Solana Validator and Fee Economics

Analyzing the Challenges and Opportunities in Solana's PoS Ecosystem

Introduction

In this article, I delve into the intricate facets of Solana's Proof of Stake (PoS) ecosystem, emphasizing three key areas. Initially, I focus on the dynamics of Solana's fee market, scrutinizing how it influences validators' revenue streams and the broader blockchain economic model. This examination is particularly pertinent in the context of the network's declining inflation rates, and I explore the ramifications of this decline on the long-term viability of validators.

Subsequently, I turn my attention to a significant challenge confronting the Solana network: the systemic exploitation through transaction spamming. This issue, spurred by incentives that encourage overloading the network, precipitates network congestion and subpar performance, thereby impeding Solana's scalability. This spamming activity, often undertaken to secure competitive advantages, detrimentally impacts the network's efficiency and overall health.

Integrating insights from my interview with a seasoned Solana validator, the discussion extends to include firsthand experiences and perspectives on these issues. This additional dimension provides a more comprehensive understanding of the practical implications and real-world challenges faced within the Solana ecosystem.

What are Solana Validators

In the Solana ecosystem, validators are pivotal for maintaining network integrity and performance. They process and validate transactions, produce blocks, and uphold the network's security through the Proof of Stake consensus mechanism, where their influence is proportional to their staked SOL. This staking not only incentivizes honest participation but also fortifies the network against attacks. Their efficient handling of transactions and support for Solana's innovative protocols, like Proof of History, are crucial for the network's high throughput and scalability, which in turn fosters the growth of Solana's ecosystem by providing a stable platform for decentralized applications.

Validator Economics

Solana Validator Cost

The economics of operating a Solana validator involve careful consideration of both costs and revenue potentials. A validator faces yearly expenses of approximately $41K, which includes server and bandwidth costs at about $375 and voting costs (~29 SOL, equating to around $3K per month, assuming a SOL price of $105).

Validators Revenue Streams

Validators on the Solana network generate income through various channels. The most significant of these is the inflation rewards, currently at 7.32%. This is supplemented by base fee rewards amounting to 0.016%. Additionally, those using the Jito client gain an extra 0.42% in Jito MEV rewards. For validators not employing the Jito client, the total earnings before commissions stand at 7.337%, while for those using Jito, it's 7.755%. Typically, validators charge a commission of 5% to 10% on these earnings, resulting in an annual commission range from 0.36% to 0.78% of the staked amount. Moreover, validators retain 100% of their priority fees, which contribute an additional 0.217% to their revenue in terms of the percentage of staked tokens. Consequently, the total annual income for validators ranges from 0.577% to 0.997% of their total staked amount.

In the broader financial landscape of the Solana network, users contribute substantial fees totaling approximately $189M per year, comprising 1.66M SOL in priority fees and 140K SOL in base fees. Half of this amount, 50%, is dedicated to burning, thereby reducing the total SOL supply. The remaining half is distributed among the validators. In addition, validators benefit from Jito MEV rewards, which add about 848.4K SOL, or roughly $89M, to their annual income. These combined revenue streams from MEV and priority fees result in yearly earnings for Solana validators ranging between $92.3M and $97.4M. Furthermore, inflation significantly impacts validator revenue, contributing an additional $146.5M to $293.4M each year. The exact amount varies depending on the individual commission rates set by the validators.

Breaking down the profitability threshold, for a validator to attain a breakeven point, they would need a staked capital ranging from $4.1M (equivalent to 39.2K SOL) to $7.1M (or 67.6K SOL). This requirement varies based on multiple factors, including operational costs, commission rates, and the type of client used. Currently, within the Solana network, 1162 out of the 1637 validators with over 1K SOL staked surpass this lower profitability threshold, indicating a healthy level of financial viability for a significant portion of the network's validators.

