This Week in Crypto (09/21/25)

Crypto market weekly overview and updates

Executive Summary

Risk-on into year-end: a softer USD, steady CNY, high gold (lower real rates), anchored Treasuries, tame oil, and weak ISM tilt policy toward easing and support liquidity. BTC leads (~$115.5K) with >57% dominance; ETFs show solid BTC/ETH inflows while sentiment is neutral and retail quiet, so rotations favor quality mid-caps on breadth days. Flows rotated out of L2s (Base/Arb) and into Ethereum and Hyperliquid; ETH still anchors TVL (~$95B), and BNB Chain stood out with surging fees/volumes as perps venues stay strong. Stablecoin supply (~$289B) shows moderating but positive momentum with persistent 4–5% yields and net inflows tilting toward Ethereum. key risks are a USD rebound, a rates backup, or an oil spike.

Market Overview

Macro

Based on these charts, the backdrop leans risk-on into year-end. DXY hovering ~97–98 and trending lower signals ongoing USD weakness, while a steadier CNY near 0.140 helps reduce devaluation tail risk and supports EM/liquidity flows. Gold around ~$3.68k reflects a strong store-of-value bid and softer real rates; the UST curve shows the 10Y anchored ~4.1% while the 30Y holds ~4.7–4.8%, consistent with a peak-rates, non-shock regime but with a lingering term premium. Crude near ~$62 points to muted inflation pressure, creating space for easier financial conditions if growth softens. ISM at 48.7 confirms contractionary manufacturing momentum but not a collapse, keeping policy bias tilted toward easing. Historically, this mix—weak USD, firm gold, cooling yields, and tame energy—precedes risk-on rotations. Expect majors to lead in crypto, followed by quality beta as breadth improves. Key triggers are DXY <97 with momentum and the 10Y grinding toward ~3.8%, ideally alongside positive net stablecoin issuance—while a USD rebound (>99–100), a rates backup (>4.3–4.5% on the 10Y or >5.1% on the 30Y), or an oil spike (>70–72) would argue for de-risking.

Crypto Market Summary

BTC/Crypto Price Action: Bitcoin trades at $115,588, down 0.45% in 24h but up 0.21% weekly. Total crypto market cap stands at $4.03T

BTC/ETH Dominance: Bitcoin dominance is commanding at 57.07%, while Ethereum holds 13.39% of total market share, indicating minimal dominance change this week.

ETF Flows: BTC led institutional interest with $886.5M inflows, followed by ETH at $557M, while SOL saw minimal activity at $38.1M.

