Executive Summary

Macro & Market Overview

The backdrop is turning quietly risk-on. A softer dollar (DXY under 98), record gold prices, steady long rates (10Y at 4.3%), and cheaper oil ($62) are easing inflation pressure and improving liquidity—conditions that have historically supported crypto.

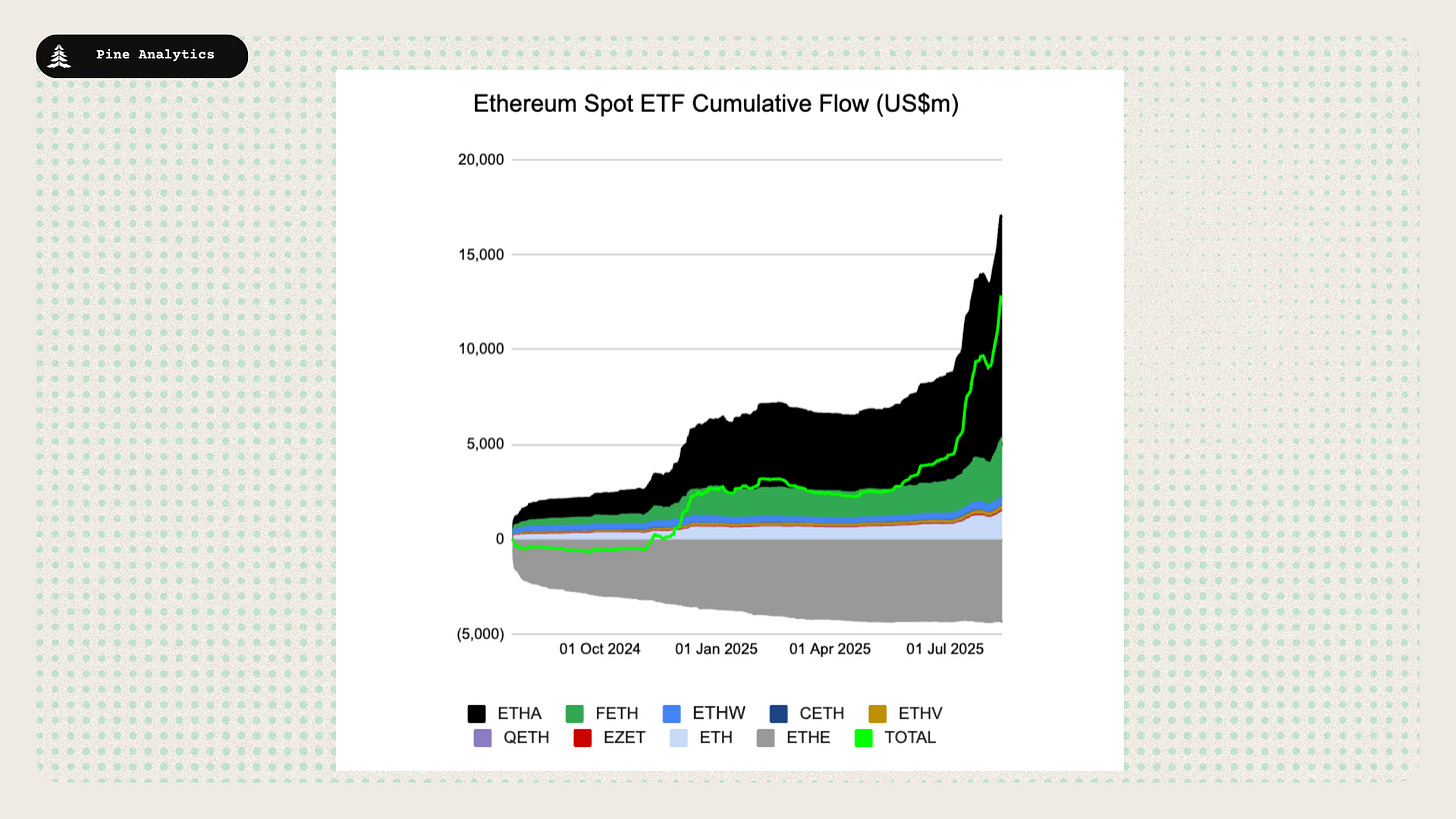

The total market cap sits at $4.01T (+0.8% on the day). Bitcoin is consolidating around $117.9k, with dominance slipping to 58.6% as capital rotates into ETH (13.6% share) and mid-caps. ETF flows back this shift, with ETH leading (+$2.8B) alongside BTC (+$547.6M) and SOL (+$25.6M).

On-Chain Trends

Ethereum and Solana remain the activity centers, while Base is steadily gaining ground. Hyperliquid stands out with weekly fees up 80% and volume up 79%. Stablecoin supply is re-accelerating, up $6.4B on the week and $17.4B on the month to $273.3B, led by USDe (+$1.2B), USDT, and USDC. Growth is concentrated on Ethereum, Arbitrum, and Solana, while Tron and Sui continue to lose ground.

