This Week in Crypto (11/09/25)

Crypto market weekly overview and updates

Executive Summary

Markets remain in a transitional phase—macro easing is underway but liquidity transmission is incomplete. Two cuts are behind us with a third expected in December, and data show disinflation without recession: oil near $60, gold around $4K, yields edging lower, and DXY below 100. Risk appetite has softened in the short term as crypto digests the policy shift—BTC sits near $102K (down from $123K), ETF flows are negative, and sentiment has retraced to “Fear.” On-chain data show broad TVL declines, bridge flow consolidation into Ethereum and Arbitrum, and strong fee generation from Hyperliquid and ETH amid a slowdown in Base and Solana activity. Stablecoin supply is flattening, with rotation into USDT and USDS while USDC contracts. Overall, capital is defensive but not fleeing: liquidity preference is moving up the quality curve, and easing policy sets the stage for stabilization first, then gradual risk re-engagement as the next cut cycle unfolds.

Market Overview

Macro

Two cuts are in, and a third is broadly expected in December. The data still read disinflationary rather than recessionary: ISM manufacturing sits below 50 (48.7), oil has broken to ~$60, and the long end has eased (10Y ~4.09%, 30Y ~4.70%). Gold near $4,000 alongside a sub-100 DXY (~99.5) points to compressing real yields and softer dollar dynamics without obvious currency stress. That’s an early-easing profile where policy is loosening but the growth impulse hasn’t turned yet—supportive for risk over a medium horizon, but not a straight line.

For BTC (~$102K from $123K), that mix argues for patience. The correction looks like a positioning reset during the transmission lag between rate cuts and actual liquidity effects. If December delivers the third cut and the dollar drifts lower, a grind back toward prior highs becomes reasonable over the next few months. If the Fed hesitates or the dollar backs up, a deeper test of the $95K area is likely. In short: macro skew is constructive, but near-term path remains two-sided—support in the high-90s, recovery contingent on confirmation that easing is flowing through rather than simply priced.

Crypto Market Summary

BTC Price Action: BTC is trading around $102,871 (+0.93% 24h, -6.91% 7d).

BTC/ETH Dominance: BTC at 60%, ETH at 12.2%; BTC’s dominance has remained the same while ETH is down over the week.

