Executive Summary

The macro backdrop has tilted risk-on, with a weaker dollar (DXY at 97), record-high gold, stable long rates (10Y at 4.3%), and subdued oil ($64). Historically, this combination has preceded liquidity rotation into equities and crypto, creating a constructive setup for risk assets.

The total crypto market cap sits at $3.94T, with BTC consolidating near $112.8K as dominance slips to 57%. ETF flows highlight capital rotation, with ETH attracting +$337.7M inflows while BTC saw –$1.18B outflows. This shift signals the early stages of rotation away from Bitcoin into Ethereum and mid-caps.

On-chain, Ethereum and Solana remain the main anchors of activity, while Base continues to gain ground. Hyperliquid is emerging as a standout with resilient fees and volumes despite broader declines. Stablecoin supply dipped ~$4.7B, marking a pause in the re-acceleration trend that began in July, though USDe and DAI expanded even as USDC contracted sharply.

NFT activity has eased from July highs but remains above pre-surge levels, with Polygon and BNB gaining share. Viral consumer applications such as Football.fun also show that demand pockets remain strong, driving bursts of user activity and revenue. Meanwhile, protocol revenue remains concentrated in Tether and Circle, though challengers like Hyperliquid, Pump, and edgeX are capturing growing momentum.

Looking ahead, the base case is BTC consolidation with rotation into ETH and mid-caps, supported by macro tailwinds and ecosystem strength across Ethereum, Solana, and Base. Hyperliquid stands out as a potential breakout venue. The key risks remain a rebound in the dollar or a spike in yields, either of which could stall rotation and re-anchor flows back into BTC.

Market Overview

Macro

Based on the data, the most likely view is bullish for crypto and other risk assets into the next few months. The Dollar Index breaking down to 97 signals structural weakness in the dollar, while gold’s surge to $3,400+ shows capital rotation into hard assets and non-sovereign stores of value. The 10Y yield holding steady near 4.3% suggests restrictive but stabilizing conditions, with the bond market leaning toward normalization rather than new shocks. Crude oil anchored around $64 reflects soft global demand and limited inflation pressure, creating room for easier liquidity if growth slows. Taken together: the dollar is weakening, gold is strengthening, and rates are steady — a backdrop that historically precedes risk-on rotations. The key macro trigger to watch remains the U.S. Dollar Index (DXY), as sustained weakness has consistently led liquidity inflows into equities and crypto.

Crypto Market Summary

Current State of the Crypto Market: Total crypto market cap at $3.94T, down 1.25% in 24h with altcoin market cap at $1.70T and daily volume of $183.32B.

BTC Price Action: BTC trading at $112,795, down 2.09% (24h) and 4.19% (7d), with total market cap at $2.25T showing bearish short-term momentum.

BTC/ETH Dominance: BTC dominance at 56.97% and ETH at 14.69%, indicating as shift into alt season as BTC dominance drops quickly.

ETF Flows: Significant institutional movement with BTC seeing -$1.18B outflows, while ETH attracted +$337.7M inflows, and SOL experienced minor -$3.5M outflows.

Social/Search Trends: BTC interest score at 69 (7d avg: 46.63) showing stable retail attention, while altcoin interest remains muted at 33 (7d avg: 27.35).

Fear & Greed Index: Current score of 53 (-7 points over 7d), shifting from previous bullish sentiment to neutral territory.

Rotation Bucket Analysis: Rotation score at 34.95, with mid-cap ($10-100B) tokens gaining market share while large-caps (≥$100B) and small-caps ($1-10B) lose ground.

Interpretations and Future Outlook

The macro backdrop over the next few months remains favorable for risk-taking. A weakening dollar (DXY at 97) and record-high gold point to sustained demand for hard assets, while crude oil’s stability around $64 reduces inflationary pressures. With the U.S. 10Y yield steady near 4.3%, conditions are still restrictive but no longer worsening—an environment that historically sets the stage for liquidity rotation into equities and crypto. As long as the dollar remains under pressure, the path of least resistance for risk assets is higher.

