This Week in Crypto (08/03/25)

Crypto market weekly overview and updates

Market Overview

Macro

U.S. 10-year yields slipping to 4.37 % and a softer DXY at 120.41 point to modestly looser financial conditions, even as investors stay wary of macro noise. WTI crude ~$67.8 signals balanced supply-demand, but any geopolitical jolt could reignite inflation. A weaker yuan (USD/CNY 7.17) underscores emerging-market stress and potential trade headwinds. The main swing factor is a potential Fed pivot if inflation cools or growth stumbles—an outcome that would further pressure the dollar and lift risk appetite. For crypto, lower real rates and a softer greenback already offer a constructive backdrop; upside accelerates once institutions rotate back in search of yield.

Crypto Market Summary

Current State of the Crypto Market: Total crypto market cap at $3.70T with a 1.65% 24h increase, despite 5.27% lower trading volume.

BTC Price Action: BTC trading at $114,055.70 (+1.28% 24h, -4.32% 7d), with the broader market showing resilience despite recent volatility.

BTC/ETH Dominance: BTC dominance ticked up to 61.42% of market share, while ETH holds 11.39%, indicating strong Bitcoin market control.

Institutional Flows: Significant institutional outflows observed: BTC (-$812.3M), ETH (-$152.3M), with SOL showing neutral flows.

Social/Search Trends: Strong retail interest across major cryptocurrencies: BTC (74), altcoins (70), and overall crypto (72), all showing upward momentum.

Fear & Greed Index: Current reading at 53 (-20 points over 7d), indicating neutral market sentiment with recent shift toward caution.

Rotation Bucket Analysis: Rotation score at 51.11, with mid-cap tokens ($10-100B) gaining momentum while large-caps (≥$100B) experience outflows.

Interpretations and Future Outlook

Lower yields and a softer dollar still frame a supportive macro backdrop, but the first weekly Bitcoin-ETF outflow after a multi-week streak of heavy inflows underscores how jittery institutional money has become: they’re locking in gains while retail interest climbs. That pause in ETF demand is likely to keep BTC range-bound near 110–120 k until the next macro catalyst—soft CPI or dovish Fed language—restores conviction. If inflows resume, a swift breakout toward 130 k+ is back on the table; if outflows persist and the dollar punches above 122 on an oil or EM shock, expect a broad de-risking that drags BTC toward the mid-100 k area and reverses the mid-cap rotation. Net, the path still tilts upward, but watch ETF flows as the real-time gut-check on institutional risk appetite.

Chain Use

Data

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Base, Unichain, and Polygon and a just under $270M net inflow into Ethereum.

Top chains by TVL: Ethereum $80.8 B (+12.4%), Solana $9.7 B (+4.3%), Bitcoin $7.0 B (+1.4%), BNB Chain $6.7 B (+6.3%), Tron $5.9 B (+11.3%), Base $4.1 B (+7.9%), Arbitrum $2.8 B (+7.7%), Sui $2.2 B (+10.0%).