Validator Economic Sustainability

In the scenario where Solana reaches its terminal inflation rate of 1.5%, the impact on the network's economics would be substantial. If the percentage of SOL staked and activity remains the same, the inflation rewards would decrease to 2.23%. As a result, validators' revenue on their stake would range from 0.44% to 0.505%. To achieve a breakeven point under these conditions, validators would require a stake between $8.1M (77.3K SOL) and $9.3M (88.7K SOL). At this terminal rate, only 473 out of 1637 validators, each holding over 1K SOL, would surpass the lower profitability threshold.

Upon reaching the terminal inflation phase, validators' annual earnings from inflation would be significantly reduced, estimated between $44.8M and $89.6M down 66%+. To preserve the current number of profitable validators and stake distribution the Solana network would need to increase its priority fees, potentially up to $200M or $400M annually.

Currently, the network generates approximately $166M per year in priority fee revenue for validators at the current rate. To maintain the same number of profitable validators when inflation reaches its terminal rate, the network would need to increase this revenue to $566M at a maximum. Considering that the network is projected to reach its terminal inflation rate in about seven years, there is ample time to enhance priority fee revenue. This goal seems achievable, especially given that priority fees experienced a substantial growth of 1000% in December of this year alone.

Comparison to Ethereum

When comparing the fee structures of Ethereum and Solana, three major differences are evident. Firstly, Solana has a fixed base fee, whereas Ethereum's base fee adjusts from block to block, based on the previous block's utilization, aiming to keep blocks about 50% full. Secondly, for both the base and priority fees on Solana, 50% of the fee is burned, and the remainder goes to the block producer (leader). In contrast, on Ethereum, the entire base fee is burned, and the priority fee is awarded to the block producer. Thirdly, there is a fundamental difference in how transaction costs are calculated: on Ethereum, the cost scales with the amount of computational resources used by the transaction, whereas on Solana, transaction costs do not vary with computational usage.

Analyzing the impact of these policies, data shows that on Ethereum, the adjustable base fee often constitutes the majority of the total fees paid to the network, including MEV. Meanwhile, on Solana, the priority fee represents a larger portion of the network's total fees. These differences have distinct effects on the users of the two networks. On Ethereum, the dynamic base fee mechanism, intended to regulate network congestion by pricing out some users, can lead to many overpaying for block space, leaving some block space unused. On the other hand, Solana's fee policy tends to encourage a high volume of low-value or spam transactions, contributing to the network's notable transaction failure rate.

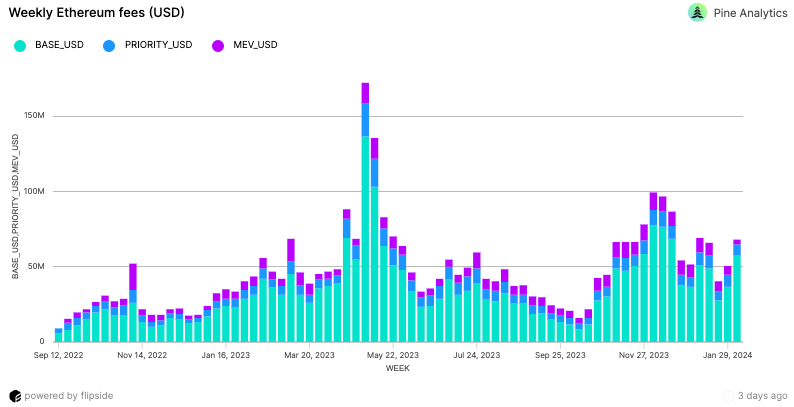

There is a significant difference in the total fees collected by Ethereum and Solana. Ethereum currently generates about $50M per week from a combination of on-chain fees and MEV, whereas Solana's total is around $4.8M. Notably, Ethereum's fee revenue is contributing to a deflationary trend within its network, offering stakers an approximate annual yield of 3.5%. In contrast, if Solana were to achieve its terminal inflation rate of 1.5% while matching Ethereum's current fee earnings, the outcome could be highly profitable for both delegates and validators. Such a scenario would not only support a larger number of validators but might also allow validators to operate profitably even with a negative commission rate.