In crypto, short-term momentum looks shaky—Bitcoin is down 4% on the week and seeing heavy ETF outflows (-$1.18B). Yet beneath the surface, leadership is shifting. ETH is attracting inflows (+$337.7M) and BTC dominance has slipped to ~57%, suggesting an early rotation phase where capital begins moving down the curve. Mid-caps are gaining share while large- and small-caps lag, signaling that investors are cautiously broadening risk exposure. The Fear & Greed Index cooling to neutral (53) implies positioning is not overextended, leaving room for renewed upside if macro tailwinds persist.

The most likely path forward is choppy consolidation in BTC with rotation into ETH and select mid-caps. If dollar weakness deepens, this could evolve into a broader alt season as liquidity expands beyond majors. Key risks remain a surprise spike in yields or a dollar rebound, either of which could stall rotation and re-anchor flows back into BTC. But with macro tailwinds aligned and dominance slipping, the balance of probabilities favors a gradual broadening of the crypto bull cycle over the coming months.

Chain Use

Data

Chains by bridge flows: This week, the most significant cross-chain flows have been a large outflow from Base, Arbitrum, and Linea and large inflows into Ethereum, Polygon, and Solana.

Top chains by TVL: Ethereum $96.4B (+4.9%), Solana $11.3B (+5.6%), Tron $6.5B (+3.2%), Base $5.0B (+4.2%), Arbitrum $3.4B (+6.3%), Hyperliquid $2.3B (+9.5%), Sui $2.1B (+0.0%), Avalanche C-Chain $2.0B (+5.3%).

