This Week in Crypto (09/14/25)

Crypto market weekly overview and updates

Executive Summary

Macro tilts cautiously risk-on: DXY drifting ~97–98 below MAs, CNY steadier, gold elevated but pausing (~$3.64k), UST curve anchored (10Y ~4.0–4.2%, 30Y ~4.9–5.0%), crude ~$62–63—conditions that usually ease financial tightness. A decisive DXY break <97 with the 10Y toward ~3.8% would reinforce risk; a USD rebound >100, 10Y >4.5%, or oil >$72 argues for de-risking.

Tape remains institution-led: steady spot demand, muted leverage, low retail. Expect BTC to grind higher and nudge dominance up if it clearly separates; ETH, SOL, and other quality beta follow as breadth improves.

Capital rotation via bridges: Net outflows from Base/ETH/Berachain and inflows to Arbitrum/Solana point to share gains for ARB/SOL if sustained; Base’s TVL likely lags without a flow turn.

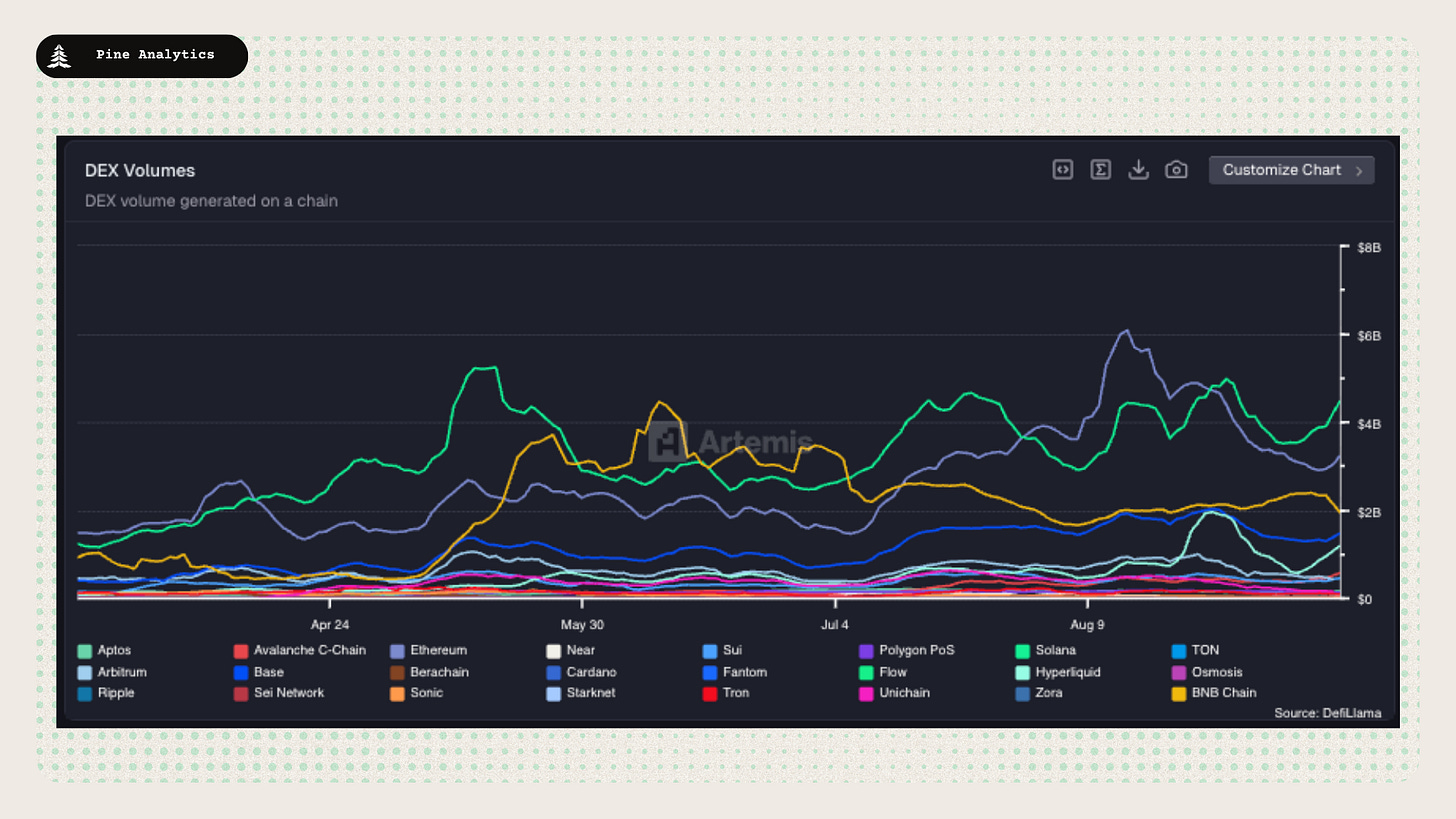

On-chain activity: TVL advanced across majors (ETH $96.1B; SOL $13.1B). DEX volumes rose w/w led by SOL ($31.5B) with ETH steady; Base grew while BNB cooled. Fees stayed concentrated at Hyperliquid ($17.5M) and ETH/SOL—consistent with incentive-amplified perp flow plus spot strength.

