This Week in Crypto (08/10/25)

Crypto market weekly overview and updates

Executive Summary

Global macro conditions are creating a quietly bullish backdrop for risk assets, with stable rates, a weakening dollar, and falling energy costs fostering liquidity expansion. In crypto, the $3.97T market cap is buoyed by strong BTC and ETH inflows, a rotation toward mid-cap assets, and rising retail participation—conditions often preceding accelerated upside. Capital is reallocating toward ecosystems like Arbitrum, Base, and Bearachain, while Ethereum remains the liquidity anchor and Sui emerges as a fast riser despite volume pullbacks. Stablecoin supply growth has re-accelerated, adding $4.3B in the past week, with issuers Tether and Circle dominating revenue. NFT markets show modest recovery, DeSci tokens are surging, and new innovations like Solana’s PreStocks expand tokenized asset access. Regulatory tailwinds in the U.S., including 401(k) crypto access and protections against debanking, add further momentum to an already supportive environment—setting the stage for continued capital rotation and potential breakout in high-quality altcoins.

Market Overview

Macro

Macro conditions are setting up a quietly bullish backdrop for long-tail risk assets. The U.S. 10-year yield at 4.23% reflects a stable rates environment without imminent inflation or recession pressure, while the DXY’s drift below 100 signals easing dollar strength—removing a key headwind for global liquidity. Crude oil’s slide to $63.58 points to softening input costs, and record-high gold above $3,450 shows investors are still hedging but not fleeing risk entirely. With energy prices down, the dollar softening, and policy rates anchored, liquidity conditions are loosening beneath the surface. This is exactly the type of macro setup where capital starts rotating out the risk curve, meaning long-tail assets are poised to outperform unless an exogenous shock breaks the current equilibrium.

Crypto Market Summary

Current State of the Crypto Market: Total crypto market shows strength at $3.97T (+0.83% 24h), with broad-based momentum across major assets.

BTC Price Action: BTC trades at $118,572.33 (+1.66% 24h, +3.54% 7d), pushing total market cap to $2.36T with continued upward pressure.

BTC/ETH Dominance: BTC dominance dropped significantly to 59.51% of market share, while ETH shot up to12.92%.

Institutional Flows: Strong institutional engagement with BTC ($403.9M inflows), ETH ($461.0M inflows), and modest SOL activity ($6.4M inflows).

Social/Search Trends: Retail interest metrics show strong momentum with BTC at 81/100 and broader crypto interest rising, indicating growing mainstream attention.

Fear & Greed Index: Current reading of 69 (+16 from last week) signals "Greed," reflecting increasingly bullish market sentiment.

Rotation Bucket Analysis: Rotation score of 75 shows capital flowing primarily into mid-cap assets, while smaller caps experience outflows.

Interpretations and Future Outlook

The macro backdrop is tilting in favor of risk-on positioning, with stable rates, a softening dollar, and easing input costs creating fertile ground for liquidity expansion. In crypto, that macro tailwind is aligning with a clear rotation pattern—capital is moving down the risk curve from BTC into ETH and mid-caps, as shown by ETH’s dominance jump and the rotation score of 75. Strong institutional inflows into BTC and ETH signal that large players are positioning for continued upside, while retail participation, as reflected in search and social metrics, is climbing rapidly—often a precursor to parabolic phases in bull markets.

With the Fear & Greed Index spiking to 69, sentiment is entering a greed-driven momentum phase, but it’s still shy of the euphoric extremes that typically mark cycle tops. BTC’s steady climb above $118K, combined with broad market strength and rising mid-cap inflows, suggests the next leg of the rally could be led by high-quality altcoins. Given the supportive macro environment and the rotation already underway, the path of least resistance for the coming weeks leans bullish—particularly for assets that can capture both institutional capital and retail narrative flow before liquidity begins spilling into the smaller-cap, high-beta segment.

Chain Use

Data

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Optimism, Unichain, and Linea and large inflows into Arbitrum, Base, and Bearachain.

Top chains by TVL: Ethereum $87.8 B (+7.2%), Solana $10.2 B (+6.3%), Tron $6.1 B (+3.4%), Base $4.5 B (+9.8%), Sui $4.3 B (+115.0%), Arbitrum $3.1 B (+6.9%), Hyperliquid $2.0 B (+5.3%), Avalanche C-Chain $2.0 B (+5.3%).

