This Week in Crypto (07/20/25)

Crypto market weekly overview and updates

Quick Takeaway

Bitcoin Market:

Bitcoin dipped slightly by 0.43% to $118,689, but the underlying trend remains bullish. ETF inflows came in at $2.3B — marking six straight weeks of massive institutional demand. BTC dominance fell sharply to 61.11% (–5.7%), continuing its breakdown and opening the door for rotation into alts. The Fear & Greed Index rose to 69, now firmly in the “Greed” zone, while online interest has cleanly reversed its multi-month downtrend. This setup reflects a market with strong structural support and growing retail engagement, where momentum can build without immediate overheating.

Altcoin Market:

Altcoin market cap sits at $1.32T, with nearly every top-100 coin posting strong gains. Ethereum leads with 34.2% market share, trading at $3,752.42, while Solana trades at $182.16 — though SOL/ETH dropped 13.0% this week. Top performers like Tezos (+78%) and Curve (+47%) reflect a resurgence in both majors and long-tail assets. With BTC dominance breaking down and on-chain metrics like DEX volume and fees soaring across Base, Sui, and Hyperliquid, the environment is ideal for extended altcoin outperformance.

Stablecoin Market:

The stablecoin market grew $2.5B this week to $256.2B, the clearest sign yet of a possible trend reversal after months of decelerating expansion. 30-day growth now totals $9.9B. Supply rose across Ethereum, Arbitrum, and BNB, while Sui and Tron saw drawdowns. USDe, USDT, and USDC expanded, while USDS and BUDL contracted. Lending rates remain stable (3%–7%), suggesting steady capital deployment, but risk assets continue to outpace stablecoins in growth velocity.

NFT Market:

NFT volumes declined again, revisiting multi-month lows. However, Ethereum, Solana, and Bitcoin-based collections saw upticks in activity — including a strong performance by Pudgy Penguins, which reached #2 in weekly volume. Despite the broader lull, some signs of life are emerging in high-profile collections. Market-wide, NFTs remain in a holding pattern with no clear breakout yet.

Chain Activity:

Ethereum saw nearly $400M in bridge inflows, while Base, Unichain, and Arbitrum saw net outflows. TVL increased significantly across Ethereum (+12.4%), Tron (+11.3%), and Sui (+10.0%), with strong growth also seen in DEX volume (Sui +119%, Solana +38%, Arbitrum +30%). Fee generation surged across Hyperliquid (+77.3%) and Ethereum (+78.6%), confirming rising user activity and sticky usage in key ecosystems.

Market Outlook:

This is the kind of setup that typically precedes a strong leg up for altcoins. Bitcoin is stable, ETF demand is relentless, dominance is breaking down, and fundamentals across major L1s are surging. Ethereum is benefitting from fresh institutional flows, while Solana and Sui show strong retail activity. With sentiment positive but not overheated, and leverage still contained, the conditions are primed for momentum to continue — especially in high-beta alts and active ecosystems.

BTC Market

Current State of the Bitcoin Market

Bitcoin experienced a slight dip this week, dropping 0.43% to a current price of $118,689.

BTC dominance is at 61.11%, with a decrease of 5.7% over the week.

The Fear and Greed Index remains in the "Greed" zone, with a marginal increase from 68 to 69 over the week and a weekly average of 69.43.

Weekly net ETF inflows totaled $2.3B — another huge weekly inflow in a 6-week trend of strong inflows.

Online interest has continued it’s break to the upside, ending the downtrend that began after the November 2024 spike. This marks the first clear reversal in attention, suggesting renewed momentum may be building.

Interpretation and Future Outlook

Bitcoin is holding strong after only a minor pullback this week, with ETF demand remaining extremely elevated — $2.3B in net inflows continues the six-week streak of heavy institutional buying. This persistent demand provides a solid floor for price action and suggests continued confidence from large players.

Online interest has clearly broken out of its downtrend, but it's not yet near previous peak levels. This indicates that retail awareness is growing, but we're still far from saturation — a setup that often precedes strong continuation in momentum-driven markets.

The Fear and Greed Index is now firmly in “Greed,” but not yet in the “Extreme Greed” zone. This sentiment profile has historically allowed for sustained upside over extended periods before overheating becomes a concern.

With strong structural support from ETFs, improving retail engagement, and sentiment that favors upside without yet flashing warning signs, the conditions are in place for Bitcoin’s momentum to continue.

Altcoin Market

Currently, the altcoin market cap is sitting at $1324 billion. Ethereum makes up approximately 34.2% of the altcoin market cap. The price of Solana (SOL) is $182.16, and the price of Ethereum (ETH) is $3752.42, with the SOL/ETH ratio down 13.0% this week. The altcoin market was very elevated this week, with nearly all of the top 100 coins seeing major price appreciation.

