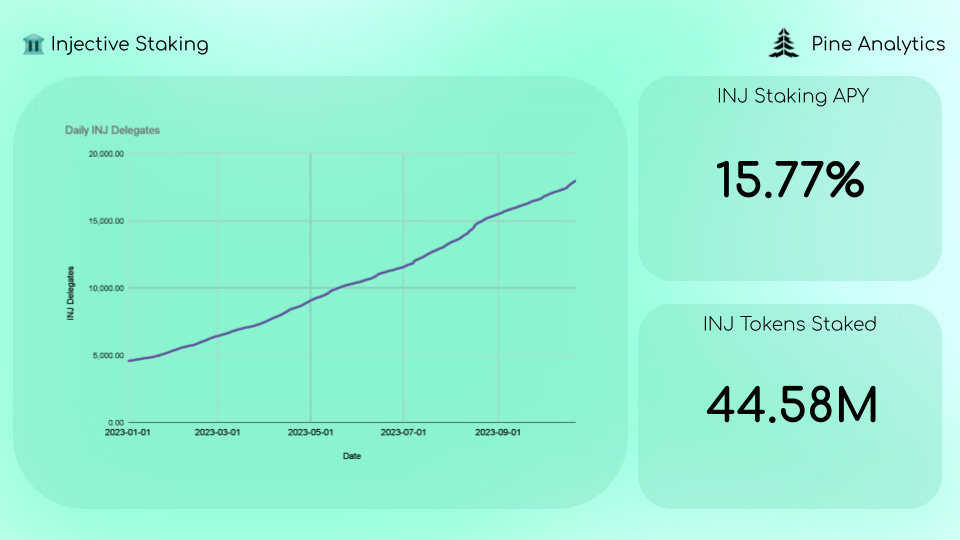

Injective's governance structure is a crucial component in maintaining its decentralized architecture, and it has seen significant growth in participation over the years. As of 2023, the number of governance delegators has surged from around 5,000 to nearly 17,000, and the network is currently supported by 60 validators. The native cryptocurrency, INJ, serves as the backbone for governance activities. Those who stake INJ tokens can expect an annual percentage yield (APY) that, while subject to market variations, has generally hovered around 15.7%.

The Injective community is actively involved in a range of governance operations. These include voting on protocol amendments, earning staking rewards, and participating in burn auctions. Such governance activities are instrumental in influencing the platform's development and future direction.

Injective Burn Auctions

In 2023, Injective has placed a strong emphasis on its token burn mechanism as a means to regulate its circulating token supply. Throughout the year, a considerable 138,000 INJ tokens have been burned, equivalent to a market value of about $850,000. Weekly, the burn rate fluctuates between 2.5K and 7.5K INJ tokens, which corresponds to a monetary value of $10,000 to $40,000. This mechanism is a part of Injective's broader strategy to manage its digital assets and was approved during the platform's mainnet rollout.

The auction process that powers this mechanism is community-led. Sixty percent of the exchange fees collected on Injective each week are allocated for a buyback and subsequent burn. Users participate in an auction where they can bid using only INJ tokens to win a basket of assets generated from these fees. The highest bidder gains possession of this asset basket, often at a rate that offers potential for arbitrage. Simultaneously, the INJ tokens used in the winning bid are immediately burned, reducing the total supply. This innovative approach not only helps in managing the token supply but also fosters community engagement and creates financial incentives.

INJ Price Action

When examining the price action of the INJ token, 2023 has been a phenomenal year. The token's value has surged from about $1 at the beginning of the year to its current price of $14.7. This remarkable growth has propelled its market capitalization from around $180 million to a staggering $1.23 billion. While 2022 was a challenging year for the INJ token, experiencing a drop from $19 to $1, 2023 has seen a remarkable resurgence. The token has not only reclaimed its previous all-time highs but has surpassed them by a substantial margin. In 2021, the token's market capitalization stood at approximately $480 million, making its current market cap double that figure. The INJ token's performance in 2023 reflects its strength and resilience in the blockchain market.