Network Dynamics: Thorchain's Present Picture

Introduction

In the transformative realm of blockchain technology, decentralized exchanges (DEXs) represent a significant step toward reshaping financial conventions. At the forefront of this evolution is THORChain, a trailblazer that's not just challenging the existing norms but actively redefining the cryptocurrency landscape.

THORChain stands out as a cross-chain DEX, enabling direct, intermediary-free swapping of digital assets across diverse blockchains. Its mission is to eliminate the walls dividing various blockchains, thereby fostering unprecedented interoperability within the decentralized finance (DeFi) ecosystem.

This piece will delve into THORChain's inner workings, exploring various metrics such as activity patterns, transaction fees, user growth, and the intricacies of its native RUNE token. The aim is to unravel the complexity of THORChain, illuminating its role in the ever-evolving DeFi arena. This exploration promises rich insights for both blockchain veterans and newcomers alike.

Thorchain Swap Fees and Volume

Analysis of THORChain's Swap Activity

Upon examining the data from THORChain's dashboard, it's clear that a handful of tokens dominate the swap activity. In particular, USD stablecoins, Bitcoin (BTC), and Ethereum (ETH) variants are leading the way, accounting for over 75% of all swaps. This underscores their significant role in THORChain's operations.

The evolution of THORChain's swap volume reveals a downward trend since 2021. This could be driven by a host of factors, such as changing market dynamics, shifts in user behavior, or a possible tilt of activity toward other platforms.

Scrutinizing Fee Collection and Swap Volume

From 2023 onwards, THORChain started to witness an increase in collected fees. Although a positive development, it's vital to remember this uptick originated from a low base and is yet to break out significantly against the long-term downtrend. Such growth could indicate a rise in smaller transactions, tweaks in fee structure, or perhaps statistical fluctuations. With a weekly fee volume of $200,000 to $500,000, the protocol exhibits substantial revenue-generating capacity.

Despite the downtrend, the weekly swap volume stands at roughly $100 million, indicating that THORChain remains a significant player in trading activity.

Thorchain Swappers

User Interaction Analysis with THORChain

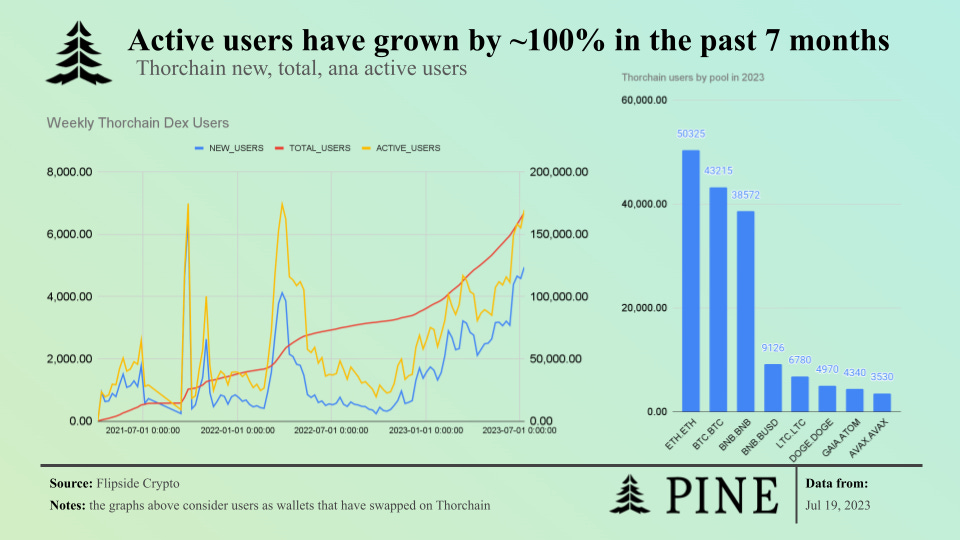

Reviewing THORChain user activity, especially concerning token swaps, reveals intriguing trends. Data shows that until 2023, weekly user engagement oscillated between 500 and 2,000, occasionally experiencing surges. However, 2023 marked a dramatic rise in user interactions, signaling a period of increased growth and engagement on the platform.

The onset of 2023 saw an upswing in active users, transitioning from a static to an ascending trend. The weekly active users, initially under 2,000, have now soared to around 6,000, indicating a sustained, long-term increase in engagement throughout the year. This demonstrates THORChain's expanding appeal and usage within the DeFi ecosystem.

