This Week in Crypto (06/30/25)

Crypto market weekly overview and updates

Quick Takeaway

Bitcoin Market:

Bitcoin held steady this week, closing at $102,200 after a modest 0.0% change. ETF inflows remained robust, with nearly $1B of net demand continuing to reinforce institutional interest. BTC dominance remains elevated, and price stability above $100K suggests healthy accumulation despite macro uncertainty. Online interest is quiet, but structurally, Bitcoin appears well-supported for a potential next leg up.

Altcoin Market:

The altcoin market cap rose to $945B, driven by strong gains across the board. Ethereum trades at $2,460.76 and Solana at $150.29, with the SOL/ETH ratio up 2.8%—a sign of rising relative strength. Top performers included PENGU (+61.8%), SEI (+56.0%), and ARB (+37.4%), while only a handful of tokens like KAIA, GT, and IP declined. If Bitcoin continues ranging, expect random surges in long-tail alts. Once BTC resumes trending, more established names like SOL and ETH could benefit disproportionately.

Stablecoin Market:

The total stablecoin market cap dipped by $1.6B this week to $244.8B, marking the second consecutive weekly decline. Despite a $1B net increase over the past month, the short-term pullback reflects decelerating expansion. Notably, Base, Ethereum, and Arbitrum saw sharp outflows, while Tron posted large inflows, continuing its trend of dominant stablecoin usage in Asia and emerging markets.

NFT Market:

NFT sales volume ticked up slightly but remains near the bottom of a multi-month downtrend. Ethereum, Solana, and Sui saw modest increases in activity, while Immutable and Polygon lagged. The market has yet to show convincing signs of reversal, but current levels represent a potential base worth watching if broader risk appetite returns.

Chain Activity:

Ethereum, Solana, and Sui saw strong growth in TVL, DEX volume, and fee generation—a clear signal of underlying usage. Solana’s on-chain metrics in particular remain strong across the board. Bridge flows showed $1.5B shifting from Base to Ethereum. Meanwhile, Hyperliquid held steady as the top chain for protocol fees, and Sui and Aptos continue to quietly grow usage.

Market Outlook:

With BTC holding range and on-chain activity accelerating, this looks like an early stage altcoin resurgence. If Bitcoin stays flat, expect explosive moves from longer-tail tokens. If Bitcoin rallies, capital rotation into high-quality alts is likely. The backdrop—stable BTC, strong chain fundamentals, and increasing usage—makes this one of the most constructive altcoin setups in months.

BTC Market

Current State of the Bitcoin Market

Bitcoin's price has increased by 6.40% over the past week, reaching a current value of $107,695.

BTC dominance remains steady at 65.5%, with no significant change over the past week.

The Fear and Greed Index has improved from 40 to 49 over the past week, with a weekly average of 45.71, indicating a shift towards a more neutral market sentiment.

Weekly net ETF inflows totaled 2.2B. this represents the third strong week of inflow after a few weeks of outflows.

Online interest has been declining since the U.S. election; this week, it continued the trend.

Interpretation and Future Outlook

Bitcoin’s 6.4% weekly gain comes alongside another wave of institutional inflows, marking a third consecutive week of sustained demand from long-term allocators. ETF inflows have now topped 2B this week, reinforcing the underlying bid. Despite this, retail sentiment and online attention remain muted, with the Fear and Greed Index hovering in neutral territory and online search interest continuing to drift lower post-election.

BTC dominance holding firm at 65.5% shows capital concentration remains high—an important signal that this move still has legs. The combination of low retail noise, high dominance, and strong institutional flow suggests the next leg up is likely forming beneath the surface. With structural demand intact and no signs of exhaustion, the current consolidation appears more like a pause than a peak.

Altcoin Market

Currently, the altcoin market cap sits at $945 billion. Ethereum accounts for approximately 31.4% of that total. The price of Solana (SOL) is $150.29, and the price of Ethereum (ETH) is $2,460.76, with the SOL/ETH ratio up 2.8% this week. Altcoins have broadly trended upward, with the vast majority of the top 100 tokens gaining—many posting double-digit percentage increases.

Top 3 Performers (7-day change):

Pudgy Penguins (PENGU): $0.01 (61.77%)

Sei (SEI): $0.30 (55.97%)

Arbitrum (ARB): $0.37 (37.40%)

Bottom 3 Performers (7-day change):

Kaia (KAIA): $0.16 (-14.09%)

GateToken (GT): $15.35 (-5.01%)

Story (IP): $2.95 (-4.32%)

Weekly Chain Metrics

Chains by bridge flows: This week, the most significant cross-chain flow has been a nearly $1.5B outflow from Base and a nearly $1.5B inflow into Ethereum.