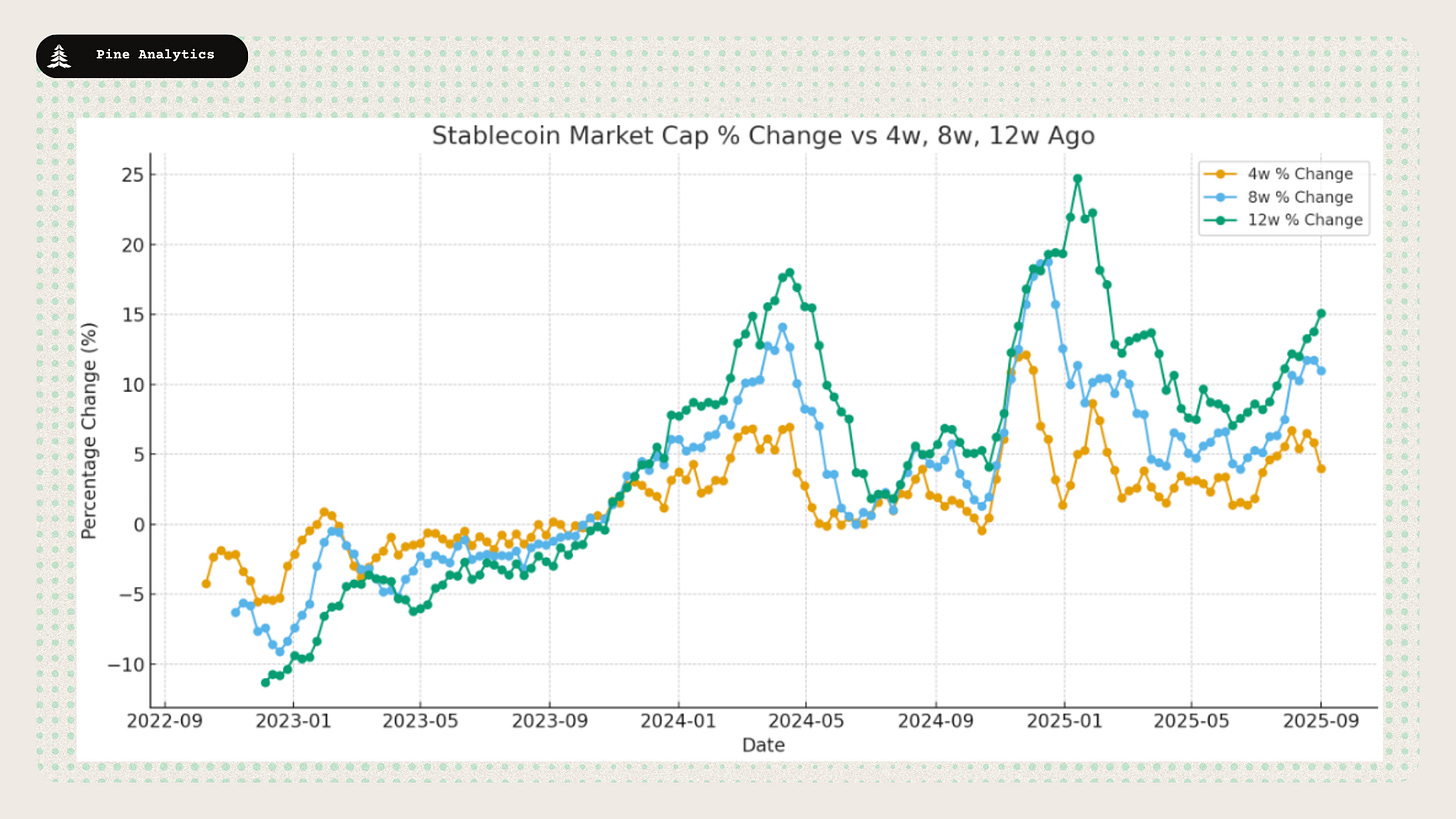

Stablecoins: ~${284.4}B total; +~$4.7B w/w and +~$11.5B m/m keep the broader expansion intact, though momentum briefly stalled as some demand rotated into alts. Yields cluster ~3–6% across Aave, Kamino, Save, JustLend, and Spark. Inflows skewed toward ETH/SOL/ARB; Tron saw outflows. By asset, USDC/USDT/USDe/USDtb expanded; DAI edged lower.

Base case & confirms: The long-term uptrend in DEX and fee activity remains intact, led this week by Solana and Hyperliquid. Continuation setup strengthens with two straight weeks of net ARB/SOL bridge inflows, sustained positive stablecoin prints, and an ETH fee turn higher (often a precursor to broader L2 acceleration). Key risks: bridge reversals back to ETH/Base, incentive cliffs on perp venues, or a USD/rates spike.

Market Overview

Macro

Based on these charts, the backdrop leans cautiously risk-on over the next few months. DXY slipping around ~97–98 and trending below its MAs signals ongoing USD softness, while a steadier CNY reduces devaluation tail risk and supports EM/liquidity flows. Gold near ~$3.64k reflects a firm store-of-value bid and softer real rates; the UST curve shows the 10Y anchored ~4.0–4.2% while the 30Y remains ~4.9–5.0%, consistent with a peak-rates, non-shock regime but with a sticky term premium. Crude near ~$62–63 implies muted inflation pressure, creating room for easier financial conditions if growth wobbles. Historically, this mix—weak USD, easing front-end rates, tame energy, firm gold—precedes risk-on rotations. Expect majors to lead in crypto (then quality beta as breadth improves). Key triggers are DXY <97 with momentum and the 10Y drifting toward ~3.8%, ideally alongside sustained positive stablecoin net issuance—while a USD rebound (>99–100), a rates backup (>4.3–4.5% on the 10Y or >5.1% on the 30Y), or an oil spike (>70–72) would argue for de-risking.

Crypto Market Summary

Current State of the Crypto Market: Market showing mixed performance with large-caps outperforming, total crypto market cap at $4.04T amid moderate volatility.

BTC Price Action: BTC trading at $115,674, down 0.07% in 24h, and up 4.5% in 7d.

BTC/ETH Dominance: BTC dominance 56.98% of market, ETH at 13.79%, indicating strong non-BTC/ETH outperformance.

