Stablecoins and Plasma’s Opportunity

A data-driven analysis of growth, regulation, and where new networks can capture demand

Executive Summary

Stablecoins have transformed from specialized trading instruments into a fundamental infrastructure layer of the global digital economy, processing trillions of dollars in annual on-chain transactions while increasingly penetrating real-world payment systems, remittance corridors, and institutional finance. This paper analyzes the macroeconomic history of stablecoin expansion, current adoption patterns across leading blockchain networks, and the regulatory frameworks that are shaping their future development.

Within this context, we introduce Plasma—a new Layer-1 blockchain designed to capture the next wave of stablecoin growth through zero-fee transfers, $2 billion+ day-one stablecoin TVL, and direct P2P wallet integration.

Through comprehensive competitive analysis across Ethereum, Tron, Solana, BSC, Base, and other major networks, this paper identifies three key opportunity zones: where Plasma can realistically capture existing transaction flows, where its competitive advantages remain incremental, and where ecosystem strategy will be the primary determinant of market share. The analysis concludes by establishing valuation benchmarks, defining adoption prerequisites, and outlining strategic priorities necessary to transition Plasma from initial market entry to breakthrough growth.

Macro View of Stablecoins

The Evolution of Stablecoins

2014–2016: Origins of Stablecoins

The concept of a cryptocurrency with stable value emerged in 2014. Early implementations included BitShares' BitUSD, launched in mid-2014, and Realcoin, which was subsequently renamed Tether later that year. These pioneering stablecoins sought to provide a "steady dollar" for cryptocurrency trading and payments.

Tether (USDT), issued by Tether Ltd. and pegged 1:1 to the US dollar, became the first widely adopted stablecoin. Throughout 2015 and 2016, Tether gained integration on exchanges like Bitfinex, providing traders with a USD substitute when reliable banking relationships for crypto platforms remained elusive.

During this period, stablecoin supply remained minimal—measured in tens of millions of USD—reflecting the nascent state of the cryptocurrency market itself. The primary use case centered on facilitating trades, offering investors a safe harbor from volatility without requiring conversion back to traditional dollars. While this early phase established the foundational stablecoin model, it had not yet achieved large-scale supply growth.

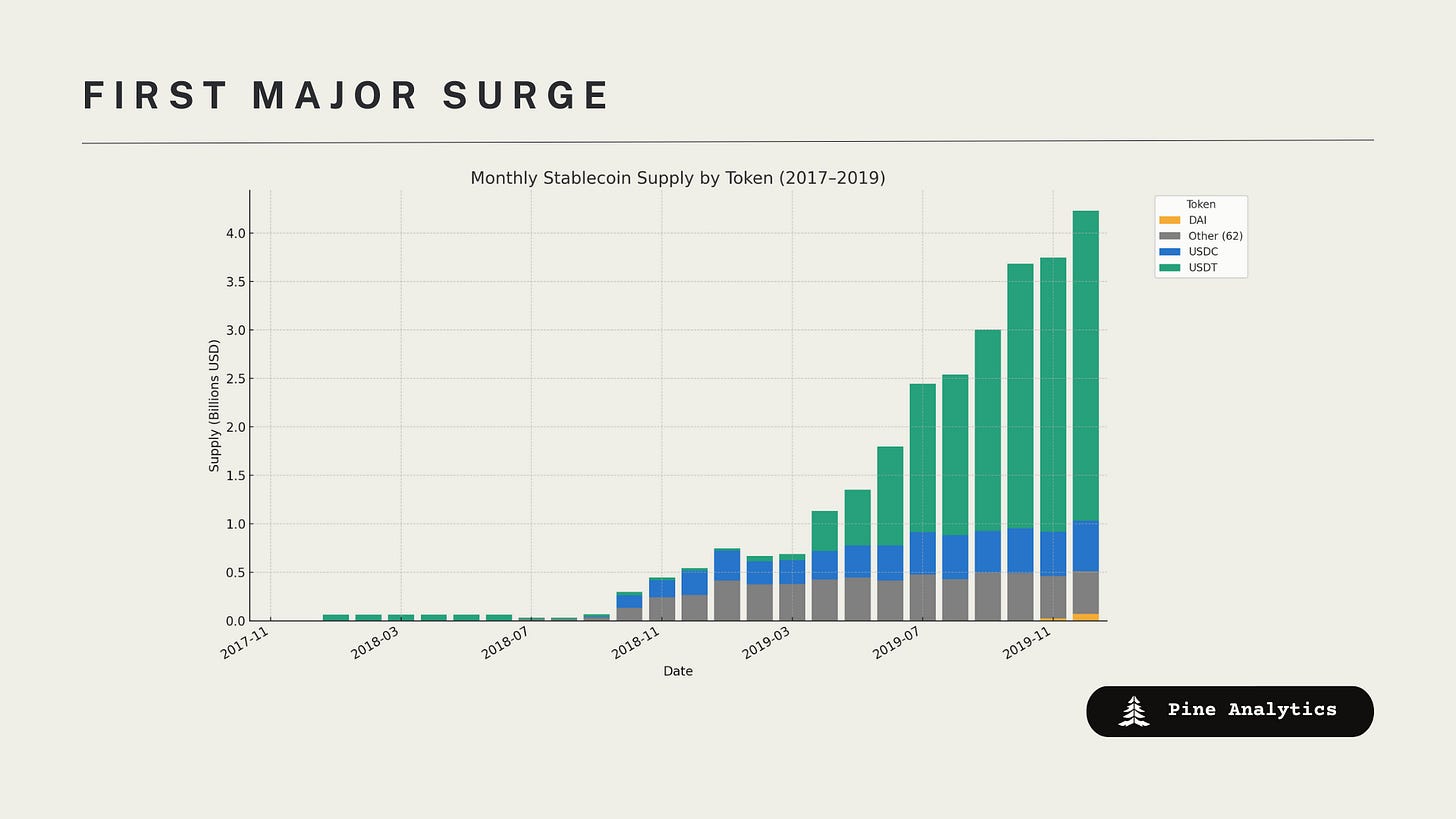

2017–2019: First Major Surge

Stablecoin supply remained modest from 2015 through 2017, ranging from approximately $2 million to $100 million in outstanding USDT. Growth accelerated in 2018 as centralized exchanges lacking USD banking relationships increasingly relied on USDT as a dollar proxy, while traders began parking profits in stablecoins between risk trades. By early to mid-2019, Tether's market capitalization had expanded to between $1 billion and $3 billion, peaking near $3 billion in December 2019. This marked the first significant growth phase, driven primarily by exchange trading and liquidity requirements rather than payment applications.

By 2019, the transformation toward stablecoins as the dominant quote asset was complete. USDT had surpassed Bitcoin as the most-traded cryptocurrency globally, establishing its position as the base currency across numerous trading venues. Additionally, leverage trading became heavily concentrated across major exchanges with USDT serving as primary collateral, further solidifying its role as the foundational asset within the cryptocurrency trading infrastructure.