Top chains by TVL: $63.0 B (+7.3%), Solana $8.6 B (+8.9%), Bitcoin $6.4 B (+3.2%), BNB Chain $6.0 B (+3.4%), Tron $4.6 B (–2.1%), Base $3.4 B (+6.3%), Arbitrum $2.5 B (+8.7%), Sui $1.8 B (+12.5%).

Top chains by DEX volume: BNB Chain $65.1 B (–19.8%), Solana $56.0 B (+14.3%), Ethereum $11.9 B (–22.7%), Base $5.78 B (–17.5%), Arbitrum $2.67 B (–38.4%), Hyperliquid $2.19 B (–29.2%), Sui $1.93 B (–7.8%), Aptos $1.34 B (+4.8%).

Top chains by weekly fees: Hyperliquid $16.1M (≈0.0%), Ethereum $9.1M (+18.2%), Solana $6.86M (+6.9%), Bitcoin $3.70M (+2.0%), BNB Chain $2.49M (–21.5%), Base $860.3K (–36.7%), Arbitrum $308.0K (–38.2%), TON $177.1K (+16.6%).

Interpretation and Future Outlook

Altcoins are showing renewed strength across the board, with the vast majority of the top 100 posting gains—many in the double digits. This week’s rally wasn’t just surface-level; it was supported by rising TVLs, increased fee generation, and growing DEX volume across chains like Solana, Sui, and Base.

We’re now in a window where altcoins could significantly outperform—especially if Bitcoin continues to consolidate in its current range. In that scenario, expect sharp, random outperformance by long-tail tokens as capital rotates deeper down the risk curve. We're already seeing early signs of this with assets like PENGU and SEI, which led the week with explosive gains.

Looking ahead, if and when Bitcoin starts its next leg up, we expect a broader wave of capital rotation into higher-quality, more established altcoins. These names are likely to benefit disproportionately as institutional confidence in the crypto asset class expands alongside BTC.

The setup is becoming increasingly constructive: bridge flows show capital returning to Ethereum, Solana is holding up across every major metric, and fee growth is concentrated in chains with real usage. We believe this environment sets the stage for a two-phase altcoin rally—first led by speculative names during BTC chop, then by majors during the next bullish expansion.

Stablecoin Market

Market Capitalization: The stablecoin market cap currently stands at $244.8 billion, reflecting a $1.6 billion decrease over the past week and a $1 billion increase over the past 30 days. This marks the second consecutive week of net stablecoin supply decline following a long—though slowing—period of expansion.

Stablecoin Supply Rates:

AAVE: 2.7%-3.7%

Kamino: 5%-6.6% (7.22% USDG)

Save Finance: 3.7%–4%

JustLend: ~2.3%–2.9% (6% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply saw sharp pullbacks across Base, Ethereum, and Arbitrum, while Tron experienced large inflows.

Token-Specific Changes: USDC, USDe, and DAI saw large supply decreases this week, while USDT experienced a large increase in supply.

Interpretation and Future Outlook: This week’s $1.6 billion supply decrease marks a continuation of the recent shift away from stablecoin growth, following a long—but slowing—period of expansion. While the 30-day trend remains slightly positive, this is now the second consecutive week of net contraction. Momentum has been fading gradually since November 2024, and while capital continues to trickle in on some chains, a meaningful reacceleration has yet to materialize.

