This Week in Crypto (09/29/25)

Crypto market weekly overview and updates

Executive Summary

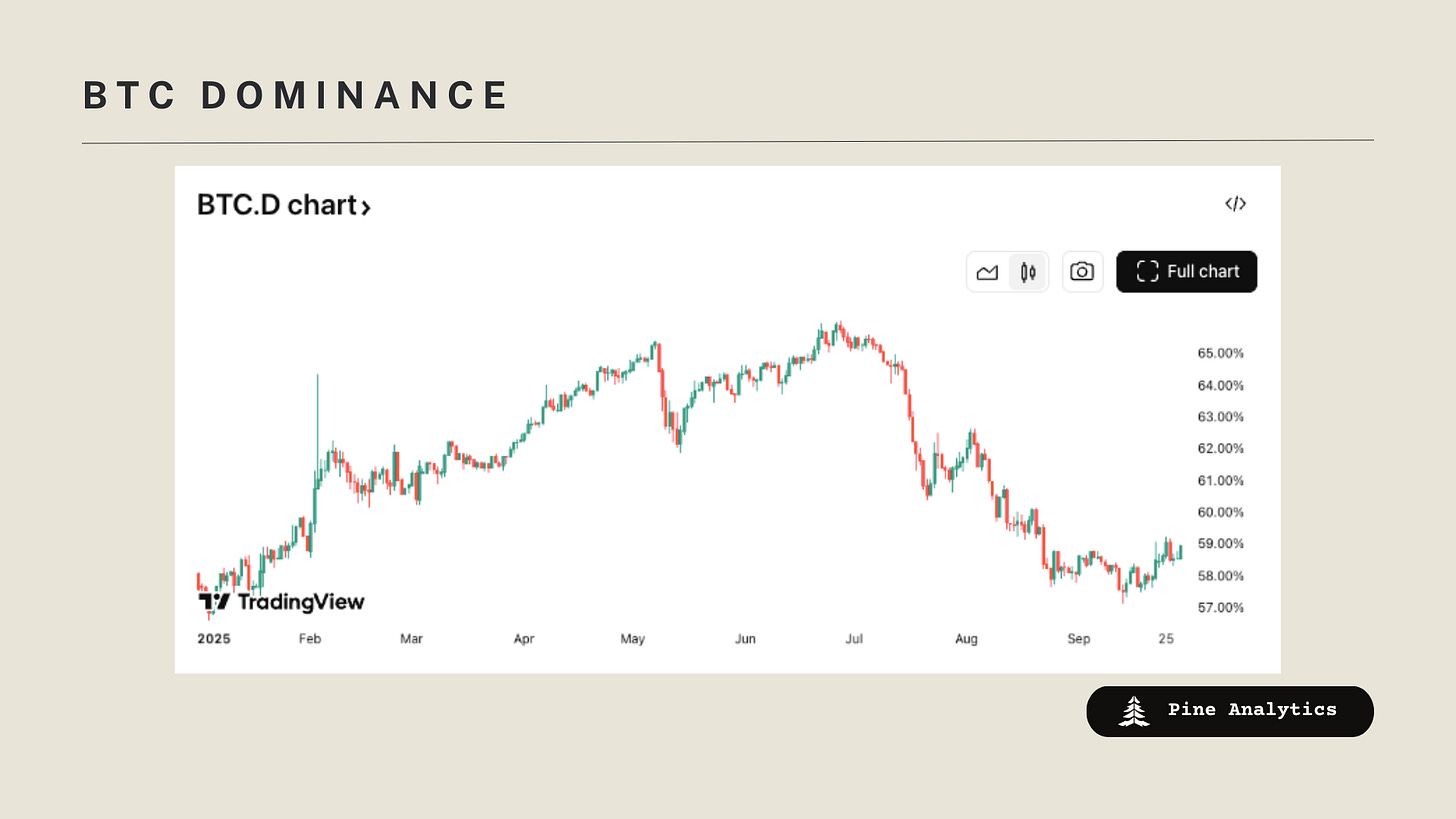

Risk-on backdrop into year-end: weak USD, steady CNY, high gold, anchored Treasuries, tame oil, and soft ISM tilt policy dovish. BTC trades ~$113.7K with 58% dominance—anchor bid amid BTC/ETH ETF outflows and modest SOL inflows. Retail remains quiet (low searches, Fear & Greed 39). Base case: BTC chops while gold runs; alts bleed until gold pauses and BTC rallies.