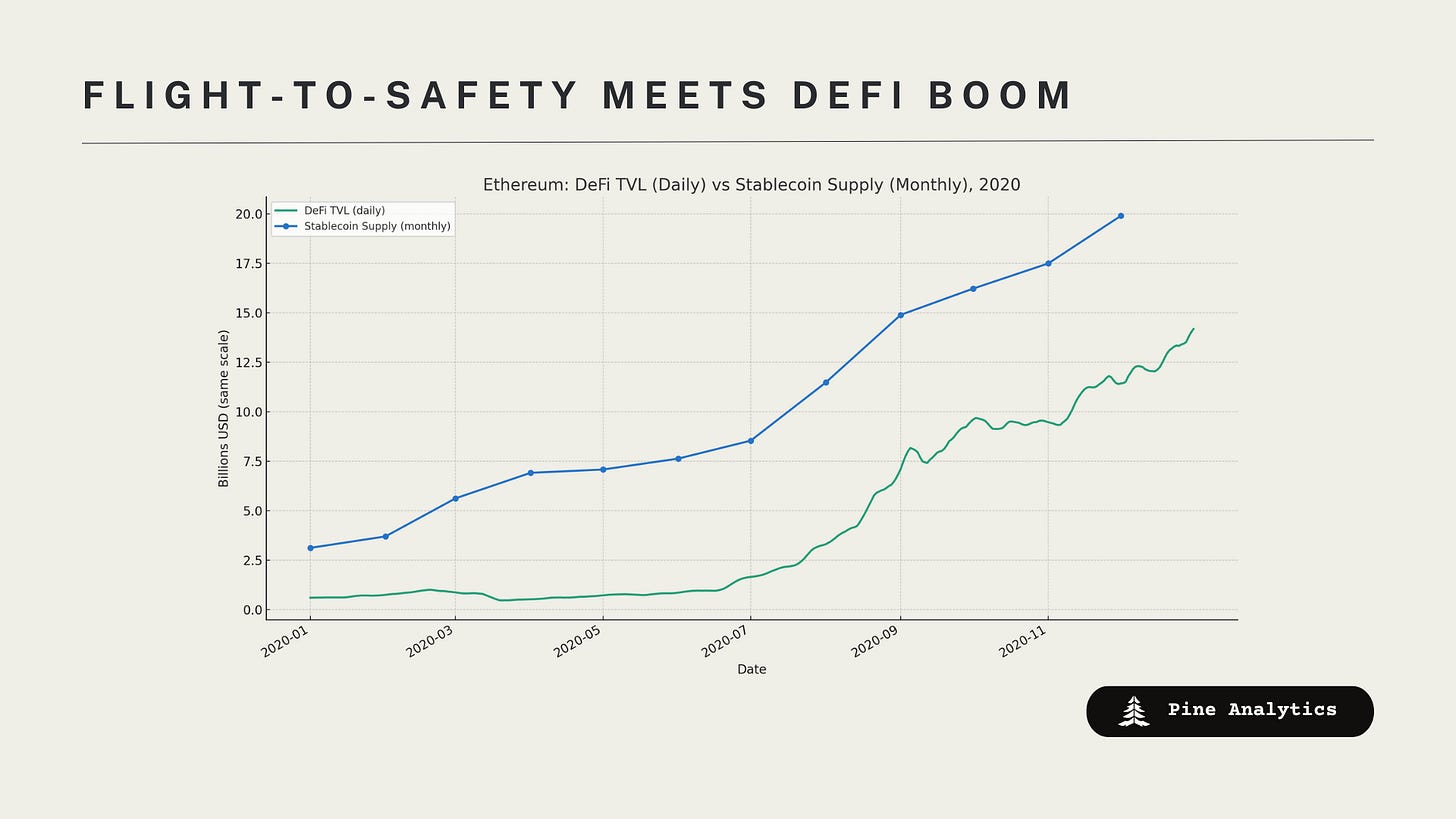

2020: Flight-to-Safety Meets DeFi Boom

Stablecoins experienced a fourfold increase in 2020, expanding from approximately $5 billion to over $20 billion. The initial surge occurred in March when COVID-19 triggered a market crash, driving investors toward dollar-pegged assets. This pushed supply beyond $10 billion by May, with Tether maintaining an 85% market share. This digital flight-to-safety generated Ethereum's highest activity levels in nearly a year, primarily driven by stablecoin transfers.

The second growth phase emerged during summer 2020 with DeFi's "yield farming" boom. Protocols including Compound, Aave, and Yearn offered attractive rewards for stablecoin liquidity, catalyzing mass minting of DAI and increased borrowing of USDC. By September, total supply exceeded $20 billion—representing approximately 300% year-to-date growth—despite elevated gas fees. This period established stablecoins as core infrastructure for centralized trading, DeFi lending, cross-exchange arbitrage, and on-chain settlement.

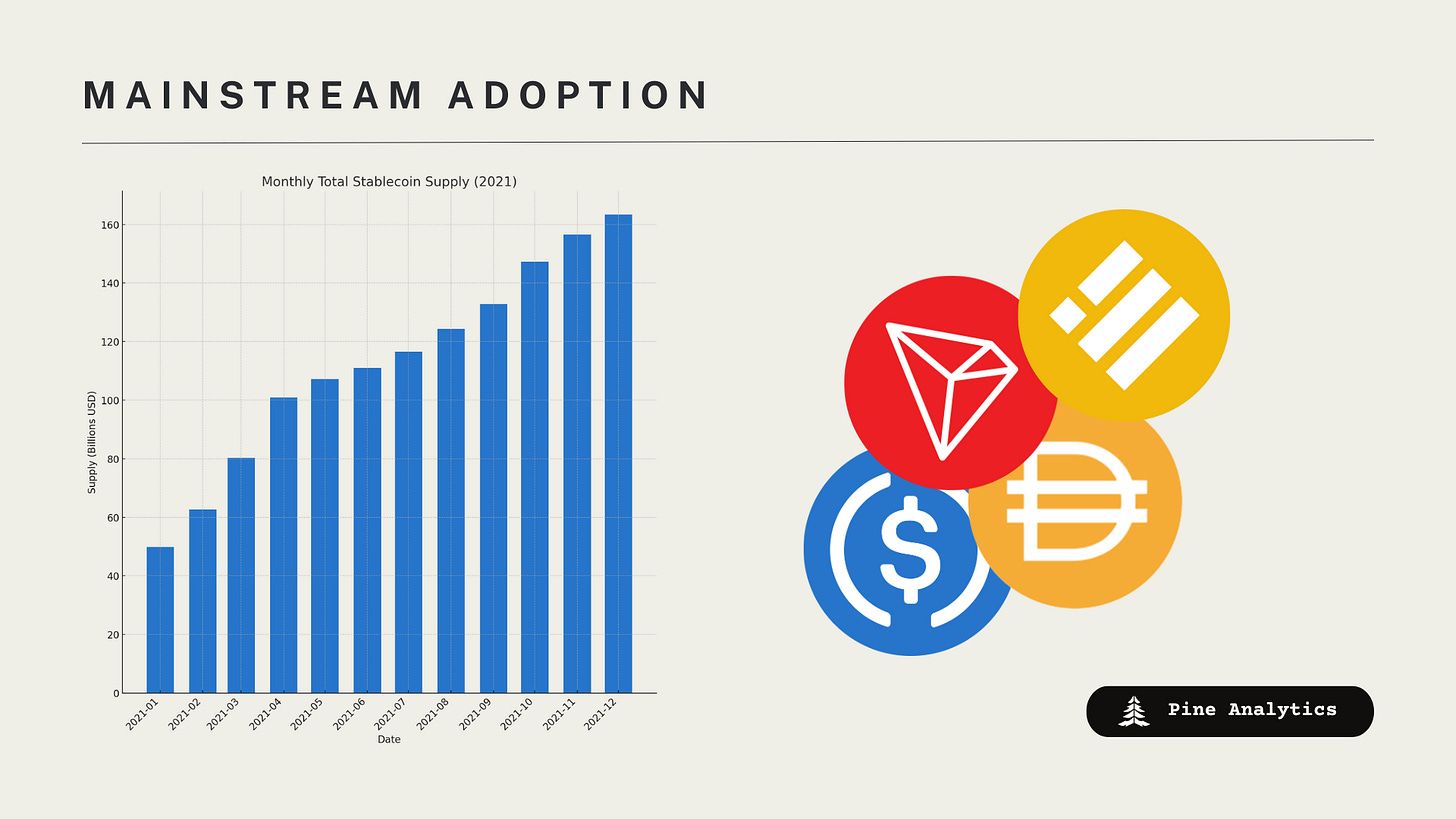

2021: Mainstream Adoption and the $100B Milestone

Stablecoins experienced explosive growth from $26 billion to $166 billion throughout 2021. The bull market and institutional participation established USDT, USDC, and other stablecoins as primary on-ramps and off-ramps for capital. By September, 75% of all exchange trades involved a stablecoin.

Within DeFi, stablecoins maintained their position as core collateral, yield-generating assets, and trading pairs, with USDC and DAI supply expanding significantly. Tether's deployment on Tron resulted in USDT's Tron supply surpassing its Ethereum supply, driven by lower transaction fees. Multi-chain expansion across BSC, Solana, and Tron broadened adoption despite Ethereum's elevated gas costs.

New major players gained prominence: BUSD ascended into the top three positions, while TerraUSD (UST) expanded from under $1 billion to several billion through Anchor's approximately 20% APY, representing the first large-scale algorithmic stablecoin to achieve top-tier status. By year-end, stablecoins had become deeply integrated across CeFi and DeFi ecosystems, from NFT pricing to institutional settlements, with companies like Visa settling transactions in USDC and Meta testing Novi wallet payments.

