Overview

Bitcoin has experienced a slight decline of 3.09% this week, settling at $58,465, while hovering at the bottom of its 6-month range. BTC dominance has marginally decreased to 56.99%, remaining close to its highest point since 2021. Despite the price dip, there were $32.4M in BTC ETF inflows, reversing recent outflow trends. The altcoin market cap contracted by $21.5 billion to $750 billion, with Ethereum at $2,583 and Solana at $144. Notably, the SOL/ETH ratio is testing its previous ATH as support.

The stablecoin market cap grew by $1.5 billion to $160.5 billion, with PYUSD surging 15% and EURC, Circle's Euro stablecoin, growing by 25%. Stablecoin activity increased notably on Polygon (2.3%) and Ethereum (1.5%). The NFT market saw a small decrease in volume (1.3%) but a significant increase in buyers (105%). BAYC experienced a 52% volume increase, climbing to 4th place in sales activity.

The Crypto Fear and Greed Index has dropped from 52 to 43, reflecting cooled sentiment. Social media interest in crypto has declined from last week, suggesting a normalization of retail attention. Notable developments include Drift's launch of a prediction market, Justin Sun's introduction of SunPump for meme coins, Arbitrum DAO's token staking launch, and Germany's state-owned KfW partnering for tokenized bond issuance in an ECB blockchain trial.

BTC Market

Current State of the Bitcoin Market

Bitcoin has been hovering at the bottom of its 6 month range after shooting back up into the range last week after a brief breakdown of price out of the range.

Bitcoin's price has decreased 3.09% this week, now sitting at $58,465.

BTC dominance has slightly dropped to 56.99% from 56.94%, sitting close to its highest point since 2021.

The Crypto Fear and Greed Index has dropped from 52 to 43, reflecting a drop in the upward price velocity from last week.

There have been BTC ETF inflows this week of $32.4M, showing a reversion in the past two weeks of outflows.

Social media interest has declined from last week.

Interpretation and Future Outlook

Bitcoin's modest 3.09% decline to $58,465 this week signals a period of consolidation near the bottom of its 6-month range, following last week's recovery from a brief breakdown. The slight increase in Bitcoin dominance to 56.99% - approaching highs not seen since 2021 - suggests that the overall crypto market is not overextended, indicating a relatively conservative market stance. This cautious outlook is further supported by the Crypto Fear and Greed Index's drop from 52 to 43, reflecting cooled sentiment and a more measured market approach. Interestingly, the $32.4M in BTC ETF inflows this week marks a reversal of recent outflow trends, hinting at renewed institutional interest despite the overall market caution. This contrasts with the decline in social media buzz, which could be interpreted as a normalization of retail attention following recent price action. This confluence of factors - price consolidation at the lower end of the range, sustained high BTC dominance, mixed institutional flows, and tempered retail interest - paints a picture of a market in a holding pattern. While the immediate momentum appears to have slowed, the overall structure remains intact, leaving open the possibility of a range breakout in either direction as market participants await clearer directional cues.

Altcoin Market

Current State of the Altcoin Market

Currently, the altcoin market cap is sitting at $750 billion, about $21.5 billion down from the start of the week. Ethereum makes up approximately 41.4% of the altcoin market cap. This week, the price of Solana (SOL) is $144, and the price of Ethereum (ETH) is $2,583, with the SOL/ETH ratio testing its previous all-time high (ATH) as support. There is a divergence among altcoins, with meme coin underperformance as one notable trend.

Top 3 Winners in Terms of Price This Week

RUNE: cross chain bridge.

AAVE: Ethereum lending market.

HNT: Solana depin project .

Top 3 Losers in Terms of Price This Week

WIF: Solana meme coin.

BRETT: Base meme coin.

SUI: Move based L1.

Interpretation and Future Outlook

This week's altcoin market exhibits mixed signals, with a modest $21.5 billion contraction in market cap suggesting a slight bearish tilt. A notable divergence in performance across altcoin categories has emerged. Meme coins such as WIF and BRETT have underperformed, potentially due to a temporary shift in trader sentiment or profit-taking. In contrast, infrastructure projects like RUNE and AAVE have demonstrated resilience, posting positive price action. Looking ahead, if Bitcoin's price remains relatively stable, the altcoin market may continue to display sector-specific movements rather than a uniform trend. However, any significant Bitcoin price movements are likely to overshadow these sector-specific trends, potentially driving a more coordinated response across the altcoin market. Notably, strong Bitcoin price action will likely meme coin outperformance, as increased market euphoria often fuels speculative interest in these high-risk, high-reward assets.

Stablecoin Market

Market Capitalization: Currently, the stablecoin market cap stands at $160.5 billion, reflecting a increase of $1.5B over the past 7 days and a $1.5 billion increase over the past 30 days. This indicates a continuation of the slow growth of the stablecoin supply since April.

Notable Growing Stablecoins: This week, there has been notable growth in PYUSD, increasing 15% to reach a market cap of $843M. Another stablecoin that has seen significant growth is EURC, Circle's Euro stablecoin. It has grown by 25% this week, reaching a market cap of $41M.

Notable Chain Changes: The two chains that saw increases in stablecoins this week are Polygon (2.3%) and Ethereum (1.5%), while there has not been much supply change on other chains.

Interpretation and Future Outlook

Since April, the stablecoin market has demonstrated slow but consistent growth following a previous five-month period of rapid expansion. This steady increase has been predominantly driven by USDT and USDC, with significant contributions from new stablecoins like PayPal's PYUSD and Ethena's USDe. Looking ahead, the stablecoin supply is structurally poised for further growth. Potential catalysts for a significant uptick in supply include regulatory clarity, broader adoption of decentralized finance (DeFi) ecosystems, and heightened demand for stable digital assets globally. The success of new projects such as PYUSD, USDe, and now possibly EURC will likely play a crucial role in driving this next phase of major growth in the stablecoin sector.

