This Week in Crypto (10/06/25)

Crypto market weekly overview and updates

Executive Summary

Risk-on vibes into year-end: the dollar’s soft, rates feel anchored, and gold’s firm—supportive backdrop for crypto. The tape is institution-led with ETFs setting the tone, while retail stays quiet. Breadth is steady, with big caps carrying the bid and rotations happening at the margins. On-chain activity cooled this week, but trends remain up and BNB stood out as resilient. Stablecoin supply keeps grinding higher in a broad, cross-ecosystem way—fuel for the next leg when risk ignites. Base case: BTC grinds and sets the pace; alts follow once leadership is decisive. Green lights are a weaker dollar, calmer rates, and continued inflows; red flags are a USD snap-back, rate spikes, or ETF outflows.

Market Overview

Macro

The setup leans risk-on. DXY near ~98.5 signals a still-soft USD, while USDCNY ~7.12 looks stable—limiting deval risk and supporting EM/crypto liquidity. Gold pushing ~$3.9k flags strong SoV demand alongside softer real rates. USTs remain anchored with the 10Y ~4.15% and 30Y ~4.76%, consistent with a peak-rate backdrop where policy can stay patient. Oil around ~$62 keeps headline inflation pressure muted, leaving room for easier financial conditions if growth wobbles. Historically, this mix—weak dollar, strong gold, anchored long rates, and tame energy—supports risk appetite and majors leading any crypto rotation, with selective beta following. Bull triggers: DXY sustained <98, 10Y drifting toward ~4.0%–3.9%, positive net stablecoin issuance. Risk flags: USD rebound >100, 10Y backing up >4.4% (30Y >4.9%), or oil spiking >$70—all would argue for de-risking.

Crypto Market Summary

BTC/Crypto Price Action: BTC trades at $124,040, up 0.91% (24h) and 10.63% (7d), leading the market’s upward momentum.

BTC/ETH Dominance: BTC dominance dominates at 58.30% while ETH holds 13.03%, reflecting flat dominance this week.