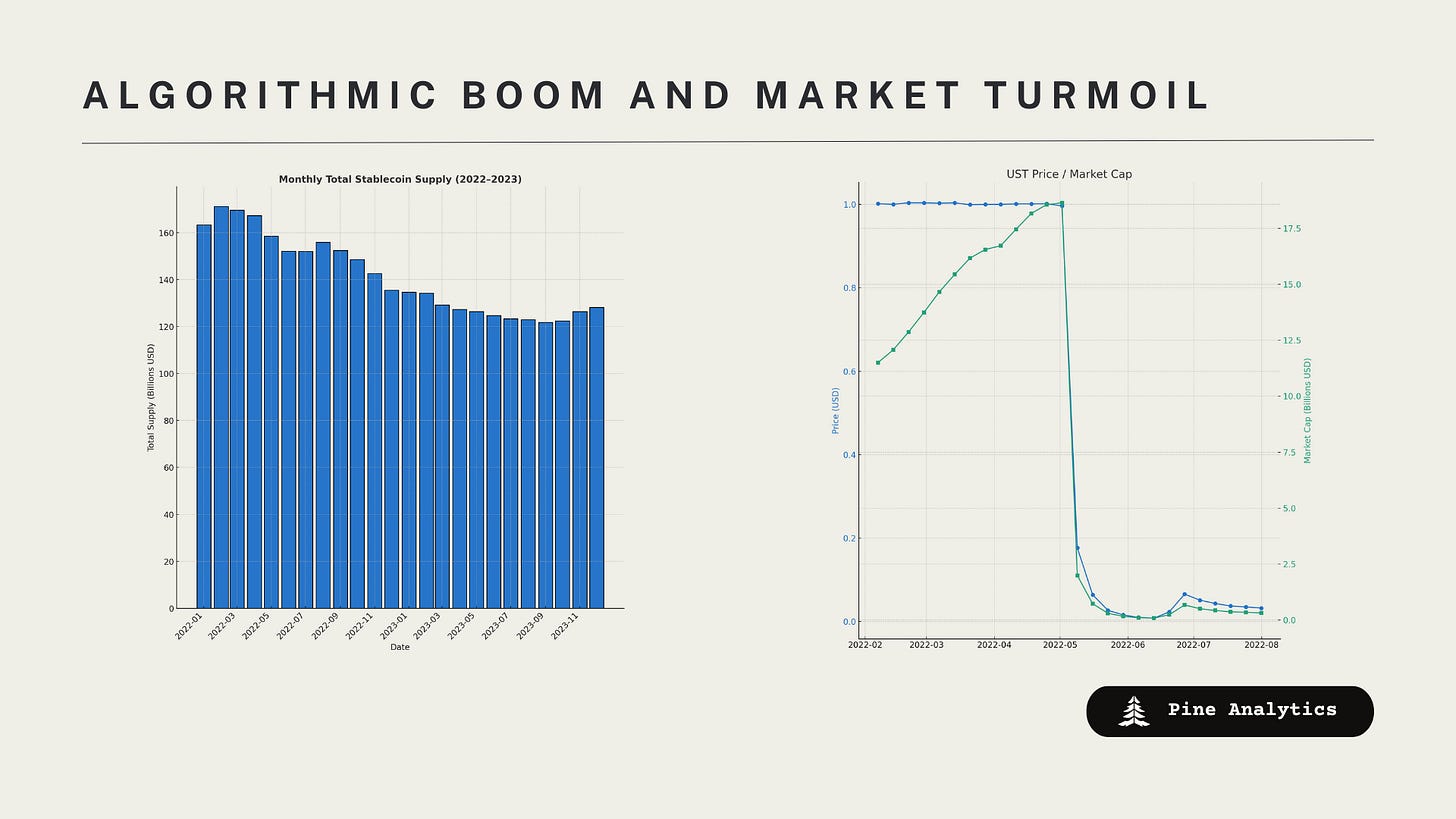

2022: Algorithmic Boom and Market Turmoil

Stablecoin supply reached its local peak at $180–190 billion in early 2022, nearly quadrupling from approximately $50 billion a year earlier. This growth was driven by the rise of TerraUSD (UST) and other algorithmic or hybrid stablecoins, combined with sustained dollar demand during the late bull market phase. UST alone expanded to $18 billion by May, primarily fueled by Anchor's high-yield incentives, seemingly validating that algorithmic stablecoins could achieve scale. Its collapse eliminated nearly the entire $18 billion within days, triggering sector-wide redemptions and reducing total stablecoin market capitalization to approximately $150 billion within weeks—marking the first major contraction in years.

The crash precipitated a flight to quality. USDC gained market share as a fully reserved option, USDT maintained its peg and reclaimed dominance, while most smaller and algorithmic stablecoins failed. By November, algorithmic stablecoins represented just $5 billion—approximately half the size of decentralized collateralized stablecoins like DAI and substantially smaller than fiat-backed alternatives.

The turmoil intensified regulatory scrutiny. U.S. lawmakers conducted hearings, global bodies developed standards, and issuers including Tether enhanced reserve transparency while reducing risky holdings following previous regulatory penalties. By year-end, broad consensus emerged that inadequately backed stablecoins posed systemic risks. Despite the upheaval, stablecoins demonstrated resilience with over $140 billion remaining in circulation. Fully reserved coins gained enhanced trust, and real-world adoption accelerated. In inflation-affected and unstable economies, USD stablecoins gained traction as stores of value and remittance tools, with Tether reporting significant growth in Latin America, Africa, and the Middle East.

2023: Consolidation, Regulation, and New Entrants

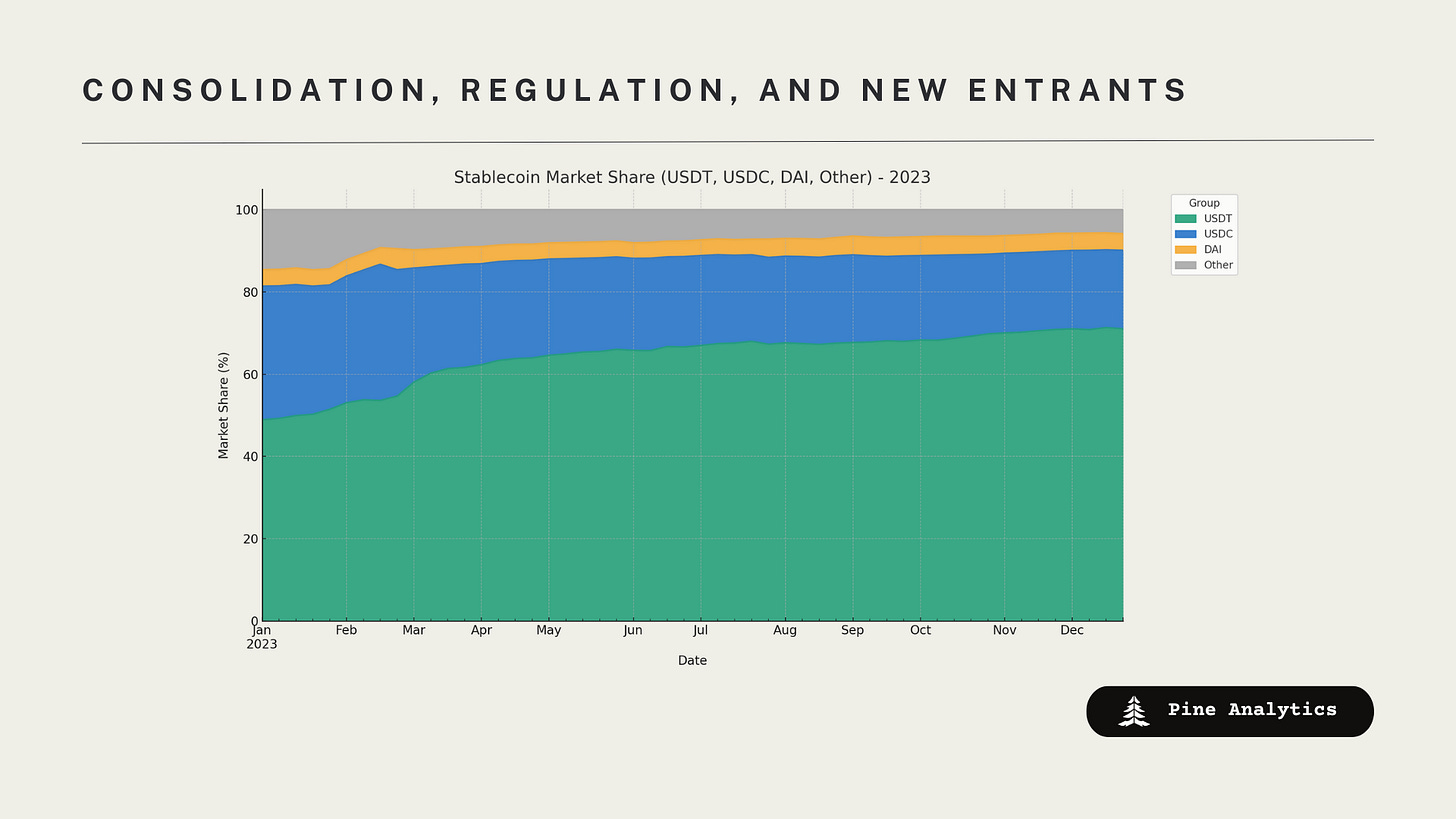

Stablecoin supply stabilized at $120–130 billion throughout 2023, with flat growth but significant market restructuring. USDT achieved new highs, reclaiming 65–70% dominance following BUSD's regulatory shutdown and USDC's brief depegging during the SVB collapse. BUSD contracted from $16 billion to several billion, USDC declined from over $40 billion to under $30 billion, and DAI maintained approximately $5 billion following Maker's increased real-world asset backing.

