Meteora's DLMM

Introduction

Meteora has revolutionized liquidity provision on decentralized exchanges with its pioneering Dynamic Liquidity Market Maker (DLMM) system. This innovative approach ingeniously merges the functionalities of traditional order books with the Uniswap V3 model of concentrated liquidity, offering liquidity providers (LPs) a novel and enhanced experience.

How does the DLMM work?

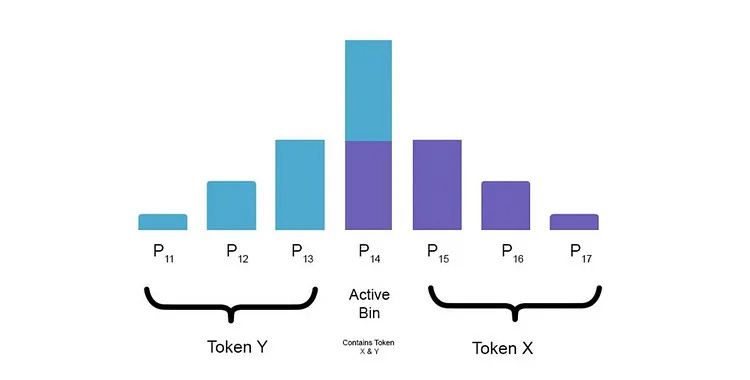

The DLMM allows liquidity providers to contribute to discrete liquidity bins, enabling them to specify buy or sell orders for token pairs at predetermined prices. Essentially, the DLMM's liquidity pools consist of numerous price-specific bins filled with tokens by LPs. Trading within these pools transitions sequentially from one bin to another as tokens are exchanged, ensuring continuous market operation. Importantly, transaction fees are accrued exclusively by LPs active in the currently traded bins, with fee distribution proportional to each LP's contribution to the bin. This system ensures that market volatility directly benefits LPs through increased fee yields.

Liquidity Provision Strategies

When engaging with Meteora's DLMM, providers can choose from three strategic liquidity shapes, each tailored to different market conditions and objectives:

Flat Distribution: This strategy involves evenly distributing liquidity across a chosen price range. It offers the broadest exposure to market volatility, maximizing fee potential within the selected range. However, it also carries the highest risk of impermanent loss should prices move beyond this range.

Bid-Ask Distribution: Tailored for those looking to dollar-cost average (DCA) out of a position, this approach focuses liquidity provision around the current market price, allowing for efficient asset liquidation or acquisition as market conditions fluctuate.

Curved Distribution: Best suited for stable markets, this strategy optimizes liquidity provision by focusing on a curve that anticipates less price movement. For maximum effectiveness, it requires active management and rebalancing in response to market activity.

Why Provide Liquidity to a DLMM?

Choosing a Dynamic Liquidity Market Maker (DLMM) over a traditional Automated Market Maker (AMM) offers several compelling advantages, particularly for liquidity providers (LPs) seeking to maximize their fee earnings from trading activities. In the context of traditional AMMs, while LPs do earn fees from swaps in proportion to their liquidity contribution, the efficiency of capital utilization often leaves much to be desired. Traditional AMMs spread liquidity across an infinite range of prices, leading to a significant portion of capital lying idle and not actively earning fees at prevailing market prices. Furthermore, fixed fee tiers in AMMs can result in missed opportunities for LPs during periods of high trading demand, where traders might be willing to pay higher fees.

The DLMM addresses these inefficiencies head-on, offering a smarter liquidity provision mechanism. It enables LPs to concentrate their liquidity within specific price ranges, much like Concentrated Liquidity Market Makers (CLMMs), but with notable improvements. The DLMM's introduction of zero-slippage price bins marks a significant advancement. Liquidity within these bins is allocated for exchange at predefined prices, eliminating slippage or price impact for trades occurring within these active bins. This structure not only ensures more efficient capital utilization by focusing liquidity where it's most likely to be traded but also enhances fee capture potential due to the increased trading volume facilitated by zero slippage. As a result, LPs can enjoy a more effective and profitable liquidity provision experience, making the DLMM an attractive alternative to traditional AMMs for those looking to optimize their trading fee earnings.

