The Bear Case for $CHIP

Introduction

USD.AI announced the launch of their governance token $CHIP and the USD.AI Foundation on January 27, 2026, marking a major milestone for the protocol. The numbers look impressive on paper: $656M in total value locked and over $5 billion in tokens traded.

The premise is compelling. USD.AI offers a yield-bearing stablecoin (sUSDai) backed not by algorithmic mechanisms or volatile crypto collateral, but by loans to AI infrastructure operators—companies that need capital to purchase GPUs, servers, and compute resources. In theory, it bridges two booming narratives: DeFi yield and the AI infrastructure arms race.

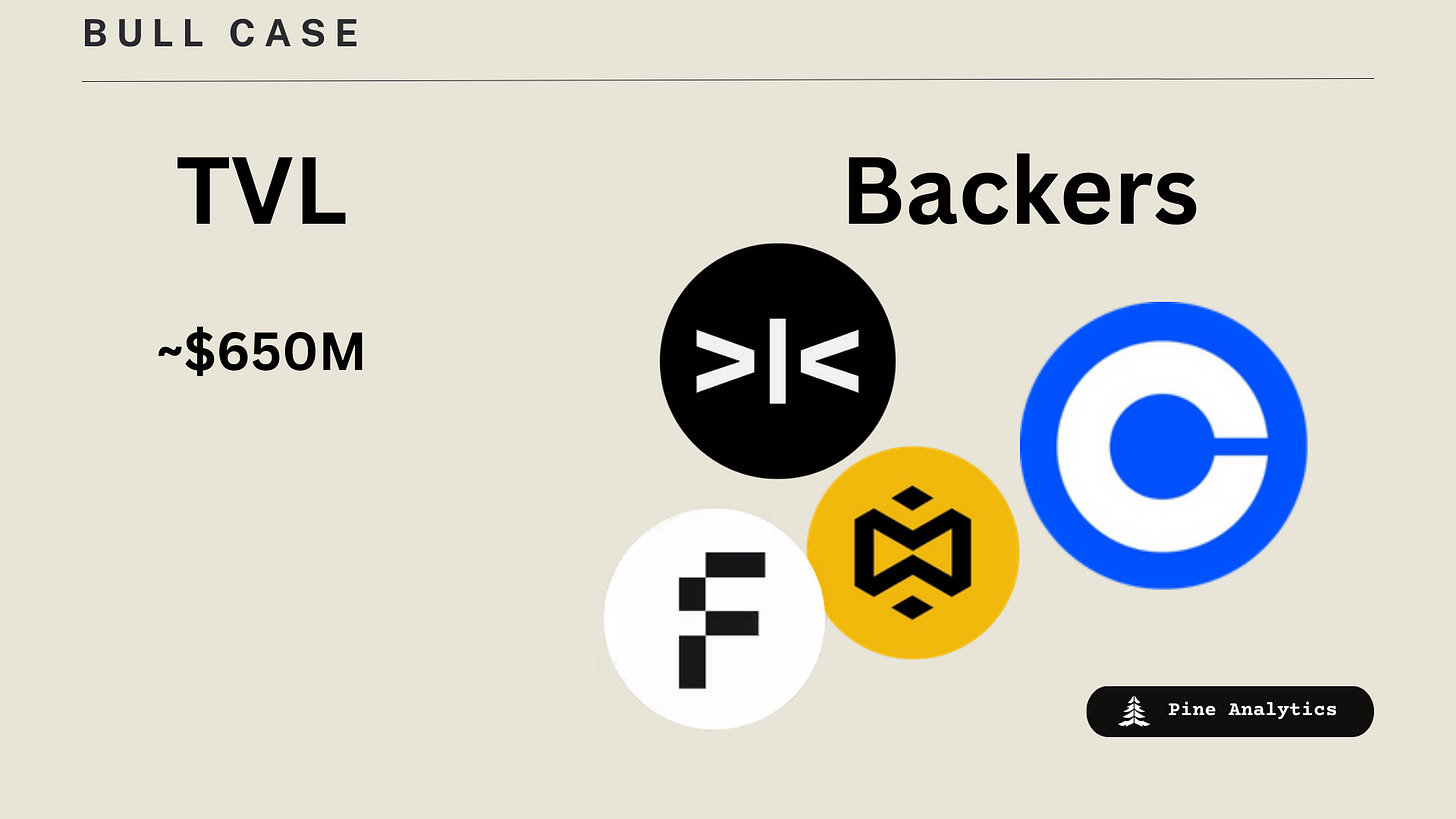

The supply side of the equation has clearly worked. Deposits have flooded in, TVL has grown rapidly, and the protocol has attracted backing from names like Framework Ventures, YZi Labs (formerly Binance Labs), and Coinbase Ventures. But supply is only half the story.