NFT Market

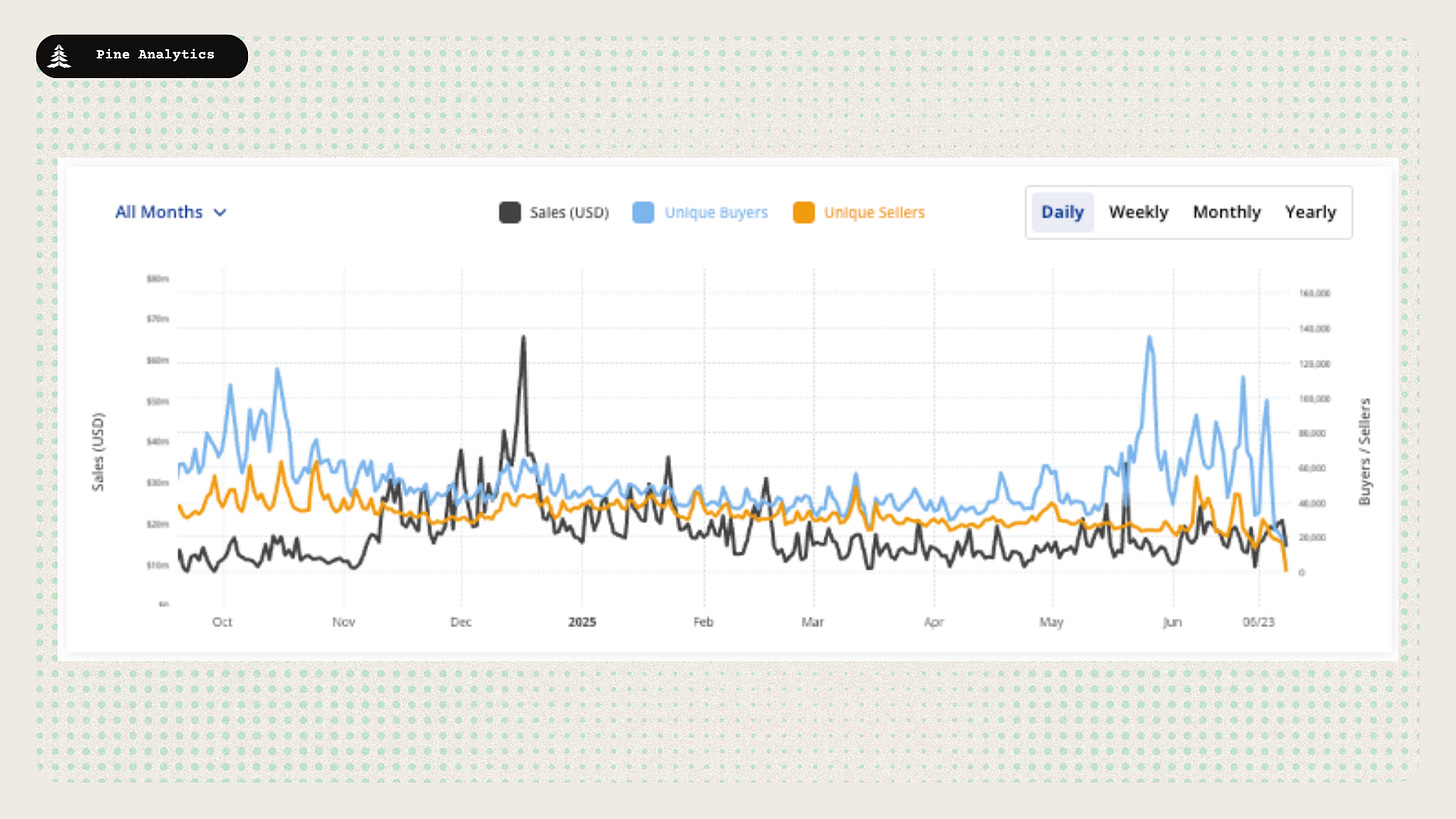

Market Activity:

NFT sales volume has slightly increased this week, hovering just above the bottom of a long-term downtrend that began in mid-December. Activity rose across all chains with significant NFT ecosystems, except for Solana.

Top Collections:

Guild of Guardians have seen a surge in activity this week, with volume increasing around 116%. Notable collections include DKNFTs, pudgy penguins, and Start Options.

Overall Market Trend:

The NFT market experienced a spike in activity in early November, but much of that momentum has since faded. Sales volumes now sit slightly above prior lows, suggesting a tentative rebound—but one that remains fragile and worth monitoring.

CT Mindshare

xStocks Launched on Solana: Kraken, in partnership with Backed and the Solana Foundation, launched xStocks, enabling 24/7 trading of over 60 tokenized U.S. stocks and ETFs on the Solana blockchain, aimed at global investors outside the U.S. This initiative enhances accessibility and integrates traditional equities with DeFi applications, marking a significant step in tokenizing real-world assets.

Fiserv Announces Stablecoin: Fiserv, Inc., a global leader in payments and financial technology, unveiled plans to launch FIUSD, a U.S. dollar-pegged stablecoin, by year-end 2025. Integrated into Fiserv’s network of 10,000 financial institutions and six million merchants, FIUSD will leverage Paxos, Circle, and Solana blockchain infrastructure to enable efficient, interoperable digital asset services for banking and payments. The initiative, supported by partnerships with PayPal and Mastercard, aims to modernize money movement with built-in compliance and fraud monitoring

Grass launched its first depin device: Grass, a decentralized physical infrastructure network (DePIN), announced the launch of its first device, designed to enable users to contribute bandwidth to its AI-driven data network. While specific details on the device’s functionality remain limited, the launch marks a step toward decentralized internet infrastructure, aligning with Grass’s mission to democratize data access for AI development. No primary sources were available for further details.

Robinhood anounces tokenized stocks: Robinhood revealed plans to offer tokenized U.S. stocks for EU investors using Solana or Arbitrum, aiming to bridge traditional finance and crypto markets. This move reflects growing interest in tokenization, with potential to drive adoption of blockchain-based securities.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://x.com/i/bookmarks/all?post_id=1812861039517778200=