The Largest DEXs on Solana Don’t Want Your Liquidity

Introduction

In the early years of DeFi, liquidity was public, passive, and visible. AMMs governed by simple math dominated, and users provided capital in return for yield. TVL was the key metric; protocols competed on community, branding, and token incentives.

On Solana, that model has evolved.

The introduction of on-chain order books like Phoenix and OpenBook gave market makers more control, while DLLMs like Meteora brought reactivity to liquidity management. These models improved upon traditional AMMs, but they remained exposed — relying on public quoting and LP participation.

Recently, a quieter shift has taken place: the emergence of execution-driven DEXs. Protocols like SolFi, Obric v2, and ZeroFi don’t operate frontends, maintain public calls, or solicit deposits. Instead, they quote prices internally and route trades through aggregators, using tightly managed vaults. With relatively small liquidity pools, these systems now handle a large share of daily Solana swap volume.

This paper examines how that happened — and what it means for the future of DeFi on Solana.

How Jupiter Rewired DEX Competition

Jupiter’s rise as Solana’s primary liquidity aggregator changed how DEXs compete. Before Jupiter, protocols attracted users directly through UX, branding, or incentives. With Jupiter routing the majority of retail flow, execution quality — not visibility — became the deciding factor.

Today, wallets and apps route trades to Jupiter by default. This shift deprioritized frontends and made fill quality the central axis of competition. DEXs no longer win by attracting users — they win by offering the best price and lowest slippage within Jupiter’s routing logic.