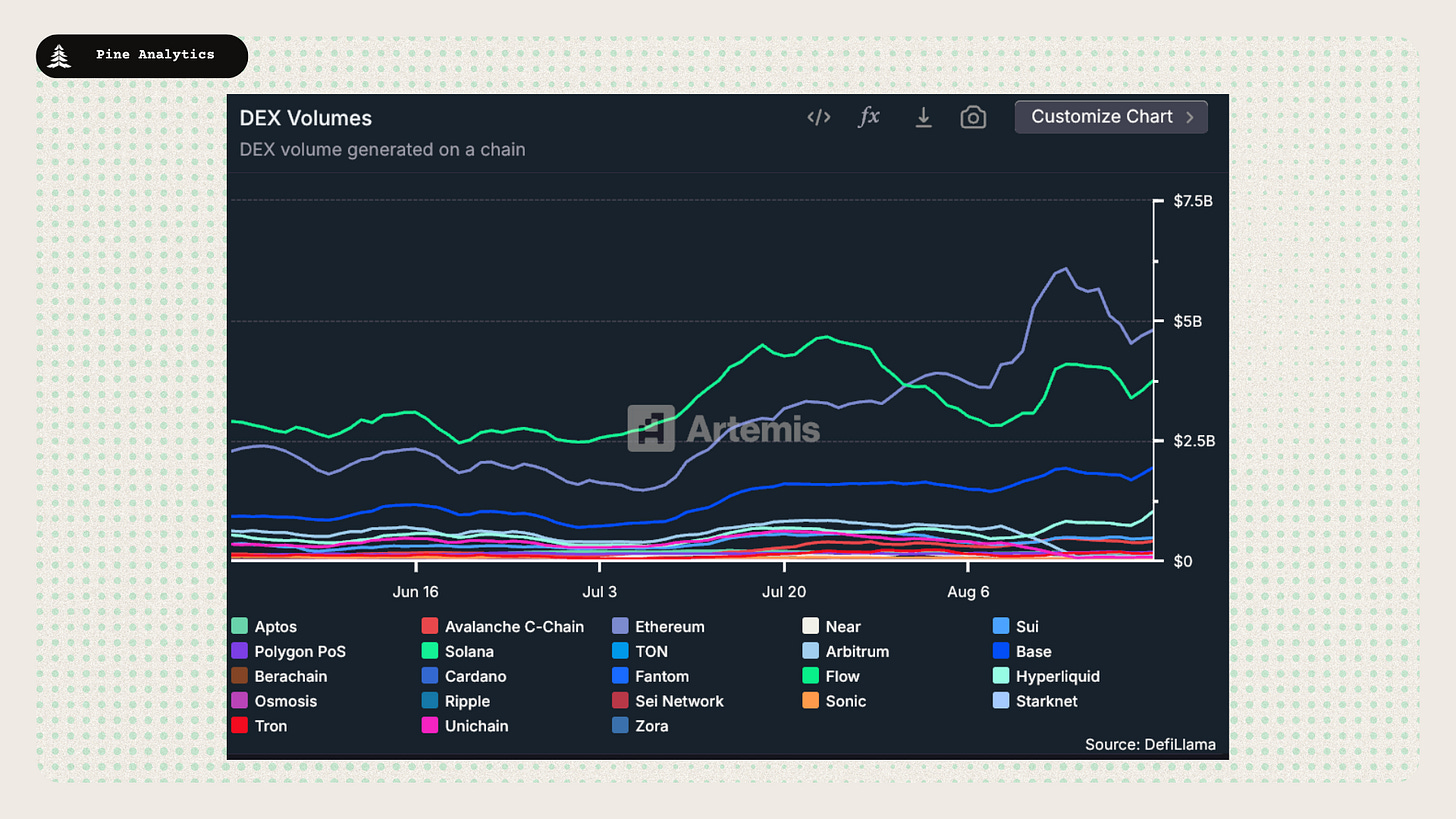

Top chains by DEX volume: Ethereum $33.6B (–15.8%), Solana $25.9B (–9.8%), Base $13.3B (+0.0%), Hyperliquid $7.0B (+25.6%), Sui $3.35B (–0.7%), Avalanche C-Chain $2.85B (–11.0%), Polygon PoS $1.25B (+2.7%), Aptos $1.13B (–6.2%).

Top chains by weekly fees: Hyperliquid $25.2M (–20.0%), Ethereum $16.1M (–20.7%), Tron $14.7M (–4.5%), Solana $8.4M (–25.0%), Base $1.43M (–23.3%), Arbitrum $575.4K (–11.8%), Avalanche C-Chain $184.8K (+11.5%), Unichain $182.0K (–7.6%).

Interpretations and Future Outlook

Despite notable bridge outflows from Base, Arbitrum, and Linea, core chains like Ethereum, Solana, and Polygon continue to attract inflows and see steady TVL growth, signaling that capital remains anchored to the largest ecosystems. While DEX volumes are down sharply across majors, Hyperliquid stands out with both higher flows and resilient activity, suggesting growing traction among traders. Fee trends reinforce this divergence—most chains saw revenues fall, but Avalanche and smaller L2s like Unichain showed relative stability. Looking ahead, the data points to a market in consolidation mode: majors remain the base of liquidity, while selective alternative venues (notably Hyperliquid) are gaining share. If volumes rebound alongside bridge inflows, mid-tier chains could see stronger rotation in the coming weeks.

App Revenue

Protocol Revenue Distribution & Market Dynamics

The DeFi ecosystem exhibits severe revenue concentration at its apex, with traditional financial infrastructure dominating earnings. Tether alone generates $21.26 million in daily revenue, surpassing the combined revenue of positions 3-10 in the rankings. When combined with Circle's $6.98 million daily revenue, these two stablecoin issuers capture $28.24 million—representing approximately 85% of the top five protocols' daily earnings. This concentration extends beyond stablecoins: the top 10 revenue-generating protocols account for roughly 95% of total market revenue, with Hyperliquid ($2.6m), Pump ($1.52m), and Axiom Pro ($1.25m) rounding out the top five. The revenue cliff is dramatic—by position 20, daily revenues drop below $150,000, illustrating how value accrues to established infrastructure and high-volume trading venues.

