This Week in Crypto (07/13/25)

Crypto market weekly overview and updates

Quick Takeaway

Bitcoin Market:

Bitcoin surged 9.69% this week to $119,096, backed by a record $2.7B in ETF inflows — the largest in a 5-week streak of institutional demand. BTC dominance fell to 64.45% (–1.54%), a subtle but important shift that hints at rotation. The Fear & Greed Index climbed to 69, and online interest broke out of its post-election downtrend, suggesting fresh momentum is building. With retail reawakening and leverage still low, the trend appears strong with room to run.

Altcoin Market:

The altcoin market cap hit $1.13T, with broad-based gains across the top 100 and strong sentiment driving price action. Ethereum sits at $2,996.45, Solana at $162.91, though the SOL/ETH ratio fell 10.7% on the week. Leading performers included MemeCore (+677%), PENGU (+93%), and MOG (+92%), while almost no large-cap tokens posted losses. With BTC trending and dominance breaking down, the environment is primed for continued altcoin outperformance.

Stablecoin Market:

Stablecoin market cap declined by $4.3B to $253.6B, but is still up $7.6B over 30 days — showing flickers of reacceleration after months of sluggish growth. Chain-level supply increased on Ethereum, Solana, and Tron, while Arbitrum saw net outflows. Token-wise, USDT, USDC, and BUDL expanded, while USDS shrank. Rates remain stable across lending markets, but broader expansion still lags behind other risk assets.

NFT Market:

NFT sales volume broke out from a multi-month downtrend, led by Ethereum and Bitcoin collections, while Polygon and Solana lagged. Ordinals surged, entering the top 5 in volume, alongside collections like Pudgy Penguins, Punks, and BAYC. Though far from peak levels, the current volume rebound suggests early signs of a potential bottom formation in NFTs.

Chain Activity:

Core chains — Ethereum, Solana, and Sui — saw strong growth across TVL, DEX volume, and fees, suggesting robust usage beyond speculation. Solana posted $69.3B in DEX volume (+27%), while Base and Sui showed some of the fastest percentage growth. Bridge flows saw $600M enter Ethereum, while Base, Unichain, and Arbitrum saw large outflows. Hyperliquid maintained its lead in fee generation, signaling sticky activity.

Market Outlook:

This is a classic early-stage altseason setup: BTC is trending, dominance is rolling over, and fundamentals across major chains are strengthening. With leverage and sentiment still below extremes, both majors and high-beta tokens look primed for continuation. If Bitcoin holds or pushes higher, expect capital to continue cascading down the risk curve — first to ETH and SOL, then to the long tail.

BTC Market

Current State of the Bitcoin Market

Bitcoin has shown strong performance this week, surging 9.69% to reach a current price of $119,096.

BTC dominance is at 64.45%, with a decrease of 1.54% over the week.

The Fear and Greed Index rose from 50 to 69 over the past week, with a weekly average of 56.86, indicating growing market optimism.

Weekly net ETF inflows totaled $2.7B — the largest weekly inflow in a 5-week trend of strong inflows.