The Emergence of Private DEXs

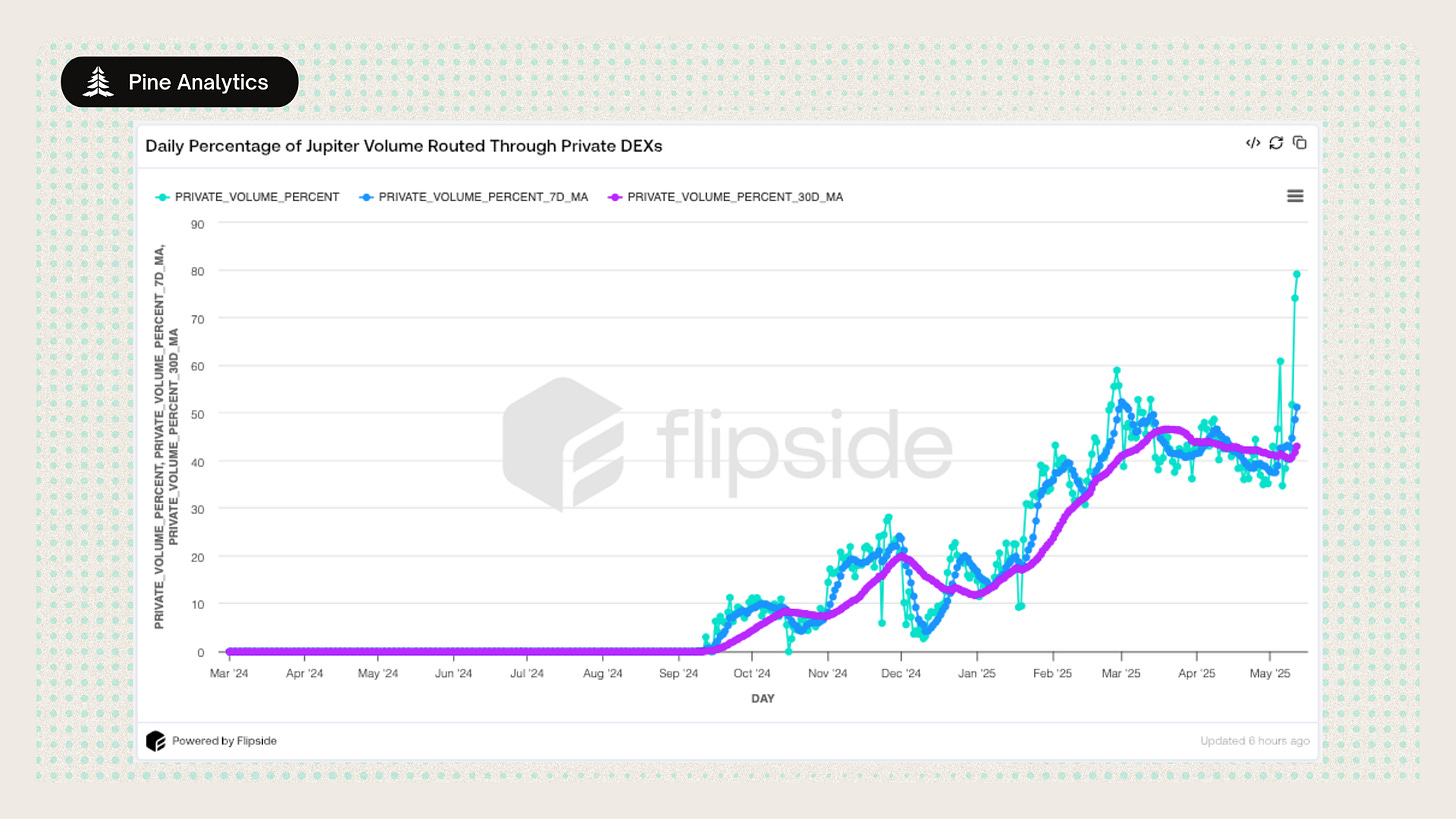

Since September 2024, three protocols — SolFi, Obric v2, and ZeroFi — have been integrated into Jupiter. They operate with no public UI and manage internal vaults rather than open pools. Despite limited capital and no incentives, they now handle 40–60% of all Jupiter-routed volume, with peaks exceeding 65%.

Their routing share reflects performance, not branding. These DEXs win routes because they quote tightly, fill reliably, and avoid unnecessary exposure.

