Pine's This Week in Crypto

Your one stop-shop for all the happenings in crypto this week.

Welcome to Pine’s weekly newsletter, where we will bring you the latest updates and insights from the world of crypto. In this edition, we'll cover the top stories that have dominated the crypto community over the past week, and delve into the data behind Flipside and Dune dashboards to explore trends and patterns in the market. Whether you're a seasoned crypto enthusiast or a newcomer to the space, our newsletter will provide you with valuable information to stay up-to-date with the latest developments and make informed decisions. So, let's dive in!

Solana: User Behavior and Crossover Between Drift Protocol and Zeta Markets

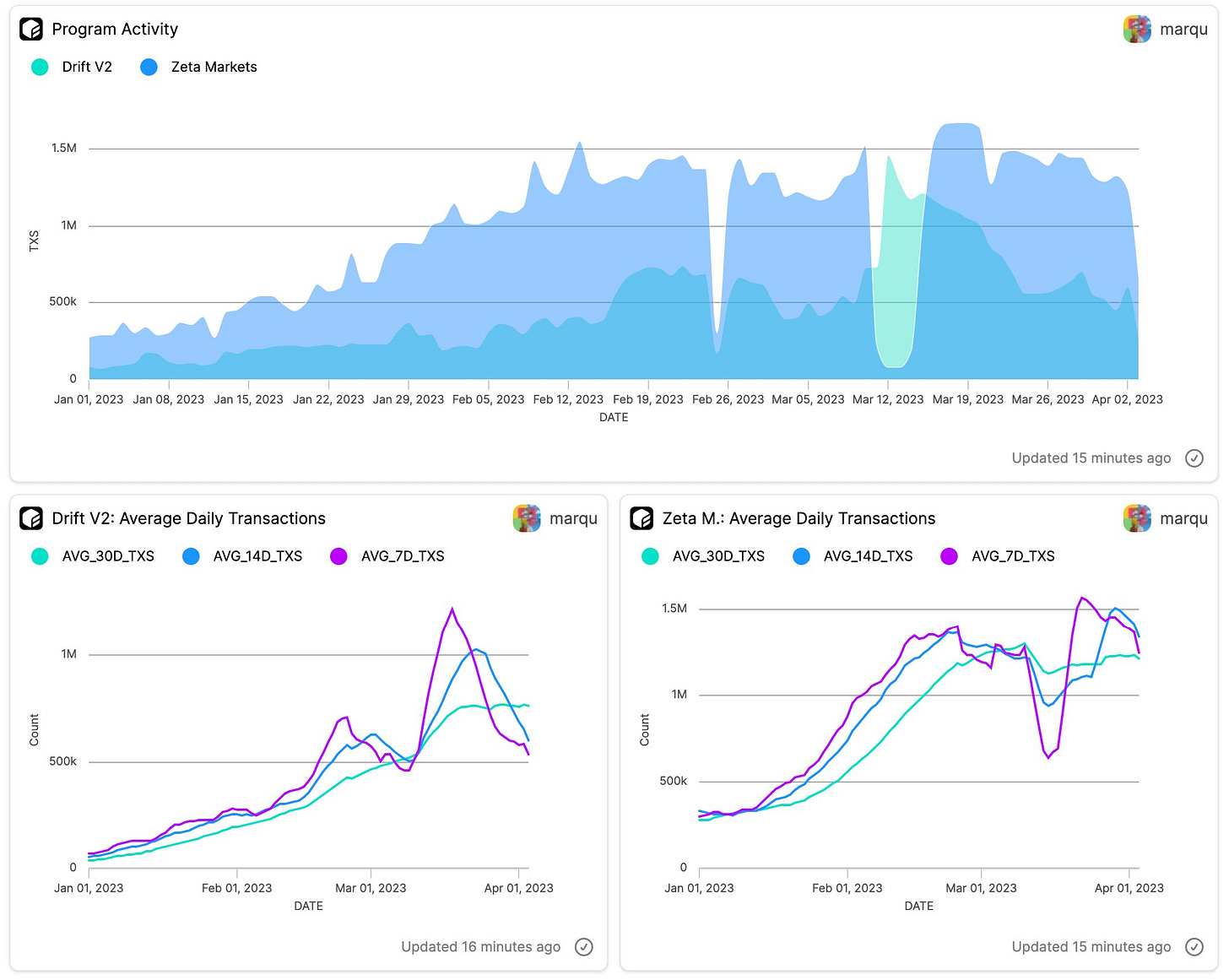

Based on recent data analysis, the decentralized finance (DeFi) ecosystem on Solana appears to be making a comeback, despite some previous setbacks. Specifically, a study of two platforms, Drift Protocol and Zeta Markets, reveals a sustained increase in program activity on both platforms since the beginning of 2023. Notably, Zeta Markets has almost twice as many daily transactions as Drift Protocol V2 for most of the observed period. However, Drift Protocol V2 had over three times as many unique users as Zeta Markets during this period, with only 8% of users being common between the two platforms.

Drift Protocol V2 has been experiencing a consistent increase in daily active users and currently maintains a 7-day average of 187. Conversely, Zeta Markets suffered a significant decrease in daily active users following the trade halt in early February and currently has a 7-day average of only 25. In exploring user crossover, it was observed that many wallets have interacted with dapps and use cases beyond trading. Notably, 36% of Zeta Markets users have also used Drift Protocol V2, while Zeta Markets does not rank within the top 10 crossovers for Drift Protocol V2 users.