Pool Interactions in 2023

The 2023 data sheds light on user behavior patterns, revealing a predilection for certain pools. Most users engaged primarily with Ethereum, Bitcoin, or BNB pools, with no other pool surpassing 10,000 wallet interactions during 2023. This increased user activity and pool preference underscore the shifting patterns of user behavior and engagement on THORChain. As 2023 progresses, it will be intriguing to observe whether these trends persist or new dynamics take shape within the burgeoning community.

Thorchian TVL Breakdown

Insights from THORChain's locked asset distribution reveal the dominance of Bitcoin and Ethereum, suggesting that these two major cryptocurrencies steer the protocol's liquidity. The substantial volume of Bitcoin, specifically, indicates THORChain's unique function as an important access point for on-chain Bitcoin DeFi transactions - a capacity often limited on other platforms.

One reason for Bitcoin's dominance within THORChain is the relative scarcity of yield opportunities for Bitcoin in the wider DeFi landscape. Thus, THORChain becomes a go-to platform for Bitcoin holders seeking yield on their assets.

Moreover, the prominence of Binance Coin (BNB) and derivatives like WBTC and BNB.ETH in Liquidity Provider (LP) pools is noteworthy. Their presence could signify potential arbitrage opportunities across chains. Traders may be utilizing these assets in THORChain's pools to capitalize on price differences between distinct blockchain networks, further emphasizing THORChain's role as an inter-chain trading hub.

RUNE Speculative Multiple

The speculative multiple, a central element of THORChain's design, is pivotal in safeguarding the assets within the network. The calculated ratio, which is the market cap of RUNE to three times the non-RUNE Total Value Locked (TVL), has experienced a consistent downtrend and currently hovers around one. This trend may indicate declining interest in the RUNE token, hinting it could be nearing its lowest price.

If the multiple maintains its current level without dropping significantly lower, this could bode well for the protocol. Such stability would demonstrate that the protocol might be operating near the lower range of its valuation, indicating a potential investment opportunity for new investors or further commitment for existing ones. More importantly, it would reflect the effectiveness of THORChain's security measures in protecting deposited assets. Hence, this metric is crucial to keep under close observation, as it provides key insights into the protocol's security and the future trajectory of RUNE's value.

However, further decreases in this multiple could lead to under-collateralization in the protocol, potentially compromising the safety of deposited assets. Hence, it's critical to closely monitor this metric for future insights into both the security of THORChain and the direction of RUNE's value.

Rune Tokenomics

Interestingly, not all vested tokens have found their way into the circulating supply. The data reveals that around 60% of the tokens that could be distributed have been actually distributed, pointing towards a substantial reserve that is yet to hit the market. This lag in distribution implies a slower token release schedule in the forthcoming years compared to the past, which could influence the token's supply dynamics and price action.

THORChain is poised to implement lending. This update will bring about substantial changes to the protocol's tokenomics. The specifics of token distribution and burning rates will be subject to the details of this implementation, adding an element of uncertainty to the future token supply landscape.

Conclusion

Despite increasing interoperability among Ethereum-based chains, the same fluidity doesn't extend to Proof of Work (PoW) chains such as Bitcoin, Litecoin, and Dogecoin. Herein lies THORChain's unique value offering as a decentralized exchange facilitating cross-chain swaps, thereby addressing a significant market gap.

A critical aspect of THORChain's operations is its increasing protocol fees. Ranging from $200,000 to $500,000 weekly and translating to an annual $25 million, these fees form a significant revenue source split between RUNE holders and liquidity providers. This not only enhances RUNE's value but also incentivizes participation within the THORChain ecosystem.

However, a note of caution is warranted. A comparison of the protocol's market cap with its annualized revenue uncovers a substantial multiple of 41. This figure, based on the assumption that RUNE token holders capture 50% of the protocol's fee revenue, could suggest a potential overvaluation of the asset. Alongside this, an upward trend in active users, escalating from under 2000 to about 6000 weekly since 2023, could stimulate RUNE demand and subsequently impact its market cap. Grasping these dynamics is essential for a nuanced understanding of RUNE's value and THORChain's future path. While the steady growth story is indeed compelling, the elevated revenue multiple underscores the importance of careful and considered appraisal within this dynamic DeFi landscape.