Regulatory progress accelerated as the U.S. debated reserve and licensing requirements, the EU's MiCA established standards for asset-backed tokens, and authorities restricted interest-bearing stablecoins. While these measures eliminated certain issuers, they established a regulated pathway potentially enabling expanded long-term adoption.

Traditional finance entered the sector: PayPal launched PYUSD, banks including Standard Chartered announced stablecoin initiatives, and Visa and Mastercard expanded settlement pilots. BlackRock and Fidelity invested in stablecoin infrastructure, establishing channels for future mass adoption.

Use cases simultaneously broadened. While speculative demand moderated, cross-border payments, remittances, and dollar savings in inflation-affected markets expanded. USDT and USDC gained adoption in Argentina, Turkey, and Nigeria, and found application in humanitarian aid. On-chain stablecoin transfers reached $27.6 trillion in 2022, surpassing Visa and Mastercard combined, demonstrating unprecedented scale. By year-end, the market had become leaner, more transparent, and institution-ready, with select trusted players positioned for the next growth phase.

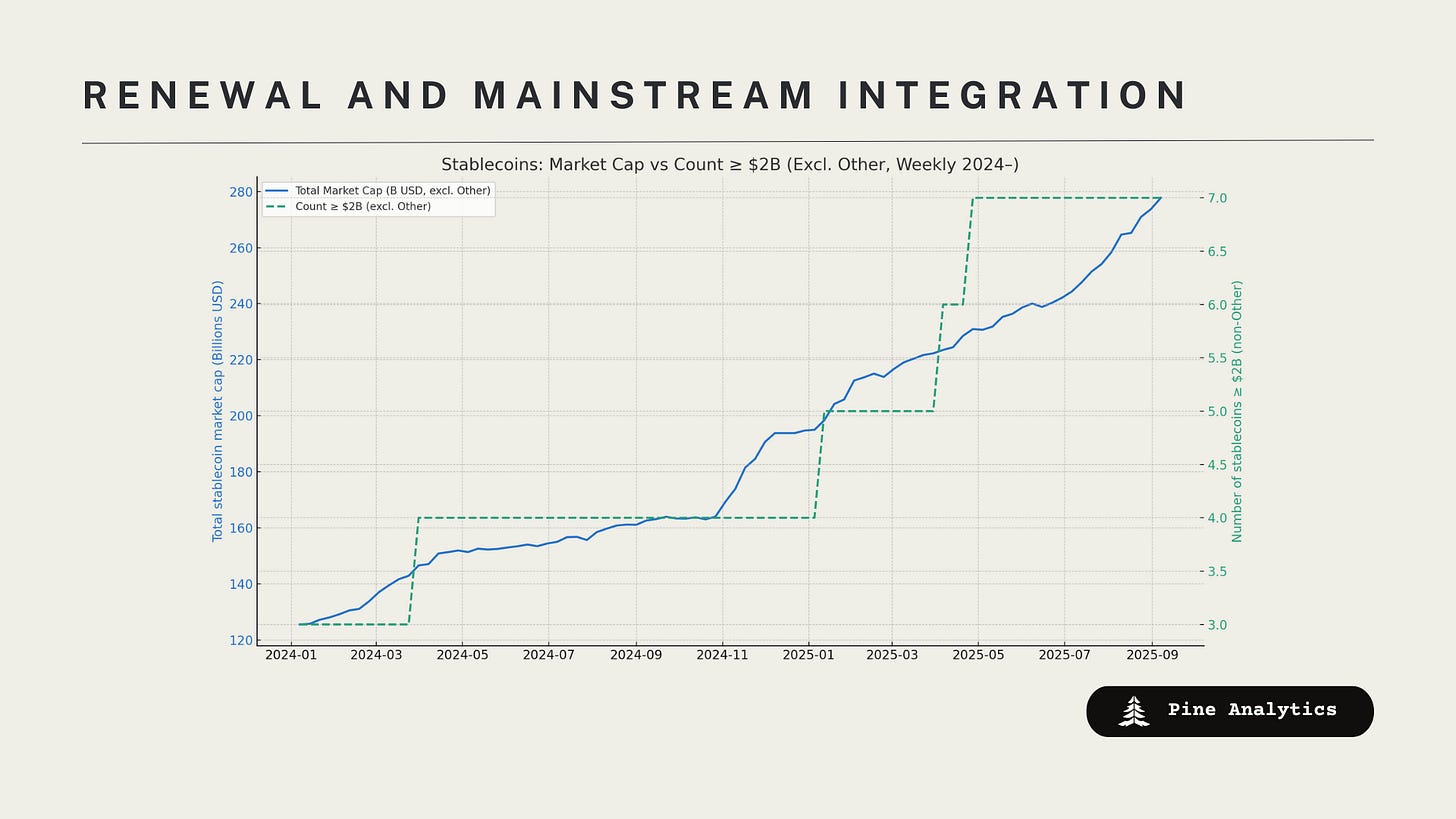

2024–Present: Renewal and Mainstream Integration

Following stagnation in 2022 and 2023, stablecoin supply recovered beyond $200 billion by mid-2025, with USDT at approximately $143 billion and USDC at approximately $58 billion. Clarified regulations are attracting banks and fintech companies. Japanese banks launched yen stablecoins in 2024, and potential U.S. legislation could authorize bank-issued dollar stablecoins. PayPal's PYUSD and planned integrations from Stripe and Visa indicate stablecoin adoption in everyday payments, settlements, and treasury operations.

Cross-border usage is accelerating, with MoneyGram and Western Union bridging stablecoins, while USDT functions as an unofficial dollar in the regions of Latin America and Africa. Reduced fees on newer blockchains enhance remittance practicality, establishing sustained demand. Within DeFi, stablecoins remain essential as collateral and liquidity. New entrants including Aave's GHO, Ethena's USDe, and Curve's crvUSD expand options, while Layer-2 scaling reduces costs. Issuers now generate profits from reserves, incentivizing supply expansion.

By 2025, the EU's MiCA framework will license issuers and limit non-euro stablecoin usage, while the U.S. considers 100% reserve requirements, liquidity standards, and audit mandates. A 2023 draft bill proposed bank-level oversight, signaling mainstream acceptance. Global bodies are establishing cross-border standards, integrating stablecoins into regulated finance. Stablecoins now anchor trading, bridge fiat and crypto systems, enable payments, and maintain pegs through volatility. USDT leads, USDC follows, and niche coins provide diversity. Advocates view regulated stablecoins as catalysts for faster, more affordable payments while reinforcing USD dominance, establishing their position as a permanent component of the digital economy.

Future of Stablecoin Adoption

Regulatory Landscape

Global stablecoin regulation is converging toward formal licensing, reserve transparency, and cross-border standards, though approaches vary by jurisdiction:

United States: In July 2025, the U.S. enacted the GENIUS Act, establishing the first comprehensive federal regulatory framework for payment stablecoins. This landmark legislation mandates 1:1 backing in U.S. dollars or other liquid, low-risk assets, requires reserve transparency, implements federal and state oversight frameworks, and restricts issuance to authorized entities including insured banks and federal or state-qualified nonbank institutions.

European Union: MiCA (Markets in Crypto-Assets) takes effect in 2025, requiring licensing, reserve audits, and transaction volume caps for non-euro stablecoins. This framework is expected to stimulate euro-denominated stablecoin growth and drive compliance-oriented market consolidation.

United Kingdom: The Financial Services and Markets Act 2023 grants the FCA authority over payment stablecoins, emphasizing operational resilience, safeguarding requirements, and fiat redemption guarantees.

Asia-Pacific:

Japan legalized stablecoin issuance in 2023 under strict bank and regulated trust company requirements. Major banks including Mizuho and Mitsubishi UFJ have launched yen stablecoins.

Singapore introduced licensing and 100% backing requirements through its Payment Services Act, attracting compliant issuers.

Hong Kong plans 2025 regulations mandating reserve segregation and daily reporting requirements.

Emerging Markets: Latin American and African nations demonstrate varied approaches, with some informally tolerating stablecoin use for remittances and dollarization, while others like Nigeria prioritize CBDC-first policies that could restrict private stablecoin adoption.

Regulation is converging toward a "regulated payment instrument" model—fully backed, redeemable, and supervised—rather than outright prohibition. This trajectory will likely benefit large, compliant issuers while marginalizing smaller or unregulated participants.

