State of Blur

Introduction

Welcome to the Blur Marketplace report, this report provides an in-depth analysis of Blur Marketplace, a key player in the Ethereum NFT secondary marketplace. It reviews transaction volume and notable participants and offers a factual representation of their performance to provide insights into the market's functioning.

The distribution and contribution of top NFT platform users to Blur's marketplace will also be explored. A significant part will focus on Blend, Blur Marketplace's NFT collateralized lending protocol, providing insights into its role and influence.

The report will further assess the distribution of the Blur token, projecting potential evolution in its supply over time. The ultimate aim is to offer an unbiased understanding of Blur Marketplace's operations, beneficial for stakeholders, interested individuals, and observers of the Ethereum NFT secondary marketplace.

What is Blur?

Blur is an NFT marketplace launched by Blur.io in October 2022, designed for professional NFT traders. It offers unique features like instant liquidity, batch and floor-sweeping transactions, and order book NFT transactions. Blur led the industry by eliminating trading fees, influencing competitors like OpenSea to do the same. It also provides traders the flexibility to set customizable royalties.

The Blur team includes pseudonymous members such as the founder Pacman, an MIT graduate and Peter Thiel Fellow, and Zeneca, the Blur Foundation Director. With an initial funding of $14 million, Blur quickly rose to prominence, even surpassing OpenSea in trading volume.

The BLUR token, an integral part of the ecosystem, allows holders to govern the marketplace and profit from community ownership. Blur plans to distribute the 3 billion minted tokens over 4-5 years. To encourage user engagement, Blur offers rewards, including airdrops for users who trade within certain timeframes.

NFT Secondary Markets

Ethereum currently dominates the high-value NFT market, accounting for over 66% of the secondary NFT sales volume in the past month, as shown in the first graph. Weekly transactions, currently around $100 million, have however decreased from a peak of over $300 million since March 1st. This dip, a yearly low, might suggest a cooling in the Ethereum NFT market due to broader market trends or specific factors within the Ethereum ecosystem.

Meanwhile, Bitcoin, although not capturing a substantial share of high-value NFT transactions, has shown notable growth, accounting for 14% of all NFT sales in the past 30 days. This upturn indicates an increasing interest in alternative platforms like Bitcoin, especially for ordinal and inscription-based NFTs, potentially driven by new technology and a large amount of liquidity on the chain.

While other blockchains, such as Matic, Solana, Immutable X, and Binance Smart Chain (BNB), may not have significantly penetrated the high-value NFT transactions sector, they are experiencing traction in low-value NFT transactions. This is likely due to their lower transaction fees, making them more accessible and attractive for lower-value trades. Recognizing these dynamics is vital as it provides strategic insights for traders and investors, signaling potential trends in the evolving NFT market.

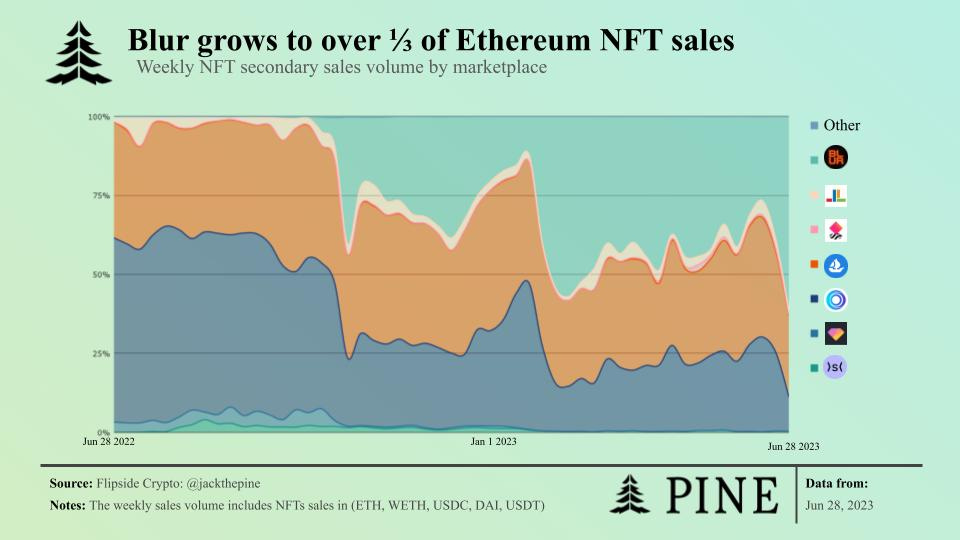

Ethereum Marketplace Markeshare

The second graphic of the report illustrates Blur's significant growth in the Ethereum NFT marketplace, capturing over 33% of sales volume in under a year and often exceeding half of all sales. This meteoric rise, facilitated in part by attractive trading rewards, coincides with a decrease in sales from established platforms like OpenSea and Rarible (X2Y2).