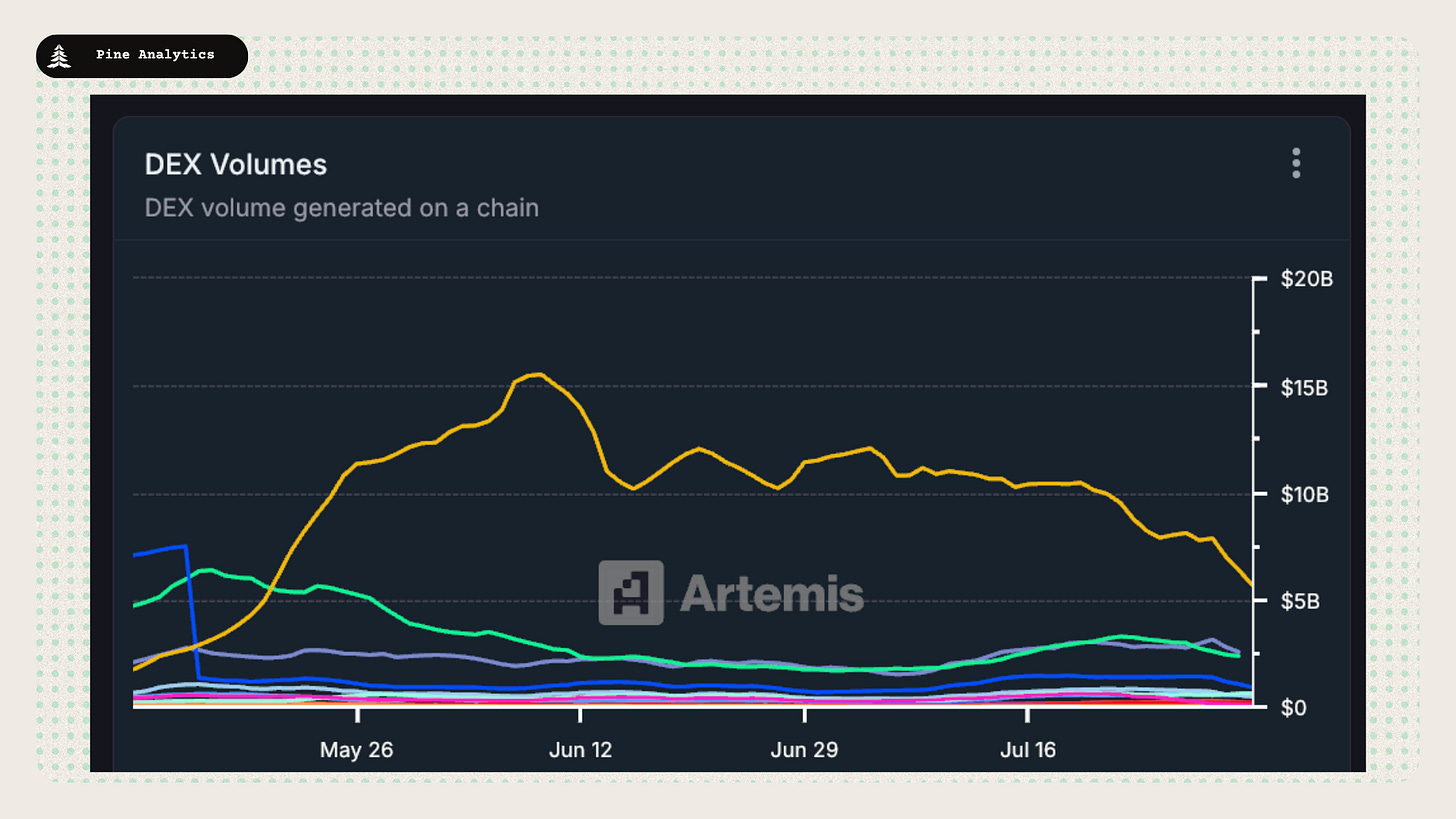

Top chains by DEX volume: BNB Chain $44.8B (–22.0%), Ethereum $18.2B (–7.1%), Solana $16.8B (–25.0%), Base $7.7B (–21.4%), Hyperliquid $4.4B (+8.5%), Sui $3.8B (–2.9%), Arbitrum $3.8B (–35.0%), Avalanche C-Chain $1.7B (+2.1%).

Top chains by weekly fees: Hyperliquid $21.0 M (–23.1 %), Ethereum $14.7 M (–12.5 %), Tron $14.0 M (+5.3 %), Solana $9.1 M (–13.3 %), Bitcoin $3.66 M (–12.0 %), BNB Chain $2.43 M (–8.6 %), Base $1.73 M (+33.3 %), Arbitrum $385.0 K (–30.3 %), Sui $354.2 K (–7.2 %).

Interpretations and Future Outlook

Liquidity is quietly rotating back to Ethereum: a ~$270 M net bridge inflow plus a 12 % TVL jump signal renewed confidence in the main chain’s security heading into the fall catalyst window (e.g., L2-driven staking upgrades, ETF hype). Meanwhile, trading activity is cooling—DEX volumes fell across every top chain except Hyperliquid and Avalanche—pointing to thinner speculative flows after July’s risk-on burst. Fee data corroborates the slowdown: headline earners like Hyperliquid, Ethereum, and Solana all posted double-digit revenue declines, while low-cost venues (Base +33 %, Tron +5 %) picked up incremental usage. Net-net, the market is shifting from a velocity-driven rally to a consolidation phase where capital gravitates toward high-liquidity hubs and cheaper execution layers.

