Pine's This Week in Crypto #5

Your one stop-shop for all the happenings in crypto this week.

Welcome to Pine’s weekly newsletter, where we will bring you the latest updates and insights from the world of crypto. In this edition, we'll cover the top stories that have dominated the crypto community over the past week, and delve into the data behind Flipside and Dune dashboards to explore trends and patterns in the market. Whether you're a seasoned crypto enthusiast or a newcomer to the space, our newsletter will provide you with valuable information to stay up-to-date with the latest developments and make informed decisions. So, let's dive in!

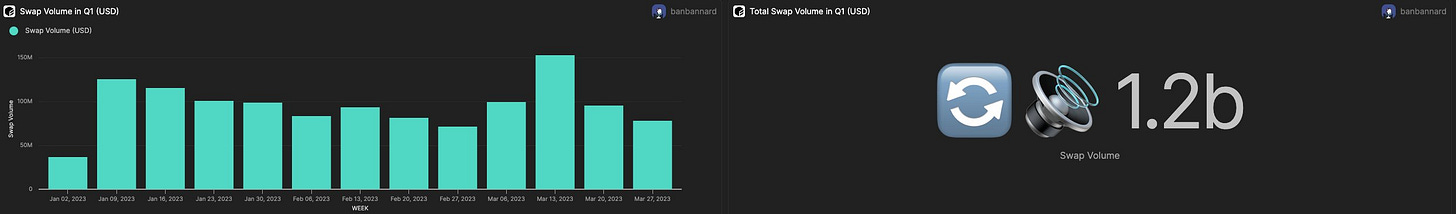

THORChain: Q1 Performance

THORChain continues to see significant swapping activity, with users actively participating in swaps. In Q1, the total swap volume on THORChain reached an impressive $1.2 billion. Notably, the week of March 13, 2023, recorded the highest weekly swap volume, amounting to approximately $152.44 million. These figures indicate a robust and thriving ecosystem on THORChain, with users engaging in substantial swapping transactions, highlighting the platform's liquidity and user demand.

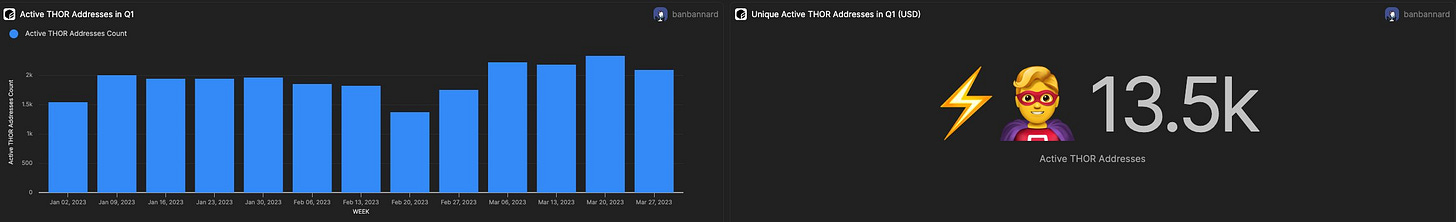

Throughout Q1, there were approximately 13,500 active addresses engaging in various transaction types within the THORChain ecosystem. These transaction types include swaps, liquidity/savers actions, bond events, transfers, and upgrades. The presence of such a substantial number of active addresses demonstrates the continued enthusiasm and participation of the THORChain community.