Current Adoption Trends

Stablecoins are rapidly evolving beyond their speculative trading origins to become core financial utilities. Cross-border payment adoption is expanding through firms like MoneyGram, Western Union, and Remitly bridging stablecoins to local currencies, while Circle establishes partnerships with regional banks in Latin America and Asia for USDC settlement. Retail and merchant adoption accelerates through PayPal (PYUSD), Stripe, and Visa integrations for settlements and payouts. In high-inflation and currency-unstable nations including Argentina, Venezuela, Turkey, and Nigeria, USDT has achieved widespread adoption for savings, commerce, and payroll applications. On-chain, stablecoins remain fundamental to DeFi infrastructure, serving as primary collateral in lending protocols, decentralized exchanges, and derivatives platforms. Institutional adoption continues expanding among hedge funds, fintech companies, and DAOs for liquidity management purposes.

Medium-Term Outlook (2–5 Years)

Within the medium term, stablecoin supply could reach $400–500 billion by 2027, with regulated, institutionally issued products comprising a substantially larger market share. The competitive landscape may consolidate to four to six dominant issuers: USDT, USDC, PayPal USD, a major bank-issued USD stablecoin, and one or two strong non-USD contenders such as euro or yen stablecoins. Use cases will expand into payments, remittances, B2B settlements, and on-chain finance, with cross-border SME payments emerging as a key growth catalyst. Jurisdictions offering favorable regulations, including Singapore and the UAE, are positioned to become major issuance hubs. Interoperability standards like ISO 20022 and tokenized bank rails will enable seamless cross-chain and cross-border settlement capabilities.

Long-Term Outlook (5–10+ Years)

In the long term, stablecoins could establish themselves as a foundational layer of global payments infrastructure, operating alongside and occasionally competing with central bank digital currencies (CBDCs). Banks may issue proprietary stablecoins directly on public or permissioned blockchains, eroding distinctions between deposits and tokenized money. Consumer-facing stablecoin integration into wallet applications and Big Tech platforms could achieve retail payment ubiquity comparable to current debit and credit card usage. USD stablecoins may strengthen dollar dominance globally, particularly in countries with underdeveloped banking systems. Regional variations may produce hybrid systems where CBDCs handle wholesale settlement while stablecoins dominate retail and cross-border transactions. Algorithmic and decentralized stablecoins, though remaining niche, will likely persist as alternatives for crypto-native users prioritizing censorship resistance.

Current Stablecoin Landscape

Stablecoins on Ethereum

USDC and USDT remain the dominant stablecoins on Ethereum, driving a substantial portion of the network's on-chain activity. On most days, swaps involving these stablecoins account for 40–60% of total network fees, while direct transfers (non-swaps) contribute 1–5%. Over the past five weeks, 75% of stablecoin swap fees originated from trading against ETH, WETH, WBTC, and UNI, underscoring their role in centralized liquidity pairs. Daily non-swap transfer volumes range from $10 billion to $50 billion, with transaction fees averaging $0.50–$2.00 (median $0.25–$1.00), making Ethereum cost-effective for large payments but expensive for smaller, high-frequency transactions. The median non-swap transfer size falls between $200 and $600, where fees represent approximately 0.5% of value—affordable for occasional use but prohibitive for retail-grade, low-value payments.

USDT exhibits heavy centralized exchange concentration: 53.5% of supply resides on exchanges, with Binance alone holding nearly one-third. Only 4.8% is deployed in DeFi, underscoring USDT's primary role in exchange liquidity, OTC flows, and arbitrage. An additional 34.6% sits in large self-custodied wallets, likely representing funds, market makers, and high-net-worth traders.

USDC demonstrates more distributed and DeFi-integrated characteristics: 22.5% on centralized exchanges, 13.6% in protocols like MakerDAO and Aave, and 44.6% in institutional-looking self-custody heavily incentivized by Circle. Standardized holdings (such as 48 million or 25 million USDC) and Coinbase's segmented cold storage reflect structured institutional usage patterns.

Fit and Gaps: Ethereum serves high-value, liquidity-intensive stablecoin users exceptionally well. Deep DeFi markets, unmatched exchange integration, and high institutional trust establish it as the most reliable infrastructure for large-scale stablecoin settlement. Aave on Ethereum, for instance, offers the deepest and often most cost-effective stablecoin borrowing environment in DeFi, attracting leveraged traders and liquidity managers. However, the base layer's high transaction costs and slower block times reduce its competitiveness for small-scale commerce, retail payments, and high-frequency settlement. These use cases increasingly migrate to Layer-2 networks and alternative blockchains where fees are negligible and confirmation times faster, while Ethereum retains its role as the settlement backbone for large, infrequent, and high-trust stablecoin flows.

Stablecoins on Tron

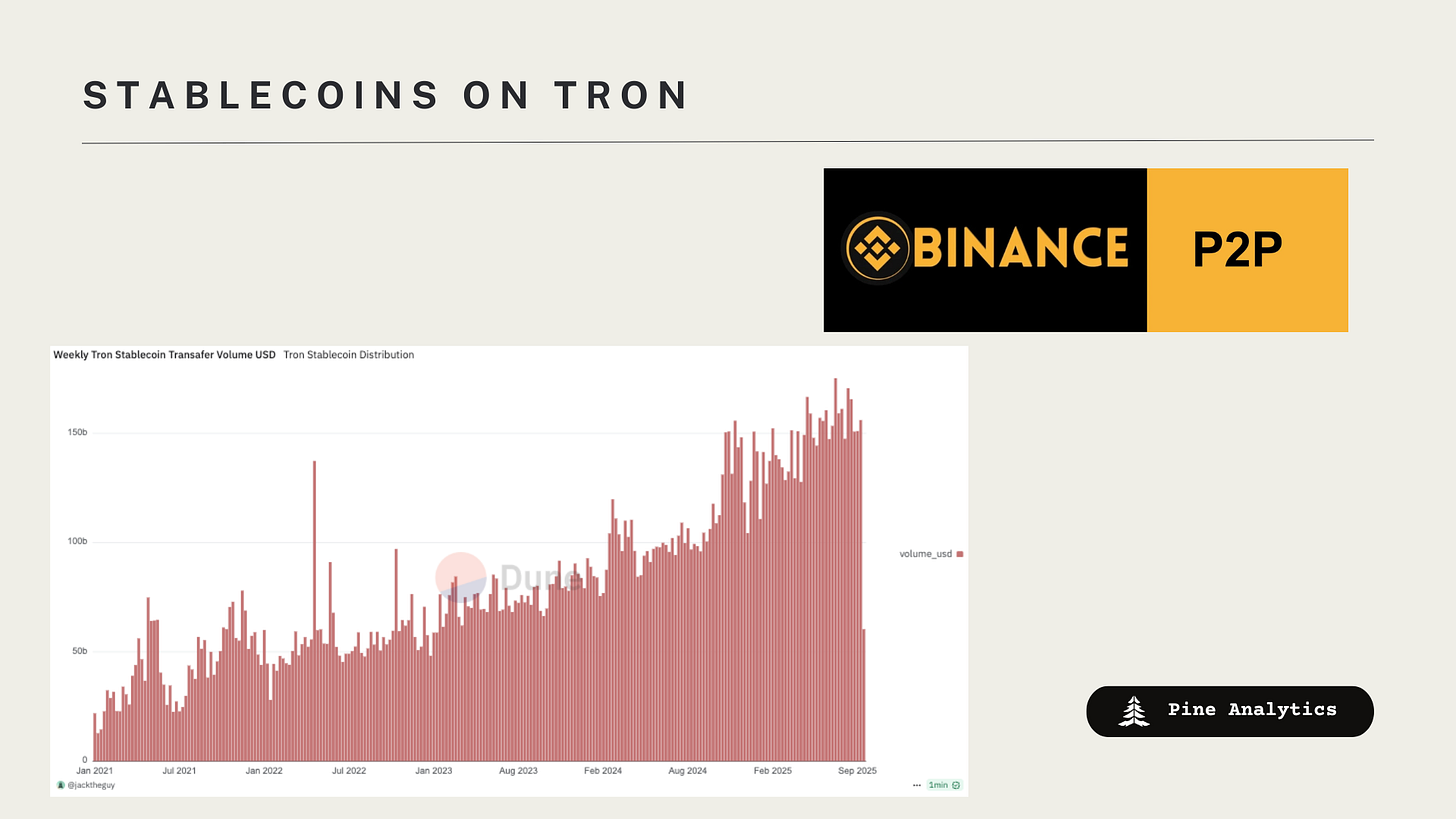

Tron has emerged as the dominant USDT settlement layer, handling 10–15 million transactions and $60–$150 billion in volume daily. Centralized exchange defaults (Binance, HTX, OKX) established TRC-20 as the standard withdrawal rail, resulting in over 50% of USDT now circulating on Tron. Most mints, redemptions, and inter-exchange transfers occur here, with strong retail usage across Latin America, Africa, and Southeast Asia.