Top 3 Performers (7-day change):

Tezos (XTZ): $1.15 (78.04%)

Curve DAO Token (CRV): $0.98 (46.89%)

Conflux (CFX): $0.16 (46.00%)

Bottom 3 Performers (7-day change):

Pump.fun (PUMP): $0.00 (-38.93%)

Hyperliquid (HYPE): $46.10 (-5.04%)

Pi (PI): $0.45 (-4.47%)

Weekly Chain Metrics

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Base, Unichain, and Arbitum and a just under $400M inflow into Ethereum.

Top chains by TVL: Ethereum $80.8B (+12.4%), Solana $9.7B (+4.3%), Bitcoin $7.0B (+1.4%), BNB Chain $6.7B (+6.3%), Tron $5.9B (+11.3%), Base $4.1B (+7.9%), Arbitrum $2.8B (+7.7%), Sui $2.2B (+10.0%).

Top chains by DEX volume: BNB Chain $65.8B (–13.0%), Solana $20.3B (+38.1%), Ethereum $17.5B (+13.6%), Base $9.1B (+18.2%), Sui $5.13B (+119.5%), Arbitrum $4.98B (+30.2%), Hyperliquid $3.65B (+59.6%), Aptos $1.73B (–13.6%).

Top chains by weekly fees: Hyperliquid $27.3M (+77.3%), Ethereum $17.5M (+78.6%), Tron $14.0M (+0.0%), Solana $10.5M (+15.4%), Bitcoin $4.02M (+11.3%), BNB Chain $2.54M (+9.3%), Base $1.18M (+37.1%), Arbitrum $578.2K (+47.7%), Sui $383.6K (+58.7%).

Interpretation and Future Outlook

Altcoin momentum continued to build this week, with on-chain activity rising across the board and Bitcoin dominance seeing another strong breakdown — a clear signal that capital rotation into alts is accelerating. The shift appears structural, not just tactical: DEX volumes surged, chain fees spiked, and TVL growth remained consistent across ecosystems like Sui, Base, and Hyperliquid.

Ethereum, in particular, is showing renewed strength, bolstered by nearly $400M in inflows — an institutional tailwind that could amplify upside across the broader altcoin market. While Solana lagged ETH slightly this week, the environment still favors high-beta assets with real usage, and SOL remains one of the most active chains on every metric.

With BTC dominance decisively rolling over, growing institutional participation in ETH, and clear on-chain signs of user engagement, the conditions are aligning for a sustained altcoin outperformance phase. If Bitcoin holds trend, this could mark the start of a more explosive second leg for the broader crypto market — one where risk-taking returns, attention fragments, and the long tail begins to run.

Stablecoin Market

Market Capitalization: The stablecoin market cap currently stands at $256.2 billion, reflecting a $2.5 billion decrease over the past week and a $9.9 billion increase over the past 30 days. This marks the possible breakout of the trend that began in November 2024 of decelerating stablecoin supply growth.

Stablecoin Supply Rates:

AAVE: 3.2%-3.6%

Kamino: 4.7%-7.6%

Save Finance: 3.8%–4.7%

JustLend: ~2.9%–3.7% (6.2% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply saw increases across Ethereum, Arbtrum, and BNB, while Sui and Tron experienced outflows.

Token-Specific Changes: USDe, USDT, and USDC saw large supply increases this week, while USDS and BUDL experienced a decrease in supply.

Interpretation and Future Outlook: This week’s $2.5 billion increase represents a slight acceleration from the multi-month trend of positive but decelerating growth. Momentum has been gradually fading since November 2024. While capital continues to trickle in, a meaningful reacceleration seems like it might have materialized.