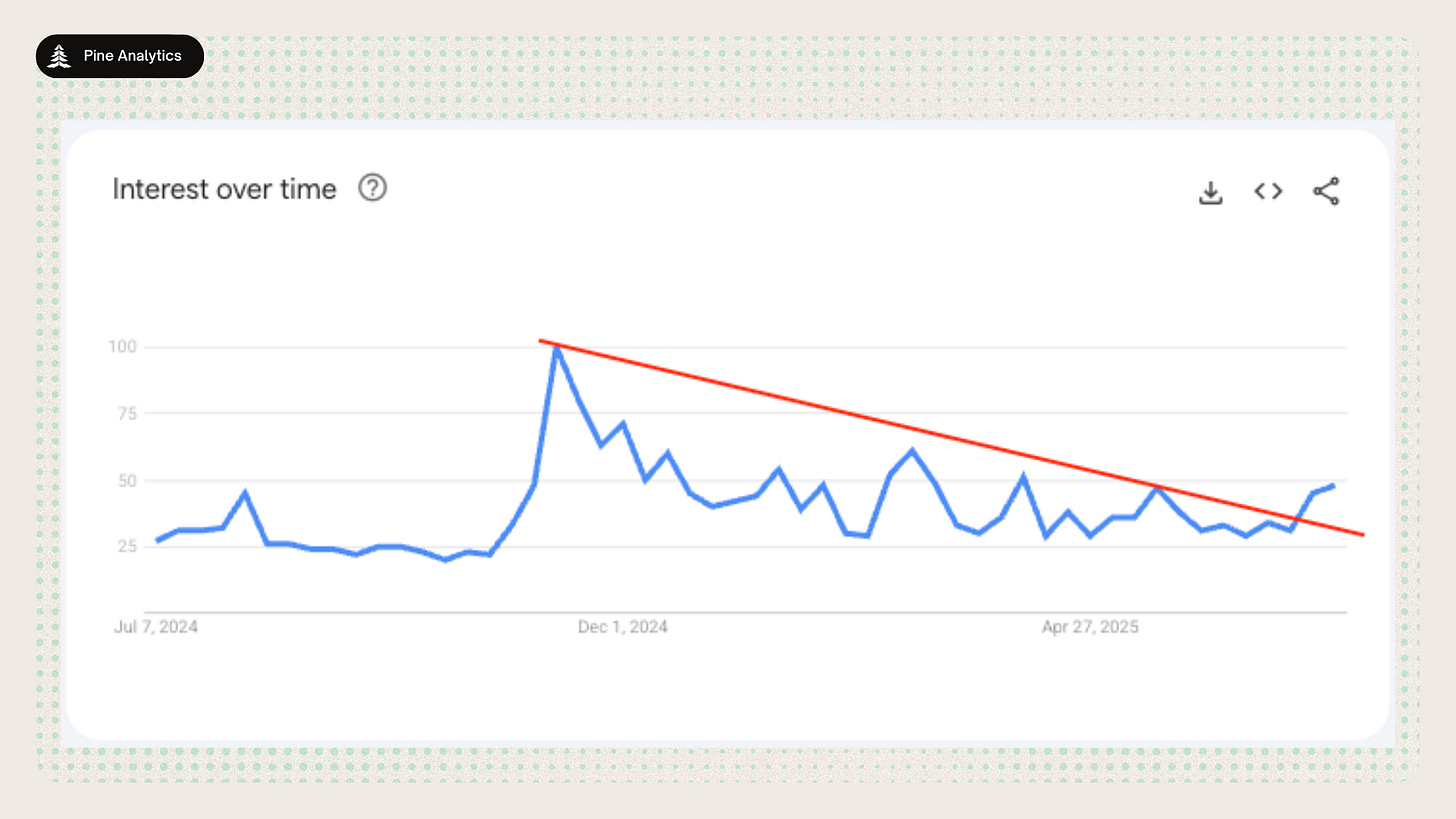

Online interest has broken to the upside, ending the downtrend that began after the November 2024 spike. This marks the first clear reversal in attention, suggesting renewed momentum may be building.

Interpretation and Future Outlook

Bitcoin surged 9.69% this week to $119,096, fueled by record-breaking ETF inflows of $2.7B — the strongest weekly inflow in a five-week streak of institutional buying. Despite a slight pullback in dominance (–1.54%), BTC remains firmly in control at 64.45%, suggesting that the rally is still being led by majors rather than a shift into alts.

Online interest has broken out of its multi-month downtrend, marking the first clear signal of renewed public attention since the post-election slump. With growing retail awareness, rising leverage, and significant institutional inflows, the market appears to be entering a momentum phase that still has room to run. While we’re seeing early signs of participation and risk-taking, sentiment and positioning have not yet reached euphoric extremes — a dynamic that supports further upside before exhaustion sets in.

Altcoin Market

Currently, the altcoin market cap is sitting at $1127 billion. Ethereum makes up approximately 32.1% of the altcoin market cap. The price of Solana (SOL) is $162.91, and the price of Ethereum (ETH) is $2996.45, with the SOL/ETH ratio down 10.7% this week. The altcoin market was euphoric this week, with nearly all of the top 100 coins seeing major price appreciation.

Top 3 Performers (7-day change):

MemeCore (M): $0.66 (677.27%)

Pudgy Penguins (PENGU): $0.03 (93.11%)

Mog Coin (MOG): $0.00 (92.42%)

Bottom 3 Performers (7-day change):

Bitget Token (BGB): $4.40 (-0.28%)

OKB (OKB): $48.80 (-0.11%)

World Liberty Financial USD (USD1): $1.00 (-0.02%)

Weekly Chain Metrics

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Base, Unichain, and Arbitum and a just over $600M inflow into Ethereum.

Top chains by TVL: Ethereum $71.9B (+10.1%), Solana $9.1B (+4.6%), Bitcoin $7.0B (+9.5%), BNB Chain $6.3B (+0.8%), Tron $5.5B (+10.4%), Base $3.8B (+8.6%), Arbitrum $2.6B (+0.8%), Sui $2.0B (+4.2%), Avalanche C-Chain $1.6B (+6.7%).