Ecosystem Revenue & Segments

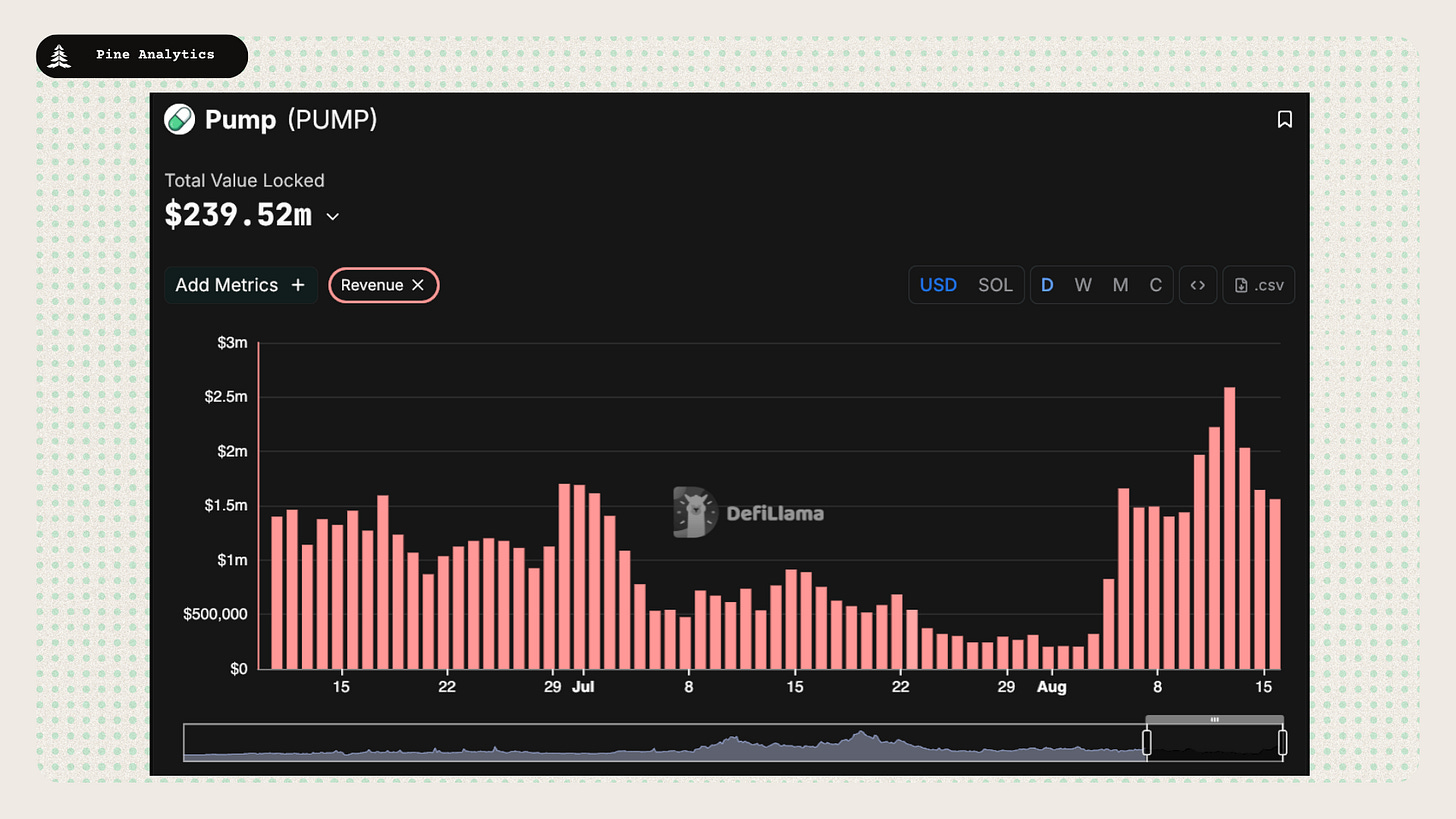

App revenue remains concentrated, with Tether and Circle capturing about 70% of daily revenue. Trading platforms like Pump and Hyperliquid make up most of the second tier.

Risks & Rotations

Still, the base case is continued capital rotation out of BTC and into ETH and high-quality mid-caps. The strongest ecosystems are those showing gains across TVL, volumes, and fees—right now, that points to Ethereum, Solana, and Base.

Market Overview

Macro

Based on the data, the most likely view is bullish for crypto and other risk assets in the next leg. The Dollar Index breaking down below 98 signals structural dollar weakness, while gold’s rally to record highs shows capital is already moving into non-sovereign stores of value. The yield curve remains inverted, but with long-end yields grinding higher and the 10Y stable around 4.3%, the bond market is signaling normalization rather than imminent crisis. Crude oil at $62 reflects weak global demand and easing input costs, which reduces inflation pressure and opens room for easier liquidity. Taken together: the dollar is weakening, hard assets are strengthening, and rates are stabilizing — conditions that historically precede risk-on rotations. The single best macro metric to watch for anticipating a regime shift remains the U.S. Dollar Index (DXY), as dollar strength or weakness consistently leads global liquidity flows and risk appetite.

Crypto Market Summary

Current State of the Crypto Market: Total crypto market cap stands at $4.01T, up 0.80% in 24h, showing continued strength in the broader market.