Analysis by fknmarqu

Avalanche: USDT and USDC Usage on Sushiswap

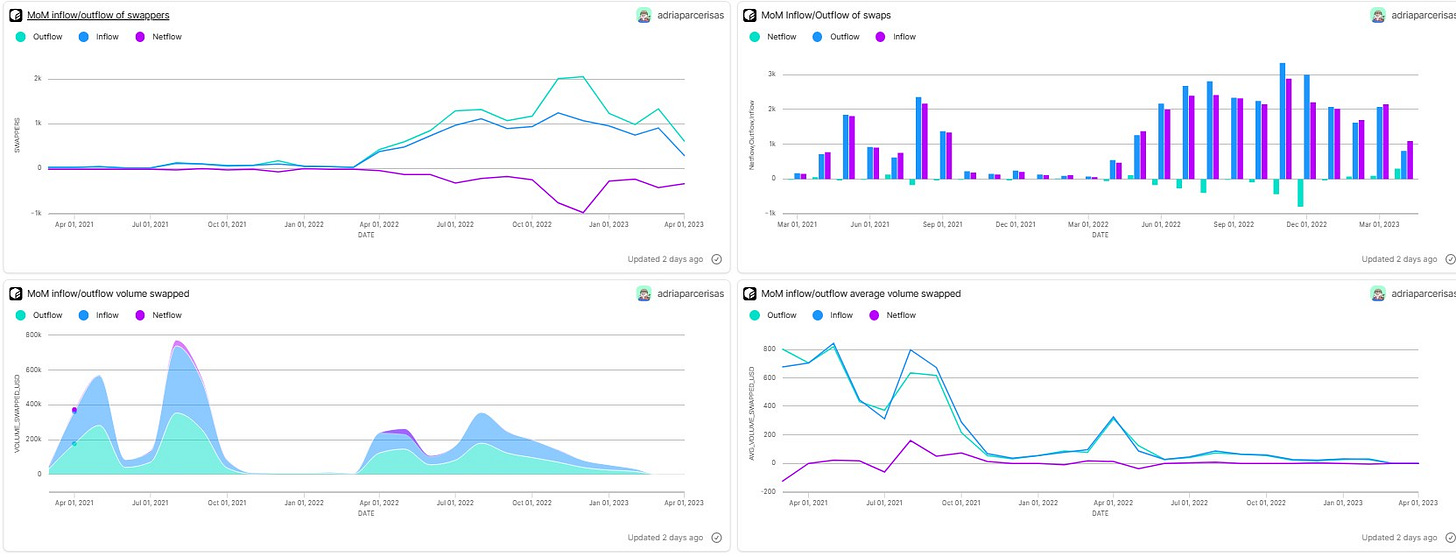

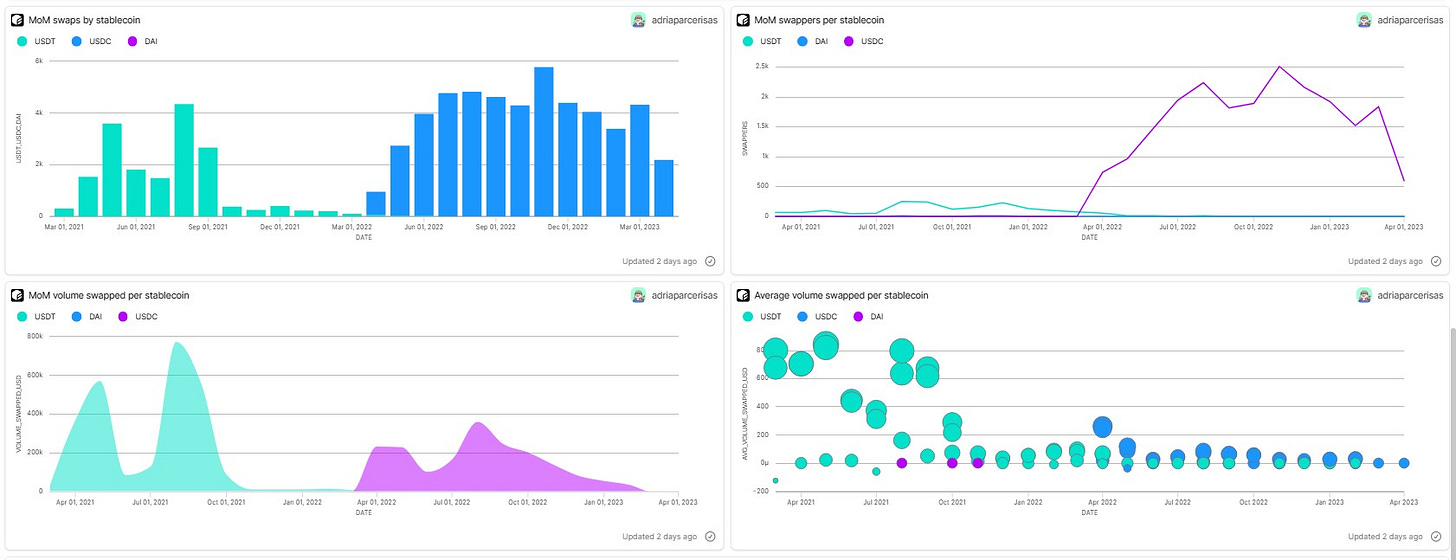

USDC and USDT are the most commonly used stablecoins on the Avalanche network, with USDT being the most popular in the early months, but later being surpassed by USDC in April 2022. The launch of USDC on SushiSwap in the Avalanche network led to a significant increase in activity, resulting in an all-time high in terms of unique swaps and unique swappers in November 2022.

Despite the initial increase in activity, the volume of swaps has declined significantly since July-August 2022, dropping from almost 400k to less than 100k, with a decline in both average volume in and out. However, it is noteworthy that the netflow generated was neutral for half of the days and negative for the rest, except for the last three months, where the netflow was positive, indicating that more $USDC is entering the SushiSwap platform.

