This Week in Crypto (06/08/25)

Crypto market weekly overview and updates

Quick Takeaway

Bitcoin Market:

Bitcoin rose 1.28% to $106,086 this week, with ETF net outflows of $140M for the second straight week. BTC dominance ticked up to 64.5%, and the Fear & Greed Index dipped slightly to 52, reflecting a neutral, cautious sentiment. Despite ETF outflows and muted online interest, BTC continues to grind higher, showing no signs of excessive leverage and maintaining a supportive environment for broader market stability.

Altcoin Market:

The altcoin market cap sits at $980B, with Ethereum at $2,516.84 and Solana at $150.85, down 2.0% against ETH. It was a mixed week for alts, with roughly half of top 100 tokens up and half down. With BTC dominance near cycle highs and leverage low in the system, this backdrop has historically supported capital rotation into altcoins. If BTC maintains its range or momentum, alts look poised for renewed momentum in the coming weeks.

Stablecoin Market:

The stablecoin market grew by $1.4B to $247.2B this week, continuing its steady, albeit slowing, expansion. Growth was concentrated on Ethereum, Avalanche, and Polygon, while Solana and Sui saw slight declines. Token-wise, USDe, USDT, and USDS increased, while USDC and DAI dipped—signaling gradual, measured growth with no explosive acceleration yet.

NFT Market:

NFT sales volumes remain flat at the bottom of a downtrend that started in December. Polygon and Bitcoin saw upticks in activity, while Ethereum and Solana slipped further. BRC20 tokens experienced a 25% spike in volume, suggesting a niche resurgence amid an otherwise quiet market.

Chain Activity:

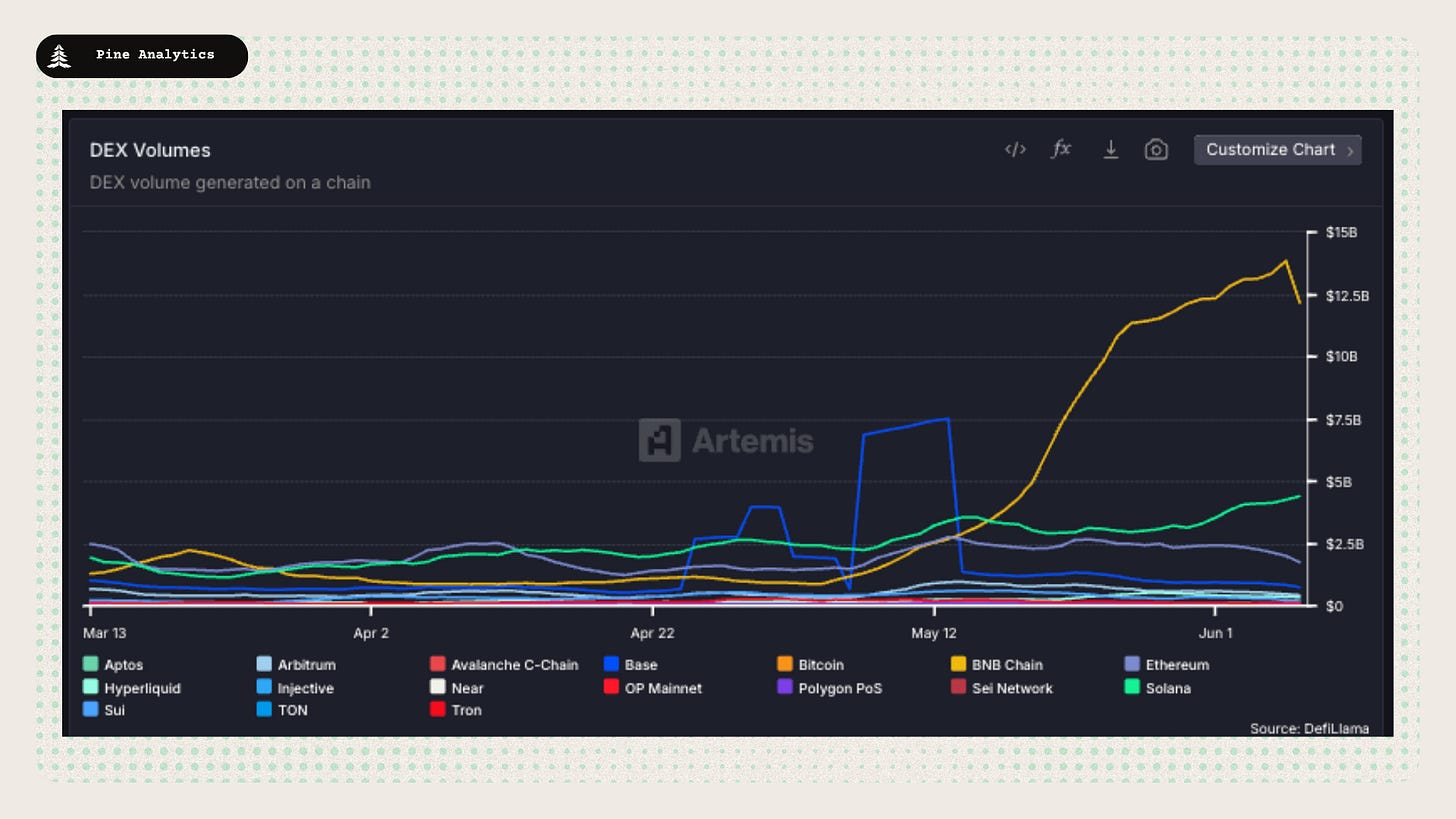

Ethereum, Polygon, and BTC saw strong bridge inflows, while Arbitrum and Base saw outflows—highlighting active cross-chain usage. Solana’s +33.3% DEX volume surge signals deepening liquidity rotation, while fee generation remained most robust on BNB Chain and Hyperliquid despite declines.

Market Outlook:

Overall, this week’s mixed performance reflects a market in consolidation rather than broad weakness. BTC’s low leverage and ongoing uptrend provide a solid foundation for the altcoin rotation trade. As long as BTC holds its ground or ranges, we expect selective altcoin breakouts and sustained on-chain activity to emerge as liquidity and sentiment improve.

BTC Market

Current State of the Bitcoin Market

Bitcoin's price has increased by 1.28% over the past week, currently trading at $106,086.

BTC dominance increased by 0.27%, now making up 64.5% of the total cryptocurrency market cap.

The Fear and Greed Index has slightly decreased from 56 to 52 over the week, with a weekly average of 54.43, indicating a neutral market sentiment.

Weekly net ETF outflows totaled 140M. this represents the seccond weekly net outflow after 5 weeks of strong inflows.

Online interest has been declining since the U.S. election; this week, it continued the trend.

Interpretation and Future Outlook

Despite net ETF outflows, BTC has continued to grind higher, reclaiming ground around prior highs. With low leverage and cautious sentiment (Fear & Greed Index neutral), the market appears to be in a healthy, low-excess environment.

The steady dominance increase highlights structural demand for BTC, while the absence of extreme leverage blowouts suggests this rally still has room to grow. We see a high likelihood of range-bound consolidation in the near term, with the potential for a clean breakout in the coming weeks—particularly if ETF inflows resume.

Altcoin Market

Currently, the altcoin market cap is sitting at $980 billion. Ethereum makes up approximately 31.0% of the altcoin market cap. The price of Solana (SOL) is $150.85, and the price of Ethereum (ETH) is $2516.84, with the SOL/ETH ratio down 2.0% this week. This has been a mixed week for all with about half of the top 100 token and the other half down.

Top 3 Performers (7-day change):

AB (AB): $0.01 (32.56%)

SPX6900 (SPX): $1.21 (24.97%)

Internet Computer (ICP): $5.58 (12.90%)

Bottom 3 Performers (7-day change):

DeXe (DEXE): $10.11 (-29.56%)

Jupiter (JUP): $0.46 (-12.56%)

Virtuals Protocol (VIRTUAL): $1.80 (-12.19%)

Weekly Chain Metrics

Chains by bridge flows: Ethereum, Polygon, and BTC saw the largest inflows this week, while Arbitrum, Base, and unichain experienced large outflows.

