This Week in Crypto (11/23/25)

Crypto market weekly overview and updates

Executive Summary

Markets are transitioning out of a late-tightening regime as real yields soften, the dollar weakens, and gold breaks to new highs—signals that the marginal cost of capital is no longer rising after two years of aggressive tightening. Yet conditions haven’t fully shifted into easing, with credit spreads edging higher and the system likely needing a stress point before policymakers pivot decisively. Crypto sits at a similar crossroads: macro pressure is fading, but sentiment has collapsed, with ETF outflows, depressed search interest, and a Fear & Greed Index near extremes even as BTC holds the mid-$80Ks. Stablecoin supply is flattening and starting to contract, rotating toward Sui and Tron while Ethereum sees outflows and USDC regains share amid USDe unwinds, pointing to a safety-first posture. Across the industry, strategic moves like Coinbase’s acquisition of Vector, new SIMDs shaping Solana’s roadmap, Circle’s launch of xReserve to unify USDC liquidity, and Ranger’s upcoming token launch underscore continued infrastructure expansion despite weak near-term flows. Altogether, the mix of improving macro conditions, washed-out sentiment, and resilient price action sets the stage for a high-convexity turn if a liquidity catalyst emerges.

Market Overview

Macro

The macro backdrop has clearly shifted into a late-tightening, early-easing regime. The U.S. dollar has softened materially over the past year, while gold has ripped to new highs—classic signs that real yields are peaking and global capital is rotating out of “safe USD duration.” Both the 10Y and 30Y Treasury yields have rolled over from their cycle highs, indicating that inflation pressure is cooling and the market is beginning to price eventual policy easing rather than additional tightening. Oil grinding down into the high-50s reinforces that disinflationary impulse. Even the Chinese yuan has been inching stronger, a notable reversal from 2022–2023 when persistent USD strength exerted a global liquidity drag. Together, these signals point to a macro environment where the marginal cost of capital is no longer rising—a structural shift after two years of relentless tightening.

For risk assets, especially crypto, this is historically the setup that precedes major expansions in liquidity and risk appetite. Crypto performs best when real yields stabilize or fall, the dollar weakens, and capital rotates into higher-beta exposures—conditions that are now taking shape. But late-tightening regimes often don’t fully transition into sustained easing until something in the financial plumbing breaks: a credit accident, a funding-market dislocation, or a sharp widening somewhere in the system that forces policymakers to shift from “higher for longer” to “stability at all costs.” With current price action across gold, rates, and the dollar, that kind of pressure point may be approaching.

Crypto Market Summary

BTC Price Action: BTC is trading around $86,825 (+2.92% 24h, -8.92% 7d).

BTC/ETH Dominance: BTC at 59.22%, ETH at 11.6%. Interestingly, both BTC and ETH dominance dropped this week.

ETF Flows: Net outflows from BTC (–$1.2B) along with outflows from ETH (-$799M) overwhelmed SOL infows (+$126.4M) this week by over 10x.

Social/Search Trends: Interest in “Bitcoin” and “crypto” is near the bottom of its 12-month range. BTC seaches have slightly ticked up, while Crypto has continued to drop.

Fear & Greed Index: Currently at 10 (“Fear”), down 7 points over the past week, indicating extreme fear.

Interpretations and Future Outlook

The broader environment is now defined by a tension between improving macro conditions and deteriorating crypto-native sentiment. On one hand, the macro regime is shifting away from the aggressive tightening that capped valuations across 2022–2023. Falling yields, a softer dollar, and gold’s breakout all point toward easing real-rate pressure—historically the precursor to renewed risk appetite. However, late-tightening phases rarely transition cleanly into full easing; they often require a stress point in the financial system to force policymakers into a more decisive pivot. With credit spreads grinding higher beneath the surface and rates markets signaling fragility, that catalyst may be nearing.

Meanwhile, crypto positioning and psychology sit at near-opposite extremes. Flows into BTC and ETH ETFs have turned negative, search and social interest remain depressed, and the Fear & Greed Index is deep in “fear” territory. BTC dominance drifting lower alongside ETH suggests broad de-risking rather than rotation. Yet BTC holding the mid-$80Ks despite extreme fear, outflows, and macro ambiguity hints at underlying structural demand and the absence of forced sellers. Historically, this combination—macro pressure easing, sentiment washed out, and price stabilizing—has been the setup that precedes strong upside once catalysts arrive. If macro continues to drift toward early easing and a liquidity impulse is triggered by a break in the financial plumbing, crypto could be one of the first risk assets to reprice sharply higher.