Analysis by adriaparcerisas

Ethereum: Staking Trends - Liquid Derivatives and Shanghai Upgrade

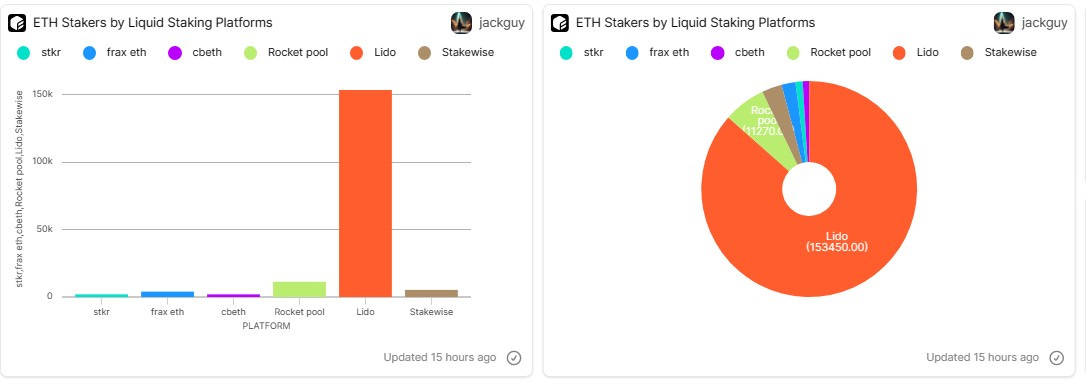

Contrary to popular belief, the Shanghai upgrade might increase the amount of $ETH staked by reducing duration risk. With over 50% of liquid staking users staking less than 1 ETH, this change could attract more users to stake, taking more ETH off the market.

Currently, Lido Finance holds over 75% market share (down from 90%+) in the liquid staking market, while other players such as Coinbase's cbETH and Frax Finance's ETH are gaining traction. Moreover, it is worth noting that if gas fees in the Ethereum network return to previous levels (45K ETH weekly average), the deflation rate of ETH could reach 0.4% per year.