Analysis by banbannard

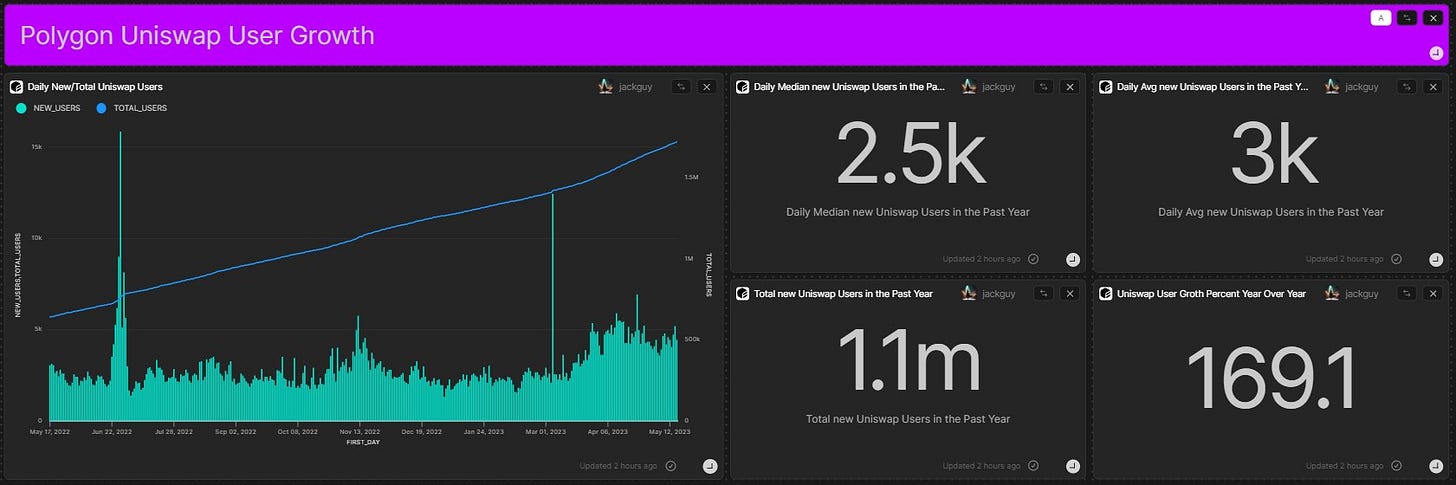

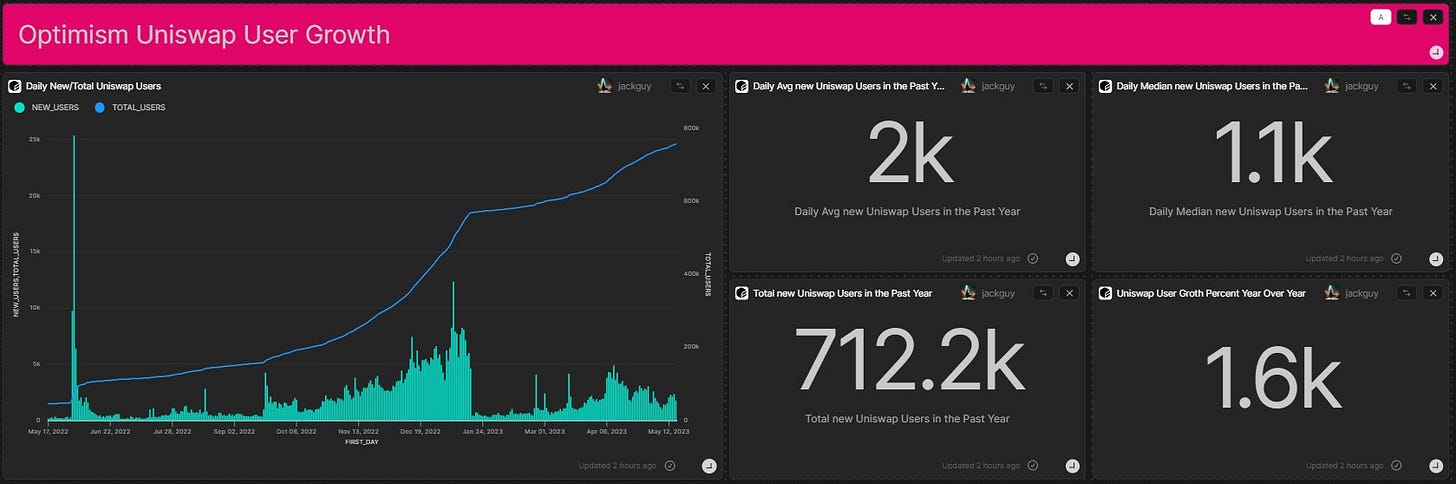

Ethereum/Layer2s: Uniswap Growth

Uniswap's user growth across various blockchains and Layer 2 solutions has been truly remarkable over the past year. On Ethereum, the number of Uniswap users expanded from 5.49 million to 7.05 million, representing a solid 28% increase. On average, approximately 4,300 new users joined Uniswap each day, demonstrating the continuous influx of users to the platform.