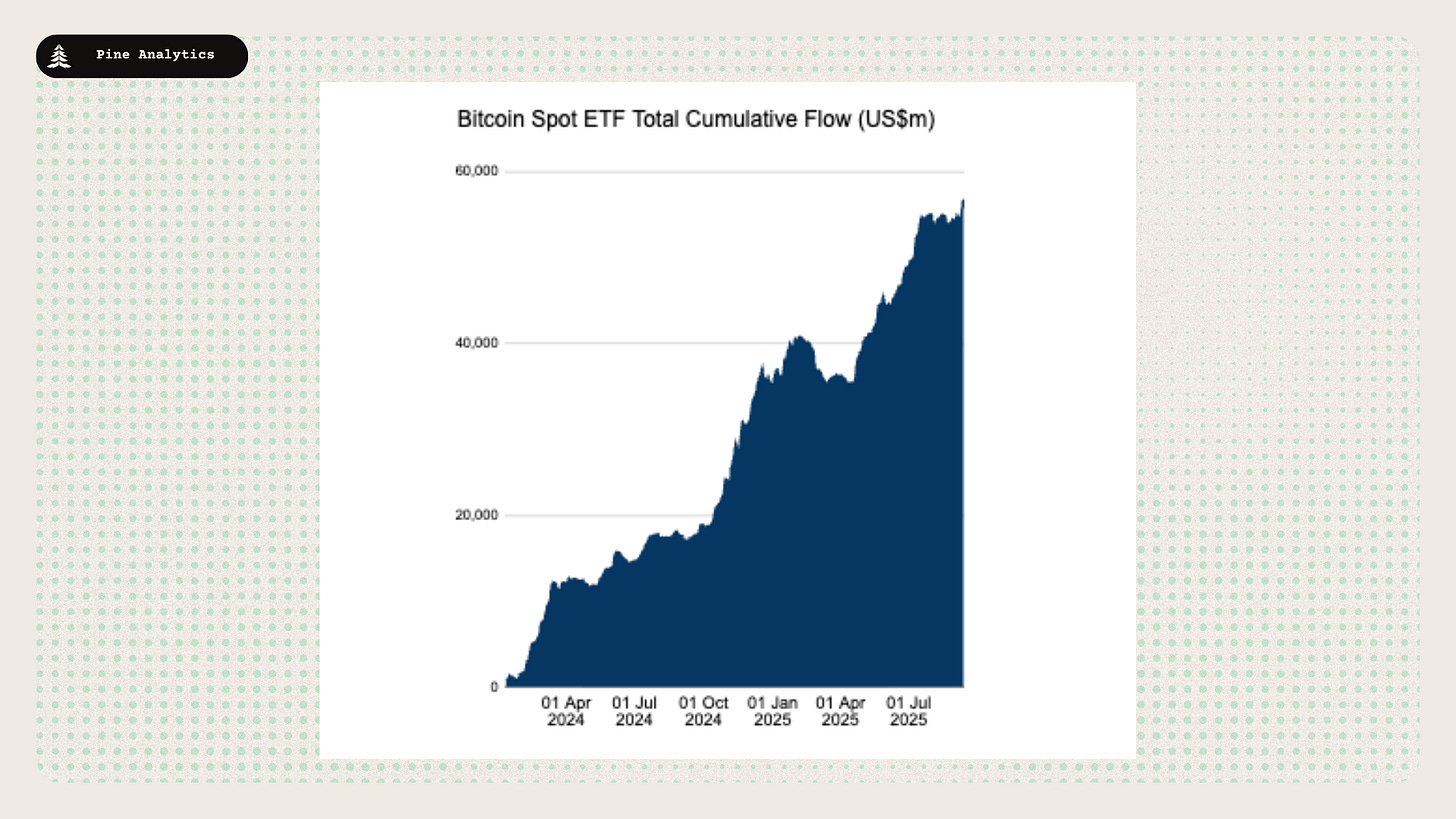

ETF Flows: Strong institutional interest with BTC ETF inflows of $2.32B, ETH inflows of $637.6M, and SOL inflows of $15.9M this week.

Social/Search Trends: Bitcoin interest remains low at 15 (out of 100), while altcoin interest is flat at 30, indicating a decline in retail attention.

Fear & Greed Index: Currently at 55 (+3 from last week), indicating "Greed" sentiment with momentum building.

Rotation Bucket Analysis: Rotation score at 53.39, with capital flowing into mega-caps (≥$100B) and large-caps ($10-100B), while smaller caps experience outflows.

Interpretations and Future Outlook

The tape looks institution-led: steady spot demand, muted leverage, and quiet retail. Macro winds are supportive, and with gold’s surge pausing, incremental liquidity has room to lean into crypto. In this setup, expect momentum to grind higher led by BTC, with dominance likely to creep up if Bitcoin clearly separates from the pack. ETH, SOL, and other quality names should follow on improving breadth—but only after BTC reasserts leadership. Risk remains if the dollar snaps back or rates lurch higher, but for now the path of least resistance tilts upward, majors first.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Base, Ethereum, and bearachain, alongside substantial inflows into Arbitrum and Solana.