Revenue Velocity Trends (24h vs 7-day daily avg)

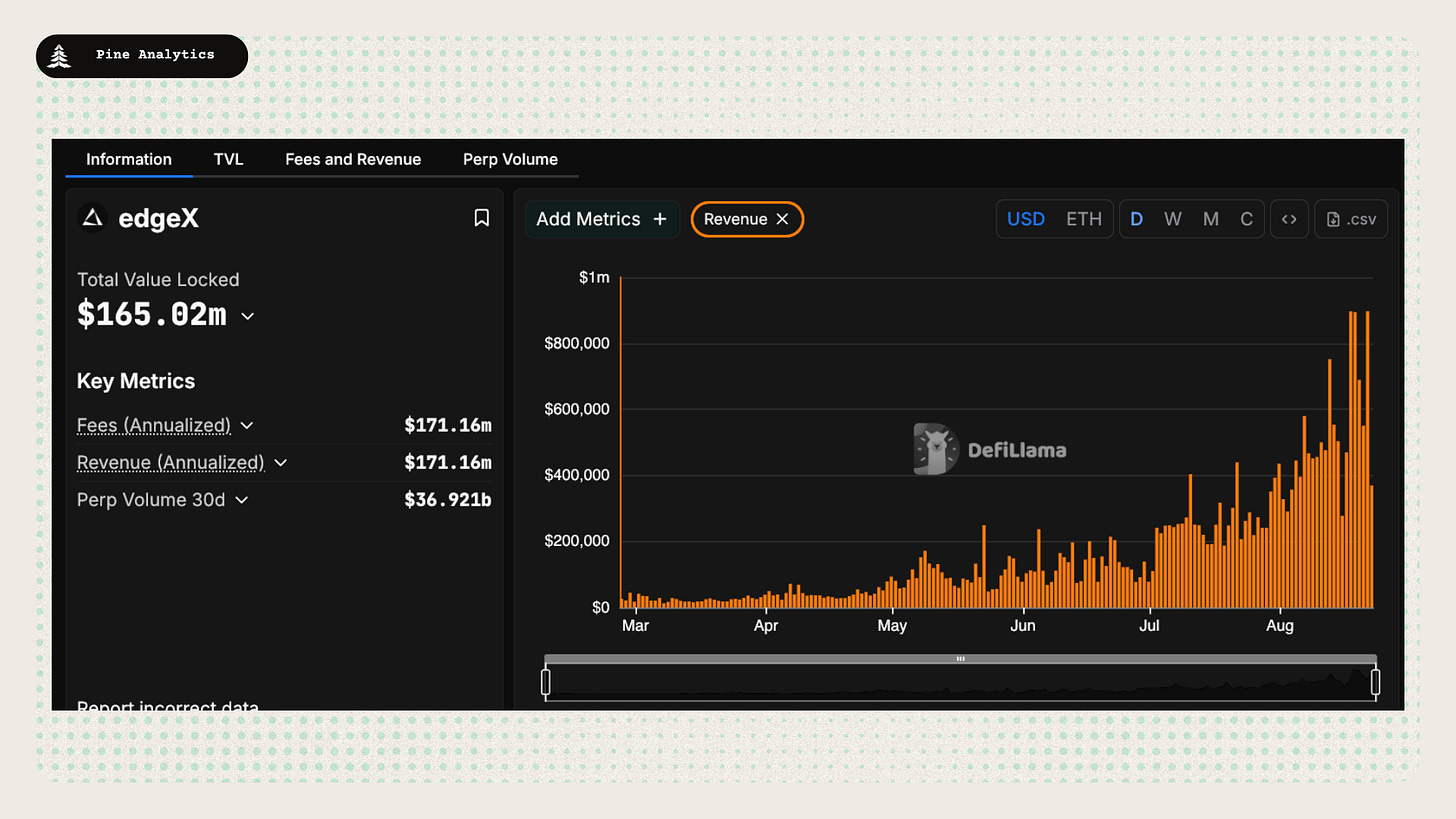

edgeX (derivatives; trading fees): +108% — $0.37m today vs $0.18m 7D daily avg

Heaven (DEX; trading fees): +102% — $0.21m today vs $0.11m 7D daily avg

Hyperliquid (perps exchange; trading fees): +54% — $2.6m today vs $1.69m 7D daily avg