NFT Market

Market Activity: Over the past week, the NFT market has experienced a small decrease in volume (1.3%) and a large increase in the number of buyers (105%). Activity on Ethereum has been on an uptrend, while NFT activity on Polygon, Bitcoin and Solana has been on a downtrend.

Top Collections: Notably, BAYC has seen an uptick in buying activity, with a 52% volume increase this week, jumping to 4th place in terms of sales activity. Other collections that have seen a spike this week are crypto punks, Solana Monkey Business, and Pudgy Penguins.

Overall Market Trend: The overall NFT market is still in a downtrend since mid-December 2023. This trend suggests a cautious outlook for the near term, although pockets of growth indicate ongoing interest and opportunities within the sector.

Interesting crypto stuff

Drift prediction market launch: This week, Drift launched a capital-efficient prediction market similar to Polymarket.

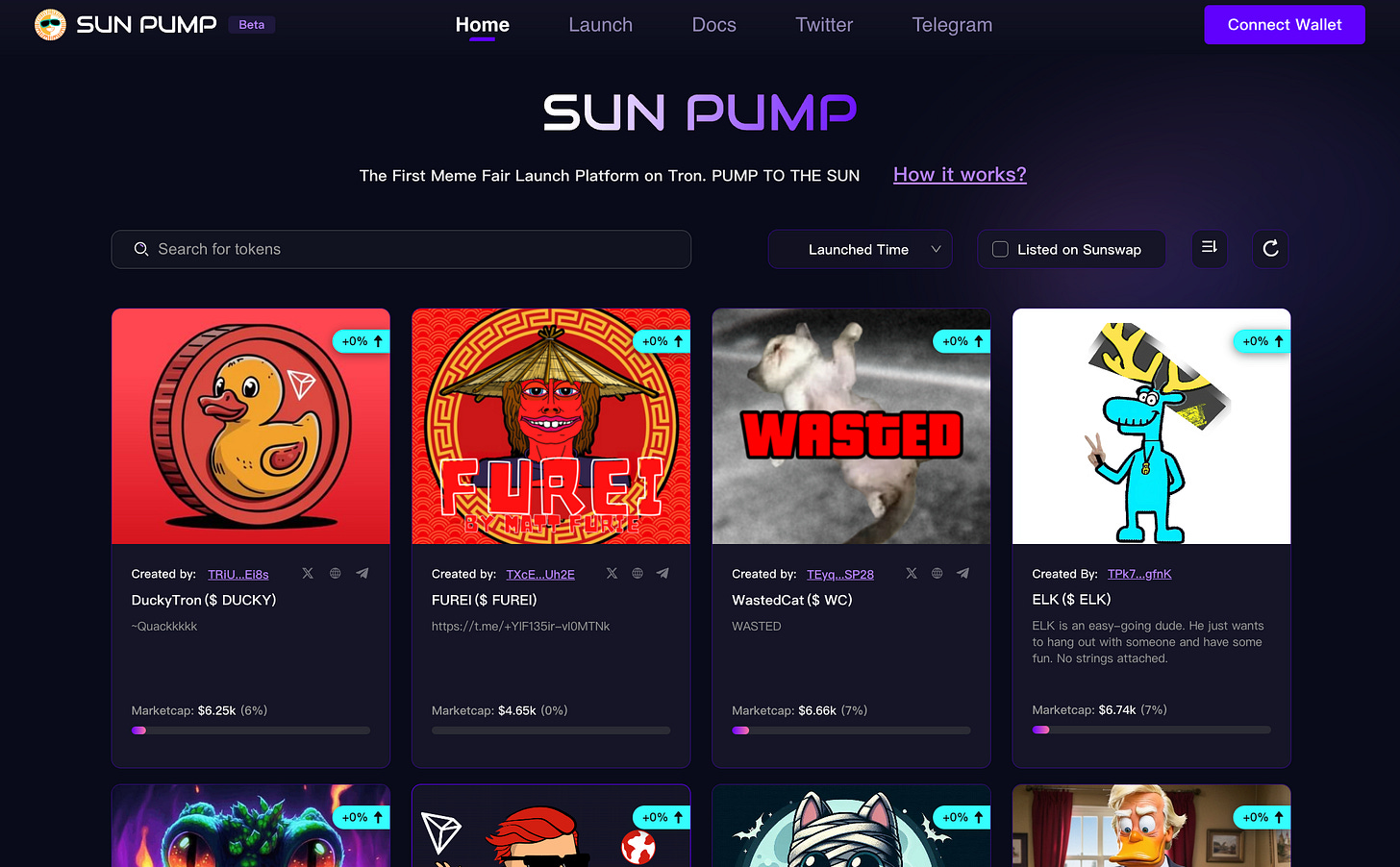

Sunpump Launch: SunPump was introduced by Justin Sun through Sun.io, aiming to capitalize on the meme coin trend. It's TRON's first dedicated platform for meme coin launches, offering creators a straightforward, low-cost way to launch their tokens.

Arbitrum DAO's Staking: Arbitrum DAO launched staking for their token this week.

Germany Tokenized Bonds: Germany's state-owned KfW partners with Boerse Stuttgart Digital for a tokenized bond issuance in an ECB blockchain trial under eWpG.

Sources

https://app.artemis.xyz/

https://defillama.com/

https://www.cryptoslam.io/

https://www.tradingview.com/symbols/BTC.D/

https://coinmarketcap.com/

https://x.com/i/bookmarks/all?post_id=1812861039517778200