Analysis by jackthepine

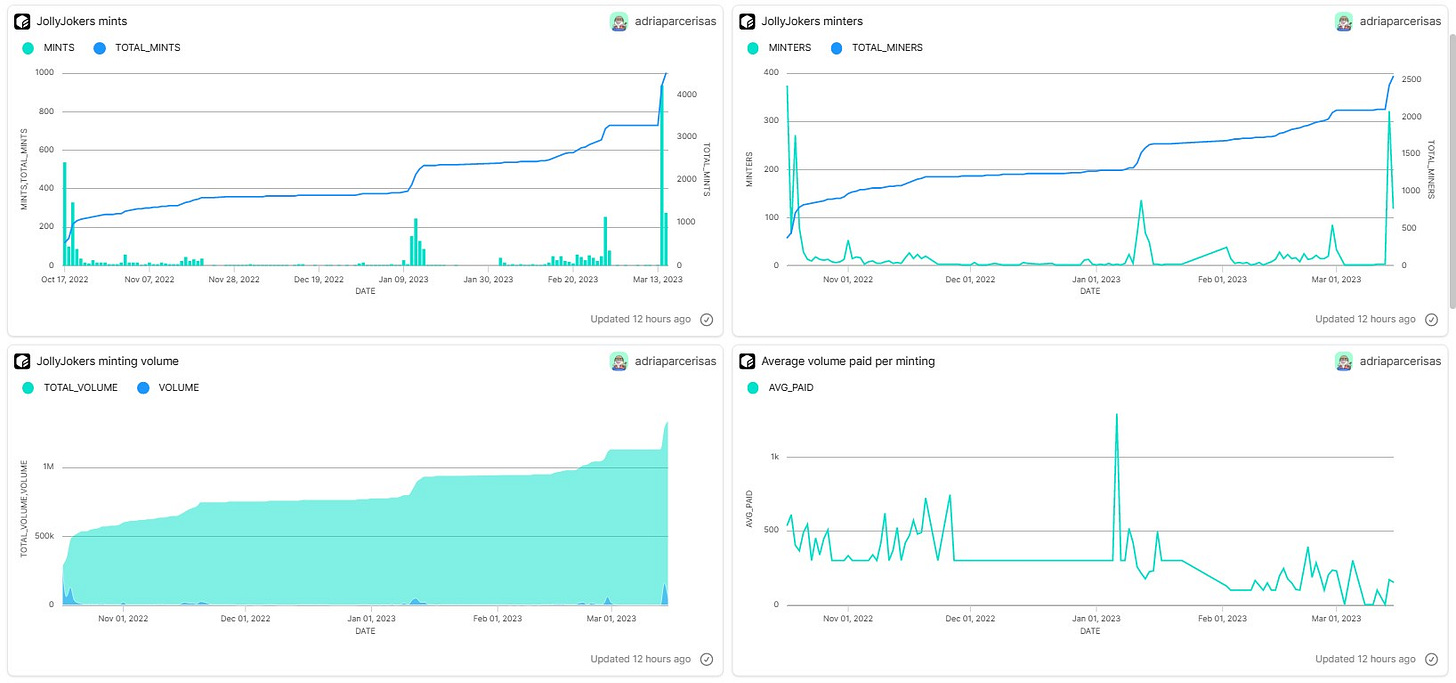

FLOW: Minting and Sales Activity of Jolly Jokers NFT Collection

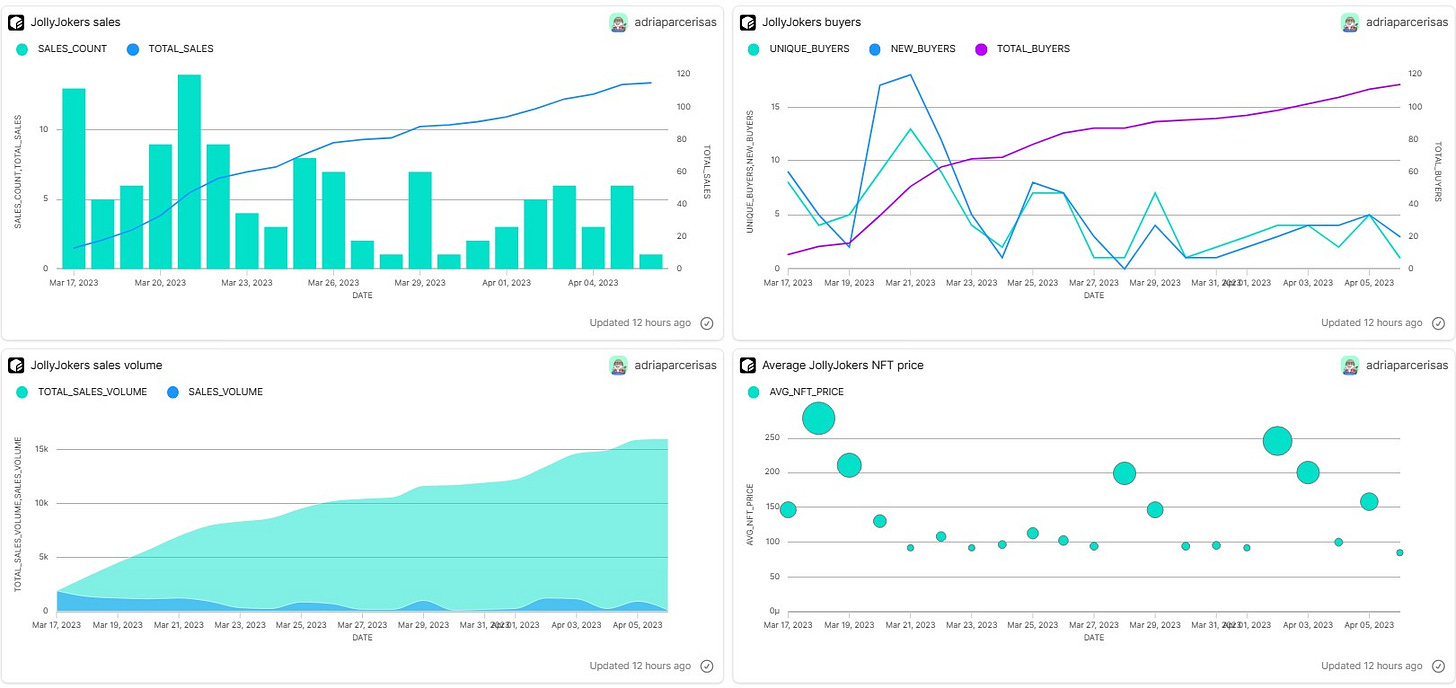

The JollyJokersNFT collection has experienced varying levels of minting and sales activity since its launch on March 17th, 2023. There was high minting activity in October, followed by a lull from November 2022 to January 2023. However, the minting activity picked up again in January and February 2023, with a significant spike in March 2023 after the completion of minting. The fixed minting price of $299 resulted in a total volume generated of more than 1M USD, with the majority of sales taking place over the first few days. So far, more than 1.4k unique buyers have purchased at least one JollyJokersNFT.