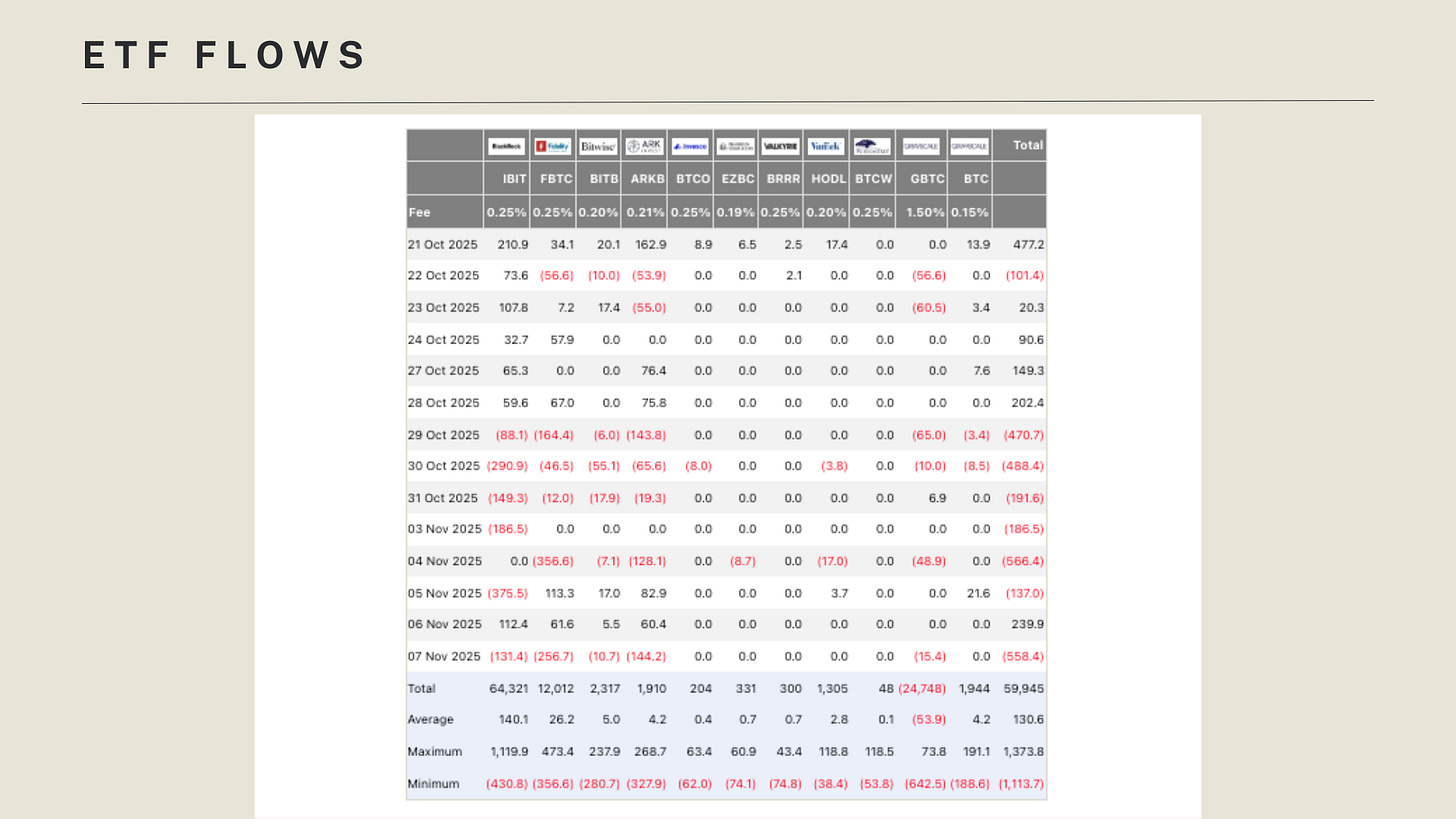

ETF Flows: Net outflows from BTC (–$1.2B) along with outflows from ETH (-$507M) overwhelmed SOL infows (+$136M) this week by over 10x.

Social/Search Trends: Interest in “Bitcoin” and “crypto” is near the bottom of its 12-month range.

Fear & Greed Index: Currently at 24 (“Fear”), down 12 points over the past week, indicating weakening risk sentiment.

Interpretations and Future Outlook

The market sits in an early-easing, late-lag phase: two cuts are done, a third is expected in December, and the data are disinflationary (PMI 48.7, oil ~$60, long end easing). Gold near $4k and DXY sub-100 point to compressing real yields without currency stress, but crypto flows are soft—BTC is ~$102K (off from $123K), ETFs saw net outflows, search interest is muted, and sentiment is “Fear.” That mix argues the drawdown is mainly positioning and transmission-lag rather than a break in the thesis.

Near term, expect two-sided trade in a $95K–$110K band: dips out of this range if the Fed hesitates or the dollar pops; recovery toward prior highs if December confirms the third cut and DXY grinds lower or ETF demand stabilizes. Medium horizon still skews constructive—liquidity should start to show up first in BTC, then broader crypto—just not on a straight line.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Polygon, Unichain, and Linena, alongside a substantial inflow into Arbitrum an Ethereum.

Top chains by TVL: Ethereum $74.9B (–12.3%), Solana $10.2B (–8.9%), BNB Chain $7.7B (–8.3%), Bitcoin $7.6B (–6.2%), Tron $5.6B (+1.9%), Base $4.8B (–9.4%), Arbitrum $3.8B (+11.8%), Plasma $2.7B (–34.1%).

