This Week in Crypto (09/07/25)

Crypto market weekly overview and updates

Executive Summary

Macro remains tilted risk-on: softer USD, a gold breakout, stable rates, and tame energy together support easier liquidity. A decisive DXY break below 97 alongside the 10Y drifting toward ~3.8% would reinforce the trend, while a USD rebound above 100 or the 10Y pushing past 4.5% would argue for de-risking.

Crypto is consolidating around ~$3.83T. We expect BTC to trade choppy-to-down while the gold impulse runs, then reassert leadership as that impulse fades. The rotation setup favors ETH and quality mid-caps once fund flows clearly inflect and breadth is confirmed by sustained positive stablecoin issuance; micro-cap exposure should remain light until liquidity visibly broadens.

On-chain, ETH and SOL still anchor activity even as weekly volumes cooled, while BNB quietly gained share. Hyperliquid remains a top fee earner despite a pullback, and bridge flows show capital repatriating to Ethereum from Base, Arbitrum, and Sui—consistent with L1 acting as the liquidity gravity well during rotations.

Stablecoins sit near ~$282.9B (–$4.7B w/w; +$19.7B m/m). Yields cluster around ~3–6% across Aave, Kamino, Spark, JustLend, and Save, supporting carry. Issuance has skewed toward Ethereum, Arbitrum, and Avalanche, with Tron seeing outflows; by asset, USDC, USDT, USDe, and USD1 expanded while DAI edged lower.

Mindshare catalysts expand the adoption surface: Hyperliquid’s USDH proposal with Paxos, Remora’s tokenized U.S. equities on Solana, GLXY shares tokenized on Solana, and the $EXO auction on Metaplex. These add new rails for liquidity and user engagement across DeFi.

Market Overview

Macro

Based on these charts, the backdrop leans risk-on over the next few months. The Dollar Index hovering ~97–98 signals ongoing USD softness, while USD/CNY steady near ~7.14 reduces devaluation tail risk and supports EM/liquidity flows. Gold’s surge to ~$3.6k reflects a store-of-value bid and softer real yields; the 10Y anchored ~4.0–4.2% (30Y ~4.7–4.9%) points to a peak-rates, non-shock regime. Crude near ~$61 implies muted inflation pressure, creating room for easier financial conditions if growth wobbles. Historically, this mix—weak USD, firm gold, stable rates, tame energy—precedes risk-on rotations. Expect majors to lead, with selective long-tail following as breadth/flows improve; the key triggers are DXY < 100 with a break toward <97 and 10Y drifting toward ~3.8%, ideally alongside positive stablecoin net issuance—while a USD rebound (>100) or rates backup (>4.5% 10Y) would argue for de-risking.

Crypto Market Summary

Current State of the Crypto Market: The crypto market shows mixed signals with a total market cap of $3.83T, reflecting growth of +0.98% in the last 24 hours.

BTC Price Action: BTC trades at $111,195, showing positive momentum with +0.94% (24h) and +1.93% (7d) gains.

BTC/ETH Dominance: Bitcoin dominance holds strong at 57.83% (stable), while ETH dominance remains at 13.52%, showing no significant weekly changes.

ETF Flows: Bitcoin recorded inflows of $250M, while ETH faced substantial outflows of $952.2M. SOL showed modest inflows of $4.7M.