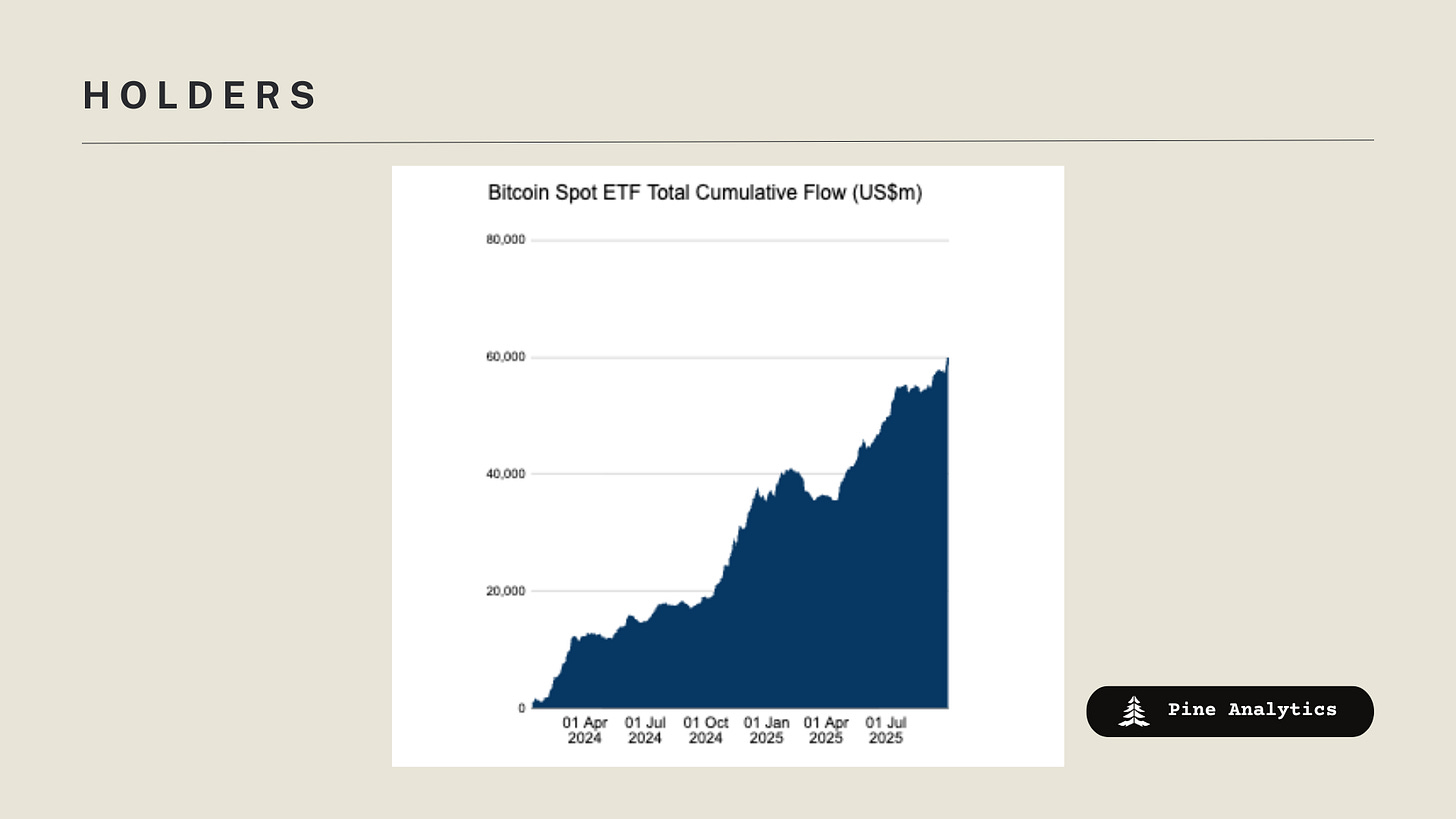

ETF Flows: Major institutional activity with BTC receiving $3.24B inflows, ETH seeing $1.30B, and SOL showing modest $34.9M in total flows.

Social/Search Trends: Bitcoin interest remains low but has ticked up off the lows since June, while crypto is flat at the bottom of interest.

Fear & Greed Index: Current score of 59 (Feer), up 16 points over 7 days, indicating a return to neutral market sentiment.

Rotation Bucket Analysis: Rotation score of 51.51 shows balanced market movement, with larger cap assets (>$1B) showing significant gains in market share (6-10% increases).

Interpretations and Future Outlook

Flows are still institution-led and macro leans supportive: soft USD (~98.5), steady CNY (~7.12), gold near ~$3.9k, anchored USTs (10Y ~4.15%, 30Y ~4.76%), and oil ~$62. ETF prints (BTC +$3.24B, ETH +$1.30B, SOL +$34.9M) fit an institution-first tape, while muted search/social keeps sentiment contained; BTC dominance ~58% anchors risk, and a ~51.5 rotation score shows balanced but cautious breadth with large caps gaining share. Base case: BTC grinds higher/sideways and alts follow only after a clear BTC impulse, led by larger caps. Bull triggers include DXY <98 with momentum, the 10Y edging toward 4.0–3.9%, continued positive ETF/stablecoin flows, rotation >55, and gold pausing; risk flags are USD >100, 10Y >4.4% (30Y >4.9%), oil >$70, or a flip to ETF outflows with BTC dominance rolling—conditions to de-risk.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Base, Ethereum, and Linea, alongside substantial inflows into Arbitrum, Staknet, and Hyperliquid.

Top chains by TVL: Ethereum $164.4B (+1.7%), Solana $15.4B (+9.2%), BNB Chain $12.8B (+5.8%), Arbitrum $9.3B (+2.2%), Base $4.6B (-6.1%), Polygon PoS $2.4B (-17.2%), Avalanche C-Chain $1.7B (+21.4%), Aptos $1.2B (+28.5%).

Top chains by weekly fees: Hyperliquid $18.2M (–18.8%), BNB Chain $9.1M (+18.2%), Ethereum $8.4M (+25.9%), Solana $7.7M (+21.1%), Base $1.10M (–16.2%), Osmosis $947.1K (+84.3%), Avalanche C-Chain $306.6K (+57.6%), Abstract $120.4K (+19.4%).

Top chains by DEX volume: Ethereum $25.9B (-22.9%), Solana $25.9B (-17.8%), BNB Chain $25.2B (-5.3%), Base $9.8B (+0.0%), Hyperliquid $5.2B (-38.4%), Sui $4.6B (+26.7%), Avalanche C-Chain $4.1B (-27.5%), Aptos $1.3B (+8.1%).

Interpretations and Future Outlook

On-chain activity softened across the board this week—both fees and DEX volume retrenched—marking a short-term break lower. The notable exception is BNB Chain, which continued to post steady growth on both metrics, signaling stickier user flow and resilient liquidity versus peers. Despite the weekly dip, all major venues remain in their longer-term uptrends.