The market shift might signal a trend where Blur's innovative, trader-centric features, including trading rewards, are luring users away from traditional platforms. The inverse relationship between Blur's ascent and the decline of traditional platforms reinforces this trend.

Outside of OpenSea, Blur, and Rarible (X2Y2), no other platform has consistently held more than 5% of total sales volume. This showcases the intense competition in the NFT market and emphasizes the need for platforms to introduce unique and enticing features to attract and maintain a strong user base in this rapidly evolving marketplace.

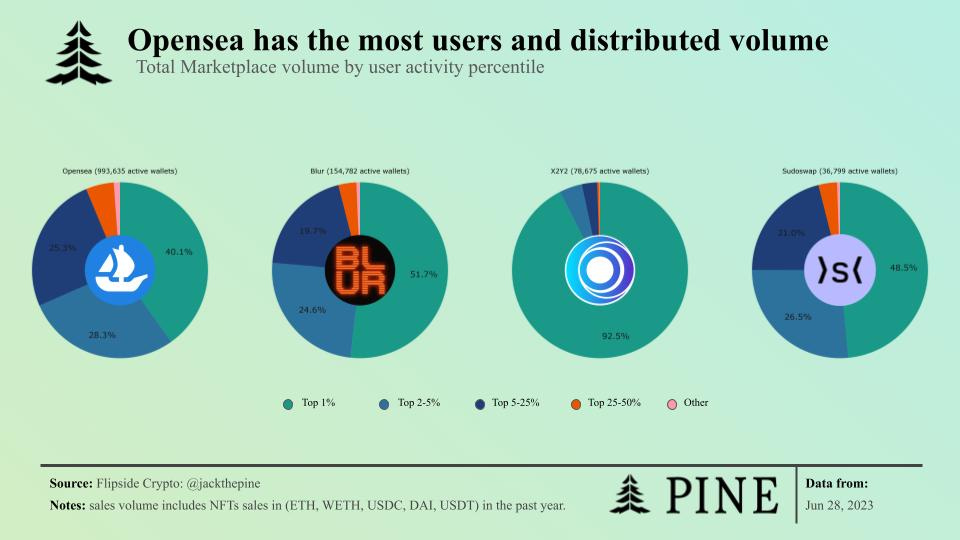

NFT Marketplace Userbase

As our third graphic illustrates, Blur, despite outpacing others in transaction volume, still trails significantly behind OpenSea in active users, demonstrating the effectiveness of its strategy to attract high volume and frequent traders. Yet, Blur has not quite captured the attention of the broader casual user base to the same extent as OpenSea.

OpenSea boasts nearly a million active wallets over the past year and displays a more even sales volume distribution, with the top 1% of users accounting for 40% of sales and the bottom 75% contributing 10%. This suggests a diverse set of traders, including a substantial number of casual users.

On the other hand, Blur, with its 154,000 active users, demonstrates a markedly different sales volume distribution. The top 1% of users contribute 51% of sales, while the bottom 75% only account for less than 5%. This implies a concentration of high-volume traders, pointing to a need for Blur to diversify its approach to appeal to casual users as effectively as OpenSea.

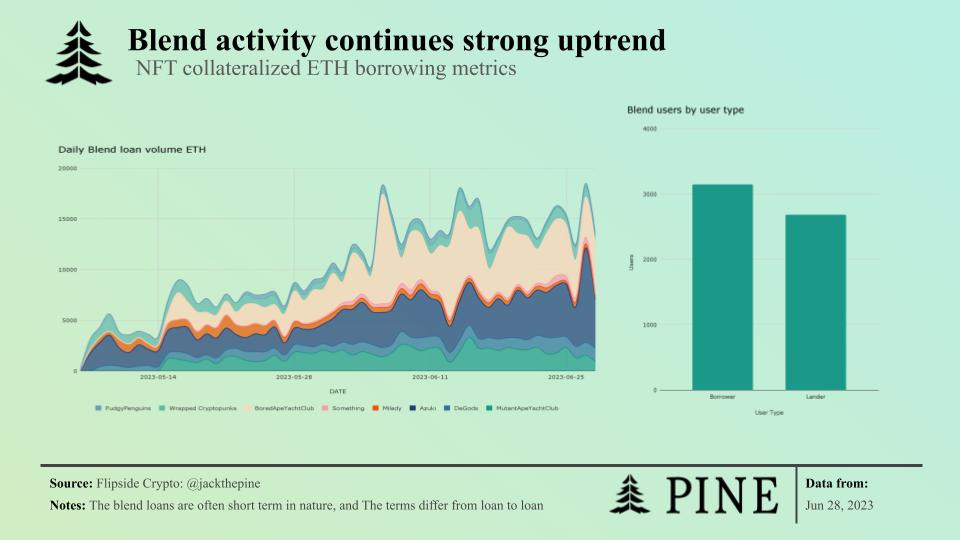

Blend Lending Activity

As demonstrated by our fourth graphic, Blend, the NFT collateralized Ethereum borrowing protocol, shows an upward trend in activity since its launch in May. This indicates its growing importance in the NFT marketplace.