Top chains by DEX volume: Solana $69.3B (+27.0%), BNB Chain $67.9B (–20.0%), Ethereum $13.3B (+11.8%), Base $6.75B (+29.3%), Arbitrum $3.48B (+26.3%), Sui $2.34B (+24.6%), Hyperliquid $2.26B (+25.2%), Aptos $1.65B (–1.9%).

Top chains by weekly fees: Hyperliquid $15.4M (+37.5%), Tron $14.0M (+5.3%), Ethereum $9.8M (+69.6%), Solana $9.1M (+18.2%), Bitcoin $3.62M (+23.3%), BNB Chain $2.33M (+8.9%), Base $861.7K (+11.0%), Arbitrum $391.3K (+42.2%), Sui $270.2K (+9.5%).

Interpretation and Future Outlook

Altcoins had a breakout week, with broad-based price appreciation across the top 100 and a clear shift in market sentiment. Bitcoin surged, but more importantly, BTC dominance broke down, a strong signal that capital is rotating into the rest of the market.

We believe this breakdown in dominance is just beginning, with momentum building behind both majors and high-beta assets. Ethereum and Solana both posted solid gains, though SOL underperformed ETH this week, with the SOL/ETH ratio dropping 10.7%. Still, DEX activity, fee generation, and TVL growth across chains like Base, Sui, and Hyperliquid suggest increasing user participation and appetite for risk.

This is the kind of environment where altcoins historically outperform — BTC leads, dominance rolls over, and capital begins cascading down the risk curve. As long as BTC holds its trend, altcoins appear well-positioned to continue appreciating.

Stablecoin Market

Market Capitalization: The stablecoin market cap currently stands at $253.6 billion, reflecting a $4.3 billion decrease over the past week and a $7.6 billion increase over the past 30 days. This marks the possible breakout of the trend that began in November 2024 of decelerating stablecoin supply growth.

Stablecoin Supply Rates:

AAVE: 3.7%-4.2%

Kamino: 5.8%-10%

Save Finance: 3.8%–4.7%

JustLend: ~1.5%–4.2% (6.2% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply saw increases across Ethereum, Solana, and Tron, while Arbitrum experienced outflows.

Token-Specific Changes: BUDL, USDT, and USDC saw large supply increases this week, while USDS experienced a decrease in supply.

Interpretation and Future Outlook: This week’s $4.3 billion increase represents a slight acceleration from the multi-month trend of positive but decelerating growth. Momentum has been gradually fading since November 2024. While capital continues to trickle in, a meaningful reacceleration has yet to materialize.

NFT Market

Market Activity:

NFT sales volume shot up over the past week, continuing a breaking up out of a downtrend that began in mid-December. Activity increased on Ethereum and Bitcoin while Polygon and Solana saw decreases.

Top Collections:

Ordinals have seen a surge in activity this week, with the collection reaching 4th place in terms of collection volume this week. Notable collections include Pudgy Penguins, Punks, and BAYC nfts.

Overall Market Trend:

The NFT market experienced a spike in activity in early November, but much of that momentum has since faded. Sales volumes are now in a deviation from their lowest levels since that spike.

CT Mindshare

PUMP TGE:

Pump.fun successfully launched its PUMP token generation event on July 12, 2025, raising $500 million as the ICO sold out in just 12 minutes across multiple exchanges. Despite some technical issues on platforms like Bybit and initial market FUD, the token is set to begin trading within 24-48 hours, with distributions starting on exchanges like Kraken.

Phantom Launches Hyperliquid Perps:

Phantom wallet has launched support for perpetual futures trading directly within its app, powered by Hyperliquid's API, enabling users to access over 100 markets with up to 40x leverage. This integration aims to bring perp trading to Phantom's 15 million monthly active users, potentially boosting Hyperliquid's ecosystem and diverting significant trading volume from other platforms.

Polymarket UMA Controversy:

Polymarket is facing backlash over a $200 million prediction market on whether Ukrainian President Zelenskyy wore a suit at NATO, where UMA's oracle controversially resolved it as "No" despite evidence to the contrary. Critics argue that UMA's token-weighted voting system allows whales to manipulate outcomes, undermining the platform's decentralization and trust in prediction markets.

Jupiter announces the launch of JUPnet:

Jupiter has announced the launch of Jupnet, an omnichain network designed to aggregate all of crypto's liquidity into a single decentralized ledger, with a public testnet expected in early Q4 2025. The network will initially support Solana, Base, Sui, and Arbitrum, with plans to integrate Bitcoin and Hyperliquid soon after, marking a significant expansion for the Solana-based DEX aggregator.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://x.com/i/bookmarks/all?post_id=1812861039517778200=