SOAR and the DRP Standard

SOAR is a token launchpad competing in the ownership coin sector. In this piece, we examine what the project is, how its ownership coins are structured, the current on-chain activity, and our thoughts on the platform.

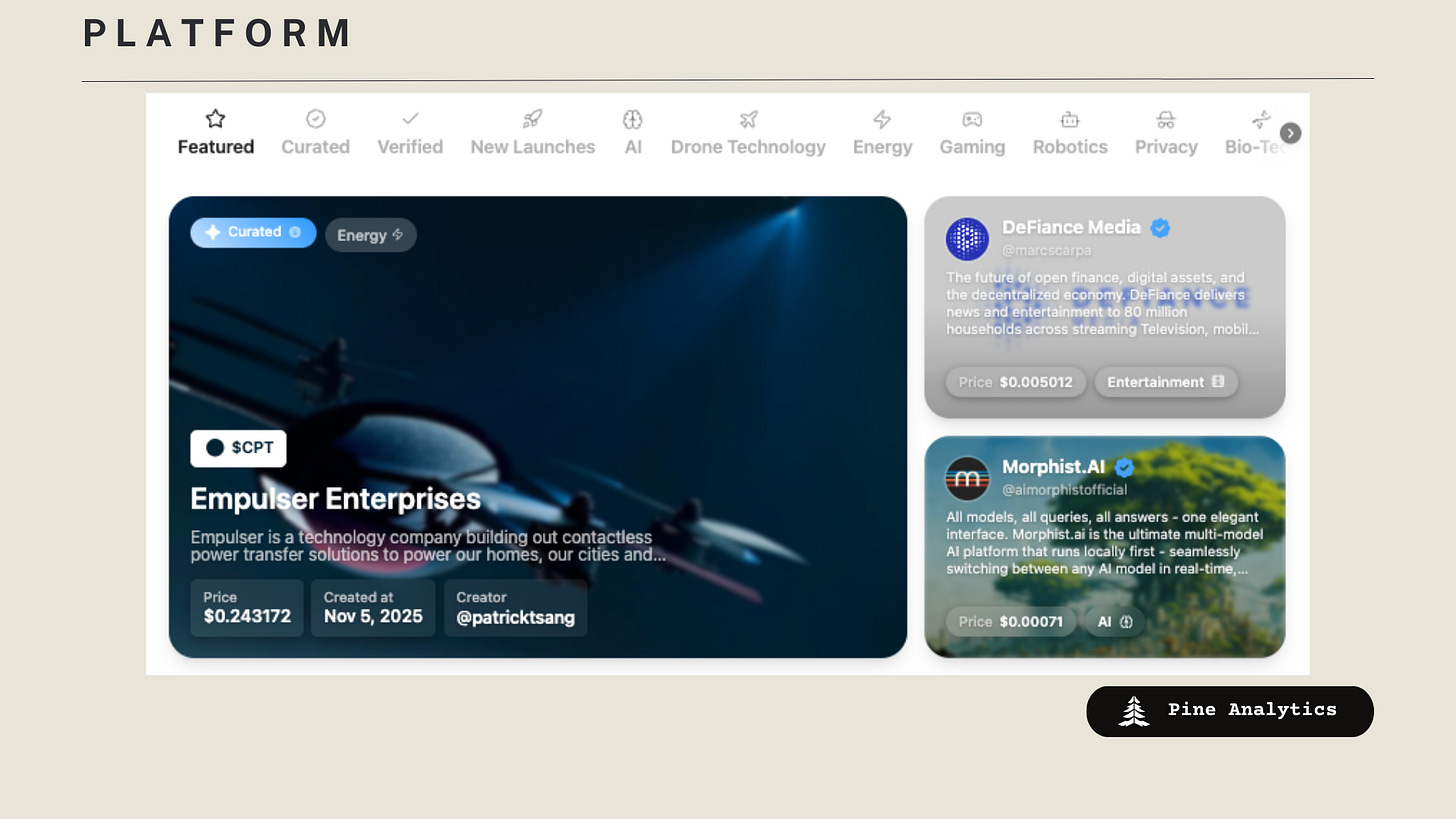

How the Platform Works

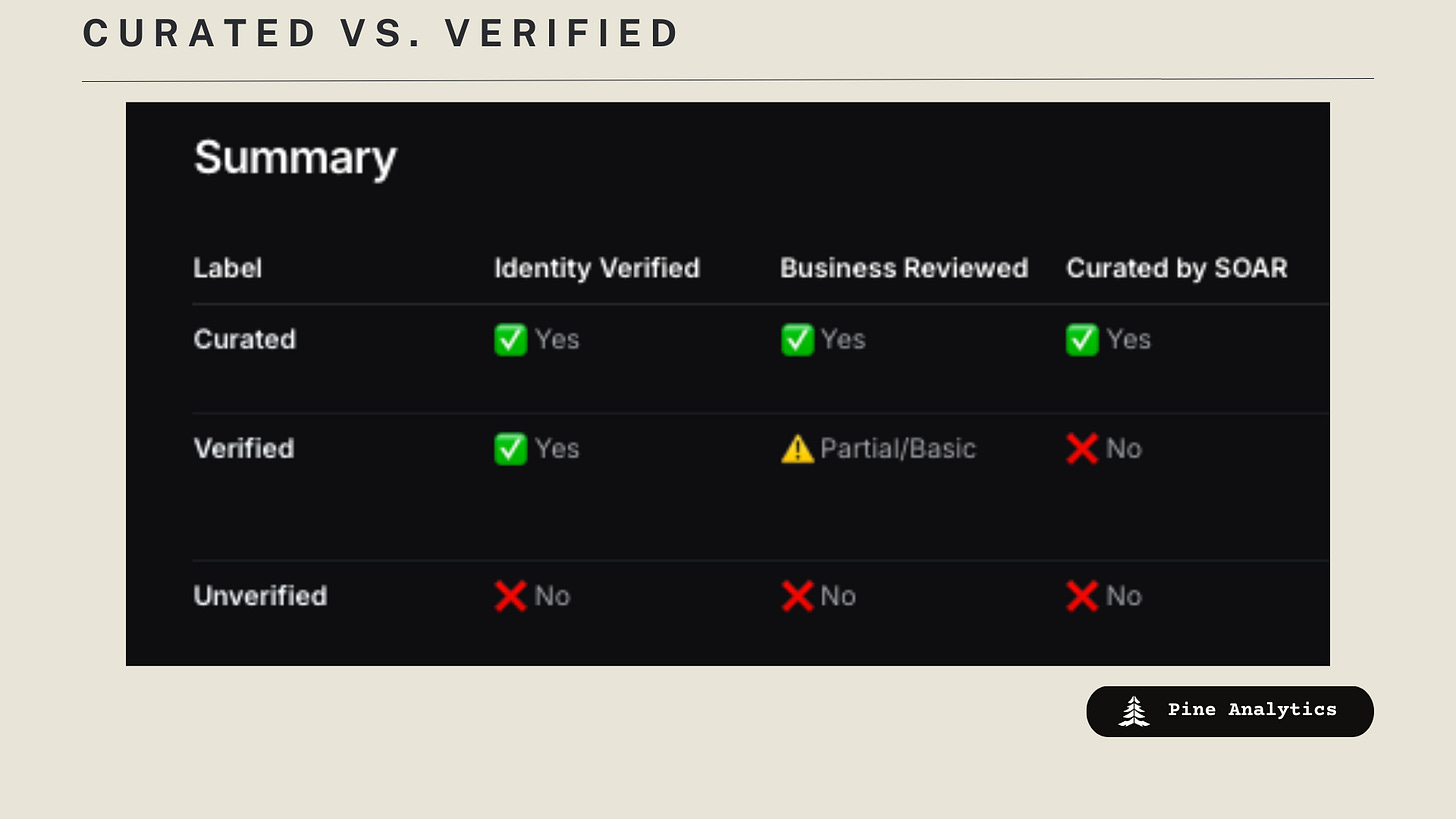

The platform allows people to launch tokens through three paths: Curated, Verified, and Unverified.