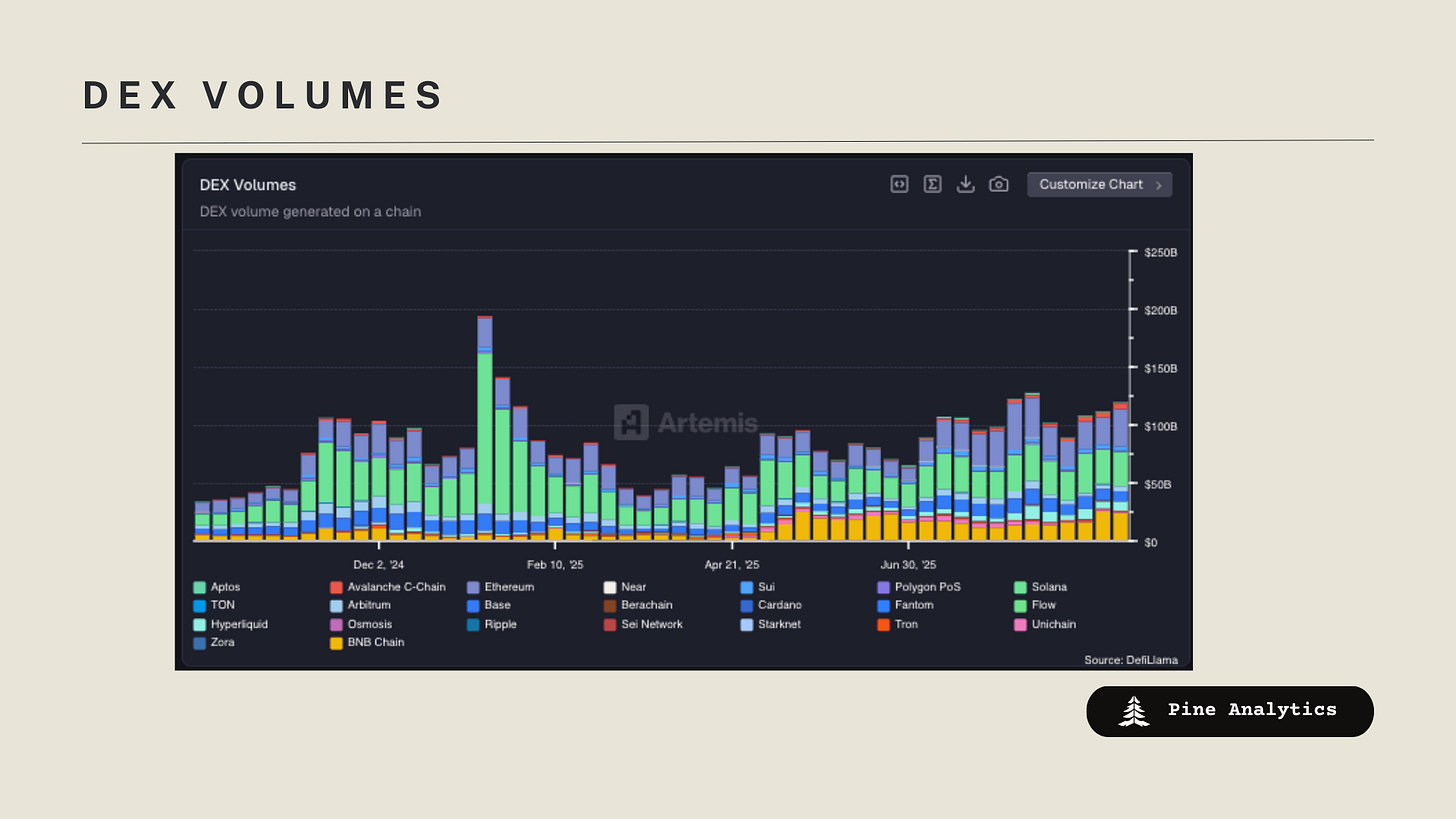

Flows rotated out of Base/Arbitrum/Polygon into Ethereum and Hyperliquid. ETH anchors TVL (~$88B), while Solana and Arbitrum lagged. Fees stay in a medium-term downtrend since mid-summer, while DEX volumes hold a longer-term uptrend with short-term boosts. BNB and Arbitrum stood out, Hyperliquid strong in perps.

