Pull Oracles Explained

Why DeFi Protocols Should Make the Switch

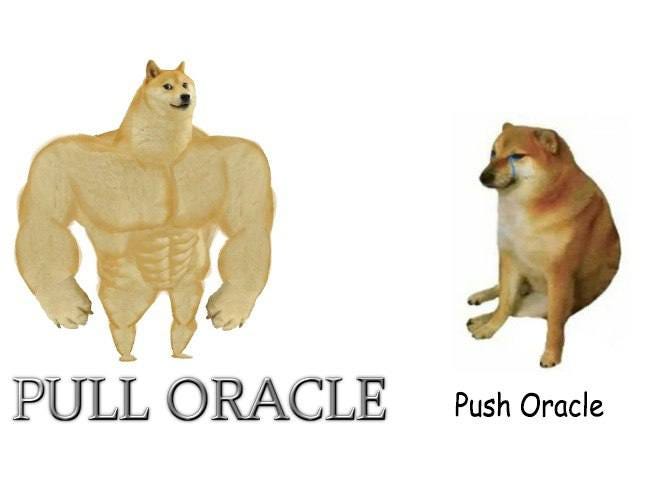

Understanding Push and Pull Oracles

Push Oracles

Operation: Push oracles update on-chain data at regular intervals or when specific conditions are met, regardless of immediate necessity.

Example: Chainlink's traditional push model updates data periodically to ensure smart contracts have current information.

Advantages:

Continuous Updates: Provides regular, automatic updates, ensuring data is always current without needing explicit requests.

Simplicity: Easier implementation as smart contracts passively receive updates without needing to request them.

Predictable Costs: Since updates happen at regular intervals, costs can be more predictable and budgeted in advance.

Drawbacks:

Unnecessary Updates: Data is updated even when not needed, resulting in inefficiency and wasted resources.

Less Real-Time Accuracy: Data may not always be up-to-the-minute accurate, which can be problematic for applications needing immediate precision.

Static Update Intervals: Fixed intervals might not match the dynamic needs of certain applications, leading to either over- or under-utilization of updates.

Pull Oracles

Operation: Pull oracles update on-chain data only when requested by a user or application, ensuring updates happen only when necessary.

Example: Pyth Network's pull model allows anyone to request and verify the latest price updates off-chain before storing them on-chain.

Advantages:

Cost Efficiency: Minimizes unnecessary transactions, reducing operational costs.

Real-Time Accuracy: Provides the most current data upon request.

User fee: transaction signer pays for Oracle fees rather than oracle.

Drawbacks:

Frequent Requests: High-frequency applications may request data more often, potentially increasing oracle costs, but this will enhance the performance of activity.

Complexity in Implementation: Pull oracles require more sophisticated smart contract logic to manage data requests and handle updates efficiently.

Benefits of Pull Oracles

Improved Data Quality and Reliability

One of the most significant benefits of pull oracles is their ability to provide real-time data upon request, ensuring that smart contracts use current and accurate information reflective of the latest market conditions. This is crucial for high-frequency trading or lending platforms where timely access to asset prices is essential for informed decision-making. Additionally, pull oracles incorporate mechanisms to verify data at the time of request, reducing the risk of using outdated or manipulated information and maintaining trust in the data provided to smart contracts. Furthermore, pull oracles mitigate the risk of front-running by offering near-instantaneous data updates, which reduces the window of opportunity for malicious actors to exploit time lags in data updates, thereby enhancing the fairness and security of the platform.

Scalability and Flexibility

Pull oracles offer greater flexibility in how and when data is updated, allowing users and applications to tailor their data requests to specific needs and ensuring they receive the most relevant information. This flexibility enables more sophisticated data management strategies, enhancing the overall functionality and user experience of DeFi platforms. For instance, lending protocols can dynamically adjust collateral valuations based on real-time data, improving the accuracy of loan-to-value ratios and reducing the risk of under-collateralization. Additionally, by pulling data only when needed, pull oracles avoid the overhead associated with unnecessary updates that push oracles incur, leading to more efficient and cost-effective operations.

Case Study and Quantitative Analysis

Quantitative Analysis

The primary advantage of pull oracles is their ability to provide low-latency data. A study conducted at the end of 2022 revealed that Pyth's pull oracle demonstrated an average latency of less than 400 milliseconds, significantly outperforming Chainlink, whose updates varied from a few seconds to minutes depending on network conditions and gas fees. This low latency is particularly beneficial for high-frequency trading and high-value applications where data speed is crucial for performance and user experience. During periods of high market volatility, Pyth's rapid update capabilities ensure that trading platforms and other DeFi applications can operate with the most current data, reducing the risk of outdated information impacting decision-making processes.