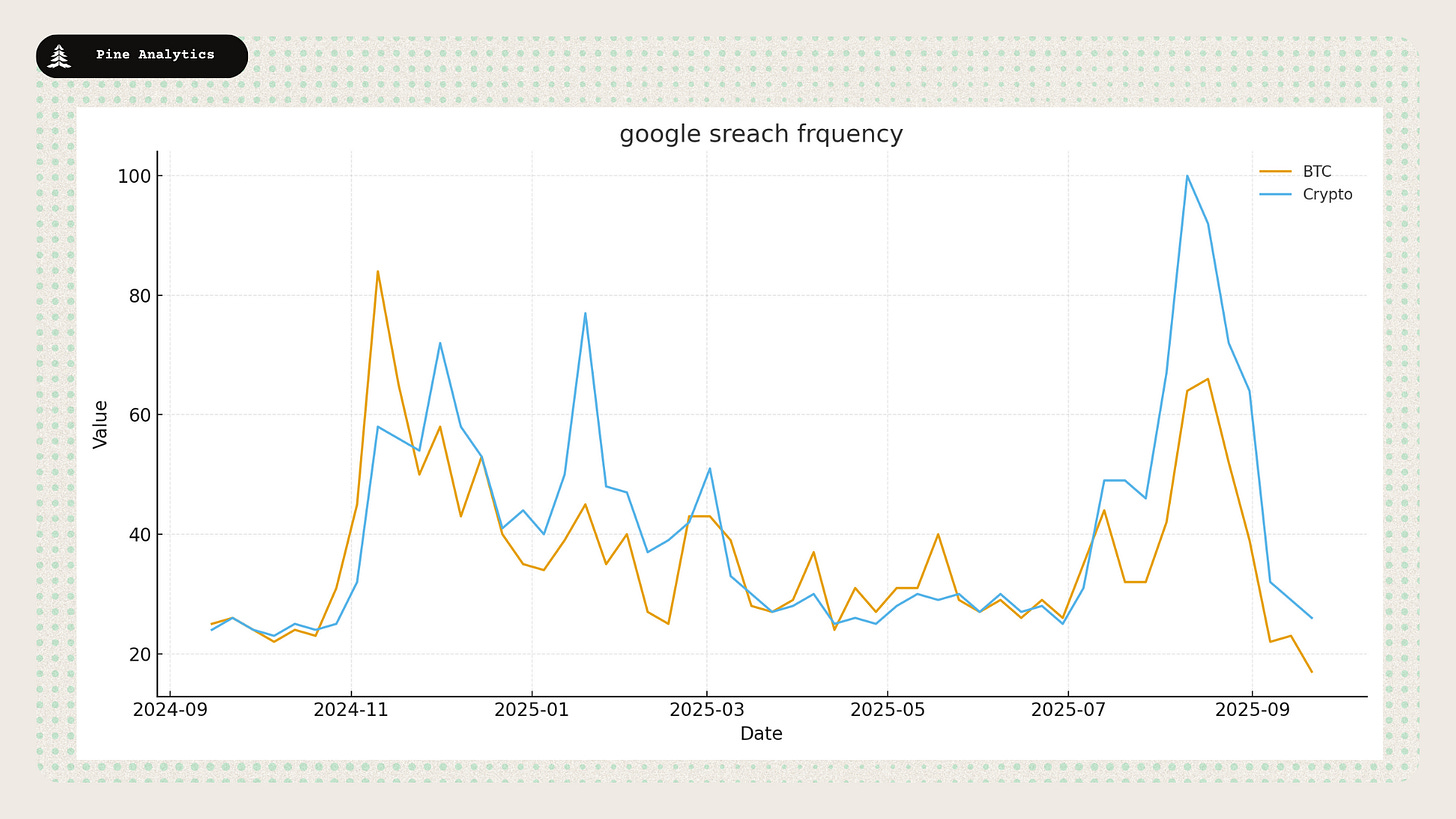

Social/Search Trends: Bitcoin interest remains low at 18 (out of 100), while Crypto interest is slightly down at 27, indicating a decline in retail attention.

Fear & Greed Index: Currently at 49 (+1 weekly), indicating neutral market sentiment with minimal change from last week.

Rotation Bucket Analysis: Rotation score at 48.4, with mid-cap tokens ($10M-$100M) showing strength (+1.20%), while all other market cap bands face selling pressure.

Interpretations and Future Outlook

Flows and price action still read institution-led: steady spot bids (ETFs net positive), low retail heat (search/trend scores), and measured leverage. Macro is a tailwind—soft USD, cooler yields, tame energy—with gold already absorbing much of the safety bid, leaving incremental liquidity room to reach for crypto beta. In this regime, expect a BTC-led grind with dominance edging higher while breadth improves in waves: ETH and SOL should follow on risk-on days, but leadership likely stays with BTC until DXY <97 and the 10Y drifts toward ~3.8% alongside sustained positive stablecoin net issuance.

Playbook: favor majors and high-quality large caps; rotate into mid-caps on breadth expansions (confirm via stablecoin growth + ETF inflows + improving market-cap breadth). Risks: USD snapback (>99–100), rates backup (>4.3% 10Y / >5.1% 30Y), or oil >$70–72—any of which argues for trimming beta and reverting to BTC/ETH core. Path of least resistance: upward, majors first, with selective beta only on confirmed liquidity signals.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Base, Arbitrum, and unichain, alongside substantial inflows into Etherem and Hyperliquid.