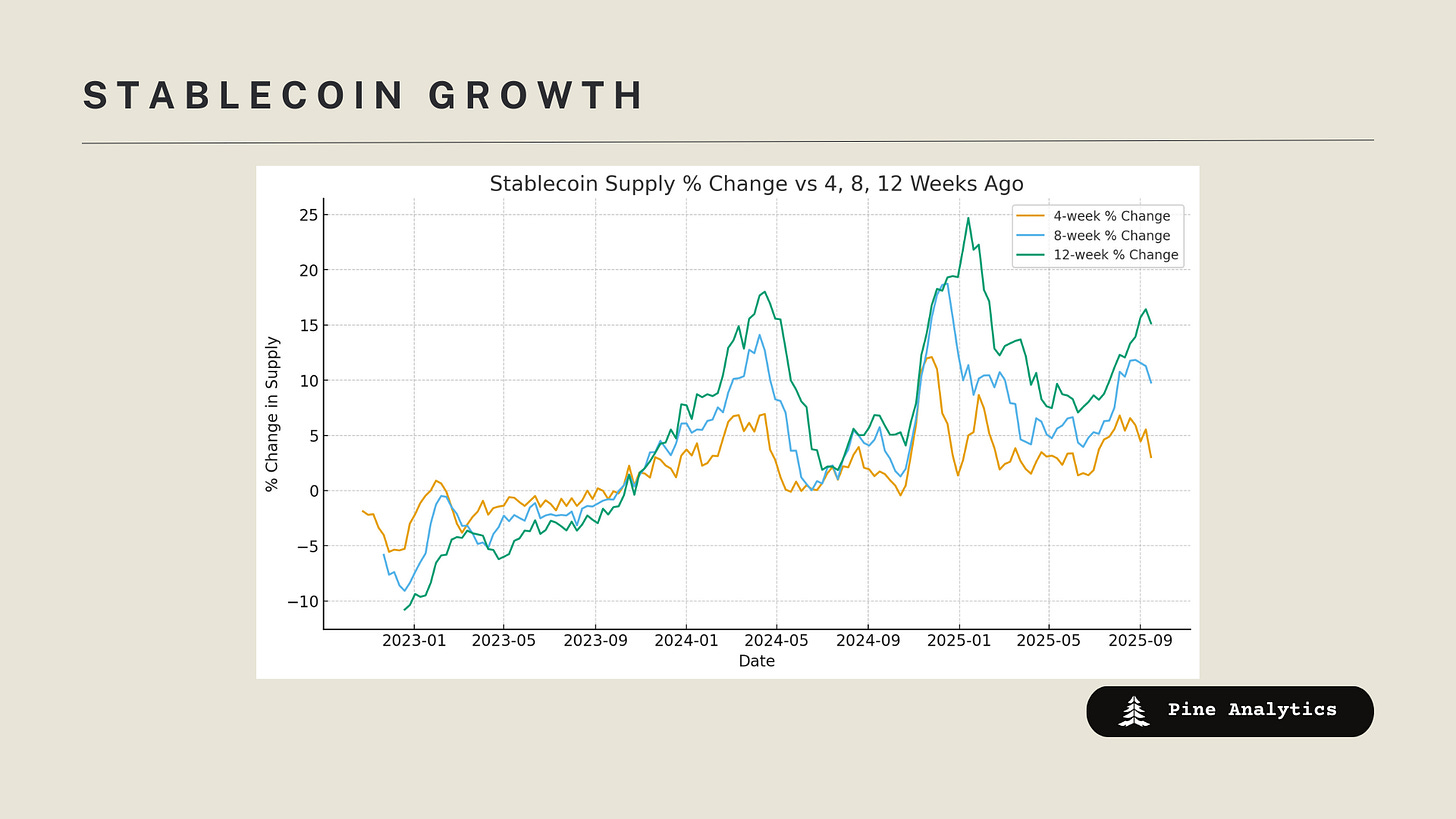

Stablecoins total ~$292B, down $2.8B WoW but +$15B MoM, showing slower growth. Ethereum gained supply share; Tron/Solana lost. USDC led outflows; USDT, PYUSD, and USDf expanded. Yields cluster 4–6% with Kamino/Save Finance higher.

Mindshare: Plasma launched with $2B inflows; Divine raised $6.6M for lending; Bulk raised $8M for Solana perps; LayerZero bought back $120M ZRO.

Risks: USD >99–100, 10Y >4.3%, 30Y >5.0%, or oil >$70.

Market Overview

Macro

The setup tilts risk-on into year-end. DXY sliding toward ~97–98 reflects ongoing USD weakness, while the CNY steadying near 0.140 limits devaluation risk and supports liquidity in EM and crypto flows. Gold pushing above ~$3.7k signals strong demand for store-of-value assets amid softer real rates, while UST yields show the 10Y anchored ~4.1% and the 30Y around 4.7%, consistent with a peak-rate regime where the Fed can stay patient. Oil holding near ~$63 keeps inflation pressures muted, leaving space for easier financial conditions if growth data underwhelms. ISM at 48.7 confirms manufacturing contraction but not collapse, aligning with a policy backdrop leaning dovish. Historically, this mix—weak USD, strong gold, anchored rates, and tame energy—supports risk appetite. Expect majors to lead in crypto rotation, followed by selective beta. Key triggers to watch: DXY breaking below 97 with momentum, the 10Y grinding toward ~3.8%, and positive net stablecoin issuance. Conversely, a USD rebound above 99–100, rates backing up (>4.3–4.5% on the 10Y, >5.0% on the 30Y), or oil spiking >70 would argue for de-risking.

Crypto Market Summary

BTC/Crypto Price Action: BTC trading at $113,657.09, up +3.73% (24h) and +0.32% (7d), with total crypto market cap at $3.90T.

BTC/ETH Dominance: BTC dominance commanding at 57.99% with ETH at 12.90%, indicating a rice in BTC dominance this week.

ETF Flows: BTC (-$534.5M) and ETH (-$719.8M), while SOL shows positive inflow of $59.6M.

Social/Search Trends: Bitcoin interest remains low at 21 (out of 100), while Crypto interest is slightly down at 25, indicating a decline in retail attention.

Fear & Greed Index: Current score of 39 (Feer), down 8 points over 7 days, indicating declining market sentiment.

Rotation Bucket Analysis: Rotation score at 50.64, with large caps (≥$100B) and mid-caps ($10B-$100B) gaining momentum while smaller caps lose share.

Interpretations and Future Outlook

Flows and positioning remain institution-led: ETFs show outflows in BTC and ETH, modest inflows in SOL, and retail heat remains muted. Macro still leans supportive—weak USD, anchored rates, and gold carrying the safety bid for now. BTC dominance near ~58% reinforces its role as the anchor trade.