Top chains by weekly fees: Hyperliquid $20.3M (+16.0%), Ethereum $9.8M (+90.8%), Tron $7.7M (–8.2%), Solana $5.6M (–16.7%), BNB Chain $4.8M (–21.1%), Bitcoin $2.6M (+23.3%), Base $2.3M (–2.4%).

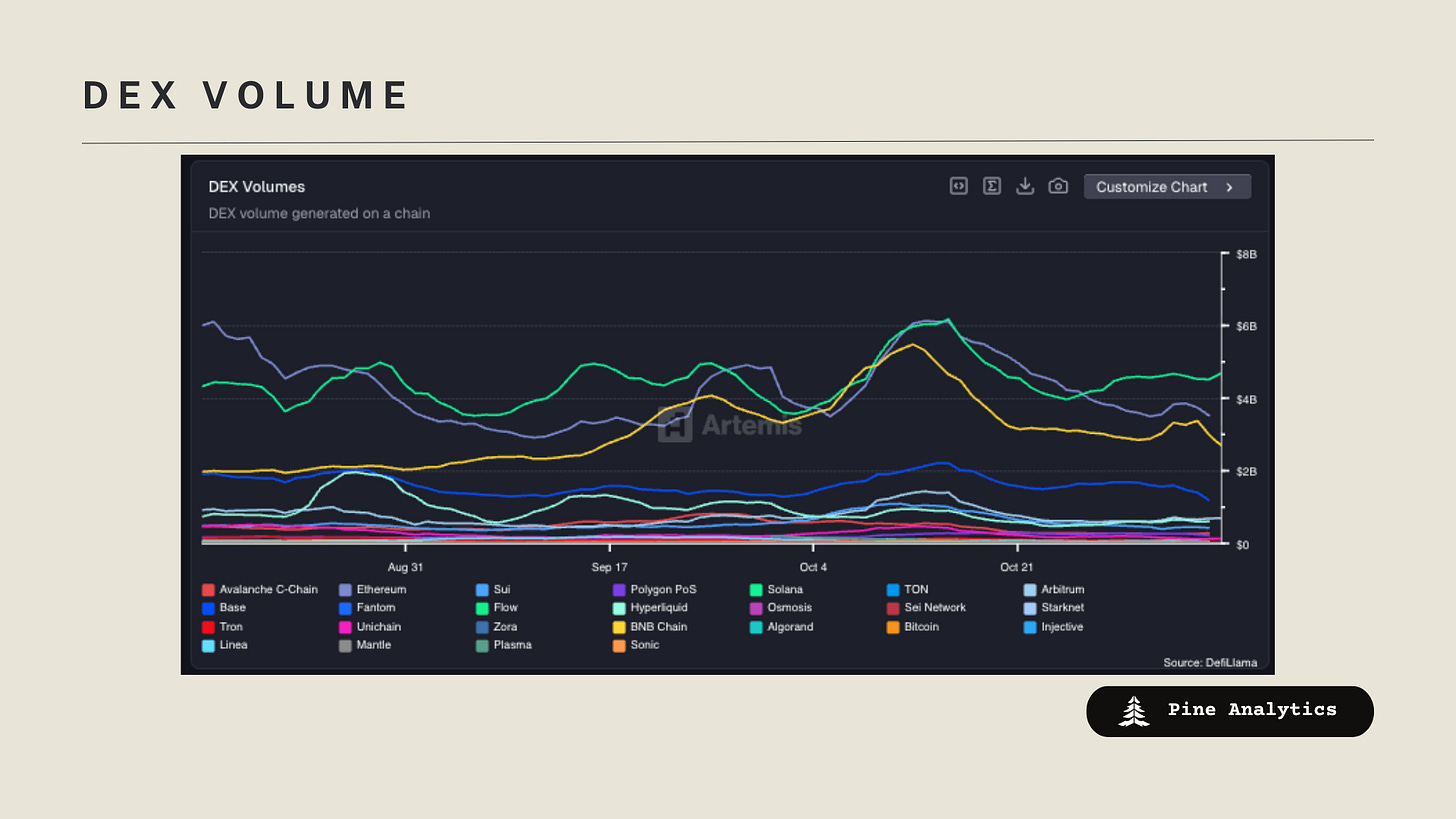

Top chains by DEX volume: Solana $31.5B (–2.2%), Ethereum $24.5B (–2.8%), BNB Chain $21.0B (+3.4%), Base $8.4B (–29.4%), Arbitrum $4.25B (–1.7%), Hyperliquid $4.24B (+1.6%), Sui $3.0B (unchanged), Avalanche C-Chain $2.01B (+6.5%).