The harder question—and the one worth examining ahead of the $CHIP launch—is the demand side. Who actually wants to borrow from USD.AI? And is that market large enough to justify the hype?

How USD.AI Works

USD.AI operates a two-token system designed to separate stability from yield.

The base token, USDai, is a stablecoin pegged to $1 and fully backed by U.S. Treasuries and cash equivalents via M^0. It’s designed for liquidity and composability across DeFi—think of it as a stable, redeemable synthetic dollar with no direct yield attached.

The yield-bearing version is sUSDai. Users deposit USDai into vaults and receive sUSDai in return, earning yield from two sources: the base Treasury rate (~4-5%) plus interest from loans made to AI infrastructure operators. Current APR sits around 6.87%, with the protocol projecting ~10.98% as more capital gets deployed into actual loans.

On the lending side, USD.AI uses a system called CALIBER to tokenize physical GPUs and compute hardware as on-chain collateral. This involves legal wrappers, warehouse receipts, physical verification, and curator oversight—a deliberately slow process designed to ensure loans are properly collateralized before funds are deployed.

The target borrowers are smaller AI operators, GPU hosts, and DePIN projects—companies that need capital for hardware but lack access to traditional bank financing or venture funding. The pitch is that USD.AI fills a gap that traditional finance ignores: fast, non-dilutive debt secured against productive AI infrastructure.

Redemptions from sUSDai operate on a 7-day timelock via a queue system (QEV), which manages liquidity during any potential loan defaults or market stress.

The Bull Case

To be fair to USD.AI, the protocol has built something real. This isn’t vaporware or a fork with a fresh coat of paint.

The product exists and functions. Over $656 million in TVL, with reserves transparent and verifiable on-chain via M^0-wrapped Treasuries. In a space littered with opaque stablecoin projects that collapsed under scrutiny, that transparency matters.

The conservative approach is a feature, not a bug. By keeping deposits in Treasuries while methodically onboarding GPU loans through CALIBER tokenization, USD.AI has avoided the blow-ups that plagued more aggressive RWA projects. Zero defaults to date. The deliberate pace may frustrate yield-seekers now, but it’s building the foundation for sustainable scale.

The AI infrastructure funding gap is real—and large. Hyperscalers spend hundreds of billions on AI capex, but that capital concentrates at the top. Smaller operators struggle to access traditional financing: banks move slowly, rarely accept GPUs as collateral, and loan minimums often start at $20 million with 60-90 day timelines. USD.AI claims seven-day closings for qualified borrowers. That speed advantage alone could unlock a significant market.

The backers are credible. Framework Ventures led a $13 million Series A, with Dragonfly, Arbitrum, YZi Labs (formerly Binance Labs), Coinbase Ventures, and Bullish participating. The PayPal partnership integrates PYUSD as a settlement asset with $1 billion in liquidity incentives. This is serious institutional backing.

The pipeline is building. The Foundation announcement cites $1.5 billion in approved facilities, including $1.2 billion to QumulusAI, Sharon AI, and Quantum SKK, with the first $100 million in GPU-backed loans originating Q1 2026. Chainlink has been adopted as the official oracle provider. If even a fraction of this pipeline converts, the yield thesis starts to prove out.

The core bet makes sense. Smaller AI infrastructure operators are genuinely underserved by traditional finance. A crypto-native credit market for GPU-backed loans fills a real gap—and USD.AI is first to market with credible infrastructure to capture it.

The Bear Case

Despite genuine innovation, USD.AI faces several structural issues that challenge both the sustainability of its current traction and the valuation implied by the upcoming $CHIP launch.