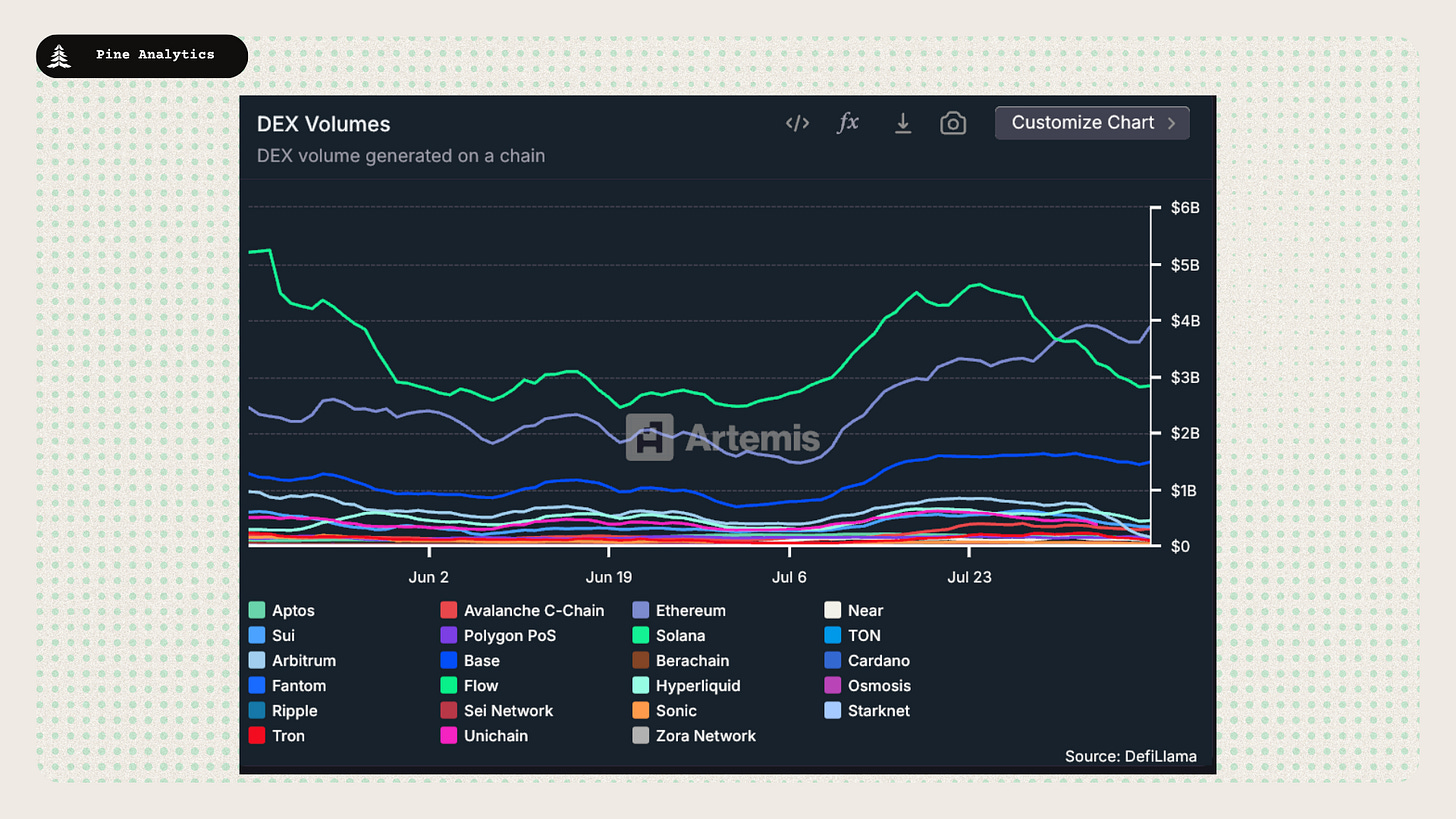

Top chains by DEX volume: Ethereum $27.3B (0.0%), Solana $19.6B (–22.2%), Base $10.5B (–6.3%), Hyperliquid $3.13B (–30.1%), Sui $2.37B (–35.2%), Arbitrum $1.10B (–79.0%), Avalanche C-Chain $2.12B (–17.3%), Tron $670.0M (–56.5%).