Unverified launches are the simplest. An unverified launch is a token launched without engaging in the protocol’s core mechanic—it launches on the Meteora dynamic bonding curve with a 50M supply and is functionally no different from any other coin launched on a bonding curve.

To explain Curated and Verified launches, we first need to dive into the platform’s main innovation: the DRP.

Understanding the DRP Standard

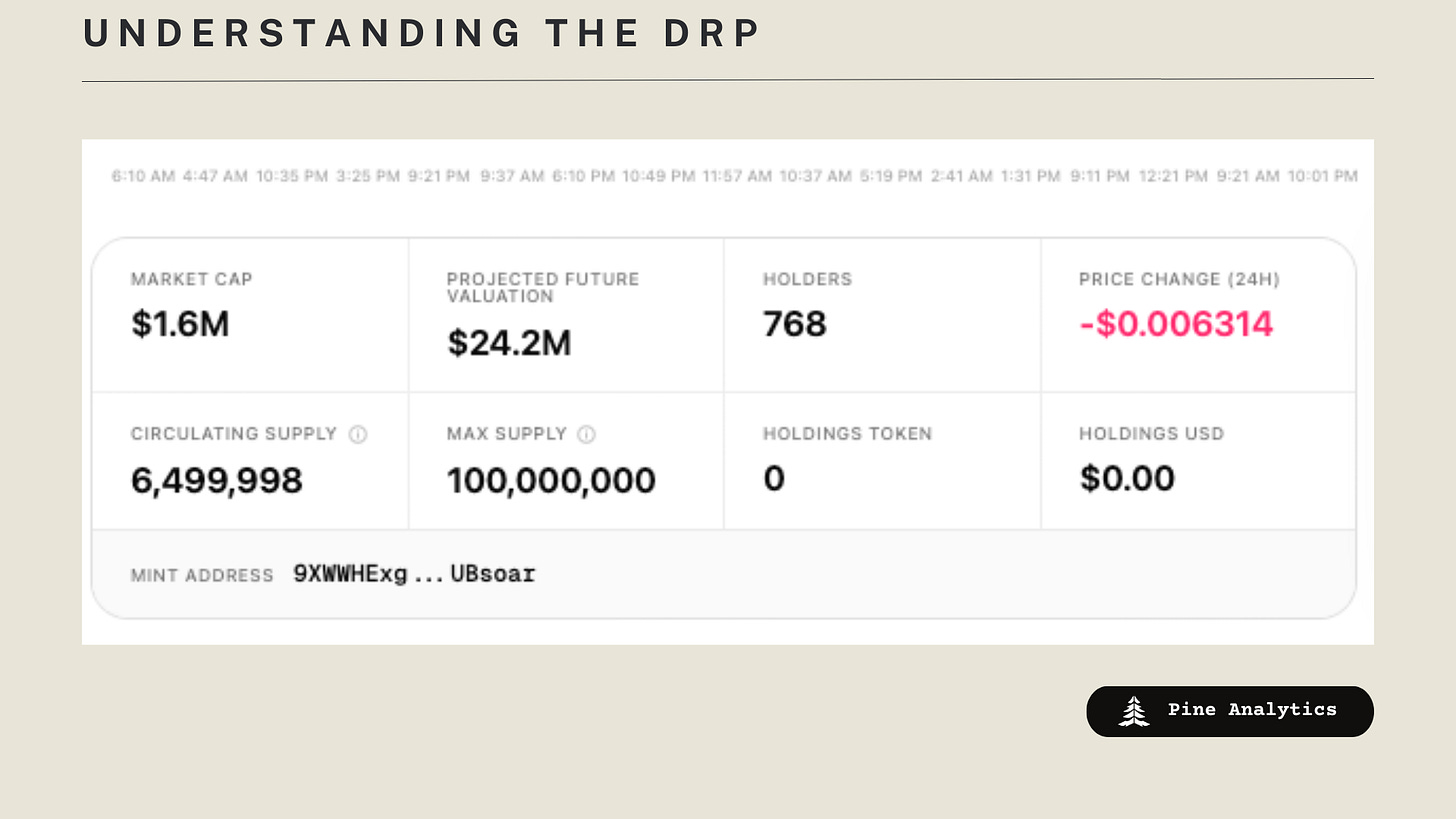

The Digital Representation of Participation (DRP) is a token standard developed by SOAR that attempts to create a direct financial link between token circulation and company obligations. The core problem it addresses is straightforward: in most token models, founders can sell tokens with no real corporate consequence beyond speculative opportunity cost. Tokens exist parallel to equity rather than connected to it, which is why projects can generate enormous value for the private company while token holders see little direct benefit.

How the mechanism works:

When a company launches, 100% of the max token supply represents 100% of the company’s value. Only about 5-6% actually enters circulation initially—the rest remains un-minted. The company signs a Senior Debt agreement with SOAR where the debt percentage equals the percentage of tokens in circulation. If 10% of tokens are circulating, the company owes SOAR 10% of its value upon a liquidity event. Selling more tokens increases debt; buying tokens back decreases it. This creates actual economic weight behind token issuance decisions.