Stablecoin Metrics

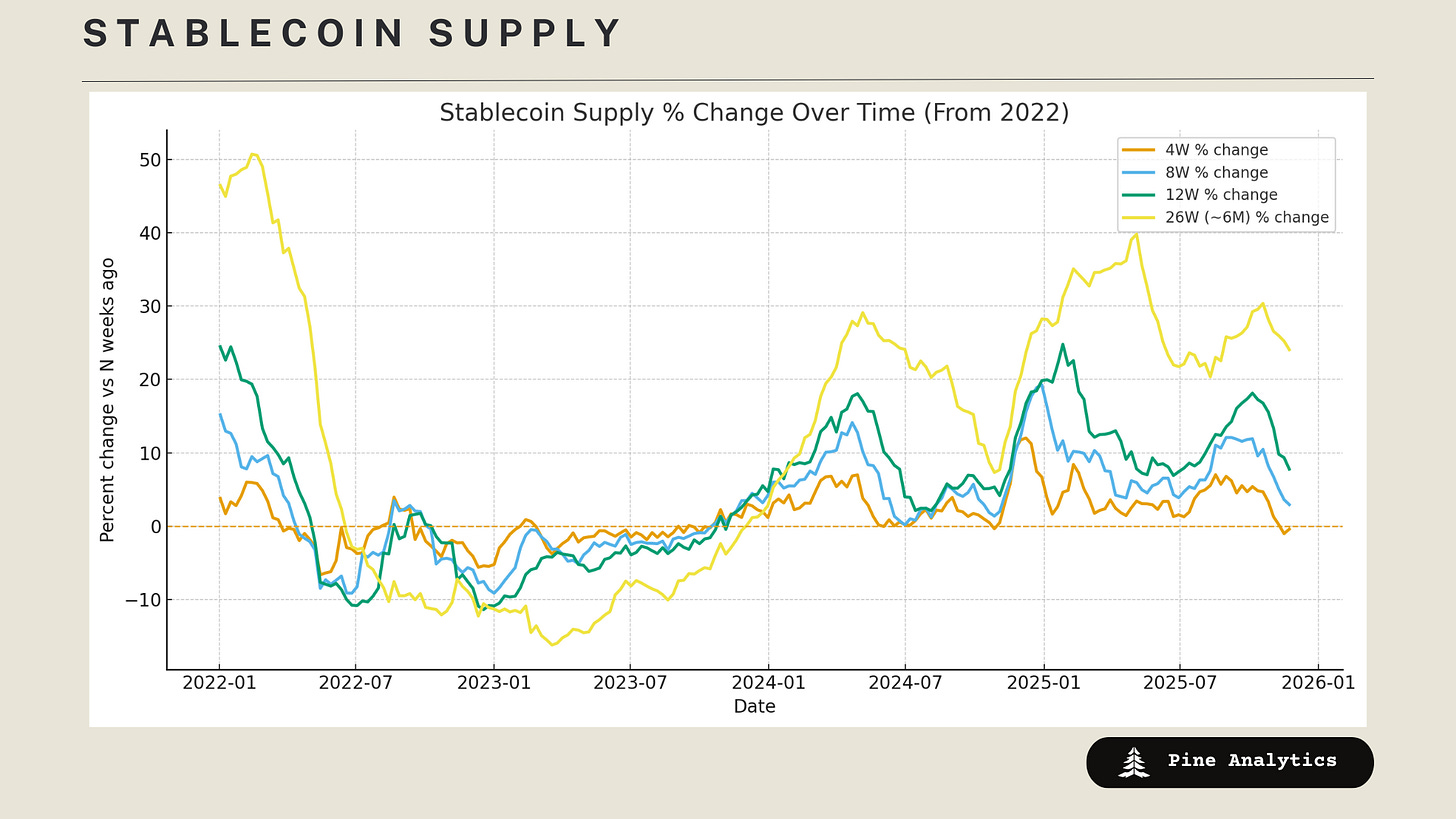

Market Capitalization: Stablecoin market cap is $304B, with supply up $1.6B week over week and down 1B over the past 30 days. The marks the start of a declining trend of Stablecoin supply.

Stablecoin Supply Rates:

AAVE: 3.2%-4.2%

Kamino: 1.68%-4.2%

Save Finance: 4.8%–6.8%

JustLend: 2.1%-3.3% (7% USDD)

Spark.fi: 4.75%

Chain-Specific Changes: Supply increased most on Sui and Tron; Ethereum and Plasma saw outflows.

Token-Specific Changes: USDC and BUIDL increased in supply, while USDe and syrupUSDT experienced major outflows.

Interpretation and Outlook: Stablecoin growth is reversing: market cap flat WoW, supply is rotating to Sui and Tron, Ethereum and Plasma are seeing outflows, and USDC is gaining as USDe unwinds—signaling consolidation and a safety-first carry.

CT Mindshare

Coinbase bought Vector

Coinbase has acquired Vector, a Solana-based onchain trading platform specializing in meme coin and social trading, marking its ninth acquisition in 2025 to bolster decentralized exchange capabilities. This integration aims to enhance Coinbase’s asset availability, trading speed, and liquidity within the high-volume Solana ecosystem, while Vector’s standalone apps will be sunsetted.

SIMD-0441 Proposal

The SIMD-0441 proposal has been floated for Solana network, introducing updates to the protocol’s consensus or economic mechanisms as part of ongoing improvements. This development, similar to other SIMDs like 0228 for market-based emissions, seeks to optimize network performance, security, and decentralization through community-vetted changes.

Circle xReserve Launch

Circle has launched xReserve, an interoperability infrastructure enabling blockchain teams to deploy USDC-backed stablecoins that are fully interoperable with native USDC across multiple chains without third-party bridges. This initiative addresses liquidity fragmentation and enhances cross-chain transfers, with initial integrations on networks like Canton and Stacks to expand the USDC ecosystem.

Ranger announced its token launch

Ranger Finance, a Solana-based DEX aggregator, has announced plans to launch its native token $RNGR to support community governance and ecosystem rewards. The token will be launched on the metadao launchpad.