Top chains by TVL: Ethereum $96.1B (+6.3%), Solana $13.1B (+13.9%), BNB Chain $7.7B (+2.7%), Tron $6.5B (+8.3%), Base $5.1B (+6.2%), Arbitrum $3.4B (+3.0%), Hyperliquid $2.6B (+13.0%), Sui $2.1B (+10.5%).

Top chains by weekly fees: Hyperliquid $17.5M (+0.0%), Ethereum $9.8M (–41.7%), Solana $9.8M (+16.7%), Tron $8.4M (+0.0%), BNB Chain $3.8M (n/a), Base $1.1M (+20.3%), Osmosis $814.1K (+29.9%), Avalanche C-Chain $291.9K (+45.3%).

Top chains by DEX volume: Solana $31.5B (+28.6%), Ethereum $22.4B (0.0%), BNB Chain $13.3B (–20.8%), Base $10.5B (+15.4%), Hyperliquid $8.4B (+99.1%), Avalanche C-Chain $4.0B (+50.4%), Sui $3.2B (+26.0%), Aptos $1.1B (+13.8%).

Interpretations and Future Outlook

DEX and fee activity remain in a long-term uptrend, with Solana and Hyperliquid leading this week. TVL is broadly bid across majors, and bridge flows are rotating toward ARB/SOL while Base and ETH saw outflows. Setup favors continuation if SOL/ARB maintain net inflows and stablecoin issuance stays positive; an ETH fee turn would likely precede a broader L2 re-acceleration. Key risks: a reversal in bridge flows, incentive decay on perp venues, or stalling stablecoin prints.

Stablecoin Metrics

Market Capitalization: The stablecoin market cap currently stands at $284.4 billion, reflecting a $2.3 billion decrease over the past week and a $11.5 billion increase over the past 30 days. This marks a continuation in the trend of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 4.5%-4.99%

Kamino: 3.8%-4.86%

Save Finance: 4.5%–5.3%

JustLend: 1.44%-4.79% (5 USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum, Solana, and Arbitrum, while Tron saw outflows.

Token-Specific Changes: USDC, USDT, USDe, and USDtb saw supply increases this week, while DAI declined modestly.

Interpretation and Outlook: Stablecoin supply rose by ~$4.7B this week, extending the mid-July re-acceleration and keeping the broader expansion trend intact. That said, momentum stalled a bit—some demand likely rotated from stables into altcoins.

CT Mindshare

pump.fun's Project Ascend

pump.fun, the viral Solana-based meme coin launchpad, unveiled Project Ascend on September 8-9, introducing automated liquidity ramps and AI-driven rug-pull detectors to make token launches safer and faster. Early adopters reported a 40% drop in failed projects within the first 48 hours, reigniting meme coin frenzy as trading volumes surged past $50M daily.

World Liberty Financial ($WLFI) Drama

World Liberty Financial, the RWA-focused stablecoin project backed by high-profile figures, launched amid fanfare this week but quickly spiraled into controversy when regulators blacklisted Justin Sun's wallet on September 12 over alleged $9M manipulation schemes. Despite the $WLFI token crashing 25% and locking $540M in reserves, proponents argue it's a necessary purge strengthening compliance in the tokenized asset space.OpenSea SEA Token Rewards Phase 3

OpenSea's highly anticipated SEA token rewards program kicked off its Phase 3 drop

on September 9, distributing exclusive perks to over 100K active NFT traders and collectors. The initiative not only boosted average floor prices by 10% across blue-chip collections but also teased an imminent $SEA token generation event, fueling speculation of a DeFi-NFT convergence worth billions in liquidity.

Polymarket Valuation Spike

Polymarket, the decentralized prediction market powerhouse, saw its valuation skyrocket to $9-10B potential after securing CFTC approval for expanded US operations on September 11, driving a 300% volume explosion on election and crypto outcome bets. This milestone not only validates blockchain-based forecasting but positions Polymarket as a TradFi disruptor, with insiders eyeing a blockbuster funding round to fuel global expansion.