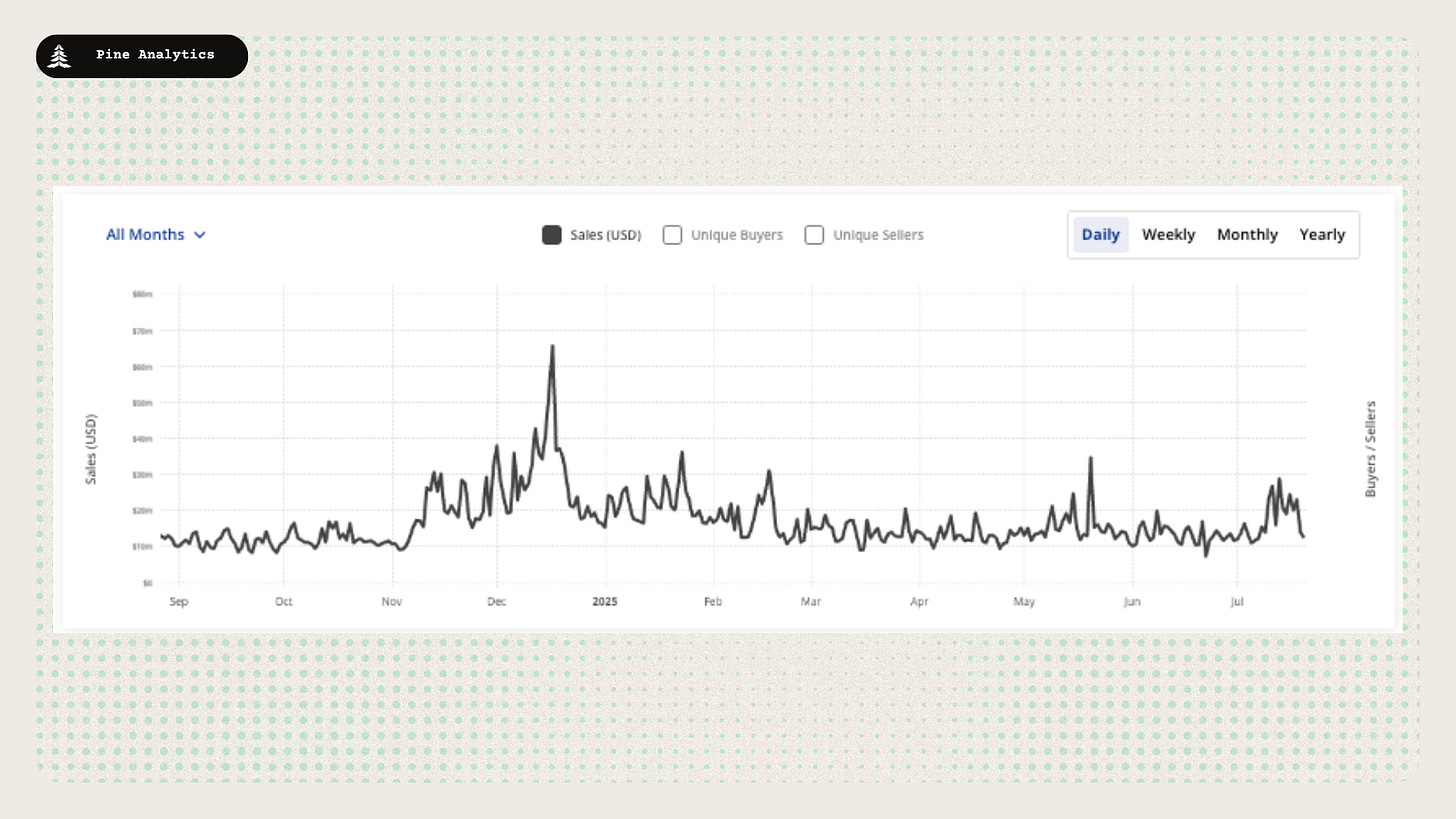

NFT Market

Market Activity:

NFT sales volume dropped over the past week, returning to the multi-month low it has been hovering around. Activity increased on Ethereum, Solana, and Bitcoin, while Polygon and Solana saw decreases.

Top Collections:

Pudgy Penguins have seen a surge in activity this week, with the collection reaching 2nd place in terms of collection volume this week. Notable collections include CryptoPunks, LilPudgys, and BAYC nfts.

Overall Market Trend:

The NFT market experienced a spike in activity in early November, but much of that momentum has since faded. Sales volumes are now in a near their lowest levels since that spike.

CT Mindshare

Plasma Public Sale: Plasma has initiated its public sale of the XPL token, targeting a $50 million raise at a $500 million fully diluted valuation by offering 10% of the total supply. The sale, leveraging Echo's Sonar technology, supports the launch of Plasma's EVM-compatible sidechain and public mainnet beta, providing immediate unlocks for non-US purchasers.

Refelect money joins the Circle Aliance: Reflect Money has joined the Circle Alliance, establishing a direct partnership with Circle to enhance USDC yield generation on the Solana blockchain. This collaboration focuses on supercharging yields within the Solana Virtual Machine ecosystem, offering improved opportunities for users in stablecoin-based finance.

btcSOL Launch: btcSOL has launched as the first Bitcoin restaking model in the Solana ecosystem, allowing users to stake SOL and automatically build exposure to native Bitcoin without manual adjustments. Developed in partnership with Marinade Finance and powered by Zeus Network, this innovation enables dual asset accumulation and went live on July 17, 2025.

Metaplex Genisis anoucement: Metaplex has unveiled Genesis, an onchain protocol for launching tokens on Solana and the Solana Virtual Machine with enhanced customizability, trust, and transparency. The protocol supports independent deployments or integrations into launchpads and applications, backed by developer resources from the Metaplex Foundation to strengthen internet capital markets.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://x.com/i/bookmarks/all?post_id=1812861039517778200=