The majority of the total generated sales volume took place during the first few days after the launch, reaching almost 20k USD on the first day and more than 15k USD on March 21st. Overall, almost 60k USD worth of JollyJokersNFTs have been sold so far. The average NFT price started at over $100 and reached more than $300 on March 19th. However, after that, the average price of JollyJokersNFT declined to lower than $100. Currently, the price seems to have reached its floor around $100 and is slowly increasing.

Analysis by adriaparcerisas

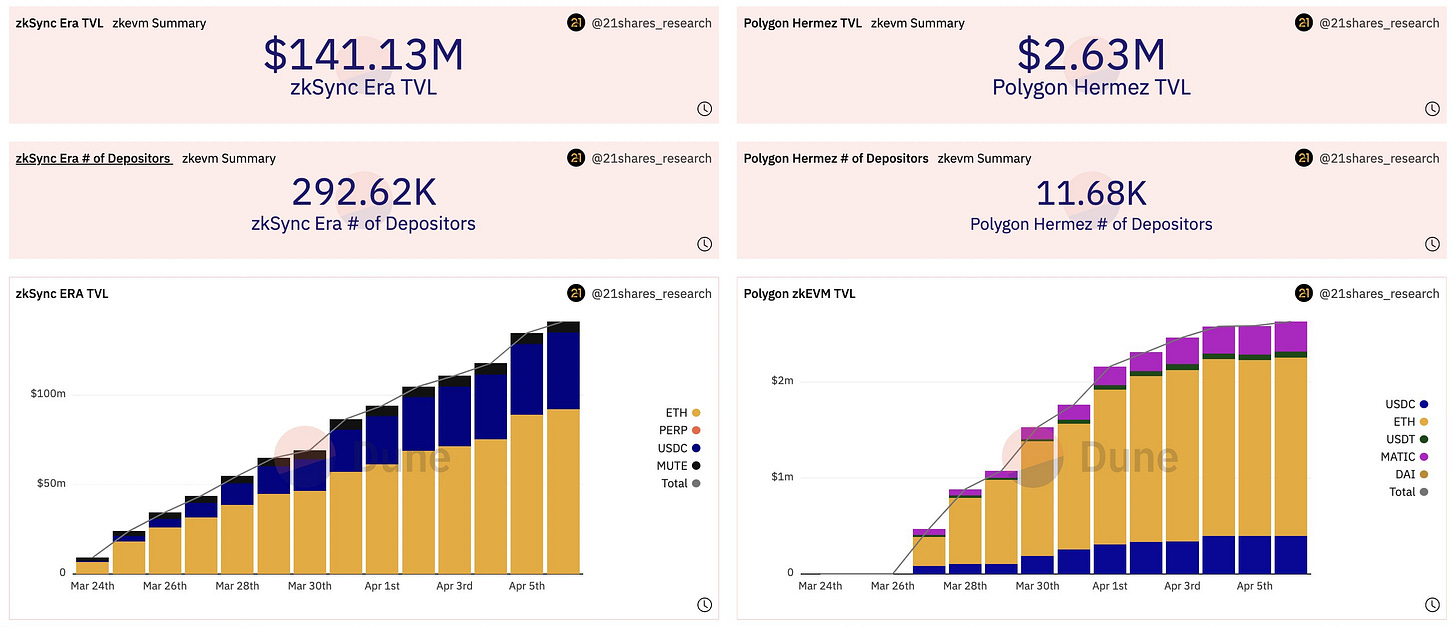

Layer 2s: zkSync Era vs. Polygon zkEVM

In the world of Ethereum Layer 2 scaling solutions, zkEVM-based chains are currently in a race to attract more bridged assets and users. The two prominent players in this space are zkSync Era and Polygon zkEVM. As of now, zkSync Era has attracted $141M in bridged