After a 3-month lockup, founders can mint additional tokens but must publicly disclose the amount, reason, and intended use of funds across multiple channels, then wait 72 hours before minting. This gives holders advance notice to exit if they disagree. The transparency mechanism is the primary check on founder behavior—there’s no governance vote or veto power, just information and the ability to sell.

The structure theoretically discourages reckless dilution since it increases debt burden, and makes buybacks meaningful since they reduce obligations. However, the contracts between SOAR and the teams launching tokens are not currently public, which creates uncertainty around the exact terms of these agreements. Whether the debt obligation has real teeth during liquidity events depends on the enforceability of the legal agreements and SOAR’s ability to collect—details that token holders cannot independently verify. The model is new and untested at scale.

Curated vs. Verified Launches

Both Curated and Verified projects have completed KYC/KYB for their business and have signed the DRP agreement when launching tokens. The difference is that Verified projects sign the DRP permissionlessly, while Curated projects represent the highest standard of screening on SOAR.

A project receives the Curated label when:

The SOAR team has conducted in-depth research and review

Material business details have been verified

Founders and teams have demonstrated strong execution and credibility

For all tokens launched on SOAR, teams do not receive funding upfront through an ICO. Instead, they receive fundraising through volume fees on their token’s trading activity. As a fee for some launches, SOAR also takes a portion of the project’s token supply.