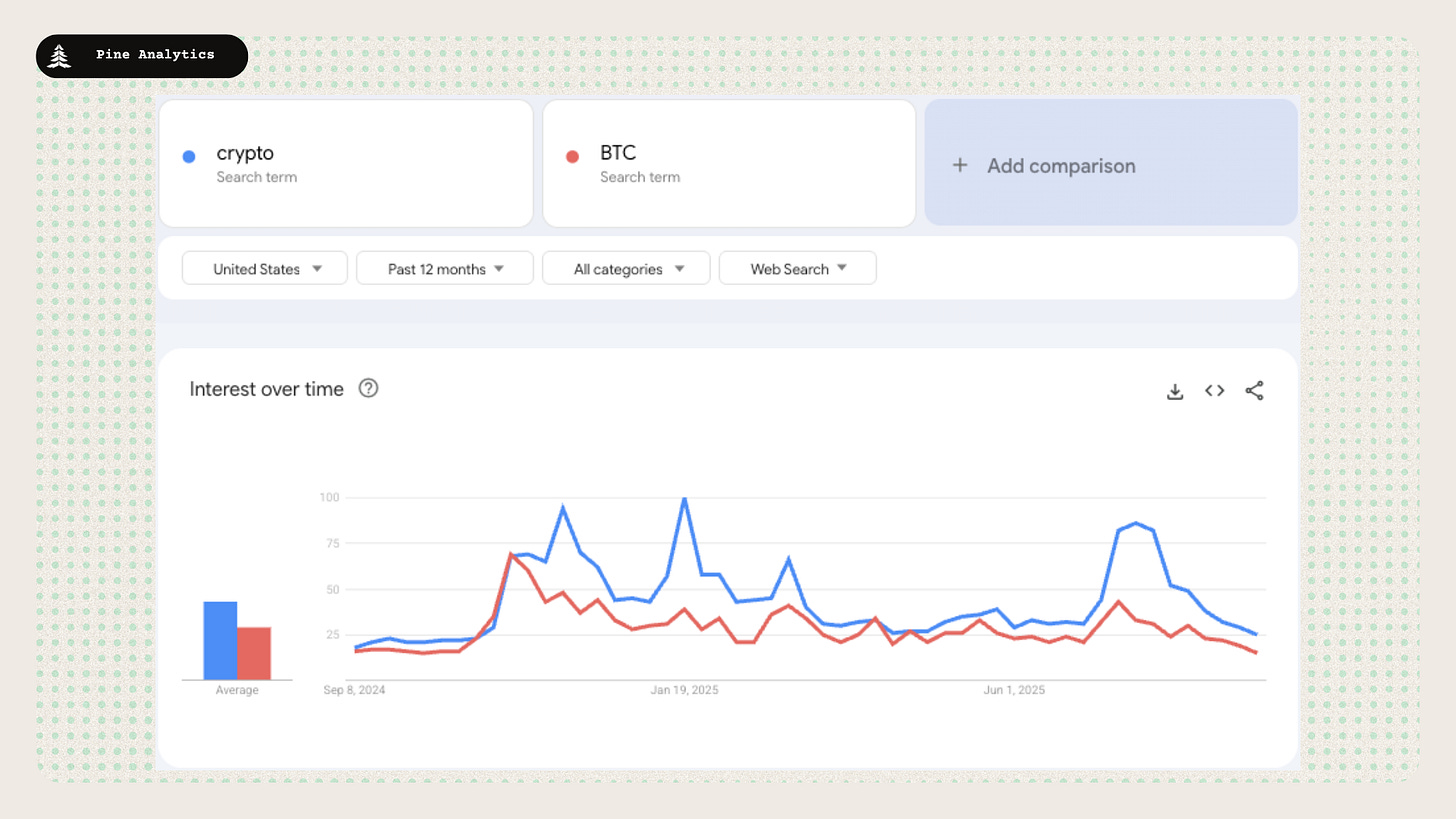

Social/Search Trends: Search interest for both BTC and crypto is declining to its lowest level in the past year.

Fear & Greed Index: Current reading of 44 (-4 weekly change) indicates "Fear" sentiment, suggesting cautious market positioning.

Rotation Bucket Analysis: Rotation score of 46.27 shows mid-cap assets ($100M-1B, 1-10B) gaining momentum, while micro-caps (<$10M) lose market share.

Interpretations and Future Outlook

Over the next few months, we expect BTC to chop and alts to chop/edge lower as gold continues its run; once that gold impulse cools, BTC’s next leg up should begin, with attention and sentiment—currently muted—flipping decisively as BTC regains momentum and breaks prior ATHs; that’s when gains should trickle down the risk curve, moving from the most liquid/large assets (BTC, ETH, top L1s) to quality mid-caps and, only later, select small caps as the run broadens.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Base, Arbitrun, and Sui, alongside substantial inflows into Ethereum. It appears that nearly all of the outflows from Base and Arbitrum have moved into ETH.