App Revenue

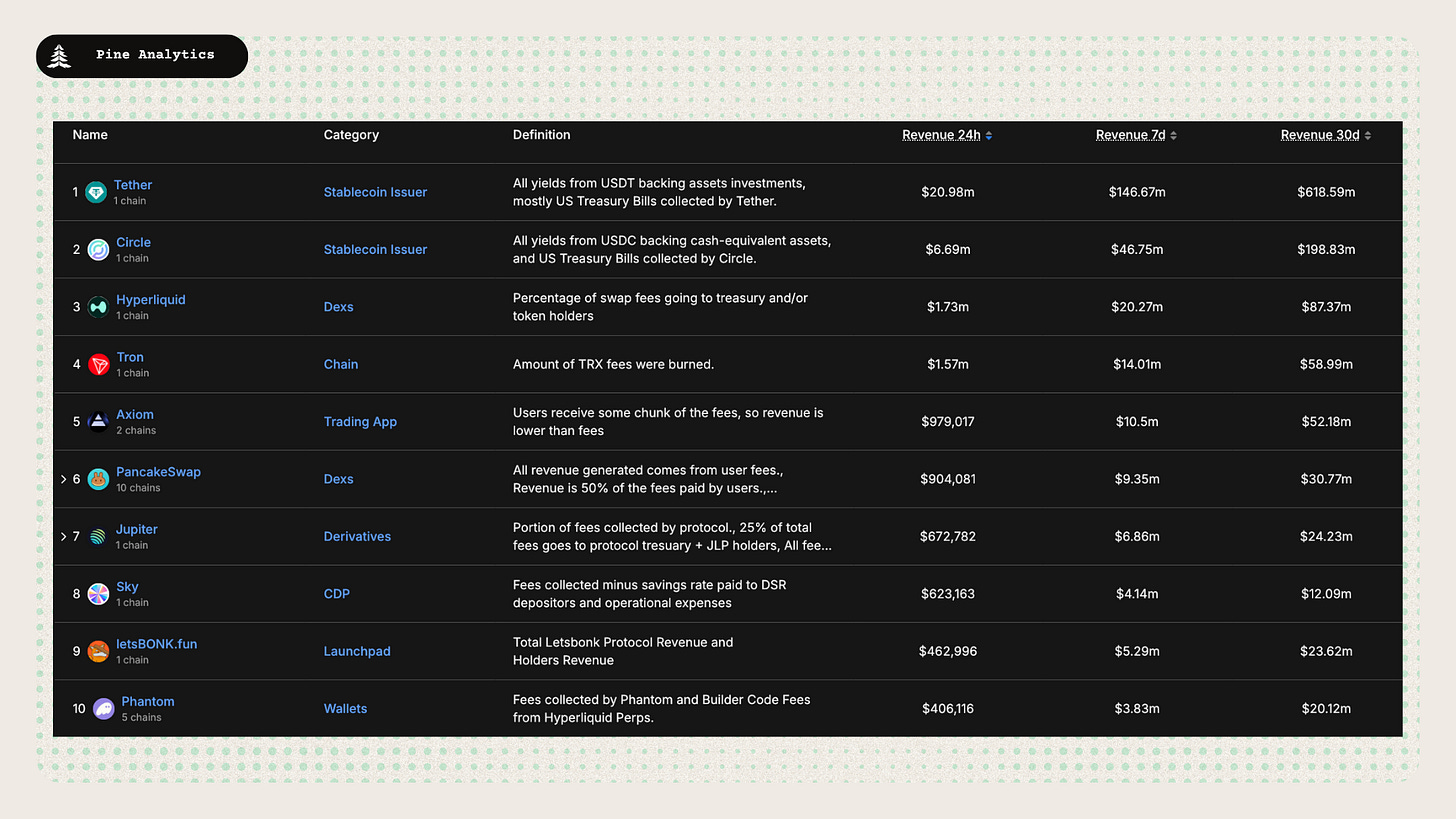

Crypto-app revenues remain extremely top-heavy. Fiat-backed stablecoin issuers capture the lion’s share—Tether alone mints roughly $21 million a day (>$600 million run-rate) from T-bill yield, with Circle following at about one-third that scale. Below this duo, only a handful of high-velocity trading venues (Hyperliquid, Axiom, PancakeSwap, Jupiter) and fee-burning L1s (Tron, Ethereum) break into the double-digit-million monthly bracket; everything else falls into a long tail of launchpads, DEXs, wallets, and niche DeFi apps earning single-digit millions or less. The pattern underscores a bar-bell market: massive off-chain yield capture at the top, a fiercely competitive long tail at the bottom, and a shrinking middle class of protocols fighting for share.

Drilling into the long-tail (ranks 80-100) and comparing weekly to monthly revenue separates genuine growers from one-off fee spikes. Stand-outs like mETH Protocol (weekly $82 k ≈ 56 % of its 30-day total), Convex Finance (41 %), four.meme (38 %), Railgun (36 %) and even marketplace stalwart OpenSea (35 %) are posting outsized weekly contributions—evidence of fresh traction that could vault them into the mid-tier if sustained. By contrast, Pharaoh Exchange (15 %), Launch Coin on Believe (16 %) and Arbitrum Timeboost (17 %) generated only a sliver of their monthly intake this week, hinting that earlier bursts of activity are fading. In aggregate, roughly one-third of tail-end protocols are accelerating, while the rest still rely on episodic volume pops,