Transactions cost 30–70k Energy ($0.10–$2.00), generally below Ethereum L1, positioning Tron as the primary rail for sub-$1,000 stablecoin payments when Ethereum fees were elevated. Over 75% of global micro-stablecoin payments clear on Tron. Yet on-chain finance remains minimal: DeFi revenue totals approximately $12 million annually, and SunSwap volume reaches approximately $3 billion monthly.

Retail volume is driven by centralized rails rather than Tron-native dApps. This includes Binance Pay/P2P and OKX Pay/P2P for small-ticket transfers; Telegram Wallet for in-app micro-payments; regional cash-in/out applications (Coins.ph, Yellow Card); merchant processors (NOWPayments, CryptoProcessing) and gift-card hubs (Bitrefill, CryptoRefills) for mainstream checkout; and tap-to-pay/PoS integrations (such as Oobit and AEON-style networks). In summary, centralized exchange rails, P2P platforms, gateways, and gift cards—not DeFi—carry most of Tron's retail settlement.

Fits and Gaps: Tron benefits from massive distribution in Latin America, Africa, and Southeast Asia, where wallets like TronLink and rails including Binance Pay/P2P and OKX Pay/P2P facilitate millions of daily USDT transfers. With over half of global USDT circulating on Tron, it has become the default settlement layer for micro-payments and inter-exchange movements. However, despite low absolute fees ($0.10–$1.50), they remain increasingly uncompetitive versus most next-generation L1s and Ethereum L2s (often sub-cent to few-cent), eroding Tron's advantage for very small or high-frequency retail payments. Additionally, its on-chain finance remains underdeveloped, with limited DeFi revenue and relatively shallow activity on platforms like SunSwap compared to other chains' deeper, institution-grade liquidity.

Stablecoins on Solana

Solana has established itself as a high-throughput, low-fee stablecoin settlement layer, processing $200 million to $1 billion in daily swap volume on USDC/USDT pairs and $2–$10 billion in non-swap transfers. With median fees around $0.001 and even the 95th percentile under $0.015, Solana enables both high-frequency trading flows and cost-efficient retail payments at scale.

USDC dominates Solana's DeFi ecosystem. Among the top 250 holders, approximately 25% sits on exchanges (over half on Binance), approximately 10% in DeFi protocols (led by Jupiter and Meteora), and approximately 8% in Circle/infrastructure accounts, with the majority (approximately 55%) in unknown institutional/private wallets. USDT distribution similarly skews toward private holdings (48%) and exchanges (31%, with 71% of exchange holdings on Binance), but maintains a much smaller DeFi footprint (3.6% versus USDC's 9.8%).

Stablecoins on Solana are increasingly spendable via mainstream and crypto-native rails. Solana Pay enables direct USDC merchant payments with near-zero fees, Stripe's Pay with Crypto now supports USDC on Solana for fiat settlement, and multiple debit card products (Squads' Fuse, Sanctum's Cloud Card, Solflare's Mastercard) link USDC balances to Visa/Mastercard networks. This combination of deep DeFi liquidity and consumer payment integrations positions Solana uniquely as both a trading hub and a retail payments layer.

Fits and Gaps: Solana excels at bridging institutional-grade liquidity with sub-cent retail payments, supporting everything from high-volume DeFi swaps to day-to-day merchant transactions. Its scale, speed, and cost-efficiency make it attractive for both high-value settlement and low-value retail. Unlike Tron, Solana pairs its payments infrastructure with a deep on-chain finance stack, with USDC embedded across lending, liquidity pools, and trading venues. However, while Solana is integrated with card rails via partners (such as Visa's USDC settlement), it remains less embedded in everyday P2P channels—Binance/OKX Pay, Telegram Wallet, regional cash-in/out and remittance applications, merchant processors/gift-card hubs, and tap-to-pay/PoS applications like Oobit—resulting in small-ticket spending often defaulting to TRC-20.

Stablecoins on Base

Base has rapidly become a high-volume USDC settlement layer, with most days recording $500 million to $1 billion in swap volume and $20–$60 billion in non-swap transfers. Activity spans 300,000–600,000 daily transactions, with median non-swap transfers of $10–$80 and fees of $0.00001–$0.00006—sufficiently low to enable micro-payments and high-frequency settlement. USDC dominates the network with $3.8 billion in supply.

Among the top 250 USDC holders, approximately 52% reside in "mega wallets" containing exactly 101 million USDC each—likely standardized institutional or protocol reserves. DeFi protocols account for 7.4% of top-holder supply, led by Morpho and Aave. EOA/unknown wallets hold approximately 37%, exchanges just 2.5%, and DEX/AMM contracts 0.6%, with the remainder in bridges and derivatives protocols. This distribution indicates Base's USDC liquidity is concentrated in large institutional accounts and lending markets rather than exchange treasuries or AMM pools.

Fit and Gaps: Base combines low fees with deep USDC liquidity, making it suitable for both institutional-scale transfers and smaller retail payments. Its integration into Coinbase/Circle infrastructure and active lending markets provide strong DeFi utility. However, much of the chain's current usage still relies on deep integration with the Coinbase exchange alongside other crypto-native flows. Broader consumer payment adoption (such as Shopify integration) remains an emerging rather than established use case.

Stablecoins on BSC

BSC ranks among the largest stablecoin settlement layers by transaction count and total value moved, handling both exchange-driven flows and retail-scale transfers. On most days, swaps involving stablecoins generate $4–$10 billion in volume across 2.5–5 million swap events, while non-swap transfers add another $2–$6 billion from 1.5–3 million transactions. The median non-swap transfer is $10–$80, and average gas costs of $0.015–$0.03 make small payments and high-frequency trading viable. The dominant asset is BSC-USD with $6.7 billion on-chain supply, functioning as the base settlement asset for most activity.

BSC-USD Distribution: Top-250 BUSDT holdings demonstrate concentration, with 58.7% in unknown or externally owned wallets (many in precise denominations of 25–100 million, consistent with institutional treasuries or coordinated holdings). Exchanges hold 21.6%—Binance alone accounts for 12.6% (855 million), followed by Gate.io (142 million) and smaller venues. DeFi protocols contain 6.7% (led by Venus at 78 million), bridges and infrastructure 0.8% (mostly the opBNB bridge at 55 million), and institutional-pattern round-number holdings comprise 11.8%. Derivatives/trading platforms hold just 0.4%.

USDC Distribution: USDC's supply (~$1 Billion) is smaller but more concentrated on exchanges, with 31.0% in exchange wallets (87% of which is Binance at 270 million). Unknown/EOA holdings comprise 40.5%, DeFi protocols 9.5% (Stargate at 43.8 million, Venus at 24.5 million), and bridges/infrastructure 1.7%. Institutional-pattern holdings account for 17.0%, while derivatives platforms represent only 0.3%.

Fit and Gaps: BSC's stablecoin activity reflects a blend of high retail throughput and significant institutional presence. BSC-USD dominates liquidity for trading pairs and large transfers, with meaningful but not dominant DeFi usage. While low fees make the chain well-suited for smaller payments and active trading, a relatively modest share of total supply is deployed in on-chain finance compared to exchange custody or off-chain holding. This indicates much of the stablecoin value functions as liquidity in transit rather than in long-term productive use.

Plasma's Go-to-Market Strategy

Core Value Proposition: Zero-Fee Stablecoins | $2B+ Day-1 Stablecoin TVL | P2P Wallet Integration

Plasma's competitive advantage rests on three pillars: zero-fee base-layer stablecoin transfers that eliminate last-mile costs and enable sub-$10, high-frequency payments; $2.5 billion+ day-one TVL anchored by Binance Earn, Aave, Fluid, and EtherFi, delivering deep USDT liquidity with structurally low USDT borrow rates for traders, market makers, and treasuries; and payments distribution through P2P wallet integration and partnerships with Yellow Card and Binance, routing remittances and everyday spending directly through Plasma without gas tuning or batching—ensuring the same zero-fee rails serve both micro-payments and institutional settlement.

Competitive Landscape: Where Plasma Can Disrupt and Where It Cannot

Networks Most Ripe for Disruption

Tron

Market Gap: Tron dominates global low-value USDT transfers but imposes material transaction fees, offers minimal DeFi depth, and provides limited on-chain financial tooling.

