Executive Summary

Markets lean risk-on heading into mid-October. Gold’s surge to ~$4.07K, a softening dollar (DXY ~99), and anchored UST yields (~4.06% 10Y, ~4.64% 30Y) signal easing real-rate pressure and healthy liquidity conditions. Oil’s slide to ~$60 keeps inflation benign, supporting risk appetite across asset classes. Within crypto, BTC holds leadership at ~$115K with 58.5% dominance, while ETF inflows (BTC +$2.7B, ETH +$428M, SOL +$29M) reinforce the institutional bid despite cooling sentiment (Fear & Greed 40). Mid-caps are gaining traction, hinting at a potential rotation if macro stability endures.

On-chain data paints a post-flash-crash recovery: activity rebounded sharply after Oct 10’s liquidation-driven shock. Arbitrum saw inflows and rising TVL (+10.8%), contrasting with outflows from Hyperliquid, Ethereum, and Base. Fee growth across BNB, Hyperliquid, and ETH outpaced spot volume—evidence of leveraged and derivatives-driven throughput. Meanwhile, stablecoin supply added $1.4B this week, signaling continued liquidity expansion though at a slower pace.

Market Overview

Macro

Setup leans risk-on: gold ripping to ~4.07k underscores strong SoV demand amid easing real-rate pressure, while WTI ~60 keeps headline inflation tame. DXY sits near ~99 after a weak year-long trend, and CNY/USD ~0.140 (~7.13 USD/CNY) looks stable—limiting deval shock risk. USTs remain anchored (10Y ~4.06%, 30Y ~4.64%) and ISM hovers ~49—soft growth but not collapsing. This mix—soft dollar, subdued energy, falling term premia—supports easier financial conditions and liquidity transmission into risk assets. For crypto, that favors majors first (BTC/ETH leadership, stronger ETF bid), with selective beta following as breadth improves. Biggest tailwinds: DXY sustained <98 and 10Y drifting toward ~3.9%. Key risk flags: a dollar bounce >100, oil >~70 reigniting inflation, or ISM lurching <47—any of which would curb risk appetite and stall rotation.

Crypto Market Summary

BTC/Crypto Price Action: BTC trades at $115,220.48 (+2.96% 24h, -7.08% 7d) with total crypto market cap at $3.93T (+4.78% 24h).

BTC/ETH Dominance: BTC dominance dominates at 58.5% while ETH holds 12.8%, reflecting a rotation into BTC this week.

ETF Flows: BTC saw net $2.71B inflow, ETH attracted $428.2M, SOL gained $29M in weekly inflows.

Social/Search Trends: Bitcoin and crypto saw a bounce in search activity from levels just above their yearly low.

Fear & Greed Index: Current score of 40 (Fear), down 19 points over 7 days, indicating a return to fear in the market.

Rotation Bucket Analysis: Rotation score at 42.28/100; mid-cap tokens ($10M-1B) gaining momentum while large caps (>$10B) experience outflows.

Interpretations and Future Outlook

Institutional bid still sets the tone while macro tilts supportive: soft USD (~99), steady CNY (~7.13), gold strong (~$4.07k), tame oil (~$60), and anchored USTs (10Y ~4.06%, 30Y ~4.64%) with ISM ~49. Price tape echoes it—BTC ~$115.2K with dominance ~58.5% and total mkt cap ~$3.93T—while ETFs print inflows (BTC +$2.71B, ETH +$488M, SOL +$29M). Sentiment is restrained (Fear & Greed 40) and search interest only bounced from near lows; breadth remains cautious (rotation 42.3) with mid-caps perking up but large caps seeing outflows. Base case: BTC grinds higher/sideways, majors lead; selective beta follows on clear BTC impulses. We don’t expect a decisive BTC leg until gold cools and consolidates. Bull triggers: DXY <98 with momentum, 10Y toward ~3.9%, sustained positive ETF/stablecoin flows, rotation >55, search/FG recovering, ISM ≥50, and gold pausing. Risk flags: USD >100, oil >$70, 10Y >4.4% (30Y >4.9%), ISM <47, or ETF outflows.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Hyperliquid, Ethereum, and Base, alongside a substantial inflow into Arbitrum.