Top chains by TVL: Ethereum $61.0B (+0.3%), Solana $8.4B (–1.2%), Bitcoin $6.1B (–1.6%), BNB Chain $5.9B (–4.8%), Tron $4.9B (–24.6%), Base $3.7B (+2.8%).

Top chains by DEX volume: BNB Chain $84.7B (–1.6%), Solana $30.8B (+33.3%), Ethereum $11.9B (–29.2%), Base $5.2B (–20.4%), Arbitrum $2.9B (–27.3%), Hyperliquid $2.4B (–25.4%), Sui $1.3B (–46.7%), Tron $0.8B (–1.0%).

Top chains by weekly fees: Tron $13.3M (+0.0%), Hyperliquid $12.6M (–28.0%), Ethereum $10.5M (+0.0%), Solana $7.7M (–8.3%), BNB Chain $3.8M (+6.9%), Bitcoin $3.2M (–22.2%), Base $1.0M (–25.9%), Sui $0.2M (–24.7%).

Interpretation and Future Outlook

Altcoins had a mixed week, but the environment is still supportive. BTC dominance remains close to its cycle highs, leverage is low in the system, and BTC is either grinding higher or pausing after a move up. Historically, this has been a constructive backdrop for altcoins, as capital rotation tends to favor them during periods of BTC stability or measured growth.

With structural demand steady and no signs of excess leverage, we anticipate that altcoins could see renewed momentum in the coming weeks—especially as the market digests BTC’s recent moves and looks for higher-beta opportunities.

