This Week in Crypto (Dec 29, 2025)

Crypto market weekly overview and updates

Executive Summary

The current crypto environment reflects a cautious, risk-off backdrop: macro conditions are soft, liquidity is adequate but not expansive, and capital continues consolidating into Bitcoin, large caps with clear narratives, and defensive hedges like gold. ETF flows are muted, search interest remains weak, and fear gauges signal apathy rather than panic — consistent with quiet accumulation phases. On-chain activity is broadly slowing across most networks, even as Base stands out on stablecoin transfer volume, and stablecoin supply growth has stalled while lending yields drift below risk-free rates, creating continued downward pressure on leverage and speculative activity. Over the next 1–3 months, the base case is range-bound consolidation led by Bitcoin, selective outperformance in utility-driven sectors, and a market where fundamentals matter more than momentum until clearer macro easing emerges.

Market Overview

Macro

As of late December 2025, the macroeconomic environment reflects a cautious, risk-off tone amid slowing global growth expectations. WTI crude oil prices have slumped to around $57 per barrel, signaling weak demand and abundant supply, while gold has surged to over $4,500 per ounce—its strongest annual performance in decades—driven by safe-haven flows, central bank purchases, and geopolitical uncertainties. The US dollar index lingers near 98, down about 9-10% year-to-date, supporting commodity strength but highlighting fading US exceptionalism. Treasury yields remain subdued, with the 10-year around 4.13%, and bond volatility at multi-year lows, indicating calm fixed-income markets but limited inflation pressures.

For crypto over the next 1-3 months (into Q1 2026), the outlook is mixed but leans toward consolidation with upside potential if liquidity improves. Bitcoin, currently trading around $87,000-88,000 after a disappointing 2025 (down slightly YTD despite earlier highs near $126,000), has shown resilience through rising dominance and institutional infrastructure like ETFs. Short-term range-bound trading ($85,000-$94,000) is likely, but renewed Fed easing, potential rate cuts, and seasonal liquidity inflows could spark a rebound toward $100,000+. Altcoins remain under pressure, with capital favoring BTC and traditional hedges like gold; selective strength in utility-driven sectors (e.g., RWAs or DeFi) may emerge, but a broad rally appears premature without clearer risk-on signals. Overall, crypto’s maturation supports gradual recovery, though macro caution caps explosive moves.

Crypto Market Summary

BTC Price Action: BTC is trading around $87,494 (-0.08% 24h, -0.75% 7d).

BTC/ETH Dominance: BTC is at 59.52% and ETH is at 12.07%. ETH dominance is slightly down, while BTC dominance has been flat over the week.