Top chains by TVL: Ethereum $92.7B (-1.2%), Solana $12.5B (-0.8%), BNB Chain $9.1B (flat), Tron $6.3B (-1.6%), Base $5.4B (flat), Arbitrum $4.1B (+10.8%), Sui $2.6B (-7.1%), Hyperliquid $2.5B (+13.6%).

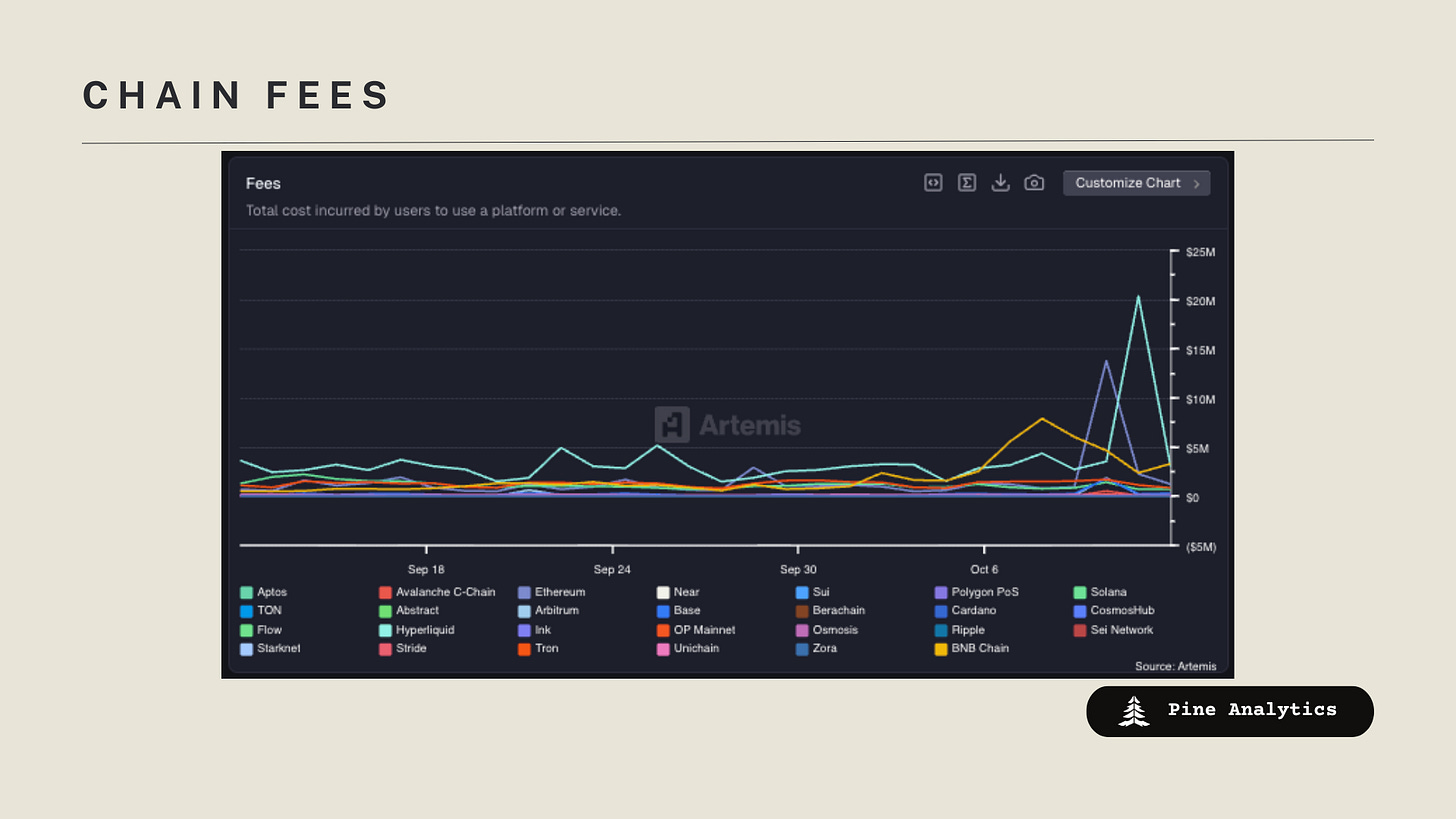

Top chains by weekly fees: Hyperliquid $38.5M (+111.5%), BNB Chain $30.8M (+266.7%), Ethereum $21.0M (+150.0%), Tron $9.8M (+7.7%), Solana $6.8M (–11.7%), Base $3.1M (+224.5%), Arbitrum $2.36M (+641.9%), Osmosis $854.0K (–6.7%).

Top chains by DEX volume: BNB Chain $35.0B (+47.1%), Ethereum $33.6B (+23.1%), Solana $29.4B (+20.0%), Base $11.9B (+30.8%), Arbitrum $8.4B (+72.0%), Sui $7.0B (+65.9%), Hyperliquid $5.0B (–14.7%), Avalanche C-Chain $3.37B (–17.6%).

Interpretations and Future Outlook

On-chain activity drifted lower across majors into Oct 10—BNB the lone holdout—then a crypto-wide flash-crash sparked a sharp, cross-chain spike that’s now morphing into a post-shock resurgence. Bridge data points to rotation, not exit: outflows from Hyperliquid/Ethereum/Base and a clear inflow to Arbitrum, echoed by ARB TVL gains while most others were flat/softer. Revenues outpaced spot: fees exploded (Hyperliquid, BNB, ETH, ARB) even as DEX volume leadership sat with BNB, ETH, SOL—with Hyperliquid’s high fees vs softer volume implying perp/funding intensity. Outlook: if elevated fees/volume hold for a few sessions, expect ETH/SOL/BNB to lead while Arbitrum remains the main flow magnet; Base needs inflow reversals to re-accelerate.