Interpretations and Future Outlook

Bridge flows show a rotation toward Ethereum and Arbitrum and away from Polygon/Unichain/Linea, consistent with “quality + liquidity” preference during a risk reset. TVL fell broadly (ETH –12%, SOL –9%, BASE –9%), with Arbitrum the outlier (+12%) and Plasma sharply lower (–34%), suggesting capital is consolidating on venues perceived as lower-friction and better tooled. Fee data reinforce that concentration: Hyperliquid and Ethereum posted strong weekly gains, while BNB, Solana, Base softened—read as perp activity holding up and L1 retail flow cooling. On usage, Solana still leads DEX volume and BNB is resilient, but Base volume slid ~30%, flagging the near-term retreat in speculative activity.

Near term, expect selective risk rather than broad beta: ETH and high-throughput L2s (notably Arbitrum) look best positioned to absorb returning flow, while Solana likely maintains share leadership in spot/retail even if volumes chop. If macro eases as expected and stablecoin supply/ETF flows stabilize, look for gradual re-accumulation in ETH-beta (L2s, infra) and a follow-through bid on SOL ecosystems; if the dollar bounces or fees/volumes keep sliding, the path is more range-bound with continued rotation out of weaker mid-tier chains (e.g., Plasma, long tail L2s).

Stablecoin Metrics

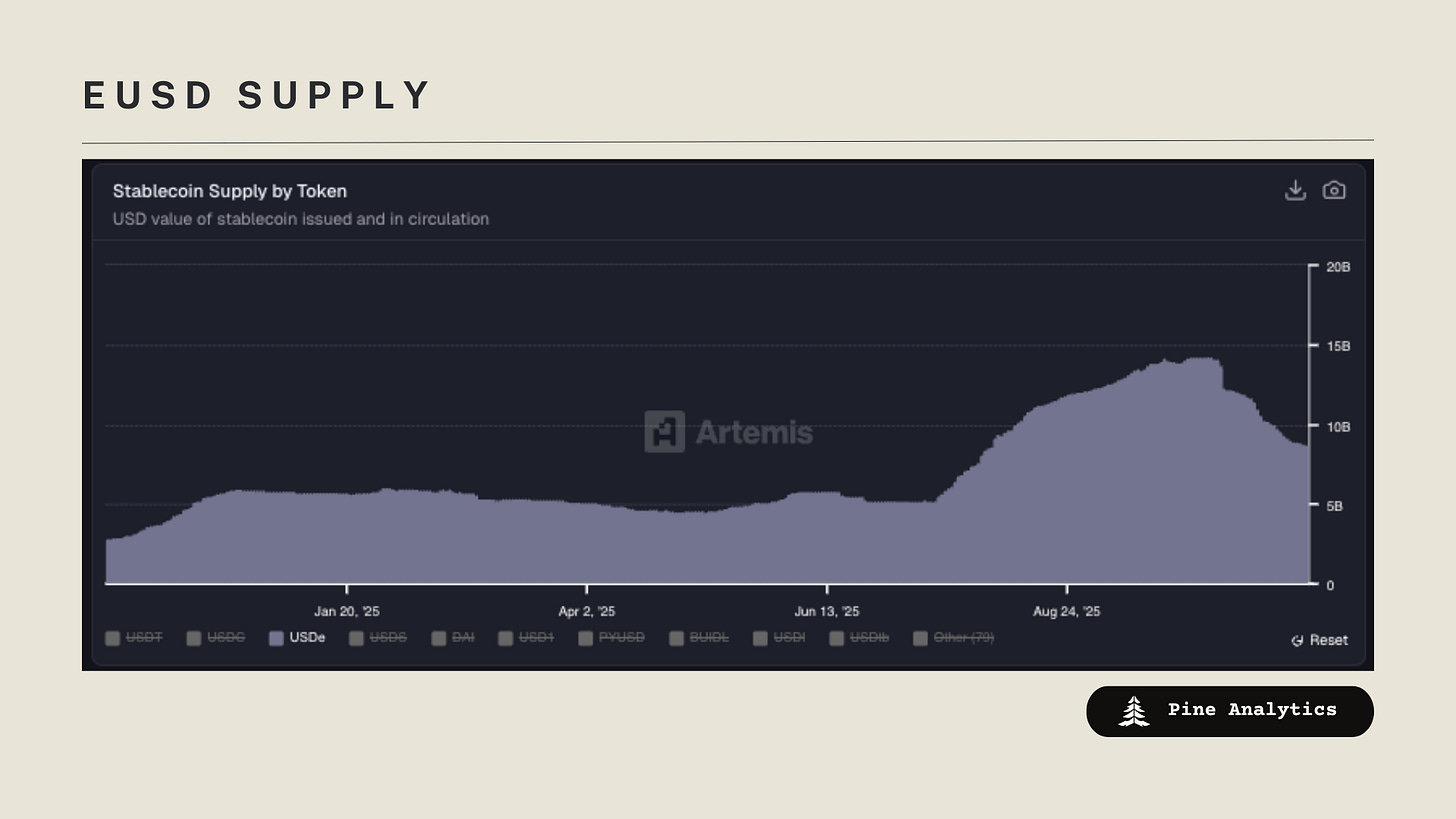

Market Capitalization: Stablecoin market cap is $305.3B, with supply up $0.3B week over week and up $3B over the past 30 days. The marks the start of a declining tred of Stablecoin supply.

Stablecoin Supply Rates:

AAVE: 4.7%-5.1%

Kamino: 2.3%-3.1%

Save Finance: 5.7%–7.8%

JustLend: 1.8%-4.7% (5.1% USDD)

Spark.fi: 4.75%

Chain-Specific Changes: Supply increased most on Ethereum; Solana and Plasma saw outflows.