1. The Utilization Gap

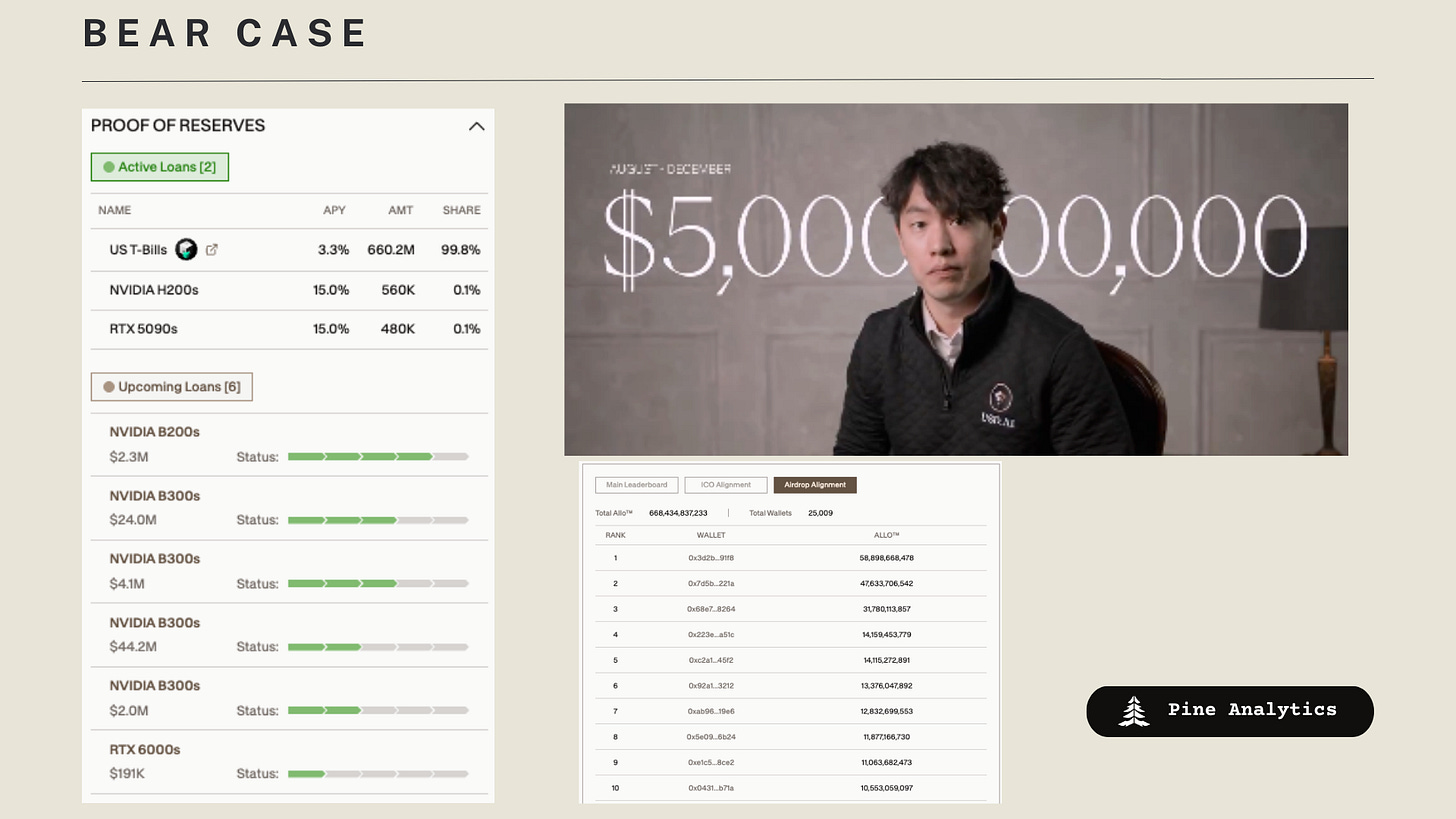

According to the protocol’s proof of reserves, there’s approximately $70 million in loans currently in the pipeline—but even if fully deployed, that would represent just ~10% utilization against $650M+ in TVL. The remaining ~99% sits in U.S. Treasuries.

In effect, users are earning Treasury yields (around 4–5%) while taking additional smart contract risk and illiquidity through 7-day redemption windows. The protocol advertises current APR near 7% and long-run targets of 10–15%, but today’s yield is overwhelmingly driven by government bonds, not AI credit.

The $70M pipeline is a start, but it raises questions: if demand were robust, why isn’t the pipeline larger given the capital available? And how quickly can it convert to funded loans?

2. Points-Driven TVL and Mercenary Capital

A large share of TVL growth appears driven by Allo Points farming rather than organic demand for AI lending yields. The system offers heavy multipliers, leveraged strategies via Pendle, and repeated liquidity bootstrapping campaigns, creating strong incentives to deposit capital purely for future $CHIP allocation.

History shows that such incentive-driven liquidity is fragile. Post-TGE outflows of 15–30% are common once points stop accruing, and in some cases much larger. The “real” sticky capital that remains for sustainable credit intermediation may be far below the headline $650M figure.