On Polygon, the user base of Uniswap experienced remarkable growth, expanding from 643,000 to 1.7 million users, reflecting an impressive 169% increase. On a daily basis, an average of 3,000 new users joined the platform. However, since mid-March, there has been a surge in new user sign-ups, with numbers ranging between 4,000 and 5,500 per day.

The growth of Uniswap on Optimism and Arbitrum has been truly explosive. On Optimism, the user base experienced a staggering growth of 1,600%, highlighting the increasing adoption of this Layer 2 solution. Similarly, on Arbitrum, an astonishing growth rate of 2,200% was witnessed, indicating the rapid expansion of Uniswap's user base on this platform as well.

Analysis by jackthepine

Ethereum: Blend NFT Lending Statistics

The Blend Lending Protocol has achieved impressive milestones in terms of loans and loan volume. With over 3,800 loans and more than 38,000 ETH in loan volume, the platform has demonstrated its growing popularity. Additionally, active user numbers have shown a steady increase, indicating a rising interest in Blend's lending services.

When examining the risk profiles of borrowers, it becomes evident that CryptoPunks borrowers carry the highest level of risk, followed by Azuki borrowers. A significant percentage of users, around 68%, have a health factor of 20 or less, indicating a high loan-to-value (LTV) ratio.

Further analysis reveals that among the top 50 borrowers, 30% have a health factor of 10 or less, signifying an even higher degree of risk. This highlights the willingness of certain users to take on significant leverage and potentially exposes them to higher volatility in the market.

In terms of the impact on collections with lending capabilities, charts measuring the floor price and activity of each project indicate that lending has been a beneficial development for projects such as Milady, Azuki, and DeGods. However, it is worth noting that Azuki's performance has shown signs of decline after an initial period of positive impact. As long as loans are repaid and more users participate in lending their NFTs, Blend is likely to experience a steady flow of loan volume until the point at which no further collections are added.

Analysis by biff_buster

Solana: Trails Protocol Impact on Zeta Market

Trails Protocol is a Web3 educational platform designed to provide users with a user-friendly and intuitive learning experience. The introduction of Trails.fm and the announcement of its initial educational round resulted in a significant surge in new users joining the Zeta Market. Within a mere two days, the daily number of new users skyrocketed from 1-2 individuals to 50, highlighting the strong appeal and rapid adoption of the platform. Although there was a subsequent decline in user numbers, the second round announcement attracted an additional 21 users to the Zeta Market.

Since the announcement of Trails, the Zeta Market has been consistently welcoming an average of 10 new users every day

After completing a learning task on Trails.fm, the subsequent step for users is to deposit to Zeta markets, which requires USDC. Since April 17, 2023, it has been observed that 56% of users have successfully deposited their USDC during the first round of Trails.fm's announcement. This data suggests that Trails.fm has effectively motivated and incentivized users to complete the necessary steps to participate in the platform's offerings.

Analysis by 0xhess

Pine Updates

Check out our new bounty on the ARB token on Osmosis with a $1,300 prize pool here!

Excited to announce we've just submitted a Nouns Prop House grant proposal to launch an on-chain analytics contest on the Turbo Toad Token! Check out our proposal here.

Pine Analytics Info

Website: https://storage.googleapis.com/pinedao/Pinehome1.html

Twitter: https://twitter.com/Pine13579573?s=20

Weekly Contest: https://www.jokedao.io/contest/polygon

Partner with Pine: https://docs.google.com/forms/