What They Trade

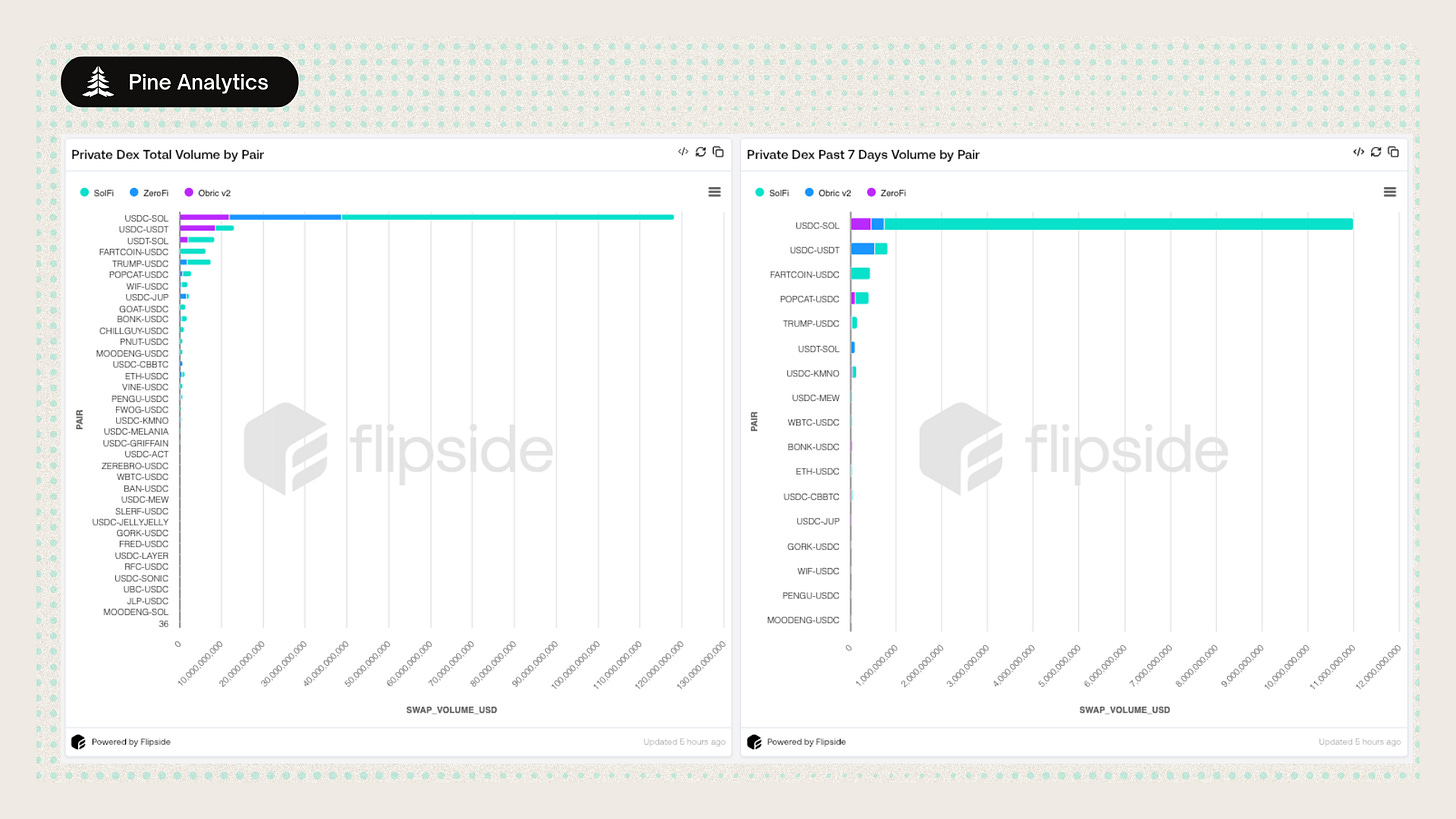

These DEXs primarily quote USDC/USDT and SOL pairs — the most liquid and frequently routed assets on Solana. Obric v2 and ZeroFi stick to high-confidence tokens with reliable pricing data. SolFi is more aggressive, occasionally quoting long-tail assets and new memecoins soon after launch.

This divergence reflects different strategies in inventory and risk management, but the majority of volume remains concentrated in core pairs.

What Sets These DEXs Apart

1. Aggregator-Only Execution

All trades are routed through Jupiter. This avoids direct exposure to toxic flow, bots, and MEV sniping, allowing the DEX to control when and what it quotes.

2. Oracle-Based Pricing

Prices are based on real-time USD feeds rather than token ratios. This prevents slippage, impermanent loss, and arbitrage dependencies, especially in stable pairs.

3. Vault-Based Liquidity

Rather than managing public pools, these DEXs maintain internal vaults. They often hold both assets in a pair but quote selectively based on inventory.

4. Selective Quoting

Quotes are surfaced only when inventory and market conditions support it. This reduces adverse selection and improves execution sustainability.

Why This Works — For Now

These DEXs succeed by leveraging Solana’s fast finality, low latency, and aggregator-centric flow. Solana’s current architecture — particularly its single-leader block production and MEV auction dynamics — creates an environment where public quoting is often disadvantageous. Private execution vaults avoid that exposure.

But this advantage depends on today’s constraints.

In The Path to Decentralized Nasdaq, Solana core contributors outline future upgrades: concurrent leaders, cancel-before-take ordering, and app-level execution control. These changes would reduce adverse selection for public makers and enable more open infrastructure to quote competitively.

If implemented, the current edge enjoyed by private DEXs could narrow. Execution would remain important, but the benefits of secrecy and isolation would diminish — reopening the door to more transparent and composable designs.

Implications

The current dominance of private execution vaults reflects a shift in DeFi’s design assumptions. On Solana, the best-performing makers are no longer open, passive participants — they are tightly scoped, performance-maximizing systems.

This model aligns well with Solana’s architecture but deviates from early DeFi ideals. The efficiency is real, but the accessibility and composability are limited. Most users don’t know who’s filling their swaps, and most protocols can’t easily build on top of these systems.

Whether that’s a temporary state or a long-term direction depends on how Solana evolves.

If upcoming protocol upgrades succeed in making public quoting safe and performant, we may see a return to more open liquidity systems. Until then, private vaults will remain the dominant model — not because they’re the most inclusive, but because they’re the most adapted to the way Solana works today.

Sources

https://www.anza.xyz/blog/the-path-to-decentralized-nasdaq

https://flipsidecrypto.xyz/pine/verbal-white-RF33Lw