Stablecoin Market

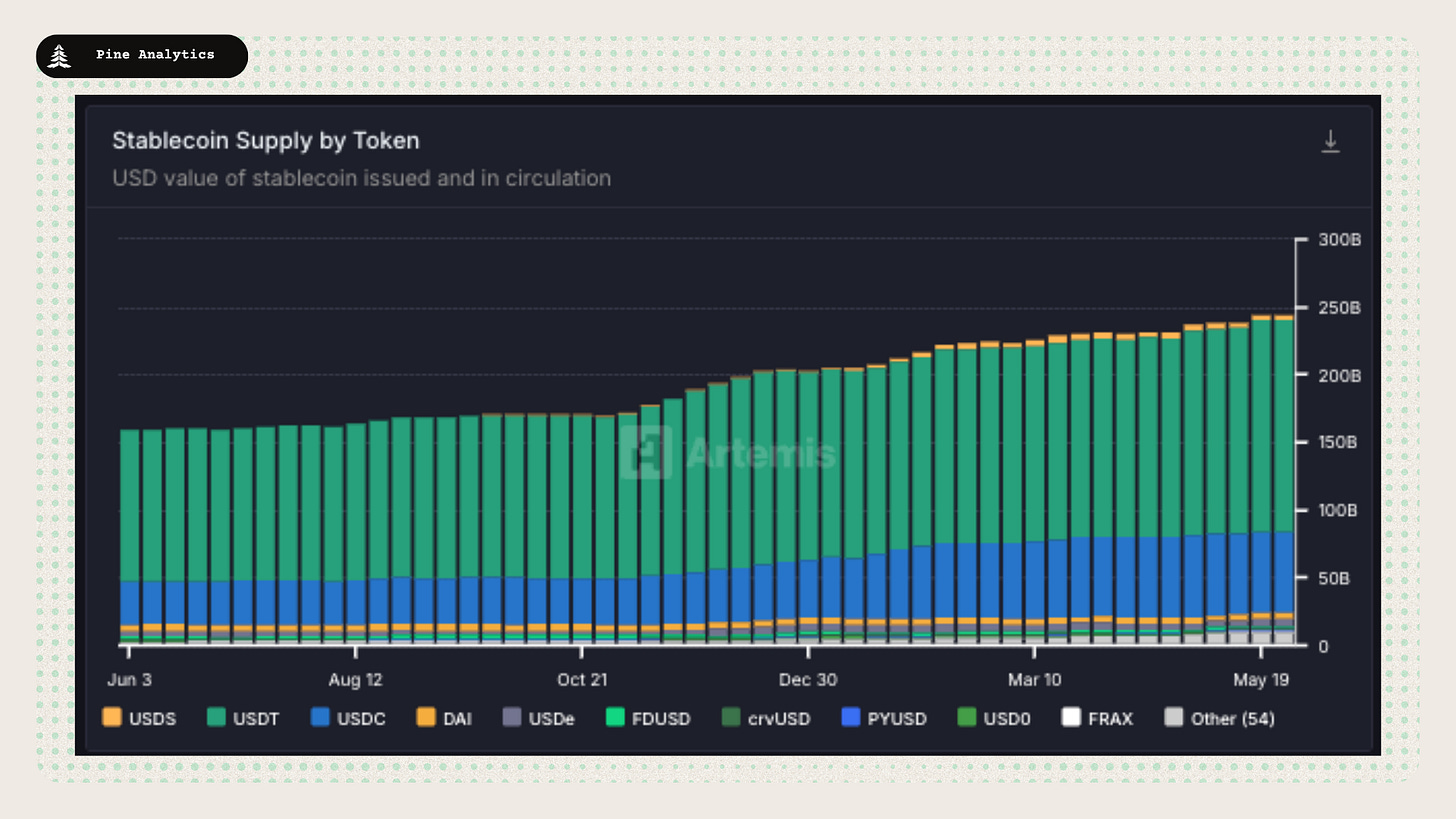

Market Capitalization: The stablecoin market cap currently stands at $247.2 billion, reflecting a $1.4 billion increase over the past week and a $9.2 billion increase over the past 30 days. This represents a continuation of slowing growth.

Stablecoin Supply Rates:

AAVE: 3.9%-4.3%

Kamino: 4.5%-5% (6.8% USDG)

Save Finance: 3.7%–4.5% (4.9% USDS)

JustLend: ~2.3%–4.4% (5.59% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased on Ethereum, Avalanche, and Polygon, while Solana and Sui saw a decline.

Token-Specific Changes: USDe, USDT, and USDS saw increases this week, while USDC and DAI experienced declines.

Interpretation and Future Outlook: This week’s $1.4 billion increase represents a continuation of the multi-month trend of positive but decelerating growth. Momentum has been gradually fading since November 2024. While capital continues to trickle in, a meaningful reacceleration has yet to materialize.

NFT Market

Market Activity:

NFT sales volume have stayed flat over the past two weeks, sitting at the bottom of a long-term downtrend that began in mid-December. Activity increased on Polygon and Bitcoin, while it declined on Ethereum and Solana.

Top Collections:

BRC20 tokens have seen a surge in activity this week, with volume increasing around 25%. Notable collections include Courtyard, DKNFT, and Punks.

Overall Market Trend:

The NFT market experienced a spike in activity in early November, but much of that momentum has faded. Sales volumes have now settled slightly above the extremely low levels seen before November.

CT Mindshare

X and Polymarket Partnership: X has partnered with Polymarket as its official prediction market, integrating real-time betting odds into its social media feed to enhance user insights on events like elections. The collaboration leverages Polymarket’s blockchain platform and X’s Grok AI to deliver data-driven perspectives.

3Jane Raised Seed Funding: 3Jane, an Ethereum-based decentralized finance (DeFi) protocol, secured $5.2 million in a seed funding round led by Paradigm, with participation from Wintermute Ventures, Coinbase Ventures, Breed VC, Robot Ventures, Bodhi Ventures, and angel investors.

Stable came out of Stealth: Stable has emerged from stealth as a new Layer 1 blockchain purpose-built for institutions, using USDT as native gas and offering free peer-to-peer USDT transfers. Backed by Bitfinex and Tether, it’s designed to create a dollar-native financial layer that eliminates legacy middlemen and redefines on-chain finance at scale.

SKY Staking went Live: SKY, a blockchain ecosystem, launched its staking program, enabling users to stake tokens to earn rewards while supporting network security. This milestone strengthens SKY’s community engagement and ecosystem growth.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://x.com/i/bookmarks/all?post_id=1812861039517778200=