Top chains by weekly fees: Hyperliquid $18.9M (–10.0%), Tron $14.0M (0.0%), Ethereum $10.5M (–28.6%), Solana $7.0M (–23.1%), Base $1.13M (–34.7%), Arbitrum $275.8K (–28.2%), TON $121.1K (+4.2%), Abstract $110.6K (–13.2%).

Interpretations and Future Outlook

Bridge flow patterns this week highlight a notable reallocation of capital from Optimism, Unichain, and Linea into Arbitrum, Base, and Bearachain—signaling a shift toward ecosystems perceived to have stronger near-term catalysts or more competitive execution environments. Ethereum continues to reinforce its position as the primary liquidity hub with a 7.2% TVL gain and stable DEX volume, while Sui’s 115% TVL surge cements its status as a fast-rising challenger despite sharp pullbacks in trading activity. Conversely, Solana, Arbitrum, and Tron all posted steep volume declines, indicating a broad cooldown in speculative flows even as their TVLs remain resilient. Fee trends confirm this slowdown, with nearly all major earners—Ethereum, Solana, Base—seeing double-digit revenue drops, suggesting that current capital inflows are being parked in DeFi positions rather than actively deployed in high-turnover trading.

App Revenue

Revenue Concentration

The cryptocurrency application ecosystem exhibits extreme revenue concentration, with stablecoin issuers dominating the market landscape. Tether and Circle alone command nearly 69% of all 24-hour revenue, generating $21.05 million and $6.81 million respectively out of the total $40.42 million market. This concentration becomes even more pronounced when examining the top five revenue generators—Tether, Circle, Hyperliquid, Axiom Pro, and Pump—which collectively account for 83.3% of daily revenue. The dominance of stablecoin issuers reflects their critical infrastructure role in the crypto ecosystem, while trading and derivatives platforms like Hyperliquid ($2.6m) and Axiom Pro ($1.8m) represent the next tier of revenue generators, though at significantly lower levels.

Short-term Revenue Surges (24h vs 7-day average)

DoubleUp (Prediction Market): 504% spike above normal daily average

KGeN (SoFi): 168% increase in daily revenue

MetaMask (Wallet): 75% above typical daily performance

Meteora: 36% increase over 7-day average

Aerodrome (DEX): 41% daily revenue spike

Long-term Growth Leaders (30-day vs yearly monthly average)