BTC Price Action: BTC trades at $117,851, with minimal movement (-0.51% 7d, +0.06% 24h), suggesting consolidation at these levels.

BTC/ETH Dominance: BTC dominance dropped to 58.56% while ETH continues up to 13.61%, indicating Bitcoin's strength is weakening relatively.

ETF Flows: BTC recorded significant inflows of $547.6M, while ETH saw inflows of $2.8B and SOL attracted $25.6M in institutional capital.

Social/Search Trends: BTC search interest is moderately bullish at 55 (34.15% momentum), while altcoin interest shows stronger momentum at 63 (57.5% growth).

Fear & Greed Index: Current reading of 64 (up from 56) signals "Greed," reflecting growing market optimism.

Rotation Bucket Analysis: Rotation score of 65 indicates capital flow favoring mid-caps, while large-caps maintain stability.

Interpretations and Future Outlook

The macro backdrop points toward a constructive environment for risk assets, with crypto positioned to benefit most from renewed liquidity expansion. The breakdown in the Dollar Index below 98 is the clearest leading indicator, signaling a weakening dollar cycle that historically supports sustained capital rotation into alternatives like Bitcoin and gold. At the same time, gold’s strength confirms broad demand for non-sovereign stores of value, reinforcing crypto’s narrative as a parallel asset class. With oil subdued and Treasury yields stable, inflationary pressures are not forcing central banks into tighter policy, leaving the door open for easier liquidity conditions.

