SEI Network Report

Introduction

The SEI Network has transitioned from an intensive testnet phase to a live deployment, marking a pivotal moment in blockchain innovation. Positioned as a sector-specific layer-1 chain within the Cosmos ecosystem, SEI is meticulously designed for optimized trading. Boasting an impressive transaction finality of 600 milliseconds and a remarkable capacity of 22,000 orders per second, SEI aims to redefine decentralized exchanges (DEXs) across DeFi, NFTs, and gaming. Unlike single-purpose app-specific blockchains, SEI's versatility lies in its ability to cater to multiple applications within the trading sector.

Built upon the foundation of the Cosmos SDK, SEI prioritizes performance, security, and interoperability. It employs the robust Tendermint Core consensus mechanism to enhance security and deploys frequent batch auctions to prevent manipulative practices. Furthermore, strategic collaborations, like the partnership with Axelar, enhance the network's interoperability, fostering bridging and communication with other protocols. Co-founded by industry veterans Jeffrey Feng and Jayendra Jog, SEI Network has raised $30 million in strategic fundraising rounds, garnering support from prominent investors like Jump, Distributed Global, and Multicoin. With its mainnet launch on August 15th, 2023, and the introduction of its native token SEI on major exchanges, SEI Network stands at the forefront of reshaping the trading landscape through innovation, efficiency, and security.

How Does SEI Optimize for DEXs?

SEI Network's optimization for decentralized exchanges (DEXs) is a remarkable feat achieved through several strategic measures. Addressing a critical challenge in DEXes, SEI employs frequent batch auctioning to preempt front-running—a persistent issue in the domain. Unlike conventional execution, where orders are vulnerable to manipulation, SEI aggregates and executes orders simultaneously at the block's end, ensuring equitable transaction outcomes.

Furthermore, SEI leverages native price oracles to provide reliable data feeds, minimizing reliance on external sources. By adopting a single-block order execution, SEI streamlines the order placement and execution process into a singular transaction, enhancing efficiency. The bundling of orders across multiple levels not only aids in minimizing gas costs but also facilitates market makers and professional traders.

The innovative approach of SEI extends beyond traditional automated market maker (AMM) models prevalent in most DEXes. Instead, SEI introduces a Centralized Limit Order Book (CLOB), envisioning a decentralized NASDAQ-like experience. This departure from the norm underscores SEI's commitment to creating a trading environment that bridges the gap between centralized and decentralized exchanges, marking a pivotal stride in reshaping the landscape of DEX technology.

Network Activity

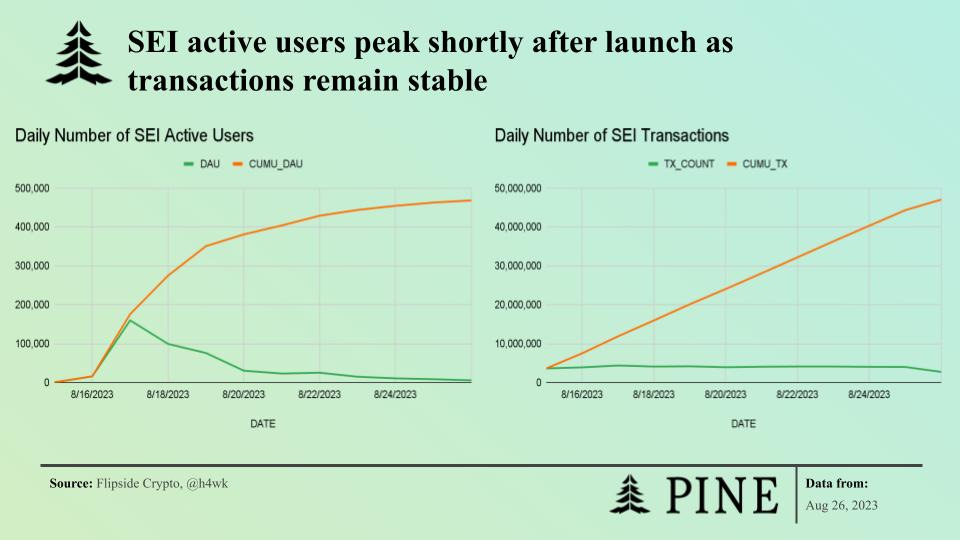

The SEI blockchain's performance since its launch has been notable, demonstrating a dynamic trajectory in user engagement and transaction activity. Shortly after its launch, the platform witnessed an impressive surge, with over 150,000 unique users actively utilizing the blockchain. However, subsequent days have seen a gradual decline in daily active users, stabilizing at approximately 10,000 users presently. It is noteworthy that despite this decline, the blockchain has achieved a significant cumulative engagement, with just under 500,000 unique users participating in transactions on SEI.

Interestingly, the platform's daily transaction volume has shown resilience since its inception. An approximate average of 5 million transactions is conducted daily, reflecting consistent utilization of the blockchain for various activities. The cumulative transaction count has impressively reached around 50 million, underlining the sustained appeal and functionality of SEI in facilitating a substantial volume of transactions. These statistics collectively signify the SEI blockchain's ability to maintain a robust transactional ecosystem, fostering ongoing user interaction and showcasing the enduring utility of the platform.