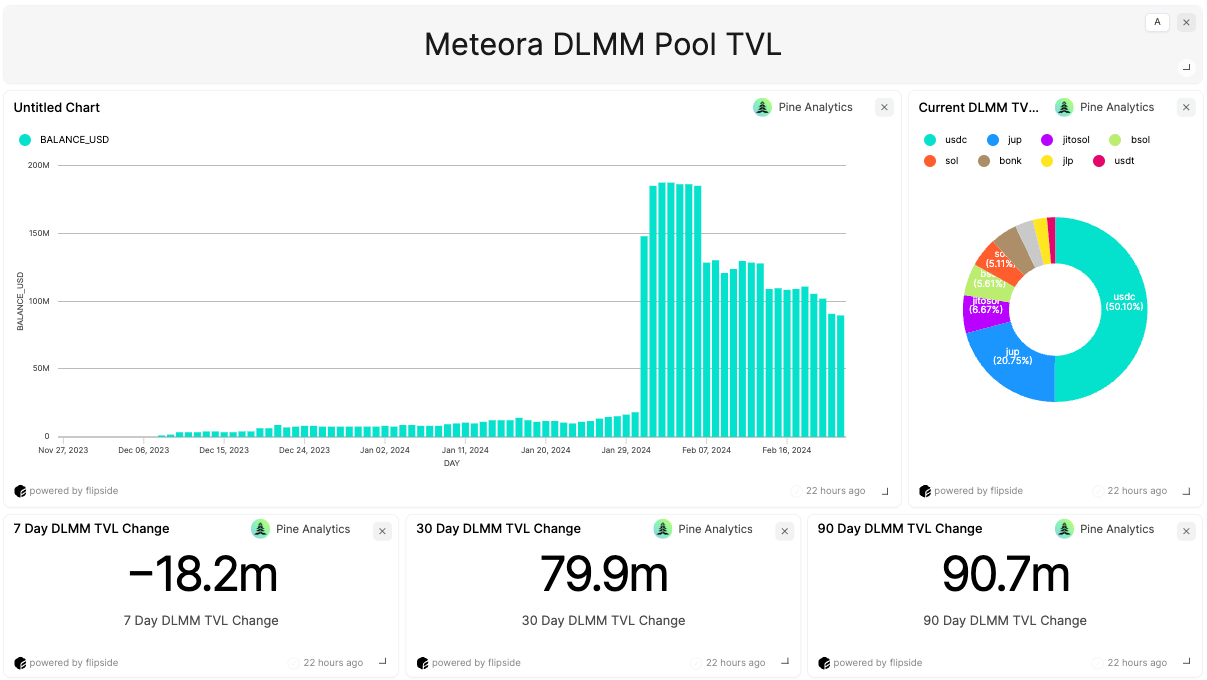

The State of Metora DLMMs

Meteora's Dynamic Liquidity Market Makers (DLMMs) made their debut at the end of November 2023, witnessing a notable increase in Total Value Locked (TVL) in the pools, reaching $18.2 million by January 30, 2024. The significant milestone followed on January 31st, when Meteora announced a new point system designed to enhance user engagement ahead of the upcoming MET token launch. This announcement acted as a catalyst, propelling the platform's TVL from $18 million to an impressive $185 million within just two days. Despite this surge, there has been a general decline in pool liquidity, stabilizing at around $90 million. Currently, the composition of the DLMM pools is such that approximately 50% of the locked value is USDC, with JUP accounting for about 20% of the total value.

The platform has attracted over 675,000 wallets engaging in activities such as swapping or providing liquidity to the DLMM pools. Daily interaction with these pools has been robust, with user numbers fluctuating between 10,000 to 30,000, including 4,000 to 8,000 new users each day.

Moreover, since the launch of Meteora's DLMM pools, their integration with Jupiter, the most popular swap router on the Solana network, has been remarkably successful. The pools now account for 5% to 6% of all transactions processed through this router, underlining Meteora's growing influence and adoption within the Solana ecosystem.