Comparison to Apost

In the Aptos blockchain, each transaction incurs a base gas fee determined by three factors: instructions, storage, and payload. The complexity of a transaction, indicated by the number of function calls, branching conditional statements, etc., directly influences its instruction gas cost. Similarly, the extent of reads from and writes into global storage determines the storage gas cost. Additionally, the size of the transaction payload impacts the overall cost, with larger payloads incurring higher fees.

The network establishes a base cost per unit of gas consumed by a transaction. Users have the option to prioritize their transaction's inclusion in the next block by paying an amount per unit of gas that exceeds the base rate. Transactions with a higher cost per gas used are given priority in upcoming blocks.

This method bears a resemblance to Ethereum's approach, where each transaction is priced based on the network resources it consumes. However, unlike Ethereum, where the cost per unit is dynamic and fluctuates with demand, Aptos maintains a fixed cost per unit, akin to Solana's fixed fee per signature.

An analysis of the Aptos Network reveals a consistently high transaction success rate, typically above 90%. There have been occasional instances, albeit rare, where this rate dipped below 70%. Despite these fluctuations, the network has generally maintained good uptime. Additionally, the data indicates that, for most days, the transaction gas price has remained close to the base fee. However, there was a notable period of about three months where the gas price surged to approximately four times the base fee.

Furthermore, it's important to note that the Aptos Network is currently collecting about $5,000 per day in transaction fees, which is less than 1% of the daily fees collected by the Solana network. This stark contrast highlights the difference in network activity between Aptos and Solana.

Overall, the data suggests that the Aptos Network is performing robustly in terms of gas fees. Nevertheless, it is important to note that the network does not appear to have been tested under extreme conditions. Therefore, it is challenging to extrapolate the current effectiveness of this fee system under the kind of strain that the Solana chain routinely experiences.

Economic Recommendations

To enhance the economic stability and decentralization of the Solana network in light of diminishing inflation rates, I suggest a multi-faceted approach, including protocol adjustments and strategies to boost overall network activity:

Reduce the Cost of Voting Transactions for Validators with Over 1K SOL Staked but Not in the Superminority: The primary cost for validators is currently the voting cost. Fees paid are effectively directed to the largest validators or are burned. Thus, when smaller validators pay these fees, they partially subsidize the larger ones. Dramatically reducing this fee would allow validators to become profitable with significantly lower SOL delegations, aiding in decentralizing the network. If these fees were reduced by 90%, validators could become profitable with about 10K SOL in stake, rather than 45K+. One way to make sure validators would not abuse these reduced fees is to introduce slashing conditions for abusing it.

Incentivize Non-Economic Validators: Considering the gap between the current network fees and the required level to sustain validators based on commissions at terminal inflation, aiding validators in generating non-commission revenue could be an effective strategy to bridge this gap.

Increasing Network Economic Activity: Achieving a sustainable economic model for Solana, especially at terminal inflation, is feasible but will require growth in network activity. If Solana could generate fees at 3x its current rate consistently at its terminal inflation, sustainability would be attained.

Help Validators Retain a Large Portion of Their Priority Fees: Currently, validators retain 50% of their priority fees, which is distinct from other revenue streams like base fees and MEV. As the inflation rate approaches its terminal rate, priority fees will become an increasingly vital source of revenue. Without a 30-fold increase in the fees paid to the network, it will not be economically viable for validators to treat priority fees in the same manner as base fees.

Change of the Base Fee: This will be discussed in the next section.

Spam Reduction

Solana's current network dynamics, characterized by a flat and relatively low base fee, coupled with the non-deterministic nature of transaction prioritization, create a situation that inadvertently encourages spamming, especially in the context of arbitrage opportunities. Over 50% of the network's compute power is consumed by failed arbitrage transactions, with only about 2% of these attempts being successful. This inefficiency stems from the fact that, under the current system, it is advantageous for users seeking to capitalize on arbitrage opportunities to spam the network. The rationale behind this strategy is to increase the chances of their transactions being executed amidst the competition. The combination of a low base fee and the unpredictability in transaction processing, including the impact of jitter in transaction scheduling, exacerbates this issue, leading to an excessive number of transactions that congest the network without adding value.