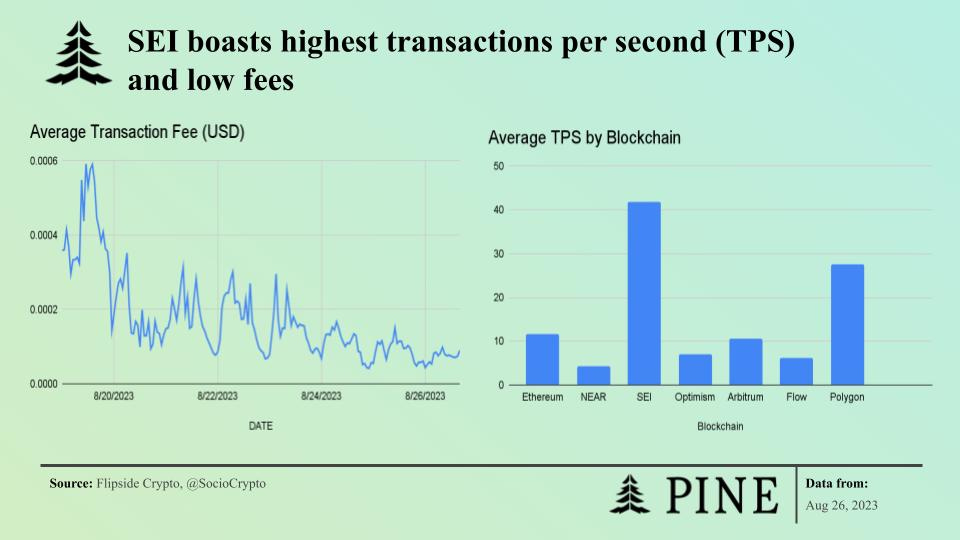

The SEI network has distinguished itself through exceptional efficiency, as evidenced by its consistently low average transaction fees. Since its launch, the platform has maintained an astonishingly meager average fee, often less than $0.0002 per transaction. Notably, this fee has experienced a substantial reduction over time, plummeting from $0.0006 to an approximate value of $0.0001 at present. In stark comparison, Ethereum's current average fee hovers around $5, underscoring SEI's unparalleled cost-effectiveness.

Equally remarkable is SEI's remarkable Transactions Per Second (TPS) performance, which far exceeds industry standards. With an average TPS surpassing 40, SEI demonstrates its superiority over Ethereum's 10 TPS. This exceptional throughput places SEI in a league of its own, even outpacing renowned high-speed blockchains like Polygon, which registers an average TPS of approximately 30. SEI's combination of minimal transaction fees and remarkable TPS showcases its prowess as a technologically advanced and cost-efficient platform, poised to redefine the standards of blockchain performance.

Bridge Activity

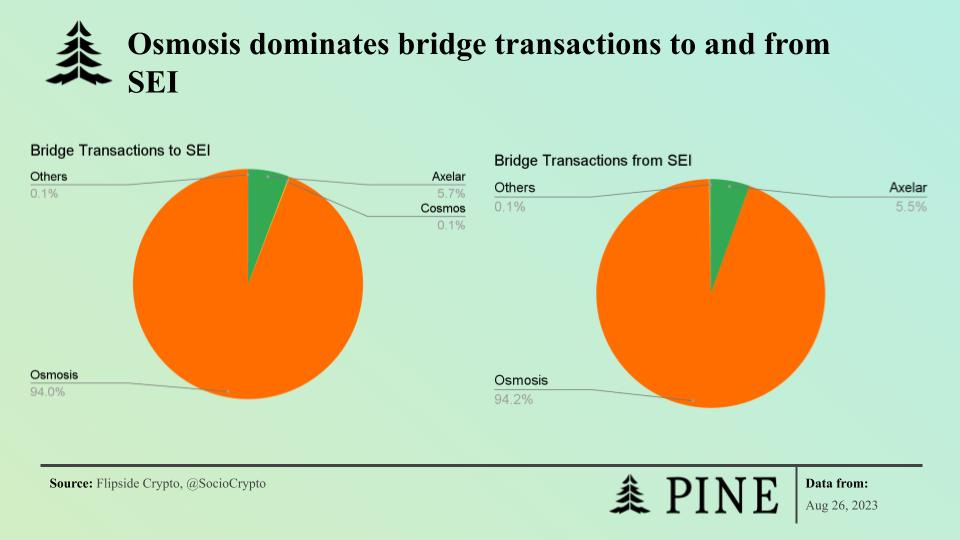

In an in-depth analysis of the SEI blockchain's bridge transactions, a distinct dominance of Osmosis becomes evident. Since the inception of SEI, Osmosis has played a pivotal role, accounting for a staggering 94% of all bridge transactions to and from the SEI network. In contrast, Axelar, another notable player in the space, contributed slightly over 5% of the bridge transactions. This stark disparity underscores Osmosis's pronounced influence in facilitating the movement of assets between SEI and external chains, marking it as a critical cog in the SEI ecosystem's interoperability dynamics.

Conclusion

The SEI Network's progression from its initial testnet phase to full deployment symbolizes a transformative juncture in blockchain technology. As a specialized layer-1 chain within the Cosmos ecosystem, SEI is poised to revolutionize trading with its lightning-fast transaction finality and unparalleled order capacity. Drawing from the robust Cosmos SDK and enriched by strategic alliances, notably with Axelar, SEI promises both security and broad interoperability. With the guidance of industry luminaries like Jeffrey Feng and Jayendra Jog, alongside significant investment backing, its trajectory is set to reshape the trading paradigm.

The efficiency of the SEI landscape is evident in its resilient transaction volumes and exceptionally low fees. Its performance metrics, especially when juxtaposed with giants like Ethereum, showcases SEI's distinct edge. Additionally, the pronounced role of Osmosis in bridge transactions highlights the importance of strategic collaborations in the ecosystem. In sum, SEI emerges as a vanguard in the blockchain sphere, combining innovation, efficiency, and strategic foresight.

Pine Analytics Info

Website: https://storage.googleapis.com/pinedao/Pinehome1.html

Twitter: https://twitter.com/PineAnalytics

Weekly Contest: https://www.jokedao.io/contest/polygon

Partner with Pine: https://docs.google.com/forms/