Token-Specific Changes: USDT and USDS increased in supply, while USDe and USDC experienced major outflows.

Interpretation and Outlook: Stablecoin growth is reversing: market cap flat WoW, supply is rotating to Ethereum, Solana and Plasma are seeing outflows, and USDT/USDS are gaining as USDC declines and USDe unwinds—signaling consolidation and a safety-first carry.

CT Mindshare

Rift trade launch

Rift has launched its innovative peer-to-peer Bitcoin trading protocol, enabling self-custody swaps between Ethereum and Bitcoin without intermediaries. This trustless platform, backed by an $8 million investment from Paradigm, empowers users to trade native tokens securely while maintaining full control over their assets.

Solomon Labs Launch

Solomon Labs is a Solana-based stablecoin protocol preparing a token launch on MetaDAO, built around BTC basis-trade yield. It issues USDv, where holders can receive the yield of the underlying basis trade. In whitelist mode, it has ~$1.4M in deposits to mint ~$1.4M USDv, with ~$250K staked and ~$800K in a Meteora USDC–USDv pool.

Kuru Series A

Kuru, an on-chain order book exchange built on Monad, has successfully raised $11.6 million in its Series A funding round led by Paradigm. This investment will support team expansion and the realization of Kuru’s vision for a high-performance decentralized trading platform.

Harmonic Launch

Harmonic has launched its HFT-style block building infrastructure and builder market on Solana, aiming to boost validator performance through an advanced aggregation layer. Backed by Paradigm, this open-source initiative introduces cutting-edge tools to supercharge the Solana ecosystem’s efficiency and scalability.