Osmosis Case study

Context and Challenge: In November 2023, the Osmosis blockchain confronted a critical challenge due to rampant spam from arbitrage bots. This issue escalated to the point where the blockchain's performance was severely hindered, at times halting the chain entirely and preventing any transactions from processing. Notably, these congestions coincided with significant events such as the launch of Celestia's TIA token and a major price movement in OSMO, leading to substantial potential losses in trading volume on the Osmosis DEX. The stability of the chain was crucial for the smooth functioning of key platforms like the DEX, Levana perps, and Mars protocol, which were all reliant on consistent asset pricing to prevent price manipulation attacks.

Proposal and Implementation: To urgently address this issue, an expedited signaling proposal was put forward to increase the protocol-enforced minimum gas price to 0.025 uOSMO, marking a tenfold increase from the previous rate of 0.0025 uOSMO. This proposal was intended as a temporary measure to stabilize the network until a more permanent solution, an EIP-1559 style fee market developed by Skip Protocol, could be implemented. The proposal also required Osmosis contributors to propose a software upgrade for implementing these changes within seven days of its passage. It was emphasized that this adjustment could be reverted once the new fee markets were operational on the Osmosis mainnet.

Results and Impact: In the context of Solana's strategies to manage blockchain spam, the Osmosis blockchain case is instructive. After increasing its minimum gas price, Osmosis saw a reduction in spam, with failed transactions dropping from 20% to 10% in the months following the change. This demonstrates that a moderate increase in base fees can effectively curb spam while keeping fees relatively low. This outcome is particularly relevant for Solana, suggesting that a base-fee-centered approach could deter low-value transactions and enhance network performance without significantly burdening users

Base Fee Recommendation

Solana has a unique opportunity to enhance its fee structure by adopting a dynamic base fee system. Drawing inspiration from Ethereum's model but tailoring it to fit its own architectural and transaction processing needs, Solana can implement a fee structure that is more aligned with actual resource usage.

Dynamic Base Fee System Based on Compute Units (CUs) and Hotspots:

CU-Based Fee Structure: Moving away from a flat base fee, Solana could implement a system where fees are calculated based on the number of Compute Units (CUs) consumed by a transaction. This approach aligns fees more accurately with resource usage, leading to fairer and more equitable pricing.

Monitoring State Usage: The system would monitor CU utilization in real-time within each block, focusing specifically on transactions that interact with particular segments of the blockchain state. This data would be aggregated over a series of blocks to form a reliable moving average, providing a clear picture of ongoing resource use.

Hot spot fee increase: Drawing inspiration from Ethereum's mechanism of pricing the base fee to use 50% of the next block's capacity, our proposal similarly aims to regulate the use of hot spots within the network. However, our goal is to price the fees of hotspots to only utilize a proportion of the maximum transaction space allotted to them per block. Currently, a single part of the state in a Solana block is permitted to use up to 12 million Compute Units (CUs) out of the total 48 million CUs available. To address transaction spam effectively, we suggest implementing a system that calculates a weighted average of CU usage in hot spots based on previous blocks' data. Once a hot spot's CU usage surpasses a predetermined threshold per block—for illustrative purposes, let's say 6 million CUs—the cost per CU for the base fee will begin to increase exponentially. Should the usage of this state part continue to rise past the threshold, the base fee for interacting with it will escalate disproportionately. This method is designed to deter the strategy of spamming the network to secure transaction inclusion in specific state parts, thereby alleviating congestion and enhancing the overall functionality of the network.

This model stands out for its adept management of network congestion, particularly in high-demand areas, and curtails the appeal of spamming tactics. It keeps the network accessible and efficient, even in quieter periods. The innovative fee structure proposed for Solana signals a leap forward in blockchain economics, ensuring a system that adjusts seamlessly to changing demands, maintaining its performance and affordability.