Blackhole: Explosive 1,100% increase above historical monthly average

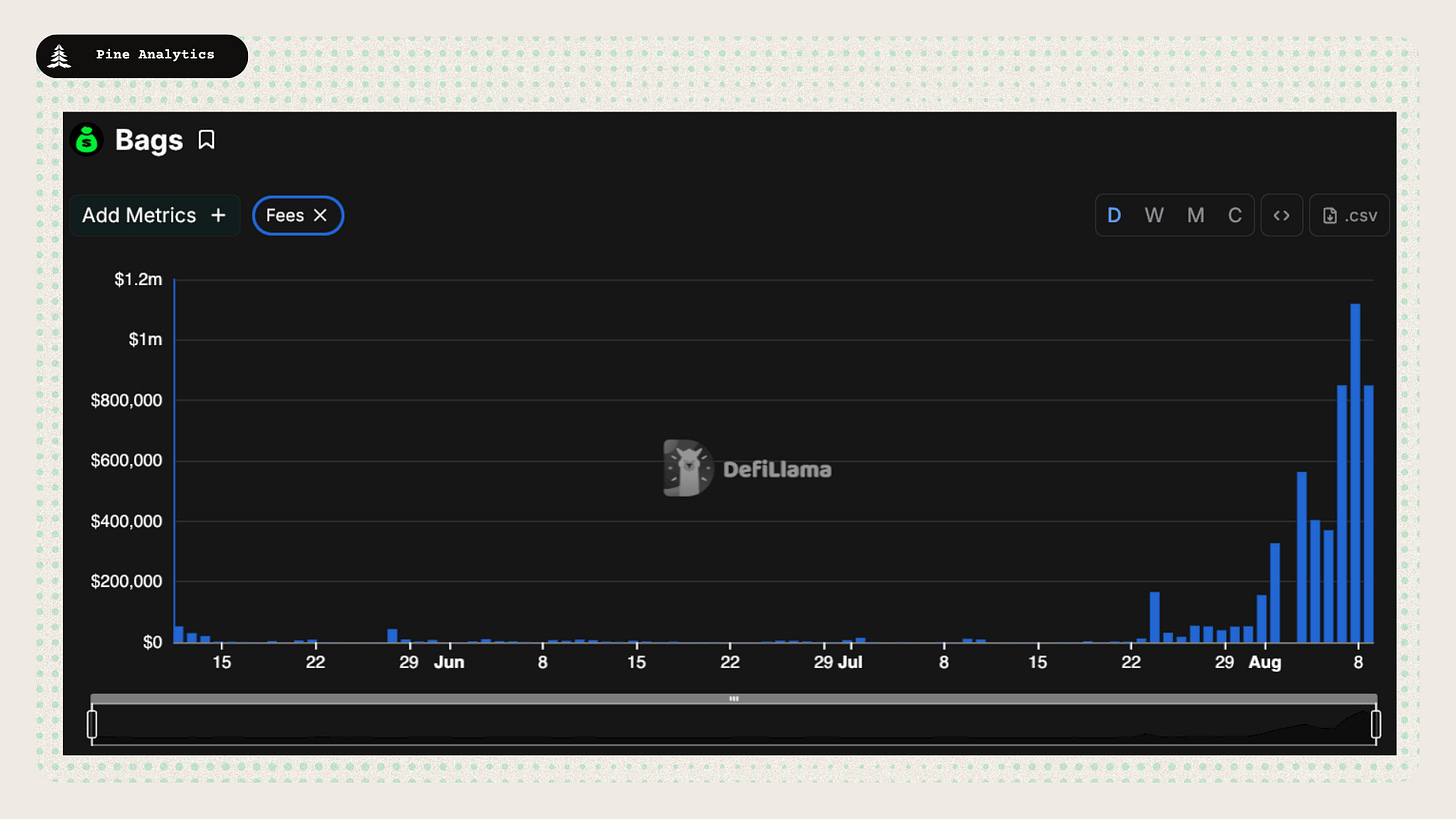

Bags (Launchpad): 1,037% growth indicating massive adoption

KGeN: 765% above typical monthly performance

edgeX (Derivatives): 449% increase suggesting strong derivatives demand

Ethena: 453% growth in recent month

Meteora: Sustained 338% above historical averages

Stablecoin Metrics

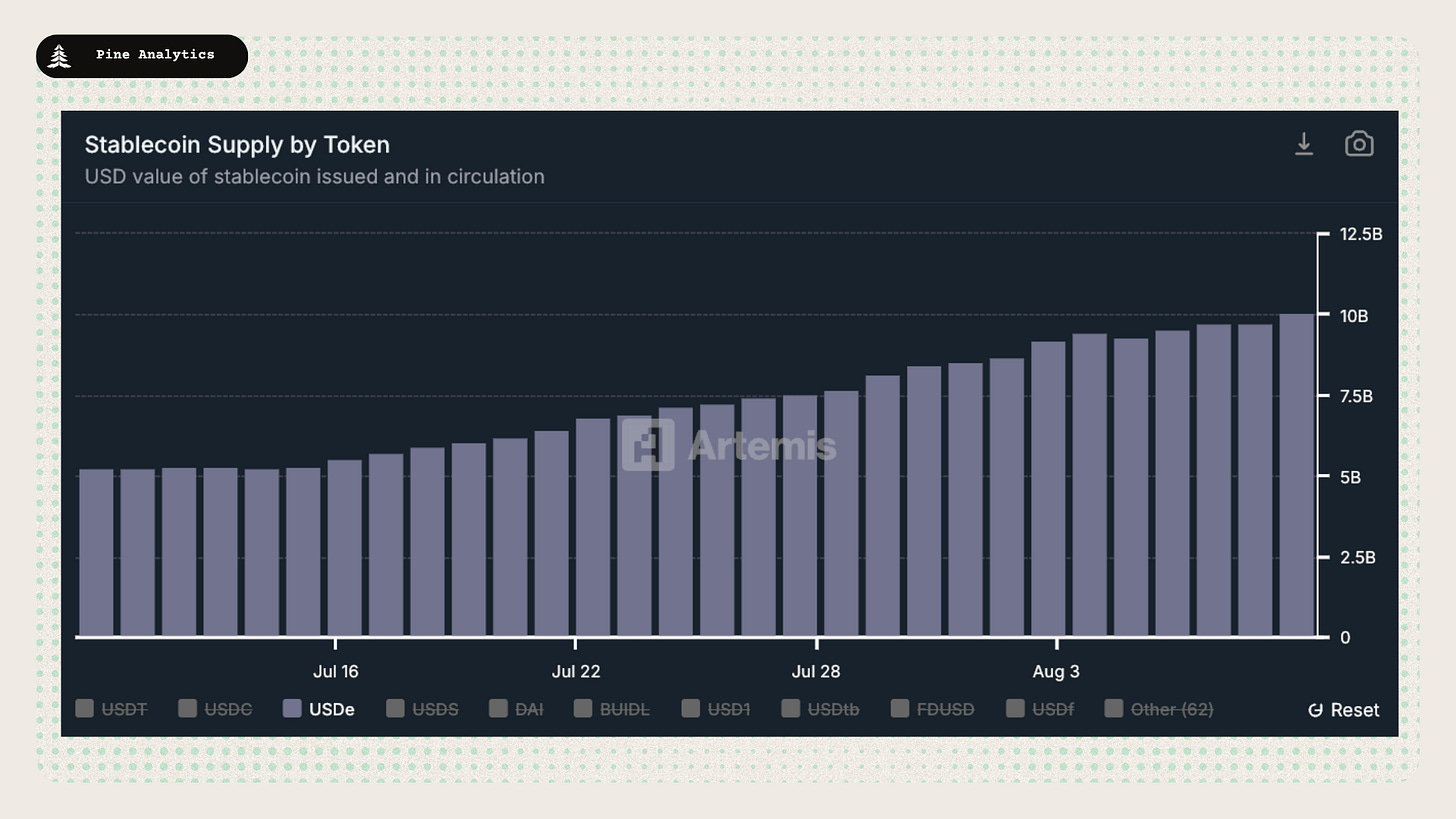

Market Capitalization: The stablecoin market cap currently stands at $266.4 billion, reflecting a $4.3 billion increase over the past week and a $16 billion increase over the past 30 days. This marks a breakout of the trend that began in November 2024 of decelerating stablecoin supply growth.

Stablecoin Supply Rates:

AAVE: 4%-4.3%

Kamino: 3.5%-7.5%

Save Finance: 4.1%–4.8%

JustLend: ~2.3%–4.2% (5.31% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased on Ethereum, Tron, and Solana, while Aptos and Polygon saw outflows. Notably, the growth on Ethereum has been massive.

Token-Specific Changes: USDe, USDT, USDS, and USDS saw large supply increases this week, while USDC experienced a large decrease. The supply increase of USDe was especially notable at $1.4B.

Interpretation and Future Outlook: This week’s $4.3 billion increase marks an acceleration from the multi-month trend of positive but slowing growth. Momentum had been gradually fading since November 2024, but there’s been a re-acceleration over the past month.

NFT Market

Market Activity:

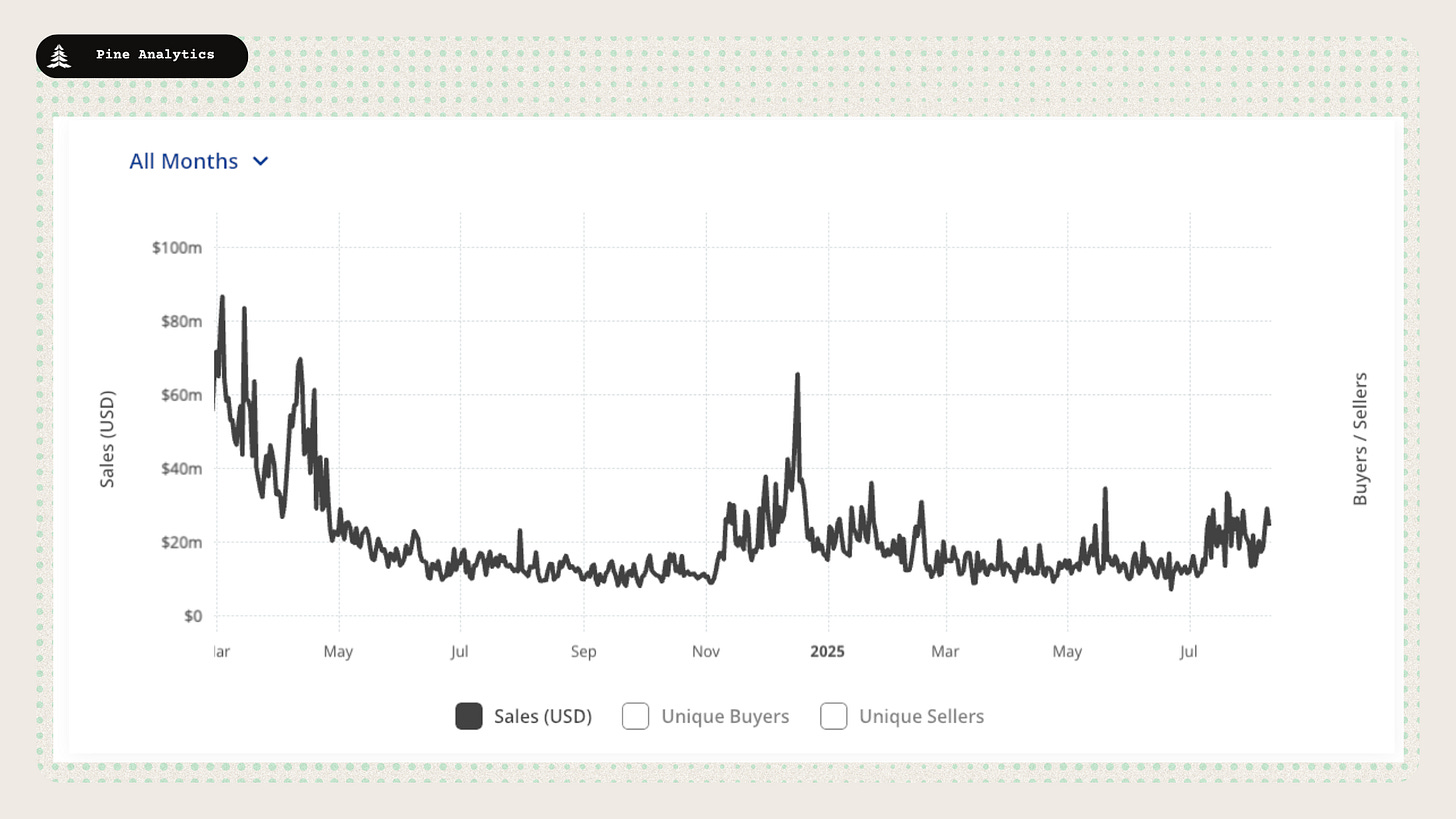

NFT sales volume shot up over the past week, continuing a uptrend that has been live for about a month. Activity increased on Ethereum, Polygon and BnB, while Bitcoin and Solana saw decreases.

Top Collections:

Pudgy Penguins have seen a surge in activity this week, with the collection reaching 3rd place in terms of collection volume this week. Notable collections include SpinNFTBox, Guild of Guardians, and Nakamigos.

Overall Market Trend:

The NFT market saw a spike in activity in early November 2024, but much of that momentum has since faded. There has been a modest uptrend in sales activity over the past month, but it remains limited.

CT Mindshare

DeSci Token Appreciation: DeSci tokens experienced notable price surges over the past week, with Bio Protocol (BIO) leading at a 95.5% increase to $0.1148 and VitaDAO (VITA) rising 48% to $1.83, signaling a potential comeback for decentralized science projects amid growing market interest. Other tokens like HairDAO (HAIR) and ValleyDAO (GROW) also appreciated significantly, up 31.9% and 37.9% respectively, highlighting renewed enthusiasm in the sector.

PreStock Launch on Solana: PreStocks has officially launched on the Solana blockchain, allowing users to trade tokenized pre-IPO stocks of high-profile private companies like SpaceX, OpenAI, Neuralink, and Discord through seamless, 24/7 access via platforms like Jupiter. This innovation democratizes private market investments, leveraging Solana's speed and low costs to bring tokenized assets to a broader audience.

401Ks can now buy Crypto: President Trump has signed an executive order permitting 401(k) retirement accounts to invest directly in Bitcoin and other cryptocurrencies, unlocking potentially trillions in new liquidity from U.S. household wealth.

Executive order to stop debanking crypto: President Trump issued an executive order to halt the "unlawful debanking" of the Bitcoin and crypto industry, prohibiting banks and regulators from discriminating against crypto firms based on political or reputational biases.