Plasma's Competitive Edge: Plasma's transaction cost profile dramatically undercuts Tron with genuinely free transfers, paired with robust DeFi partnerships and merchant/payment integrations. This combination can capture fee-sensitive retail P2P, remittance, and micro-merchant flows—particularly in regions where DeFi access is simultaneously in demand.

BSC

Market Gap: With $0.015–$0.03 average fees already negligible for most $10+ transfers, Plasma's zero-cost model offers limited appeal on price alone. However, the chain's governance centralization and BNB-USD stablecoin dominance deter builders seeking neutral infrastructure.

Plasma's Competitive Edge: Plasma positions itself as a neutral alternative that treats USDT liquidity as first-class without promoting BNB-USD as the primary stablecoin. Zero-cost transfers provide incremental advantages for high-churn activity, sub-$10 transactions, and micro-payments where even 1–3 cent fees accumulate. Plasma can target BSC-native protocols seeking diversification from Binance-centric usage, and builders discouraged by ecosystem lock-in, offering them a low-friction venue to expand USD-stable liquidity and activate idle balances through DeFi, payments, and cross-border settlement.

Base

Market Gap: Base operates with near-zero fees averaging $0.00001–$0.00006, which are negligible for virtually all transaction sizes. Consequently, Plasma's free stablecoin transfers offer no meaningful cost advantage for most existing use cases. Base's Coinbase integration provides deep liquidity, robust on/off-ramp infrastructure, and instant access to Coinbase's user base. However, this connection represents a double-edged sword: while the chain benefits from the exchange's reach, it inherits a centralized sequencer. Base cannot be considered credibly neutral, and applications not directly benefiting from Coinbase's ecosystem may perceive strategic or reputational drawbacks to sole reliance on it—particularly those serving users outside Western markets.

Plasma's Competitive Edge: Rather than competing on transaction costs, Plasma differentiates through offering a neutral environment for projects seeking to avoid dependence on a U.S.-based, centrally operated rollup. This positioning appeals to developers whose user base resides in emerging markets or whose product strategy requires neutrality in settlement and governance. By combining neutrality with strong DeFi and payments integrations, Plasma positions itself as the preferred alternative for non-Coinbase-aligned applications to build USD-stablecoin liquidity and user networks without ecosystem lock-in.

Networks Partially Ripe for Disruption

Ethereum

Market Gap: Ethereum maintains the largest network effects across DeFi liquidity, application integrations, and institutional adoption. It is widely recognized as the most credibly neutral blockchain, establishing it as the preferred settlement layer for high-value, trust-sensitive transactions. However, it imposes the highest fees among major networks, and with median stablecoin transfer sizes of $200–$600, transaction costs materially reduce value for many transfers. A substantial portion of these transactions remain on Ethereum specifically to interact with applications, integrations, or liquidity pools exclusive to the network. However, stablecoin transfers occurring without direct reliance on Ethereum-native products, features, or liquidity are highly vulnerable to displacement.

Plasma's Competitive Edge: While Plasma is unlikely to replace Ethereum for core high-value, DeFi-centric settlement flows in the near term, it can aggressively target stablecoin transfers existing on Ethereum purely through inertia. By offering zero-cost transfers, Plasma can intercept these non-application-dependent payments—particularly mid-value transactions where current gas costs are proportionally significant. Effectively, Ethereum maintains its position as the hub for high-trust execution, while Plasma captures stablecoin transfers where Ethereum applications are not the primary driver.

Networks Least Ripe for Disruption

Solana

Market Gap: Solana offers sub-cent transaction fees for median stablecoin transfers (approximately $0.001) and around $0.015 for more expensive swaps, making costs negligible for nearly all stablecoin use cases. The network is credibly neutral, maintains deep DeFi liquidity, and supports a comprehensive range of stablecoin applications. Consequently, Plasma's free stablecoin transfers provide minimal material advantage in most situations. The one clear structural gap exists in asset composition: Solana's stablecoin ecosystem centers heavily around USDC, leaving USDT liquidity, pairs, and tooling relatively underdeveloped.

Plasma's Competitive Edge: While Plasma cannot compete meaningfully with Solana on fees or neutrality, it can establish a niche by building a USDT-first ecosystem. Rather than attempting to displace the bulk of Solana's stablecoin activity—increasingly tied to USDC flows across native applications, DeFi integrations, and Visa-linked payment rails—Plasma can dominate at the margins. By targeting P2P flows and informal settlement activity that might otherwise migrate to Solana through integrations, Plasma can redirect that demand into its own rails. This strategy positions Plasma less as a direct competitor to Solana's mainstream stablecoin economy and more as a successor to the grassroots flows currently concentrated on Tron.

Marginal Stablecoin Growth Segments Plasma Can Capture

With stablecoin supply projected to reach $400–$500 billion by 2027, Plasma's design aligns with the most cost-sensitive areas of future growth:

Retail & P2P Payments in Emerging Markets

Competitive Edge: Zero-Fee Stablecoins + P2P Wallet Integration

Grassroots stablecoin usage in emerging markets is currently dominated by Tron, but transaction fees and weak financial tooling constrain its scalability. Plasma's zero-fee transfers eliminate this cost barrier, making sub-$100, high-frequency payments viable at scale. Through direct embedding into P2P wallets, remittance providers, and local processors, Plasma can establish itself as the default rail for everyday spending and informal settlement in regions where fee sensitivity is paramount.

Non-US B2B Settlement

Competitive Edge: Zero-Fee Stablecoins + $2B+ Day-1 Stablecoin TVL

Cross-border corporations and regional fintech companies outside the U.S. require a neutral settlement layer disconnected from U.S. on/off-ramp infrastructure (Base/Coinbase, USDC dominance). Plasma's zero-fee stablecoin transfers eliminate recurring settlement costs entirely, while $2 billion+ in day-one stablecoin TVL anchored by Binance Earn, Aave, Fluid, and EtherFi ensures deep USDT liquidity and structurally low borrow rates. This combination makes Plasma attractive for trade finance, payroll, and recurring cross-border B2B flows where both cost efficiency and liquidity depth are critical.

DeFi Liquidity (Contingent on Momentum)

Competitive Edge: $2B+ Day-1 Stablecoin TVL + P2P Wallet Integration

While Ethereum and Solana remain DeFi's liquidity hubs, USDT often plays second fiddle to USDC. Plasma can differentiate by establishing deep, USDT-first liquidity from day one and extending it beyond trading into payments. If early inflows sustain, Plasma becomes the natural venue for USDT-denominated lending, borrowing, and arbitrage, while P2P wallet integration connects that liquidity to retail payments. This dual positioning enables Plasma to serve traders and treasuries on one side, and end-users and merchants on the other, with zero-fee stablecoins as the connective tissue.

Strategic Summary

Plasma's competitive wedge combines zero-fee stablecoin transfers, $2 billion+ day-one stablecoin TVL, and P2P wallet distribution, enabling it to target the most cost-sensitive segments of stablecoin growth. Tron's fee-heavy retail P2P and remittance flows are immediately vulnerable, while BSC's centralization and BNB-USD dominance create opportunities for a neutral, USDT-first alternative. Base's negligible fees diminish cost as a differentiator, but its U.S.-centric infrastructure and centralized sequencer leave room for Plasma to capture non-U.S. B2B settlement flows demanding neutrality and recurring cost efficiency.

Ethereum and Solana remain the most resilient incumbents, though selective gaps persist. Plasma can capture mid-value "inertia transfers" on Ethereum where fees are disproportionately high, and differentiate on Solana by cultivating a USDT-focused DeFi environment that connects deep liquidity with retail payment rails. By focusing on emerging-market P2P, global B2B settlement, and USDT-denominated DeFi liquidity, Plasma positions itself to intercept marginal stablecoin supply growth in a market projected to reach $400–$500 billion by 2027.

Fee Generation on Plasma

Revenue Model Beyond Transfers

Plasma's zero-cost stablecoin transfers eliminate a small but common source of gas revenue for incumbent chains. Instead, its fee model focuses on non-transfer transactions tied to high-throughput DeFi protocols, DEX trading, and derivatives platforms. These activities consume substantially more computational and storage resources than simple transfers. By concentrating on sectors with heavy contract interaction and frequent state updates, Plasma can establish a durable fee base while preserving free transfers.

Critical Conditions for Material Fee Revenue

State contention generates the majority of blockchain fee revenue. This occurs when traders compete for priority execution during time-sensitive opportunities like arbitrage windows, liquidations, or volatile price movements. For Plasma to capture meaningful fees, two conditions are essential:

1. Large Asset Movements Creating Profitable Opportunities

Whether $1B stablecoin pool shifting 0.05% or $10M volatile asset pool swinging 5%, the key is total dollar movement creating opportunities worth competing for. When liquidations yield $10k+ or arbitrage windows offer $100k+, traders bid fees exponentially to secure execution priority.