ZORA Protocol (NFT marketplace; mint fees): +354% — $0.18m today vs $0.04m 7D daily avg

Sustained Growth Leaders (7-day vs 30-day daily avg)

Heaven (DEX; trading fees): +518% — from $0.12m to $0.73m daily average

Axiom Pro (perpetuals; trading fees): +92% — from $0.77m to $1.48m daily average

edgeX (derivatives; trading fees): +156% — from $0.49m to $1.10m daily average

Pump (launchpad; bonding curve fees): +11% — maintaining elevated $1.57m daily average

Stablecoin Metrics

Market Capitalization: The stablecoin market cap currently stands at $268.8 billion, reflecting a $4.7 billion decrease over the past week and a $9.5 billion increase over the past 30 days. This marks a pullback in the trend of accelerated growth that has been going for the past month and a half.

Stablecoin Supply Rates:

AAVE: 4.2%-4.9%

Kamino: 4%-7%

Save Finance: 3.9%–5.5%

JustLend: ~1.8%–5.8%

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum, Solana, and Arbitrum, while Tron and TON saw outflows.

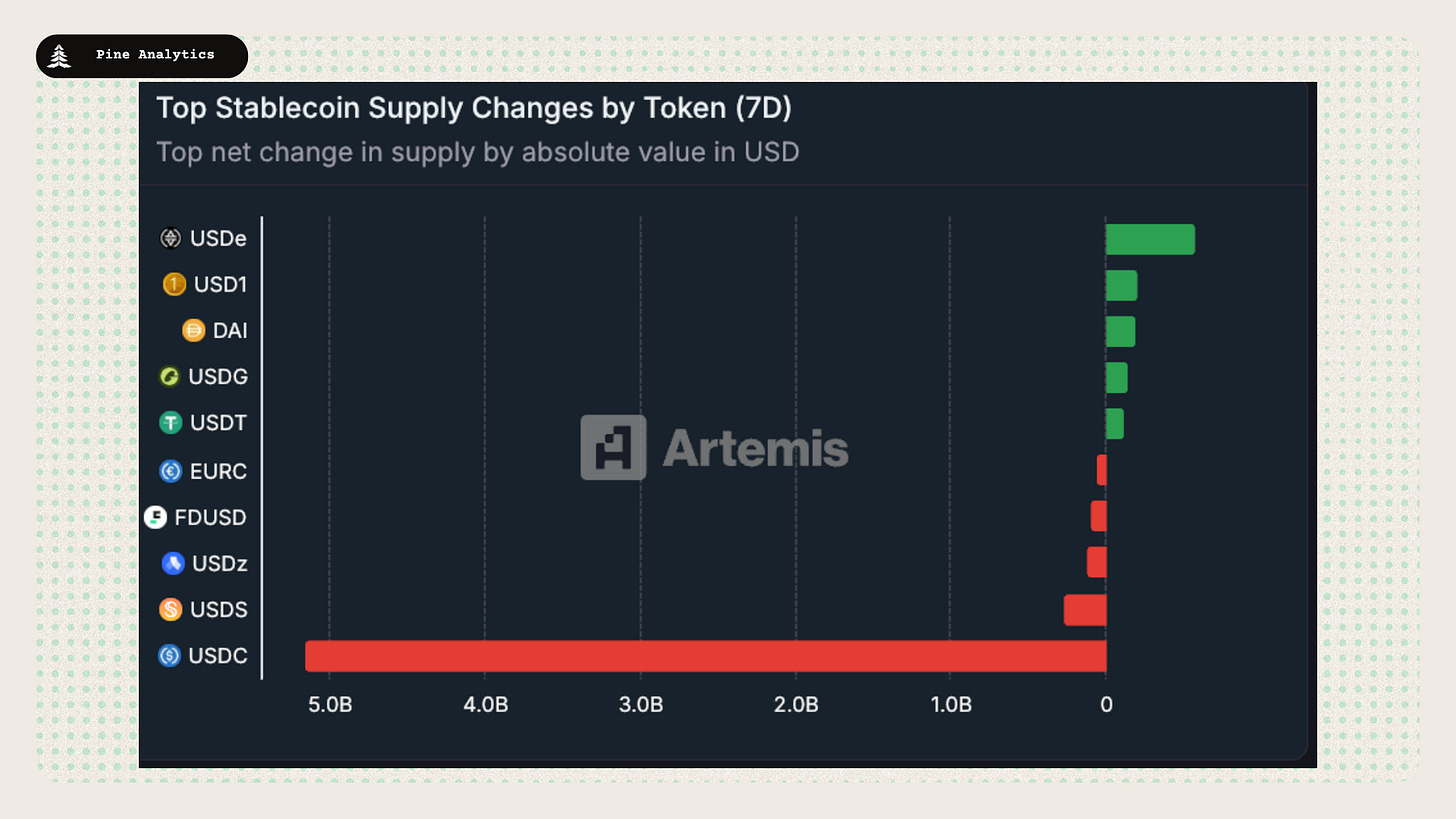

Token-Specific Changes: USDe, USD1, and DAI saw supply increases this week, while USDC declined sharply. USDC’s decrease was especially notable at ~$5.2B.

Interpretation and Outlook: This week’s ~$4.7B net decrease marks a pullback relative to the recent month-and-a-half trend of accelerating stablecoin growth. Re-acceleration started in mid-July, and this move looks like a pause in that broader trend of supply expansion.

NFT Market

Market Activity:

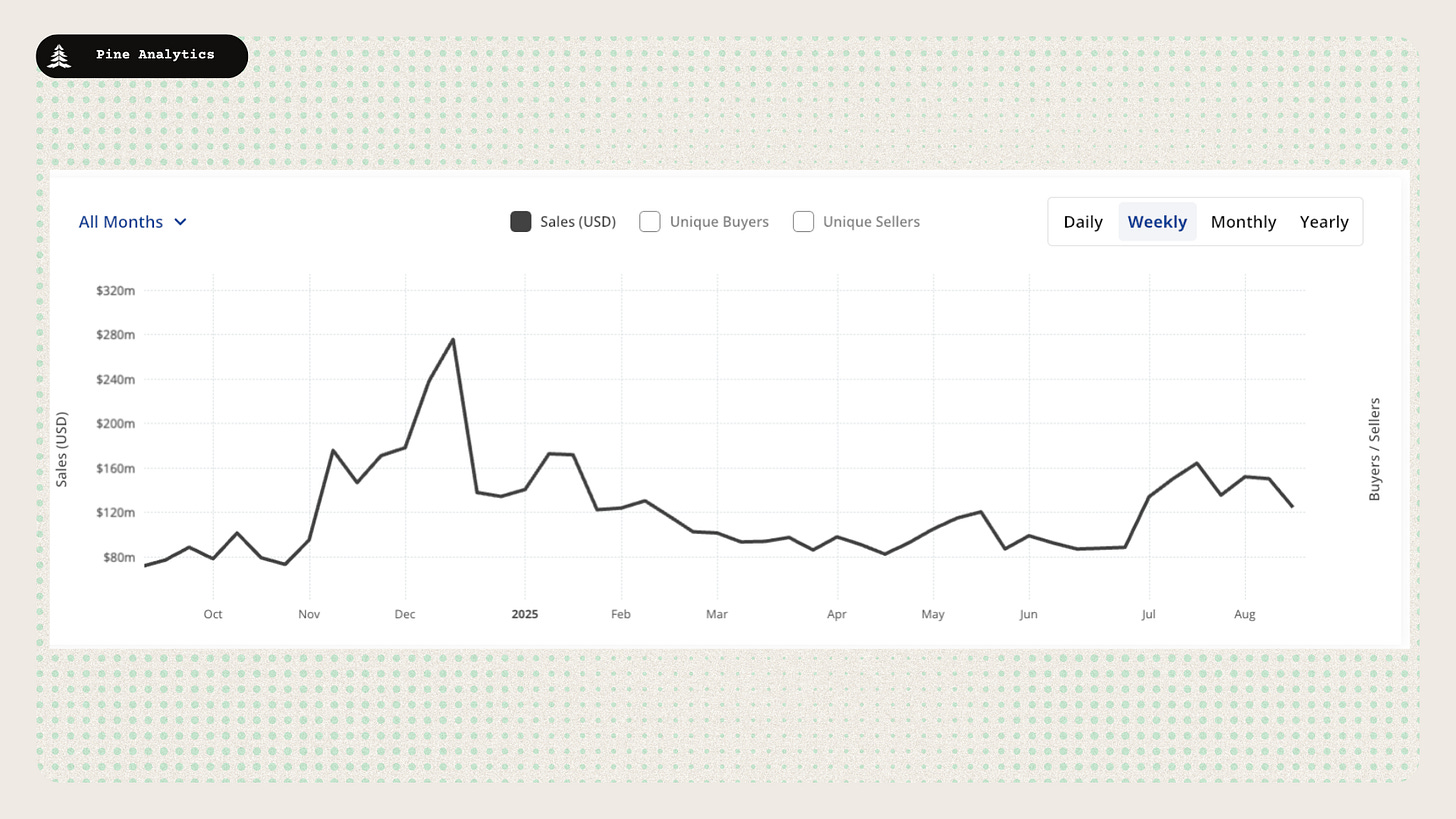

NFT sales volume declined slightly this week from elevated levels, easing off the surge that began in mid-July but still remaining higher than pre-surge levels. Activity picked up on Polygon and BNB, while most other chains saw decreases.

Top Collections:

SpinNFTboxs have seen a surge in activity this week, with the collection reaching 2nd place in terms of collection volume this week. Notable collections include Moonbirds, Pudgy Penguins and Alice Keys of Power.

Overall Market Trend:

The NFT market saw a spike in activity in early November 2024, but much of that momentum has since faded. There has been a modest uptrend in sales activity over the past month, but it remains limited.

CT Mindshare

footballdotfun activity spike: Football.fun, a Web3 social sports prediction game blending real-world football with crypto trading, saw a dramatic activity spike, generating over $440,000 in revenue in just 24 hours and claiming the top spot on the Base blockchain by revenue. This surge, fueled by skyrocketing deposits, user growth, and skill-based leaderboards, boosted its market cap from $30 million to $120 million in a single day, signaling a potential revival in Web3 gaming.

FRNT Stablecoin: Wyoming has pioneered the launch of FRNT, the first U.S. state-issued stablecoin, fully backed 1:1 by USD and short-term Treasuries with an additional 2% overcollateralization for enhanced stability. Deployed across seven blockchains including Avalanche and integrated with Visa for real-world spending, FRNT enables instant government payments like tax refunds and payroll, marking a milestone in blending programmable money with traditional finance.

SIMD-341 dropped: Solana has introduced SIMD-341, a new improvement proposal implementing protocol-level account compression via a dedicated syscall to drastically lower storage costs on the network. By requiring offchain state preservation for onchain recovery, this innovation aims to enhance efficiency and scalability, potentially transforming how data is managed in Solana's ecosystem.

WLFI Token Launch: World Liberty Financial, a DeFi platform linked to the Trump family, has debuted its WLFI token on the Ethereum mainnet, with the token generation event set for September 1, 2025, unlocking 20% of the supply for immediate trading. This launch, featuring a shift from governance-only to a broader utility token, positions WLFI as a high-profile intersection of politics and cryptocurrency, with early perpetuals implying a $40 billion fully diluted valuation.