Stablecoin Metrics

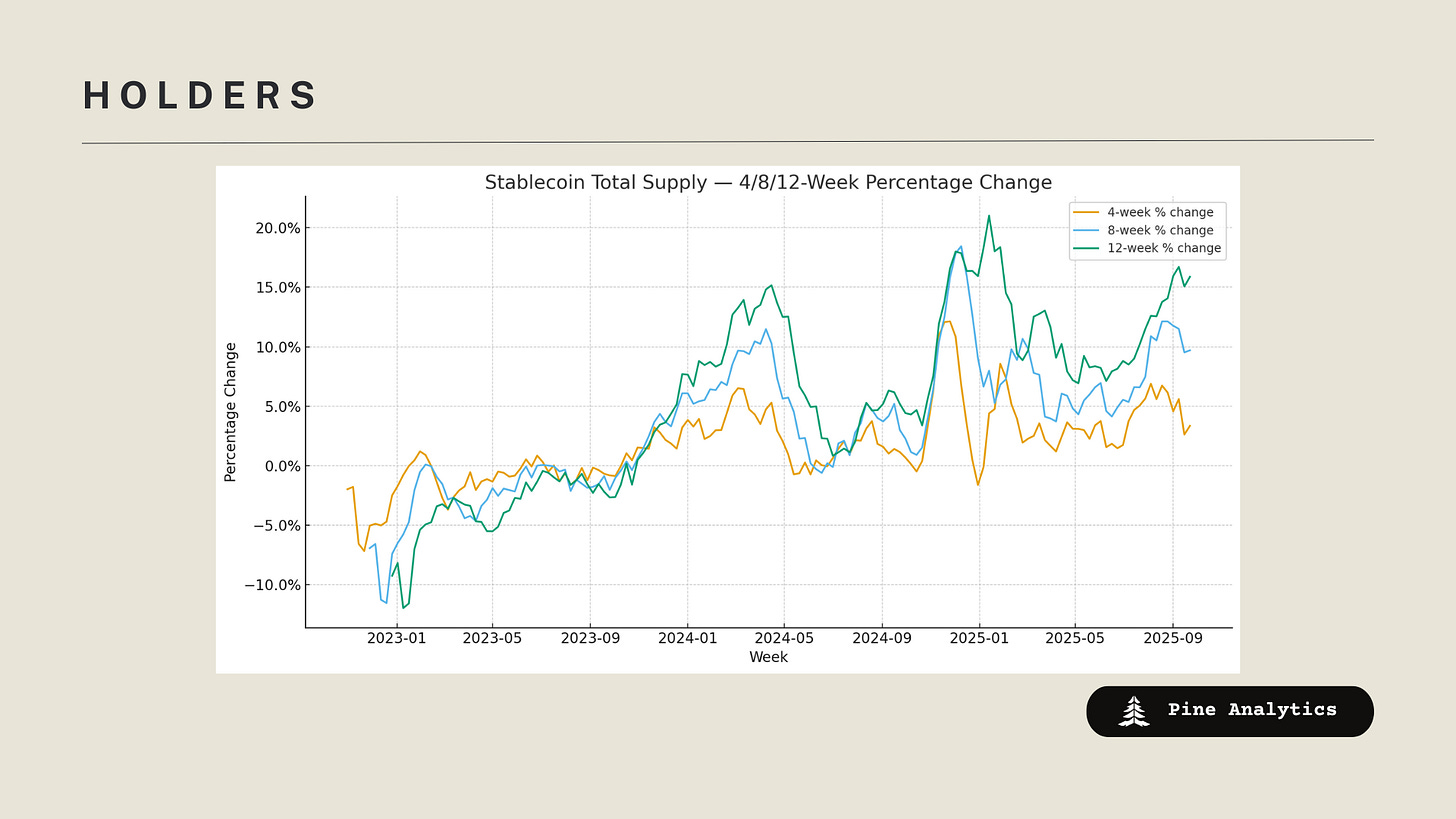

Market Capitalization: The stablecoin market cap currently stands at $298.2 billion, reflecting a $6 billion increase over the past week and a $15.1 billion increase over the past 30 days. This marks a continuation of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 3.85%-4.07%

Kamino: 4.26%-4.8%

Save Finance: 6.06%–8.20%

JustLend: 1.81%-4.38% (4.91% USDD)

Spark.fi: 4.5%

Chain-Specific Changes: This week, stablecoin supply increased most on Ethereum, Solana, and BNB while Polygon saw outflows.

Token-Specific Changes: USDT, USDC, and BUDIL saw supply increases this week, while USDF and DAI had outflows.

Interpretation and Outlook: Stablecoin supply rose by $6B this week, extending the mid-July reacceleration in growth. The increase is broad-based across the crypto ecosystem rather than concentrated in any specific corner.

CT Mindshare

Lithos’s Launch

Lithos has officially kicked off its Genesis Bootstrapping on the Plasma chain, marking the debut of the first ve(3,3) DEX with clean pools, advisor backing, and airdrop incentives to position it as the ecosystem’s core liquidity hub. This launch features a points program for farming rewards, split between locked veLITH for governance and liquid LITH, with stages running through early 2025 to bootstrap liquidity and attract new projects and users to Plasma.

CASH a new stablecoin on solana launched.

CASH, a USD-backed stablecoin, has launched on Solana through a collaboration with Phantom Wallet and Stripe, offering low-fee transactions, developer incentives, and integration for everyday DeFi use. It emphasizes liquidity bootstrapping with rewards on platforms like Kamino, aiming to become a go-to asset for payments and stable value storage in the ecosystem.

ORO’s Tokenized GOLD Launched.

ORO has introduced GOLD, a tokenized gold asset on Solana backed 1:1 by audited physical reserves, enabling users to buy, stake for yield, and redeem for real metal through DeFi protocols like Meteora. This launch creates composable, internet-native gold for fractional ownership, bridging traditional commodities with blockchain for enhanced accessibility and liquidity.

Double Zero launched their token 2Z

Double Zero has debuted its 2Z token on Solana at a $7.4B FDV, powering a fiber network for optimized blockchain traffic across 25 global locations with SEC no-action letter confirmation. Backed by top VCs, 2Z supports staking rewards, governance, and payments, following mainnet beta with no airdrop.