Stablecoin Metrics

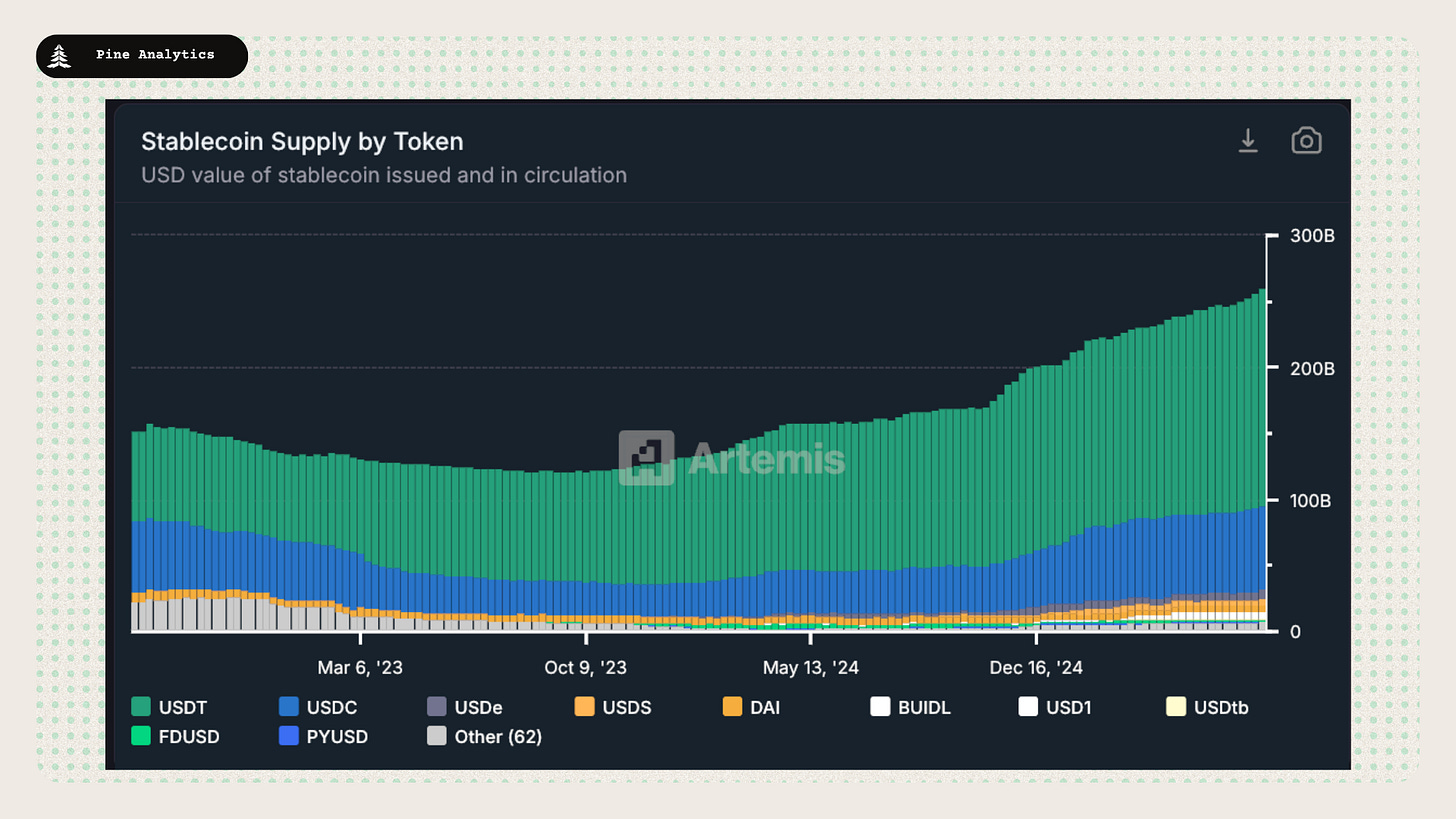

Market Capitalization: The stablecoin market cap currently stands at $261.7 billion, reflecting a $1.3 billion decrease over the past week and a $11.2 billion increase over the past 30 days. This marks the possible breakout of the trend that began in November 2024 of decelerating stablecoin supply growth.

Stablecoin Supply Rates:

AAVE: 4%-4.2%

Kamino: 3.8%-6%

Save Finance: 3.6%–5%

JustLend: ~2.2%–3.2% (5.65% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply saw increases across Ethereum, Tron, and TON, while Solana and Sei experienced outflows.

Token-Specific Changes: USDe, USDT, USDf, and USDS saw large supply increases this week, while USDC a large decrease in supply.

Interpretation and Future Outlook: This week’s $1.3 billion increase represents a slight acceleration from the multi-month trend of positive but decelerating growth. Momentum has been gradually fading since November 2024. While capital continues to trickle in, a meaningful reacceleration seems like it might have started materialized.

NFT Market

Market Activity:

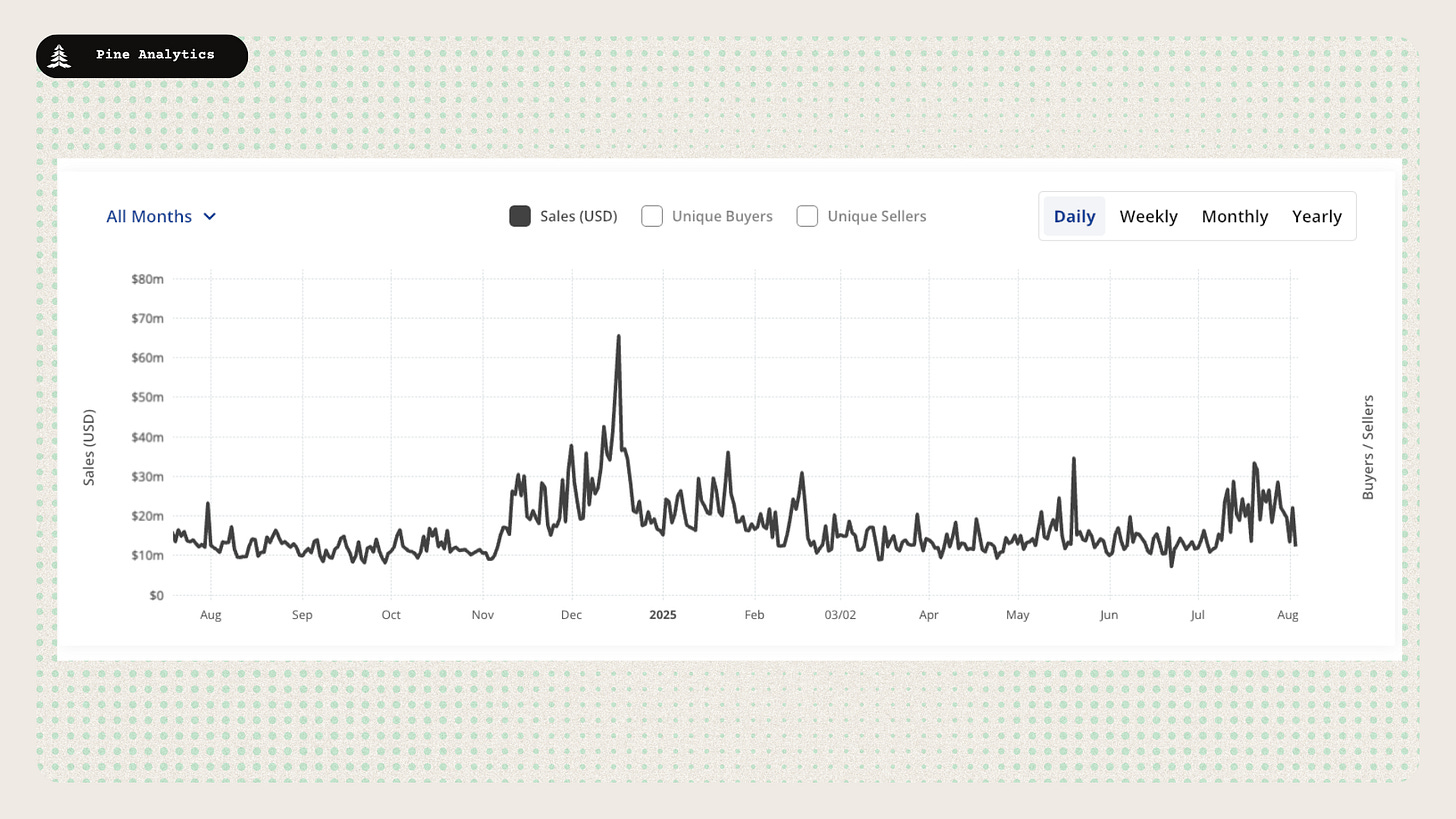

NFT sales volume dropped over the past week, returning to the multi-month low it has been hovering around. Activity increased on Polygon and BnB, while Ethereum, Solana, and Bitcoin saw decreases.

Top Collections:

SpinNFTBox have seen a surge in activity this week, with the collection reaching 8th place in terms of collection volume this week. Notable collections include Sorare, Courtyard, and DKTNFTs.

Overall Market Trend:

The NFT market experienced a spike in activity in early November, but much of that momentum has since faded. Sales volumes are now in a near their lowest levels since that spike.

CT Mindshare

$OMFG ICO: The $OMFG ICO for Omnipair, a novel Generalized Automated Market Maker on Solana, raised over $1.1 million in a fair launch with no team allocations, VCs, or shady tokenomics, achieving instant liquidity and a post-launch market cap of around $3.9 million. This project introduces permissionless leverage on long-tail assets through a futarchy-governed model, backed by MetaDAO and attracting attention for its capital-efficient liquidity mechanisms.

Orca announced their launchpad: Orca has unveiled Wavebreak, a human-first launchpad for Solana tokens that integrates CAPTCHA to prioritize real users over bots, enabling fair launches with instant liquidity and trader rewards. Set to reduce sniper activity and promote integrity, the platform allows tokens to launch in minutes while fostering equitable participation and ongoing improvements based on community feedback.

Native USDC announced on Hyperliquid: Circle has announced the integration of native USDC and CCTP V2 on Hyperliquid, bringing a regulated, fully reserved stablecoin redeemable 1:1 for US dollars to the performance-focused blockchain. This upgrade supports seamless cross-chain transfers and enhances DeFi applications, providing improved liquidity and accessibility for users on Hyperliquid.

JITO launched BAM: Jito has launched BAM, the Block Assembly Marketplace, to redefine Solana's blockspace economy with verifiable fairness, app-controlled execution, and decentralized plugins that eliminate sandwich attacks and enable programmable transaction ordering. This innovation redirects value to builders, supports institutional-grade execution, and opens new possibilities for fair launches and infrastructure scaling on Solana.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://x.com/i/bookmarks/all?post_id=1812861039517778200=