From its inception, daily borrowing on Blend has tripled from approximately 5,000 ETH to over 15,000 ETH. This significant engagement signifies a rising demand for Blend's services, reflecting increased trust among NFT traders to leverage their assets, indicative of a maturing NFT market.

However, this considerable activity primarily emanates from a limited group of highly active users, with just over 3,000 borrowers and nearly 2,500 lenders. The high transaction frequency within this core user group emphasizes Blend's potential for competitive advantage. By offering a combined marketplace and NFT collateralized lending platform, Blend can engage power users more actively. Yet, to sustain and boost its growth, Blend must expand its user base, promoting engagement among new users while continuing to cater to its core group's needs.

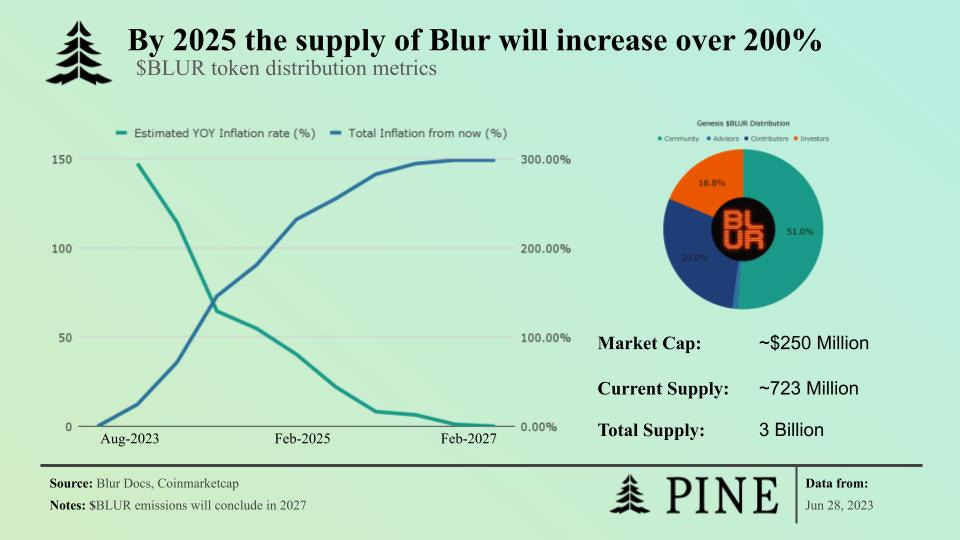

$BLUR Tokenomics

The fifth graphic offers key insights into the Blur token's tokenomics, notably the discrepancy between its current and fully diluted market cap. With a present market cap of $250 million, Blur's fully diluted market cap is expected to be around $1 billion. This divergence is due to approximately 75% of the total supply yet to be distributed, planned to occur over the next four years, nearly equally split between the community and the team or project investors.

The current inflation rate is approximately 150%, anticipated to fall to about 50% by 2025, reaching zero inflation by 2027. This declining inflation rate will likely impact the Blur token's value and the platform's overall growth.

However, it's vital to consider Blur's position within the $100 million weekly secondary NFT sales industry. Optimistically, a 1% fee would result in an annual revenue of $25 million. Therefore, given the fully diluted market cap of the governance token at $1 billion, the Price/Earnings ratio stands at 40 - assuming a 1% fee, which Blur does not currently charge. This information is crucial for understanding market dynamics in the NFT space, and stakeholders should closely monitor these developments.

Conclusion

In conclusion, our report highlights the impressive ascent of Blur Marketplace in the Ethereum NFT secondary market, fueled by its trader-centric features, unique offerings such as Blend, and the strategic distribution of the BLUR token. Despite the competitive landscape, Blur has successfully captured a substantial share of the market, particularly among high-volume traders, though its user base remains smaller than that of market pioneer OpenSea.

With the majority of Blur’s market cap yet to be distributed, the anticipated changes in the token's inflation rate may significantly influence its value and the platform's overall growth trajectory. It's also important to note Blur's standing in the $100 million per week secondary NFT sales industry, which could yield substantial revenues even with a small transaction fee.

The integration of a marketplace with an NFT collateralized lending platform in Blend sets Blur apart, fostering higher activity among power users. Yet, the platform's future growth will require appealing to a broader user base, including casual traders.

As the Blur platform evolves, stakeholders should closely watch the developments, particularly the changes in BLUR tokenomics, user dynamics, and marketplace features, as these will have lasting implications for Blur's position in the evolving NFT market and the broader NFT ecosystem.