Top chains by TVL: Ethereum $90.1B (–1.4%), Solana $11.3B (–0.9%), BNB Chain $7.4B (–1.3%), Tron $5.6B (–8.2%), Base $4.8B (+2.1%), Arbitrum $3.3B (+3.1%), Hyperliquid $2.3B (+0.0%), Sui $1.9B (–5.0%).

Top chains by weekly fees: Top chains by weekly fees: Hyperliquid $18.2M (–40.9%), Ethereum $16.8M (+26.3%), Solana $8.4M (–14.3%), Tron $8.4M (–29.4%), Base $914.9K (n/a), Osmosis $642.6K (+1.1%), Arbitrum $436.8K (–2.0%), Sui $296.8K (+13.7%).

Top chains by DEX volume: Solana $24.5B (–20.5%), Ethereum $23.1B (–13.2%), BNB Chain $16.1B (+15.0%), Base $9.8B (–17.6%), Hyperliquid $5.2B (–47.1%), Arbitrum $3.8B (–10.8%), Avalanche C-Chain $2.8B (+4.0%), Sui $2.6B (–12.9%).

Interpretations and Future Outlook

Bridge data points to a clear repatriation of capital to Ethereum, with sizable exits from Base, Arbitrum, and Sui flowing back to L1. Despite modest week-over-week TVL upticks on Base/Arbitrum, that looks more like price/LP effects than fresh deposits; if outflows persist, TVL should lag lower.

Activity is diverging: Solana and Ethereum still anchor DEX flow, but both cooled w/w, while BNB Chain quietly gained share. Hyperliquid remains a top fee earner even after a steep pullback, and Ethereum’s fee rebound suggests demand consolidating on mainnet as risk rotates down the stack.

On-chain DEX and fee activity has been in an uptrend since mid-August; while momentum has ebbed at times, the structure—higher highs/lows and improving breadth—remains intact. We view shallow pullbacks as accumulation windows and expect continuation, likely led first by majors/ETH fee strength and then by selective mid-caps as stablecoin issuance and bridge flows turn more supportive.