Within crypto markets, the data shows consolidation at the top of the cycle. Bitcoin’s stability around $118K, combined with declining dominance, suggests capital is beginning to rotate into Ethereum and mid-cap assets. ETF flows reinforce this pattern: Bitcoin remains the primary institutional vehicle, but smaller flows into SOL and other assets show broadening risk appetite. Social sentiment and search trends confirm this shift, with stronger momentum outside of BTC. The Fear & Greed Index moving deeper into “Greed” suggests optimism is building, though it also raises the probability of volatility spikes as positioning becomes more crowded.

Looking ahead, the most probable path is one of continued rotation from Bitcoin into Ethereum and mid-cap alts, supported by institutional flows and a favorable macro regime. Volatility should be expected as the market digests these rotations, but with the dollar weakening and real assets strengthening, the structural bias remains higher.

Chain Use

Data

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Optimism, Unichain, and Linea and large inflows into Ethereum, Polygon, and Solana.

Top chains by TVL: Ethereum $91.9B (+4.2%), Solana $10.7B (+2.9%), Tron $6.3B (+3.3%), Base $4.8B (+6.7%), Arbitrum $3.2B (+3.2%), Sui $2.1B (-51.2%), Hyperliquid $2.1B (+5.0%), Avalanche C-Chain $1.9B (-5.0%).