2. Native Price Discovery on Plasma

Plasma must host primary price formation venues, not mirrors of prices set elsewhere. When Plasma's USDT pools, perpetual exchanges, or lending markets move first, every arbitrage bot and liquidator across all chains must execute on Plasma immediately, creating unavoidable fee pressure that drives revenue.

Data-Backed Fee Dynamics

Solana's fee structure demonstrates why these conditions matter. Median fees on Solana sit at approximately $0.0001 (one-tenth of a cent), with the chain processing 1,000-1,500 TPS. If all transactions paid only this low-contention rate, revenue would total roughly $129,000 per day. Instead, Solana regularly generates approximately $1.6 million daily and has peaked above $30 million, indicating that low-contention transfers account for less than 5-10% of validator revenue (excluding Jito/Paladin tips, which would reduce this share further).

For Plasma to replicate these dynamics, it must cultivate deep-liquidity, high-turnover venues, particularly volatile USD-stable pairs with meaningful market capitalizations. While this approach can eventually extend to derivatives, the most reliable near-term path to meaningful fees lies in volatile, high-liquidity spot markets that naturally generate contention.

Valuation Comparables

Current Market Benchmarks

Across leading smart contract platforms, valuations trade at hundreds or even thousands of times their annualized fee revenue. This demonstrates that investors price these networks based on total addressable market (TAM) and perceived likelihood of becoming a dominant execution layer, rather than current monetization metrics.

Current Market Capitalizations (August 2025)

Tier 1 – Breakout Ecosystems:

Ethereum: $550 billion

Solana: $103 billion

Tron: $33 billion

Tier 2 – Significant but Not Dominant:

Sui: $13 billion

Avalanche: $9.9 billion

TON: $8.6 billion

Tier 3 – Baseline Adoption:

NEAR: $3.4 billion

Aptos: $3.2 billion

Polygon: $2.4 billion

Sei: $1.9 billion

Chains in Tier 3 typically trade in the $2–4 billion range once they achieve modest adoption with active projects and ecosystem traction. Tier 2 valuations (approximately $8–13 billion) are reached when a chain demonstrates credible breakout potential, featuring stronger developer adoption and diverse on-chain activity, but before achieving full self-sustaining dominance. Tier 1 valuations ($30 billion+) require high economic throughput, entrenched liquidity, and a credible long-term path to platform dominance.

Implications for Plasma

Plasma's base case valuation sits in the $2–4 billion range, assuming its initial DeFi protocols and integrations achieve modest adoption. This positioning alone would exceed the trajectory most new L1s face, as Plasma launches with day-one stablecoin deposits higher than Avalanche's current supply and has already secured strong P2P integrations to generate recurring flows.

The upside case presents more compelling prospects: a Tier 2 valuation ($8–12 billion) becomes realistic if adoption compounds, since Plasma won't need to incubate breakout applications from zero as most new chains must. With a substantial TVL base at launch and credible P2P distribution, the chain requires only that its early protocols and integrations gain traction—not an entirely new killer application—to justify movement into that valuation band. However, the probability of Plasma becoming a breakout L1 cannot be determined at this stage and will depend heavily on ecosystem growth and team execution in the years following launch.

Multiple Compression Risk

While current L1 fee multiples are inflated by growth expectations, they are unlikely to remain at these levels indefinitely. As more L1s launch, the credibility of any single chain's dominance without sustainable fee generation will erode. In the short term, Plasma could optimistically trade at valuations comparable to Avalanche or TON. However, long-term maintenance or expansion of that valuation will require sustained, high-value fee capture—the type of economics demonstrated by Solana, Tron, or Ethereum. Achieving this will also depend on cultivating a thriving developer ecosystem capable of continually building new applications, deepening liquidity, and driving recurring demand for blockspace, ensuring Plasma's economics mature beyond its initial wedge.

Final Thoughts

Stablecoins have evolved from niche trading tools into a permanent layer of global finance, anchoring exchange liquidity, DeFi collateral, cross-border remittances, and everyday payments. Their evolution has reshaped blockchain competition, with each leading chain establishing distinct user bases and geographic strongholds. Regulation now reinforces this trajectory, ensuring that stablecoins remain central to both crypto-native systems and mainstream financial infrastructure. With global supply projected to reach $400–500 billion by 2027, stablecoin growth will increasingly be tied not only to speculative demand but also to regulated payments, institutional adoption, and real-world settlement.

Plasma enters this environment with a clear competitive wedge: zero-fee stablecoin transfers, $2 billion+ day-one stablecoin TVL, and direct P2P wallet integrations. These advantages enable credible competition for the most cost-sensitive flows—emerging-market retail payments, non-U.S. B2B settlement, and USDT-denominated DeFi—without relying on incubating new killer applications from scratch. Its ability to achieve a Tier 2 valuation band depends on whether early integrations and liquidity base can sustain adoption, while longer-term success requires building a thriving developer ecosystem to deepen liquidity, diversify applications, and generate recurring fee revenue.

In a market where credibility, neutrality, and execution matter as much as cost, Plasma's long-term position will depend on proving its competitive advantages translate into sustainable network effects. Zero-fee transfers must evolve from a user acquisition tool to permanent cost advantage that locks in payment flows. The $2 billion+ day-one stablecoin TVL must compound into deeper liquidity that makes Plasma the default venue for USDT use. Direct P2P wallet integrations must expand from initial partnerships into ubiquitous distribution across emerging markets. Success requires demonstrating that these launch advantages form the foundation of an ecosystem where stablecoins generate both user value through free transfers and network value through state contention, creating the enduring economics necessary to justify and sustain a major L1 valuation.

Sources

Stablecoin Evolution

2014–2016: Origins of Stablecoins

What is BitUSD: The First Stablecoin Ever Created - The Ledger by Spark

Tether (USDT) Turns 8: A History of FUD, Regulation and Growth - TradingView/BeInCrypto

2017–2019: First Major Surge

Tether Supply Metrics and Circulation Charts Over the Years - BTCPeers

Tether (cryptocurrency) - Wikipedia

Tether's Price Has Stabilized, But the Stablecoin's Supply Is Still Shrinking - CoinDesk, October 2018

2020: Flight-to-Safety Meets DeFi Boom

ECB Financial Stability Review: Stablecoins' Role - European Central Bank, 2021

Ethereum Equals Bitcoin on Daily Value Transfers - DailyCoin

Federal Reserve: The Stable in Stablecoins - Federal Reserve International Finance Discussion Paper

2021: Mainstream Adoption and the $100B Milestone

Stablecoin Market Capitalization Data - DefiLlama

ECB Financial Stability Review: Stablecoin Growth - European Central Bank

2022: Algorithmic Boom and Market Turmoil

The Stable in Stablecoins - Federal Reserve FEDS Notes, December 2022

Stablecoins: Cryptocurrency on Rise in Financial Systems - World Economic Forum, 2025

An Overview of the Stablecoin Sector - CoinMarketCap Academy

2023–Present: Consolidation and Mainstream Integration

World Economic Forum and CoinMarketCap sources (as above)

Federal Reserve and ECB reports (as above)

Regulatory Landscape

United States

Trump Signs Stablecoin Law as Crypto Industry Aims for Mainstream Adoption - Reuters, July 2025

The GENIUS Act Impact on Stablecoins - Investopedia

Myths vs Facts: GENIUS Act - U.S. Senate Banking Committee

Update: 2025 US Stablecoin Legislation - Womble Bond Dickinson

Europe

MiCA Regulation Explained - Legal Nodes

United Kingdom

The Future Financial Services Regulatory Regime for Cryptoassets in the UK - Norton Rose Fulbright

Current Stablecoin Landscape

Ethereum

Ethereum Stablecoin Analytics - Dune Analytics

Tron

USDT on Tron Dashboard - Dune Analytics/Steakhouse

Stablecoin Blockchains Are Coming - Unchained Crypto

Solana

Solana Compute Analytics - Dune Analytics

Solana's Stablecoin Landscape - Helius

Solana Pay - Official Solana Pay

Base

Base Network Analytics - Dune Analytics

Shopify to Enable USDC Payments on Coinbase's Base - CoinDesk, June 2025

CDP Wallets x Shopify - Coinbase Developer Platform

BNB Chain

BNB Chain Stablecoin Analytics - Dune Analytics

BNB Chain Additional Data - Dune Analytics

State of BNB Chain Q1 2025 - Messari

BNB Chain Updates - Binance Square

BNB Chain Role in Future Stablecoin Payments - Blockchain News

Fee Generation Analysis

Solana Explorer - Solscan

Artemis Analytics - Artemis

Market Data

CoinMarketCap - Current Market Capitalizations