Stablecoin Metrics

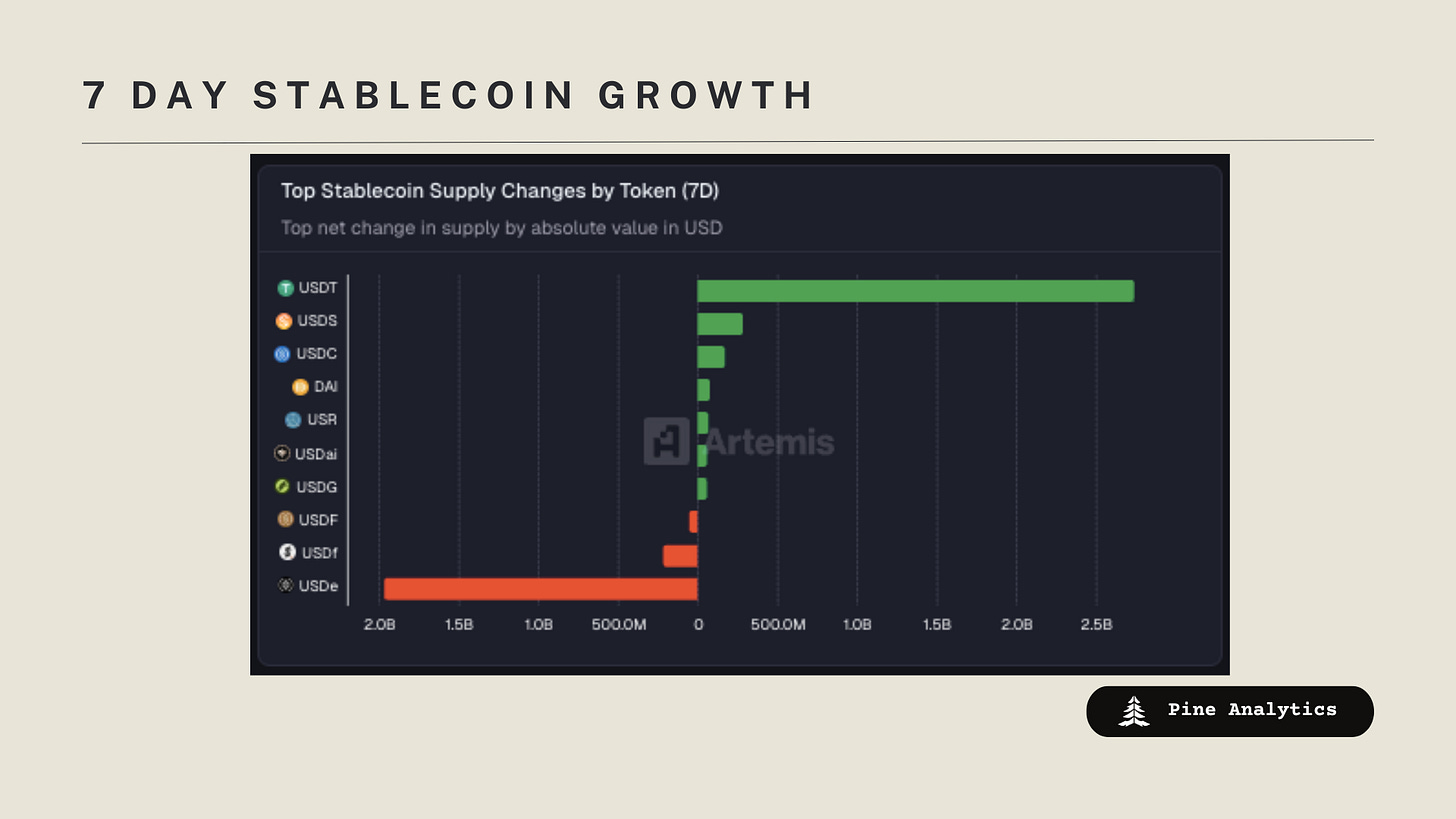

Market Capitalization: The stablecoin market cap currently stands at $300.6 billion, reflecting a $1.4 billion increase over the past week and a $15 billion increase over the past 30 days. This marks a slowing of accelerated growth that has been going for the past two months.

Stablecoin Supply Rates:

AAVE: 3.7%-4.4%

Kamino: 1.6%-4.4%

Save Finance: 5.7%–6.7%

JustLend: 1.9%-3.7% (5% USDD)

Spark.fi: 4.75%

Chain-Specific Changes: This week, stablecoin supply increased most on Tron, Solana, and Plasma while Ethereum saw major outflows.

Token-Specific Changes: USDT, USDC, and USDS saw supply increases this week, while USDF and USDe had outflows.

Interpretation and Outlook: Stablecoin supply rose by $1.4B this week, a slowdaon in the mid-July reacceleration in growth. The increase is broad-based across the crypto ecosystem rather than concentrated in any specific corner.

CT Mindshare

Altcoin Flashcrash

In a dramatic market event, altcoins experienced a severe flash crash on October 10, 2025, leading to a record $19 billion in liquidations as leveraged positions were wiped out. While Bitcoin remained relatively stable, the incident highlighted the risks of high leverage in the crypto space.

UMBRA ICO

The Umbra privacy protocol, powered by Arcium on Solana, successfully completed its ICO, raising $155 million in commitments but retaining only $3 million and returning the excess to investors. The $UMBRA token launched at $0.075 and surged to $2.33, demonstrating strong market interest in privacy-focused projects amid market volatility.

Jupiter Announces jupUSD

Jupiter Exchange, the leading DEX aggregator on Solana, has announced the launch of its native stablecoin jupUSD in partnership with Ethena Labs, set for release in the fourth quarter of 2025. This move aims to enhance liquidity and provide a Solana-native dollar backed initially by tokenized U.S. Treasuries.

375ai Raised 10M

Edge data intelligence company 375ai has secured $10 million in funding led by Delphi Ventures, Strobe Capital, and HackVC to expand its decentralized network for capturing real-world data. The investment will accelerate deployments across the US, enabling AI models to access real-time insights from physical environments.