Stablecoin Metrics

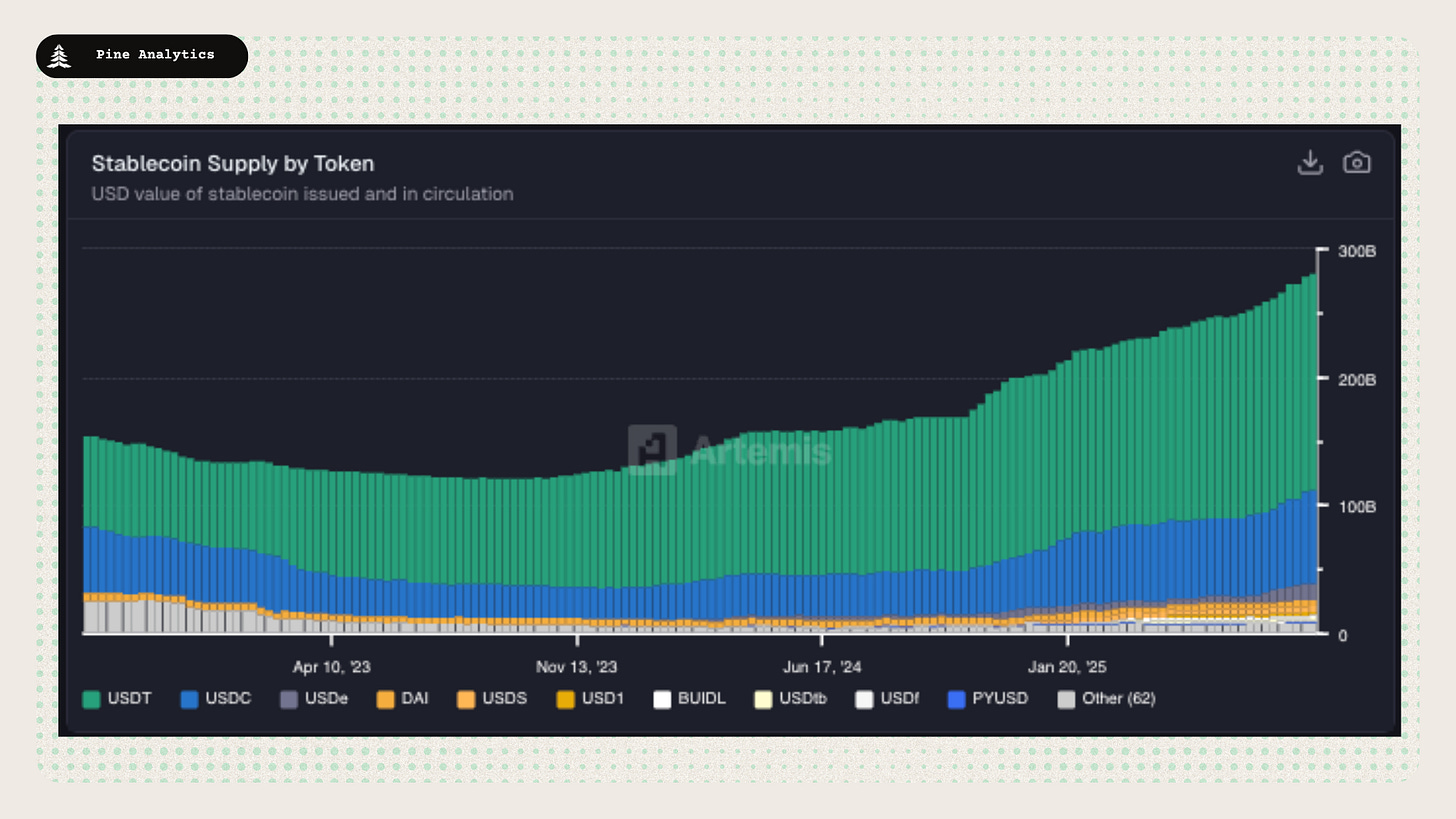

Market Capitalization: The stablecoin market cap currently stands at $282.9 billion, reflecting a $4.7 billion decrease over the past week and a $19.7 billion increase over the past 30 days. This marks a continuation in the trend of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 3.8%-4.4%

Kamino: 3.6%-14.9%

Save Finance: 5%–5.15%

JustLend: 3.5%–4.9% (6.2 USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum, Arbitrum, and Avalanche, while Tron saw outflows.

Token-Specific Changes: USDC, USDT, USDe, and USD1 saw supply increases this week, while DAI declined modestly.

Interpretation and Outlook: Stablecoin supply rose about ~$4.7B this week, extending the re-acceleration that began in mid-July and keeping the broader expansion trend intact. The past two months point to sustained demand rather than a one-off spike.

CT Mindshare

Hyperliquid USDH Anoucement

Hyperliquid, a leading decentralized exchange, has unveiled plans to launch its native USDH stablecoin through an upcoming governance vote, partnering with Paxos to ensure full compliance and direct yields toward HYPE token buybacks. This initiative aims to reduce trading fees and integrate the stablecoin into the platform's next network upgrade, enhancing liquidity and ecosystem growth.Galaxy Launches Shares on Solana

Remora Market Stock Launch

Remora Markets has debuted its tokenized U.S. equities platform on Solana, offering 24/7 crypto-based trading for shares of companies like Tesla, Nvidia, and Circle. As a fully compliant exchange, it democratizes access to real-world assets in DeFi, igniting competition in Solana's RWA sector after months of development.

$EXO Token Auction Anoucement

.Exotic Markets is set to kick off its $EXO token auction on September 10th, 2025, at 4PM UTC via Metaplex, with 250,000 tokens available in the genesis unified price auction. This event provides early participants access to the governance and utility token for their Solana DeFi platform, following successful seed funding rounds totaling $9.5 million.

Galaxy Launches Shares on Solana

Galaxy Digital has collaborated with Superstate to tokenize its GLXY Class A common shares on the Solana blockchain, enabling seamless holding and transfer within crypto wallets for approved investors. This launch represents a milestone in compliant public equity tokenization, bridging traditional finance with blockchain infrastructure for 24/7 accessibility.