3. Token Launch Ahead of Thesis Validation

$CHIP is being launched at a $300M FDV before the core lending thesis has been demonstrated at scale. The protocol frames itself as an “interest-rate setter for AI infrastructure,” yet with only $70M in the pipeline, it is not meaningfully discovering or setting compute credit prices. It is primarily packaging Treasury exposure with a small experimental loan book.

The token will trade on expectations of a future, fully-deployed AI credit market long before that market has been proven to exist. Any disappointment in borrower growth or deployment velocity risks a sharp repricing.

4. The Borrower Problem

Global AI infrastructure spending runs into the hundreds of billions per year, but that capital is financed by hyperscalers issuing debt at sub-5% rates. USD.AI isn’t competing for those borrowers. Its realistic audience is the long tail: smaller GPU operators, DePIN projects, and AI startups without access to traditional capital markets.

This is a much smaller, riskier, and more cyclical borrower base than the headline “AI capex” narrative suggests. And these borrowers face a structural disadvantage: paying 15–20% APR while better-capitalized competitors finance at 4–5%. Meanwhile, GPU collateral depreciates quickly—in a default scenario, recovery values may fall far below outstanding principal.

5. Communication and Narrative Risk

Marketing materials frame current activity as “liquid GPU debt” and position the protocol as already shaping AI interest rates, despite the fact that ~99% of backing remains in Treasuries. This creates a credibility gap between narrative and on-chain reality—one that becomes particularly sensitive when paired with a token launch, as early buyers are effectively underwriting expectations the product has not yet fulfilled.

In sum, USD.AI currently resembles a Treasury-backed yield product with an early-stage GPU lending experiment layered on top, rather than a mature AI credit market. The $70M loan pipeline shows progress, but against $650M+ in deposits it underscores how far the protocol remains from its stated vision. The combination of low utilization, incentive-driven TVL, unproven borrower depth, and narrative-heavy positioning makes the risk-reward of the $CHIP launch highly sensitive to whether real loan deployment materializes quickly and at scale.