Another benefit of the pull oracle is its cost structure. Pyth can create infrastructure spanning many ecosystems without bearing transaction costs directly. Instead, the costs are absorbed by users who require the price data. For instance, Pyth’s cost per update is significantly lower, at approximately $0.05 per update compared to $0.20 per update for Chainlink, making it a cost-effective solution for frequent updates across multiple blockchains. This allows Pyth to grow its offerings much faster than others, supporting over 500 price feeds across 55 blockchain ecosystems by 2024.

In addition to latency and cost benefits, the accuracy and reliability of Pyth's pull oracle have been quantitatively demonstrated across various metrics. A detailed comparison study conducted in late 2022 indicated that Pyth’s price feeds have a mean absolute percentage error (MAPE) of less than 0.05%, compared to Chainlink’s MAPE of 0.15% and Band’s MAPE of 0.20%. During high volatility events, Pyth maintained a 99.5% accuracy rate, significantly higher than Chainlink's 97% and Band’s 95%. Moreover, Pyth’s system handled over 1 million data requests per day with a 99.9% uptime, showcasing its robust infrastructure and scalability. Further analysis revealed that Pyth’s infrastructure supports over 500 price feeds spanning digital assets, FX, ETFs, equities, and commodities, distributed across 55 blockchain ecosystems. This extensive coverage is enabled by Pyth’s cost-efficient model, translating to savings of up to 50% in operational costs compared to push oracles in high-frequency trading environments.

Synthetix and Pyth Network

The primary upgrade from Synthetix Perps V1 to Perps V2 was the implementation of Pyth's fast off-chain oracles, which significantly reduced trading fees. Perps V1 relied on slower oracles that required higher fees to mitigate frontrunning, thereby capping trading volume at $5 billion. In contrast, Perps V2, leveraging Pyth's low-latency off-chain oracles, lowered fees from 10 basis points (bps) to 2 bps. This enhancement not only reduced trading costs but also boosted trading volume beyond $40 billion. The near-instantaneous data provided by Pyth's oracles allowed for much narrower spreads, significantly improving the overall trading experience and quality for users by reducing latency and increasing efficiency. Here

Current Oracle Landscape

In Q2 2024, Chainlink continues to dominate the oracle market with extensive integration across multiple chains, particularly Ethereum, Binance Smart Chain, and Polygon. Chainlink uses a push oracle model, providing reliable data feeds for numerous DeFi applications, including lending platforms and DEXs, cementing its significant market share. Band Protocol, which also employs a push model, maintains a robust presence primarily serving Cosmos and Binance Smart Chain ecosystems. Pyth Network uses a pull oracle model and is rapidly expanding on Solana and Ethereum, known for its low-latency price feeds crucial for high-frequency trading platforms.

API3 and DIA, both utilizing push models, are experiencing steady growth, providing decentralized APIs and open-source data solutions to a variety of DeFi projects on Ethereum and Binance Smart Chain. Tellor and Provable, which use pull and push models respectively, serve niche markets needing secure off-chain data integration, with active deployments on Ethereum and Polygon. Switchboard, focusing on the Solana ecosystem and using a pull model, offers customizable oracle services and is seeing increasing adoption. Collectively, these oracle providers support diverse blockchain applications, driving innovation and reliability in the decentralized space.

The oracle market is witnessing several key trends that are shaping its evolution. One notable trend is the increasing demand for real-time data feeds, driven by the growing complexity and speed of DeFi applications. This demand is boosting the adoption of pull oracles like Pyth Network, which offer low-latency updates essential for high-frequency trading and derivatives platforms. Additionally, there is a shift towards cross-chain compatibility, with oracles expanding their support to multiple blockchain ecosystems. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a prime example of this trend, enabling decentralized applications to operate seamlessly across different blockchains.

Conclusion

In conclusion, DeFi protocols can greatly benefit from transitioning to pull oracles. Push oracles, like those used by Chainlink and Band Protocol, offer simplicity and predictable costs but can be inefficient and less accurate in real-time applications. Pull oracles, such as Pyth Network, provide on-demand, real-time data, enhancing accuracy and efficiency crucial for high-frequency trading and lending platforms. Despite requiring more sophisticated implementation and potentially higher costs for frequent requests, pull oracles offer improved data quality, scalability, and flexibility, making them a superior choice for many DeFi applications.

Sources

https://pyth.network/blog/pyth-a-new-model-to-the-price-oracle

https://blog.synthetix.io/pyth-retrospective-airdrop/

https://docs.pyth.network/price-feeds/pull-updates

https://coincodex.com/article/41416/battle-of-the-oracles-pyth-network-vs-chainlink/

https://cryptobriefing.com/pyth-network-oracles-innovation/