assets, while Polygon zkEVM has only managed to attract $2.63M. Despite the initial traction, the bridging activities for both zkSync Era and Polygon zkEVM have been slowing down in recent times. zkSync Era, however, still maintains its lead in terms of the number of unique depositing addresses, with 292.62K addresses compared to Polygon zkEVM's 11.68K addresses.

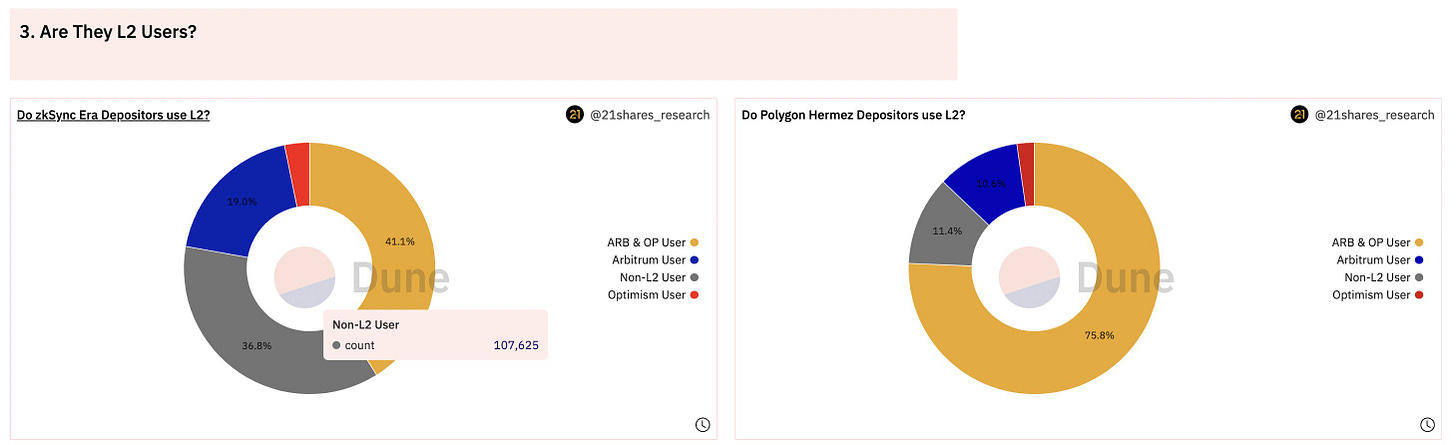

A significant portion of the depositing addresses on both chains could potentially be airdrop farmers, as 36.8% of zkSync Era depositors have not used Arbitrum/Optimism before. In contrast, only 11.4% of Polygon zkEVM depositors have not used Arbitrum/Optimism, and over 75.8% of them have used both. Interestingly, more than 36.5% of depositing addresses were created after the launch of zkSync Era, indicating that users might be creating multiple wallets to farm potential airdrops.