On-Chain Data

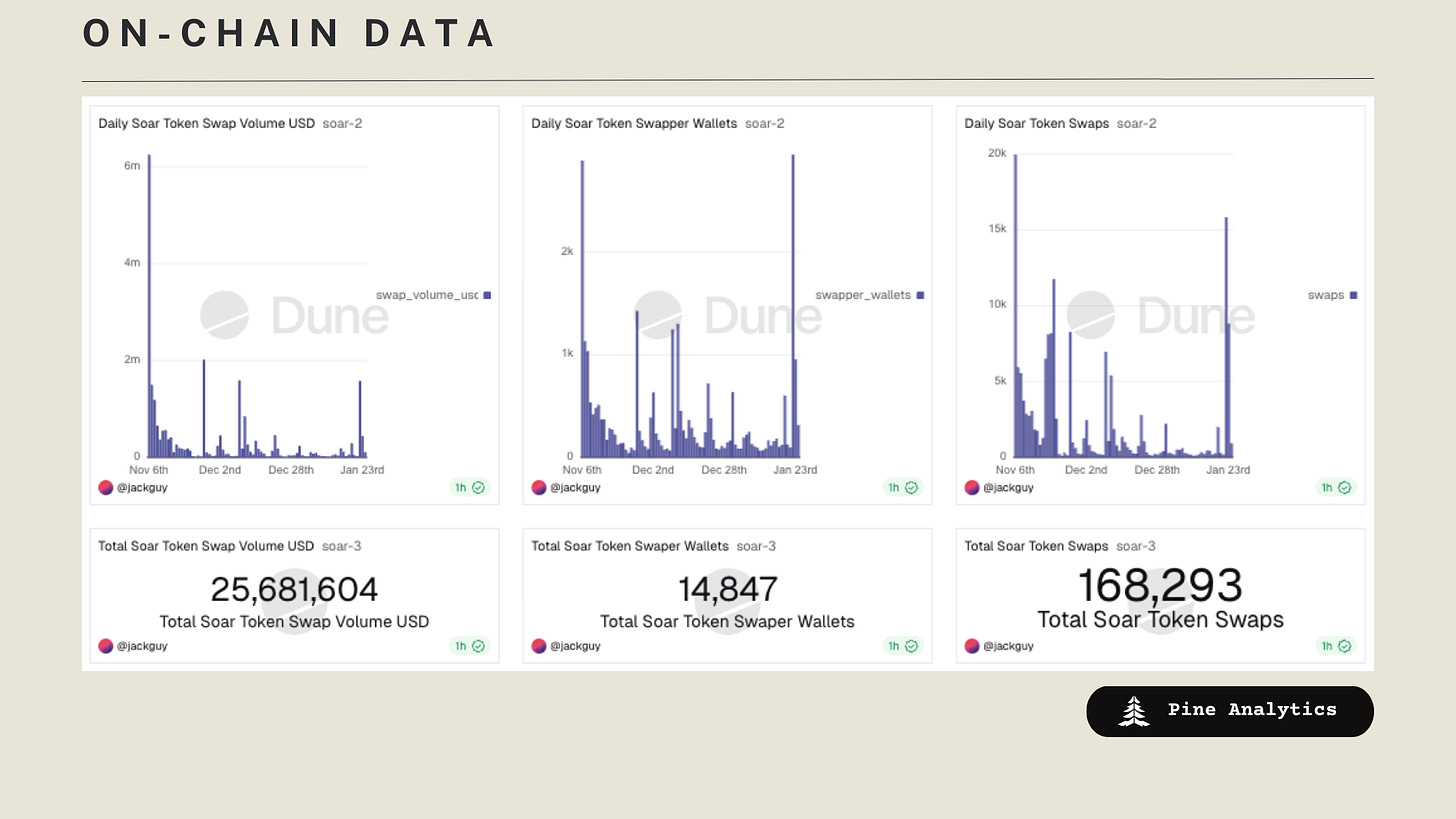

Since November, 5,400 tokens have launched on SOAR. Of these, there are 12 Verified tokens, of which 3 are Curated launches.

The 12 Verified tokens have a cumulative enterprise value of $36M, with most of that value concentrated in Empulser Enterprises ($22M) and Shiza ($7.8M). Shiza currently represents the largest gains for early buyers on the platform.

These tokens have generated $25.6M in total swap volume, resulting in $192K in fees for launching teams. Just under half of all SOAR token trading volume came in the first week of the platform being live. Since then, there have been bursts of trading volume that revert back to five-figure daily trading volume.

Our Thoughts

This is a cool concept with potential, but it needs a few things:

Contract transparency — SOAR needs to make the agreements that teams sign public so token holders understand exactly where they fall in the capital stack.

High-quality founders — The platform needs to attract more high-quality founders to launch tokens that perform well. A successful major runner would kickstart a flywheel effect, catalyzing more active token bidders and making the platform more attractive for new launches.

Funding model concerns — The model of only gaining token fees rather than an ICO model seems less compelling to teams that need a specific amount of capital. Giving up a portion of your company without knowing what you’ll get in return does not seem compelling to high-quality founders, which may cause adverse selection. The team noted they are working on this.

Sources

https://dune.com/jackguy/soar-metrics?utm_source=share&utm_medium=copy&utm_campaign=dashboard

https://docs.launchonsoar.com/overview/home