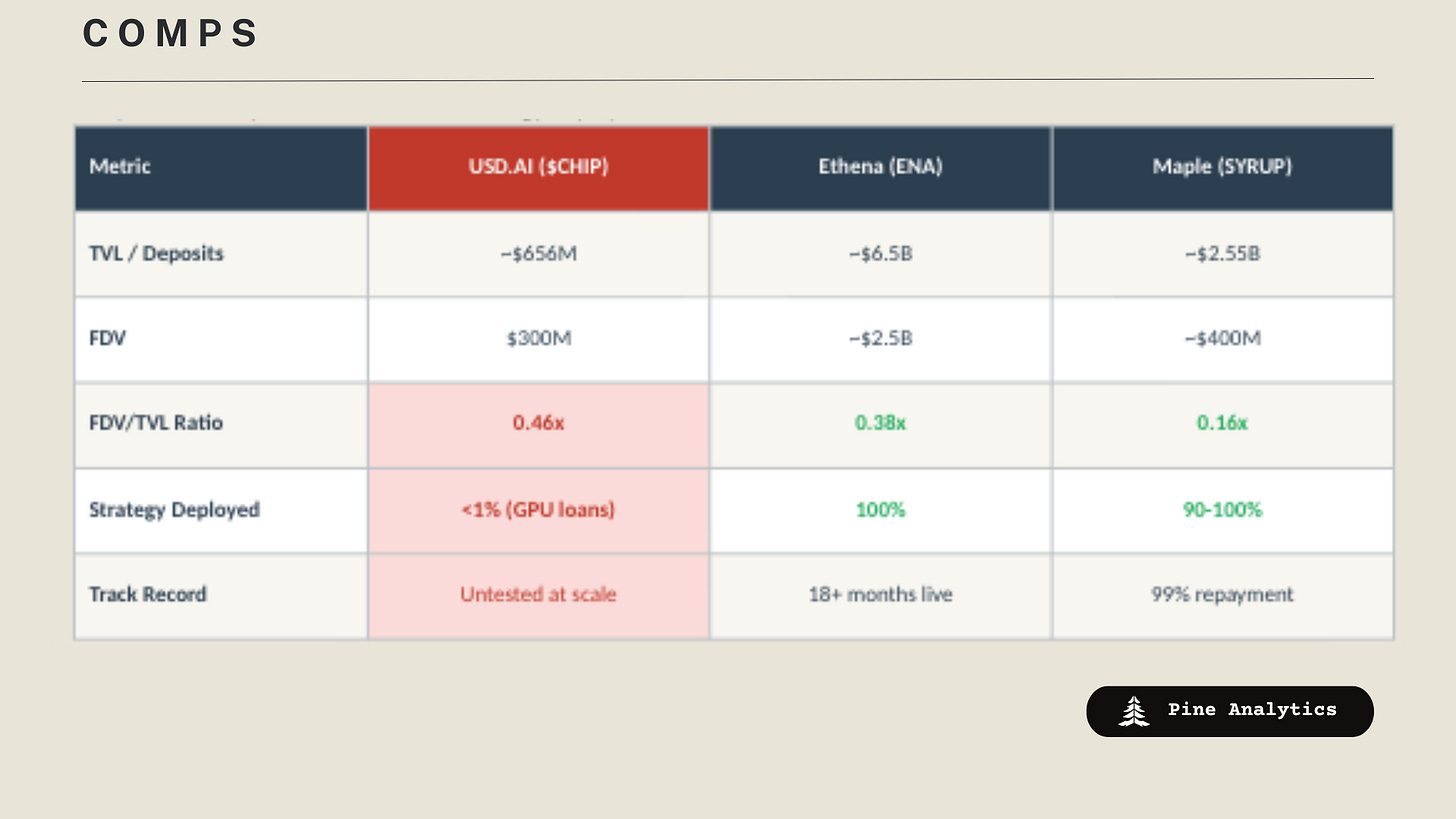

Valuation Comps: $CHIP vs. Ethena & Maple Finance

At a $300M FDV launch, $CHIP is entering the market with a richer valuation than proven stablecoin protocols that have already demonstrated product-market fit at scale.

The numbers tell a clear story: $CHIP launches at 1.2x Ethena’s FDV/TVL multiple and 2.9x Maple’s—despite having only ~$70M in the loan pipeline against $650M+ in deposits, roughly 10% of capital on track to be deployed into its stated yield strategy.

Ethena has earned its 0.38x multiple by executing its delta-neutral funding rate strategy across $6.5B in USDe for over 18 months, surviving multiple volatility events including a 50%+ TVL drawdown post-airdrop and recovering. Every dollar deposited is immediately hedged—there’s no idle capital sitting in generic yield products.

Maple trades at just 0.16x FDV/TVL after scaling to $2.55B in deposits, originating $8B+ in cumulative loans, and maintaining a 99% repayment rate through multiple credit cycles—including rebuilding from a 97% TVL collapse in 2022. The protocol generates ~$30M in annualized revenue with 25% flowing to token buybacks.

USD.AI, by contrast, has ~99% of deposits sitting in Treasuries—the same yield anyone can access through Ondo, Mountain Protocol, or a brokerage account. The $70M loan pipeline is progress, but it’s not yet funded, performing credit. You’re paying a premium valuation for optionality on a yield strategy that remains largely unproven, while comparable protocols that have already executed trade cheaper.

If $CHIP’s FDV/TVL multiple compressed to Ethena’s 0.38x, it would imply a ~$250M FDV—a 17% haircut from launch. If it compressed to Maple’s 0.16x, the implied FDV drops to ~$105M—a 65% decline. And that assumes TVL holds post-TGE, which history suggests it won’t.

Final thoughts

The timing of the $CHIP launch raises serious questions.

Protocols typically launch tokens to bootstrap growth at a critical inflection point. USD.AI is doing something different—monetizing attention before proving the thesis works. The $70M loan pipeline is progress, but with ~90% of deposits still in Treasuries, the differentiated product isn’t live at meaningful scale. The $1.5 billion in “approved facilities” and $100 million in “Q1 2026 originations” remain announcements, not on-chain reality.

The communication doesn’t help. Marketing frames USD.AI as already “setting interest rates for AI infrastructure”—language that overstates current operations. A $70M pipeline against $650M in deposits isn’t “setting rates” for anything. When narrative and reality diverge this far, it’s worth asking who benefits.

The valuation compounds the concern. At $300M FDV, $CHIP launches at a premium to Ethena and Maple—protocols with years of operating history and fully deployed strategies. USD.AI is asking investors to pay more for less.

Could we be wrong? Sure. The team has credible backers and real infrastructure. But the pattern is hard to ignore: token launch before thesis validation, rich valuation against undeployed capital, marketing that stretches reality, and TVL built largely on airdrop farming. This looks less like bootstrapping growth and more like early investors creating a liquidity event before the market can assess whether the product works.

If $CHIP rallies on narrative momentum and retail enthusiasm, we view it as a short opportunity rather than a long-term hold.