Analysis by tomwanhh and 21Shares

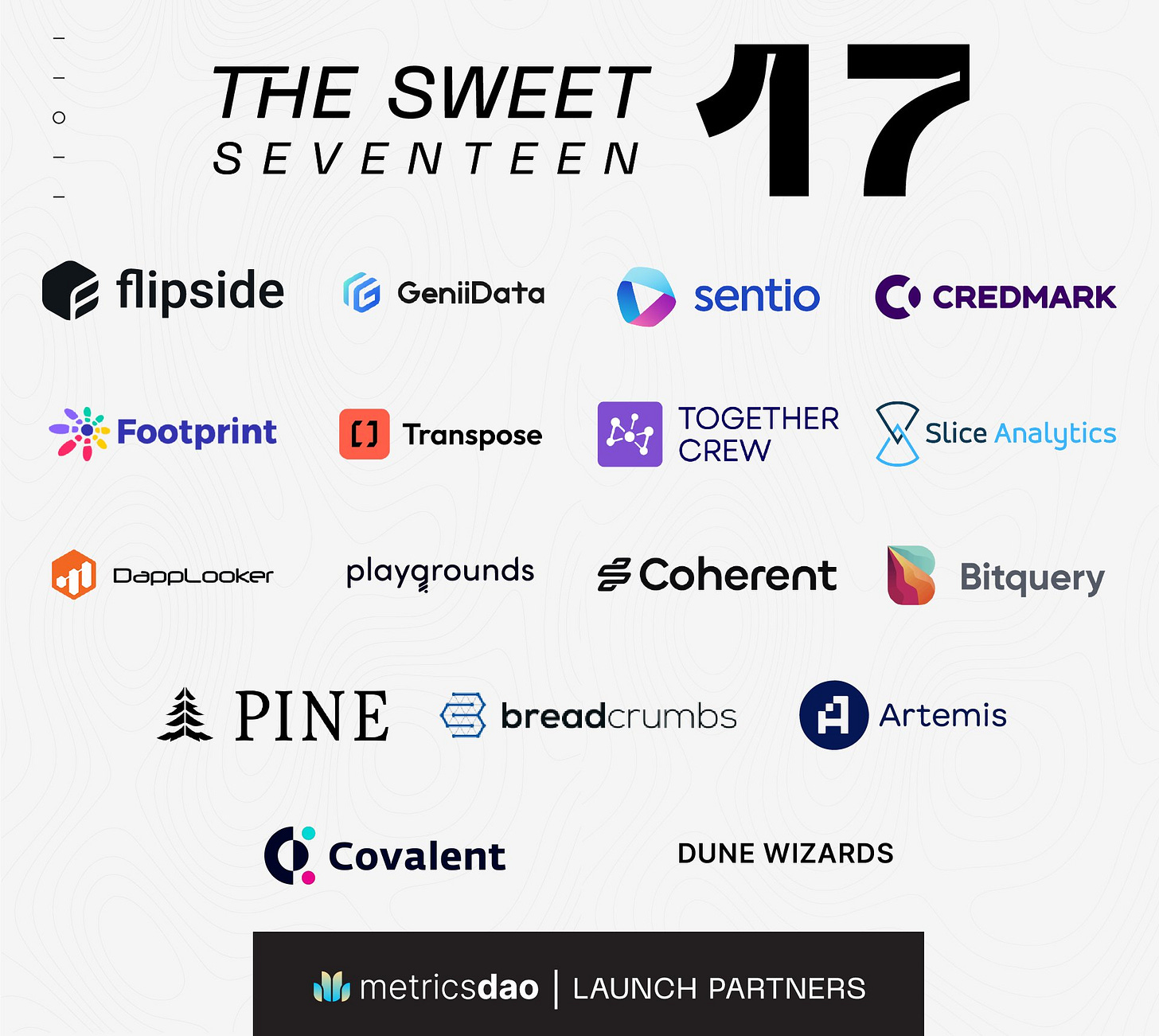

Pine + MetricsDAO Partnership

We are excited to announce that we are an official launch partner of MetricsDAO. This partnership will help us to combine our networks and skills to create a hub of analytics research and open up the crypto industry to a wider audience. With the new Metrics App, we will be able to save on technical overhead, recurring costs, and time by running our analytics challenges and tasks through the purpose-built analytics challenge market. This collaboration is a key part of our plans for 2023 and we are excited about the potential it holds for our community members and clients. Check out MetricsDAO’s recent interview with our founder Jack to learn more, How Pine Will Use the Metrics App for its Analytics Challenges.

Pine Analytics Info

Website: https://storage.googleapis.com/pinedao/Pinehome1.html

Twitter: https://twitter.com/Pine13579573?s=20

Weekly Contest: https://www.jokedao.io/contest/polygon

Partner with Pine: https://docs.google.com/forms/