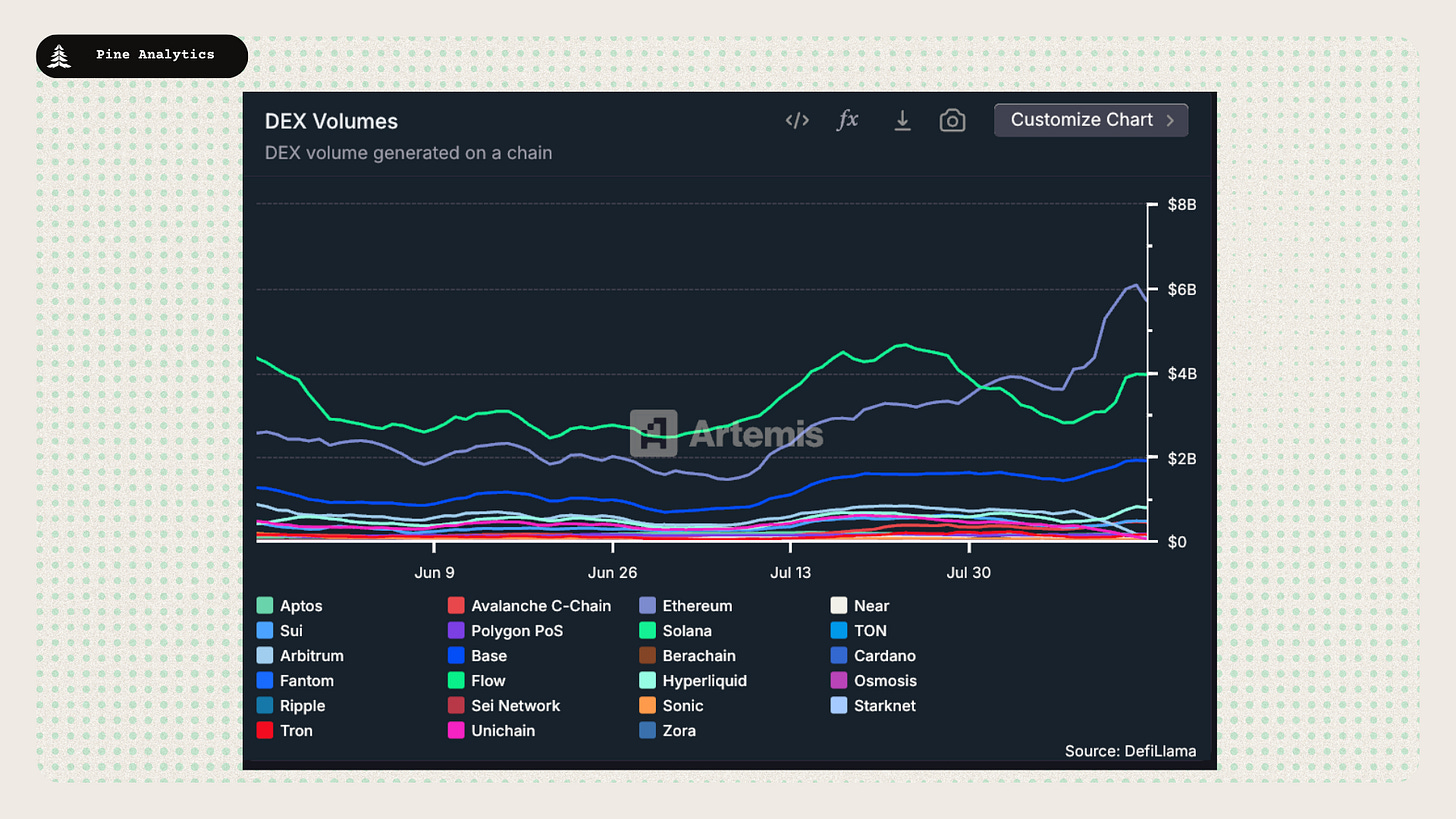

Top chains by DEX volume: Ethereum $42.7B (+69.4%), Solana $28.0B (+42.9%), Base $13.3B (+35.7%), Hyperliquid $5.78B (+79.2%), Sui $3.40B (+42.4%), Avalanche C-Chain $3.30B (+65.0%), Arbitrum $1.23B (–74.2%), Polygon PoS $1.21B (+12.4%).

Top chains by weekly fees: Hyperliquid $31.5M (+80.0%), Ethereum $20.3M (+70.6%), Tron $15.4M (+10.0%), Solana $11.2M (+23.1%), Base $1.86M (+49.7%), Arbitrum $652.0K (+116.0%), Unichain $168.7K (+49.7%), Avalanche C-Chain $166.0K (+47.2%).

Interpretations and Future Outlook

On-chain activity is consolidating around Ethereum and Solana, both of which show steady TVL growth paired with strong volume and fee momentum. Ethereum continues to anchor liquidity with the largest inflows, while Solana benefits from rising usage and capital flows as the leading high-throughput chain. Base is also outperforming, with solid gains across TVL, trading volume, and fees, showing it is capturing a growing share of flows.

Hyperliquid stands out as the fastest-growing execution venue, leading all chains in both volume (+79%) and fee growth (+80%), suggesting it is becoming a hotspot for speculative trading.

On the underperforming side, Sui is the weakest performer: despite volume and fee growth, its TVL collapsed by more than 50%, showing unstable or short-term capital. Arbitrum presents a mixed picture—while fee growth was strong (+116%), its DEX volume fell sharply (–74%), reflecting fading speculative activity. Avalanche also struggled, with TVL and inflows turning negative despite a rebound in volume and fees.

App Revenue

Revenue Concentration

The cryptocurrency application ecosystem demonstrates extreme revenue concentration, with stablecoin issuers commanding an overwhelming market share. Tether and Circle alone generate $28.29 million in combined 24-hour revenue ($21.18m and $7.11m respectively), representing approximately 70% of the top protocols' daily revenue. This duopoly in stablecoin infrastructure dwarfs all other revenue sources, with Tether's daily revenue exceeding the combined revenue of the next eight protocols. The top five revenue generators—Tether, Circle, Tron, Pump, and Hyperliquid—collectively account for over 80% of the market's daily revenue, highlighting the ecosystem's dependency on a handful of critical infrastructure providers and high-volume trading platforms.