Validator Challenges and Perspective

I recently had the opportunity to speak with Bryan, the node operator at Cogent Crypto. Bryan is not only responsible for operating a validator with over 2 million SOL staked but has also assisted individuals of varying technical levels in setting up and running their own Solana validators. His experience offers a unique perspective that encompasses both small and large validators, providing valuable insights into the challenges and strategies within the Solana network.

Gaining Stake and Maximizing Scores

A primary goal for validators, as emphasized by Bryan, is achieving high scores in staking pools like Marinade or Solblaze. These pools are crucial for validators, particularly new entrants, as they hold substantial quantities of Solana and aid in acquiring the necessary stake. Navigating and adapting to the changing criteria used by these pools to allocate their stake is a significant challenge, requiring ongoing attention and adjustment.

Gaining visibility is another major challenge for validators. Strategies vary from active social media presence to the development of useful tools for the Solana community. Some validators initially set their commission rates at 0% to attract delegates with a higher APY, planning to increase these rates later. The effectiveness of these tactics can vary, and some may take time to produce results. An example highlighted by Bryan is Solana Compass, which initially struggled to attract stake but later gained traction by creating valuable tools, especially after the Alameda SOL sell-off.

Biases and Transparency Challenges

Bryan also pointed out the common misconception that larger validators are always safer, a belief that contributes to the centralization of the network. Additionally, return transparency is a significant issue, with different websites and frontends showing varied APYs for the same validators using different methodologies. This inconsistency influences staker decisions, leading validators to adapt their strategies, such as altering the distribution of MEV rewards and commission rates to appear more favorable on these platforms. A potential solution to this problem would be to establish a 'gold standard' methodology for calculating APYs, used uniformly across all platforms and frontends, to ensure clarity and consistency in the information presented to delegates.

Operational Efficiency

A continuous challenge for validators is finding efficient and reliable server hosting solutions. Access to resources that provide real-time information on optimal hosting locations can significantly simplify this aspect of a validator's responsibilities

Parting Thoughts

In my concluding thoughts, it's evident that Solana's network currently relies heavily on inflation rewards to sustain validators. However, considering the timeline to reach terminal inflation, the required level of economic activity to maintain validator profitability is within striking distance. Achieving this will necessitate sustained growth and focused efforts.

To expand the number of profitable validators, the network must uphold the social consensus allowing validators to retain their current rate of priority fee earnings. Redirecting this revenue to delegates should only occur once the economic activity significantly surpasses current levels. Furthermore, the community must explore alternative revenue sources for validators beyond commission/priority fees. Expanding these revenue streams could greatly enhance network decentralization.

Addressing the issue of spam transactions, Solana faces a unique challenge in balancing affordable fees with effective spam reduction. Unlike Ethereum, which manages this through a dynamic base fee targeting 50% block space utilization, Solana is pioneering its approach without precedent. Other emerging fast smart contract blockchains have yet to experience the demand levels that necessitate such measures. A viable solution could involve adopting Ethereum's concept of targeting base fees in areas of high congestion within the state to discourage network spamming, seamlessly bridging the gap between necessity and innovation.

Lastly, providing the community with high-quality, 'gold standard' resources regarding validator hosting, rewards, and strategies for stake acquisition is imperative. This will make the process of becoming and operating as a validator more accessible and comprehensible, contributing to the overall health and decentralization of the Solana network.

Sources

https://solanabeach.io/validators

https://www.helius.dev/blog/solana-validator-economics-a-primer

https://www.helius.dev/blog/consensus-on-solana

https://www.theblock.co/data/on-chain-metrics/solana

https://medium.com/@MTCapital_US/mt-capital

https://medium.com/@harshpatel_36138/whats…

https://www.publish0x.com/decrypting-crypto…

https://www.stakingrewards.com/asset/solana

https://docs.solanalabs.com/implemented…

https://eth2book.info/capella/part2/incentives/issuance/

https://forum.osmosis.zone/t/increase-minimum-transaction-fee/440

https://flipsidecrypto.xyz/pine/validator-economics-data-6YRG00