Base case: BTC chops and alts bleed while gold runs, but once gold pauses, BTC is set to lead higher. Only after BTC is firmly in motion should alts be expected to follow, and likely with a lag. Until then, alts remain vulnerable to further bleed.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Base, Arbitrum, and polygon, alongside substantial inflows into Etherem and Hyperliquid.

Top chains by TVL: Ethereum $87.7B (-7.9%), Solana $11.3B (-9.6%), BNB Chain $7.8B (-3.7%), Tron $6.0B (-1.5%), Base $5.0B (-2.0%), Arbitrum $3.1B (-8.6%), Avalanche C-Chain $2.1B (-4.5%), Sui $2.0B (-4.8%).

Top chains by weekly fees: Hyperliquid $22.4M (+14.3%), Tron $8.4M (–7.7%), BNB Chain $7.7M (+29.3%), Ethereum $6.95M (+5.9%), Solana $6.35M (–39.5%), Base $1.31M (–3.3%), Arbitrum $1.15M (+328.9%).

Top chains by DEX volume: Ethereum $33.6B (+45.5%), Solana $31.5B (+4.7%), BNB Chain $26.6B (+11.8%), Base $7.7B (+15.4%), Hyperliquid $7.7B (+14.2%), Avalanche C-Chain $5.70B (+34.7%), Arbitrum $5.23B (+36.2%), Sui $3.65B (+15.9%).

Interpretations and Future Outlook

DEX volume remains on its longer-term uptrend, with majors like Ethereum and Solana sustaining strength and L2s showing periodic bursts of activity. Fees, however, are still locked in a medium-term downtrend dating back to mid-summer, with only short-lived rebounds. Over the past week, the divergence continued: a shorter-term upswing in DEX volumes contrasts with a renewed drift lower in fees.

Stablecoin Metrics

Market Capitalization: The stablecoin market cap currently stands at $292.2 billion, reflecting a $2.8 billion decrease over the past week and a $15.2 billion increase over the past 30 days. This marks a slowing in the trend of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 3.6%-4.6%

Kamino: 4.91%-13.38%

Save Finance: 5.25%–6.21%

JustLend: 1.7%-4.9% (5% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum while Tron and Solana saw outflows.

Token-Specific Changes: USDT, PYUSD, and USDf saw supply increases this week, while USDC had a very large outflow.

Interpretation and Outlook: Stablecoin supply rose by ~$2.8B this week, marking a slowdown from the mid-July re-acceleration in growth. Even so, momentum remains slightly above pre-re-acceleration levels.

CT Mindshare

Plasma blockchain launch

The Plasma blockchain, designed specifically for stablecoin transactions, has officially launched its mainnet beta along with its native XPL token, marking a significant step toward enabling instant, low-fee USD payments at a global scale.

This launch comes with an impressive $2 billion in stablecoin inflows and EVM compatibility, positioning Plasma as a high-performance Layer 1 solution for the future of finance.

Divine raised $6.6M

Divine, a blockchain-based micro-lending company, has secured $6.6 million in seed funding led by Paradigm to expand its undercollateralized lending protocol, Credit, aimed at borrowers without traditional access to capital.

The round includes participation from Nascent and other strategic investors, focusing on scaling stablecoin lending worldwide through decentralized finance innovations.

Bulk raised $8M

Bulk, a decentralized exchange for perpetual contracts on Solana, has raised $8 million in seed funding led by Robot Ventures and 6th Man Ventures to enhance its execution layer with sub-20ms latency for institutional-grade trading.

This funding aims to redefine perpetuals DEX trading amid Solana’s growing ecosystem, supported by additional backers to accelerate development and market adoption.

Layer zero buyback over $100M of their token

LayerZero Foundation has executed a $120 million buyback of 50 million ZRO tokens from early investors, reducing circulating supply and boosting token value by 26% in a strategic move to enhance long-term governance and liquidity.

This initiative underscores LayerZero’s commitment to its cross-chain protocol, following other ecosystem milestones like high transaction volumes and partnerships.