Short-term Revenue Surges (24h vs 7-day daily avg)

DODO (DEX; swap fees to treasury/holders): +406% — $0.18m today vs $0.04m 7D daily avg.

Aave (Lending; share of market fees to treasury): +6% — $0.48m vs $0.45m.

Circle (Stablecoin issuer; yield on USDC reserves): +3% — $7.11m vs $6.90m.

Tether (Stablecoin issuer; yield on USDT reserves): +1% — $21.18m vs $21.05m.

Medium-term Growth Leaders (7-day vs 30-day daily avg)

Pump (Launchpad, Solana; 0.05% protocol fee per trade): +113%

Bags (Launchpad; protocol fees on launches): +92%

DODO (DEX; swap fees to treasury/holders): +74%

Phantom (Wallet; app fees + Hyperliquid perps frontend fees): +48%

Stablecoin Metrics

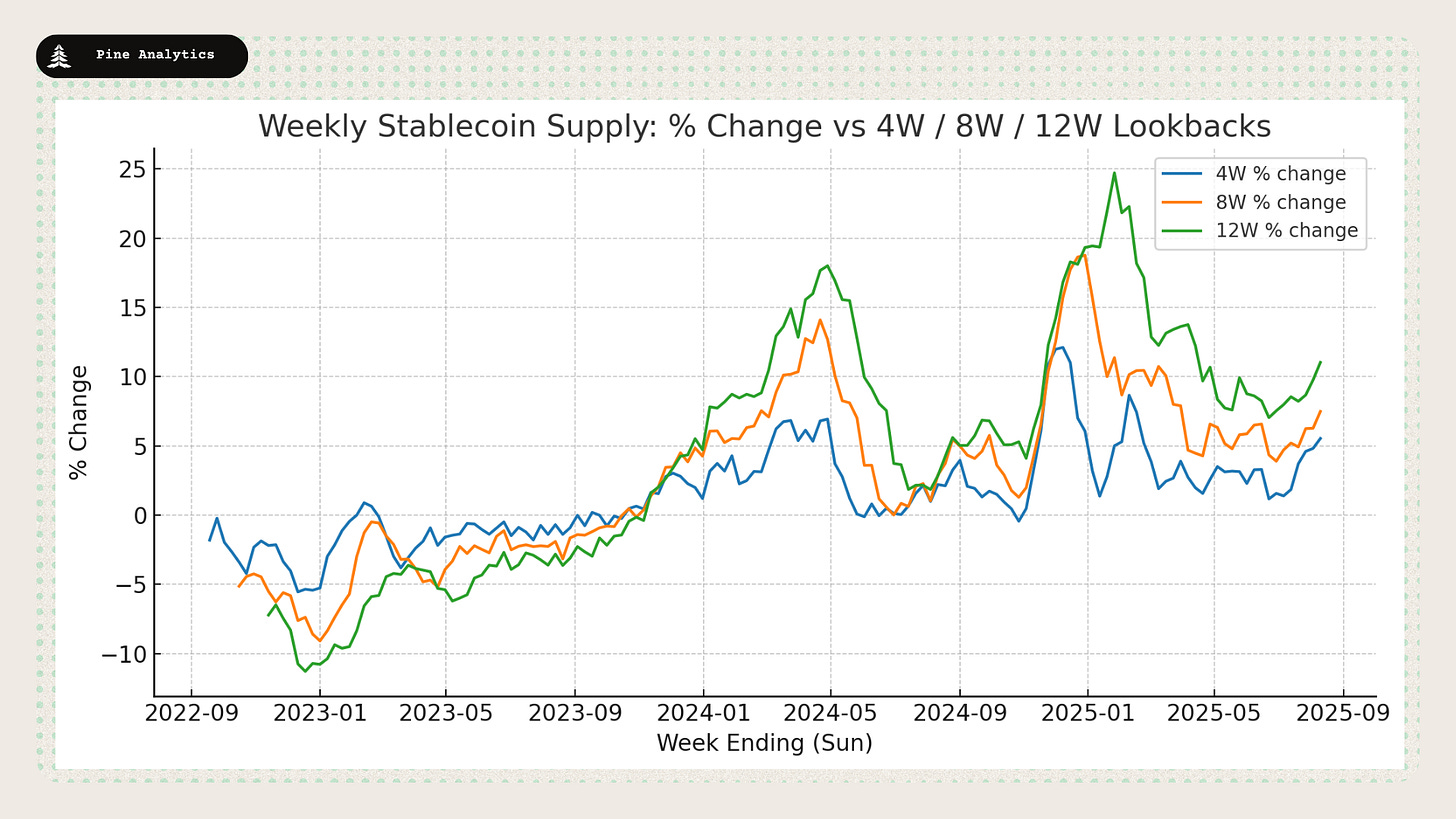

Market Capitalization: The stablecoin market cap currently stands at $273.3 billion, reflecting a $6.4 billion increase over the past week and a $17.4 billion increase over the past 30 days. This marks a breakout of the trend that began in November 2024 of decelerating stablecoin supply growth.

Stablecoin Supply Rates:

AAVE: 4.5%-9.4%

Kamino: 6.3%-7.2%

Save Finance: 3.4%–4%

JustLend: ~2.3%–7.6% (6.2% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum, Arbitrum, and Solana, while Tron and Sui saw outflows. Notably, Ethereum’s growth was nearly $6B.

Token-Specific Changes: USDe, USDT, and USDC saw large supply increases this week, while USDS declined sharply. USDe’s increase was especially notable at ~$1.2B.

Interpretation and Outlook: This week’s ~$6.4B net increase marks an acceleration relative to the recent multi-month trend of positive but decelerating growth. Momentum had been fading since November 2024, but it re-accelerated over the past month and continues to build.

NFT Market

Market Activity:

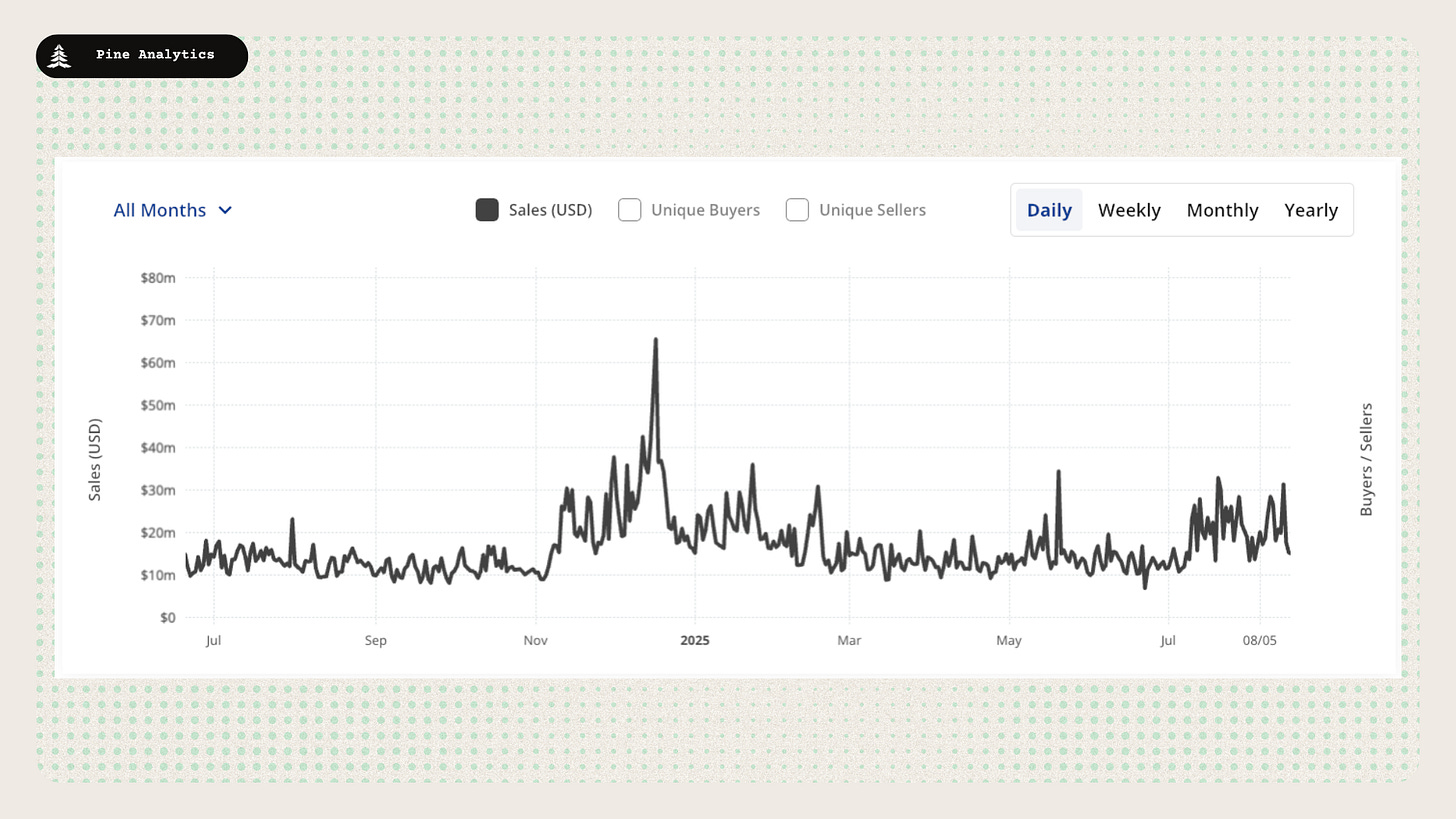

NFT sales volume stayed flat at an elevated level, continuing a uptrend that has been live for about a month. Activity increased on Ethereum and BnB, while most other chains saw decreases.

Top Collections:

BAYC have seen a surge in activity this week, with the collection reaching 2nd place in terms of collection volume this week. Notable collections include Moonbirds, Cryptopunks and many other OG ETH collections.

Overall Market Trend:

The NFT market saw a spike in activity in early November 2024, but much of that momentum has since faded. There has been a modest uptrend in sales activity over the past month, but it remains limited.

CT Mindshare

Circle Announced a new L1: Circle has introduced Arc, a new open Layer-1 blockchain specifically designed for stablecoin finance, featuring EVM compatibility and native USDC as gas to streamline payments, FX, and capital markets applications. This launch comes amid Circle's strong Q2 earnings, positioning Arc as a strategic move to enhance control and efficiency in the stablecoin ecosystem.

Monero 51% attack: The privacy coin Monero has fallen victim to a 51% attack by the AI-focused Qubic network, enabling potential chain reorganizations and raising alarms about the vulnerability of proof-of-work blockchains. Following the incident, Qubic's community voted to target Dogecoin next, highlighting ongoing security risks for smaller PoW networks.

Heaven DEX Launch: Heaven DEX, a hybrid launchpad and automated market maker on Solana, has launched with its native $LIGHT token via a Genesis ICO that raised approximately $27 million in under 11 hours. The platform's flywheel mechanism has already burned over $1.2 million worth of $LIGHT, fostering rapid ecosystem growth and token deflation shortly after launch.

MetaDAO’s token split proposal passed: MetaDAO's Proposal #31 has successfully passed, approving a 1:1000 token split and migration to a new mintable $META with elastic supply to improve liquidity and accessibility. This governance decision aims to revitalize the project's tokenomics and support future community-driven initiatives.