Top chains by TVL: Ethereum $94.9B (-1.2%), Solana $12.5B (-4.6%), BNB Chain $8.0B (+3.9%), Tron $6.4B (-1.5%), Base $5.1B (0.0%), Arbitrum $3.5B (0.0%), Hyperliquid $2.4B (-7.7%), Avalanche C-Chain $2.2B (+4.8%).

Top chains by weekly fees: Hyperliquid $20.3M (+11.5%), Solana $11.2M (+14.3%), Ethereum $9.1M (–7.1%), Tron $9.1M (+8.3%), BNB Chain $5.07M (+35.0%), Base $1.31M (+19.5%), Osmosis $794.5K (–2.4%), Avalanche C-Chain $350.0K (+19.9%).

Top chains by DEX volume: Solana $29.4B (–6.7%), Ethereum $23.1B (+3.1%), BNB Chain $23.1B (+37.5%), Base $10.5B (+7.1%), Hyperliquid $6.67B (–26.7%), Avalanche C-Chain $4.36B (+13.4%), Sui $3.12B (–2.2%), Aptos $966M (–10.1%).

Interpretations and Future Outlook

Fees were up across the board this week, while DEX volumes slipped on most chains. BNB Chain was the clear outlier, posting a sharp jump in spot volume. Liquidity rotated out of L2s (notably Base/Arbitrum/Unichain) and into Ethereum and Hyperliquid, reinforcing a tilt toward L1 quality and perp venues. Net: supportive fee backdrop, softer spot breadth—favor majors and perps.

Stablecoin Metrics

Market Capitalization: The stablecoin market cap currently stands at $289 billion, reflecting a $3.4 billion decrease over the past week and a $11.4 billion increase over the past 30 days. This marks a continuation in the trend of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 4.5%-5.07%

Kamino: 4.4%-5.1%

Save Finance: 5%–5.4%

JustLend: 1.6%-4.8% (5% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum while Tron and Solana saw outflows.

Token-Specific Changes: USDC, USDT, USDe, USDS, and USDf saw supply increases this week, while BUDL declined modestly.

Interpretation and Outlook: Stablecoin supply rose by ~$3.4B this week, marking a slowdown from the mid-July re-acceleration in growth. Even so, momentum remains well above pre-re-acceleration levels.

CT Mindshare

Aster token price aprecation

The Aster token has seen remarkable price appreciation, surging 83% in the last 24 hours to $1.62 amid whale accumulations and a successful swap from APX to ASTER on a 1:1 basis. This rally has been amplified by influencer endorsements, a short squeeze forcing traders to cover positions, and renewed investor interest following an airdrop and mentions by prominent figures like Binance's Changpeng Zhao.

Titan raised $7M Seed round

Titan, Solana's premier meta-DEX aggregator, has raised $7 million in a seed round led by Galaxy Ventures, with participation from investors like Frictionless Capital, Mirana Ventures, and Solana co-founder Anatoly Yakovenko. The funding will scale its proprietary Argos algorithm, which outperforms competitors in 70-75% of trades, while the platform launches publicly with zero swap fees to attract users and potentially mirror models like Robinhood for high-frequency traders.

Plasma mainnet launch anounced

Plasma, a stablecoin-focused Layer-1 blockchain, has announced its mainnet beta launch on September 25 alongside the native XPL token, starting with $2 billion in stablecoin liquidity and zero-fee USDT transfers. Backed by Tether and featuring partnerships with DeFi protocols like Aave and Pendle, the project offers significant rewards for early Discord contributors, such as up to 30,000 XPL (valued around $20,000) for OG role holders, amid a pre-market FDV of $6.7 billion.

Streamer coin meta gained attention

The streamer coin meta on platforms like Pump.fun has captured widespread attention by tying memecoins to live streams, enabling creators to launch tokens that fluctuate based on viewer engagement and rake in daily payouts totaling $2 million. This trend collapses attention into rapid market dynamics, with some streamer coins hitting multimillion-dollar valuations in hours, though experts highlight risks around sustainability and long-term value amid hype-driven volatility.