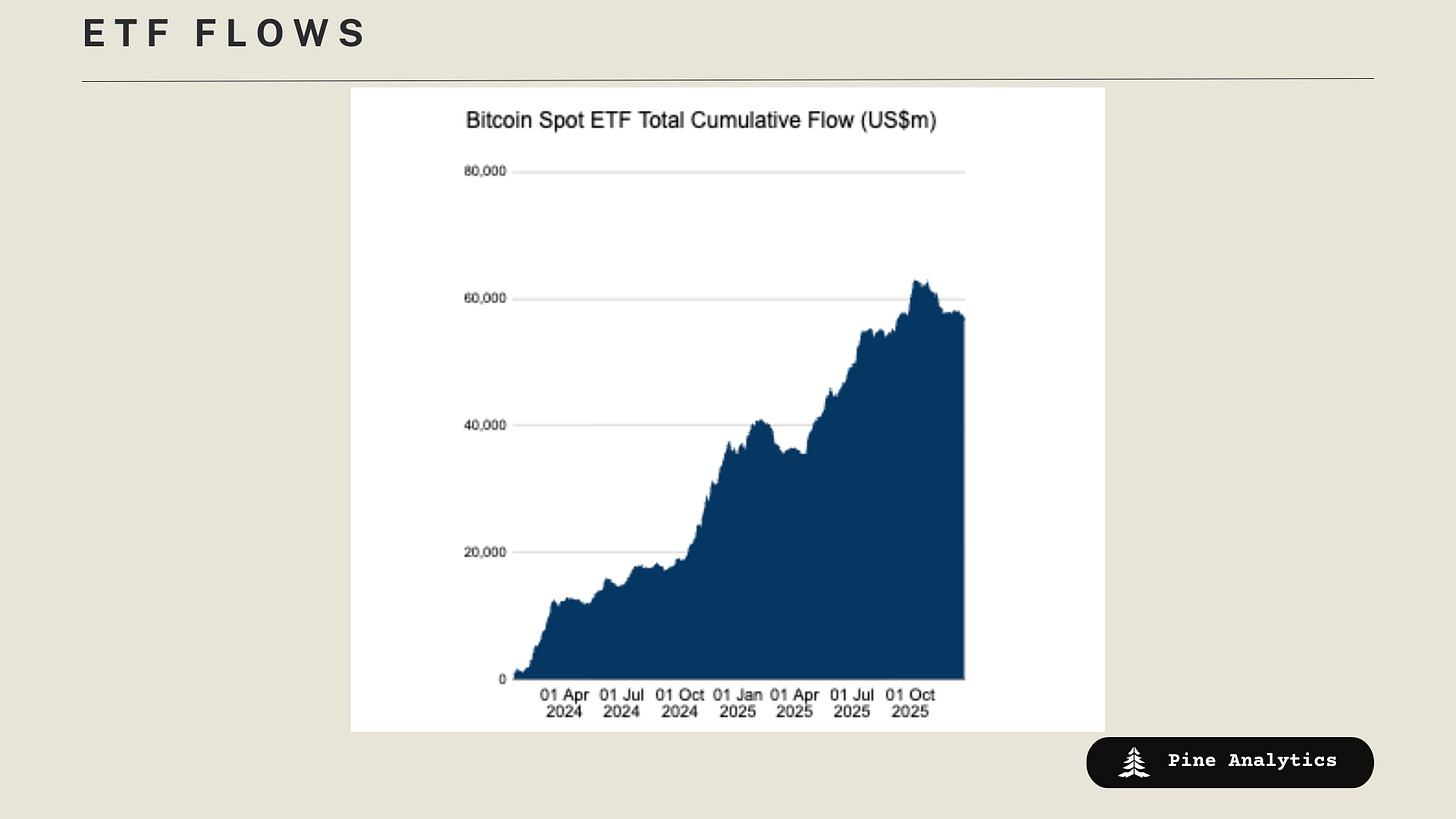

ETF Flows: Net outflows from BTC (-$781M) along with outflows from ETH (-103M) dwarfed the SOL infows of (+$13.5M).

Social/Search Trends: Interest in “Bitcoin” and “crypto” is near the bottom of its 12-month range.

Fear & Greed Index: Currently at 30 (“Fear”), up 9 points over the past week, indicating ameliorating fear.

Interpretations and Future Outlook

Taken together, the macro picture and on-chain/market data point to a crypto market that is cautious, liquid enough to avoid crisis, but not yet inspired to take risk. Capital is consolidating in “quality” Bitcoin, large caps with clear narratives, and hard-asset hedges like gold, while speculative capital remains sidelined. Weak search interest, muted ETF flows, and fear readings in the low 30s suggest apathy rather than panic, which historically precedes accumulation phases rather than deep capitulation.

Over the next 1–3 months, the base case remains a slow, uneven grind. Bitcoin likely continues to anchor the market and trade in defined ranges, reacting primarily to liquidity expectations and policy signals. If rate-cut momentum builds or dollar softness accelerates, we should expect incremental inflows and a push toward prior resistance levels, but without the kind of reflexive leverage that drives parabolic cycles. Altcoins, meanwhile, will remain bifurcated: projects with real utility (RWAs, core DeFi, infrastructure) can outperform on idiosyncratic catalysts, while most long-tail assets struggle against tightening liquidity and investor selectivity.

Structurally, this phase looks like quiet consolidation rather than trend reversal. Positioning is light, valuations are more disciplined, and narratives are rebuilding around durability rather than speculation. That backdrop lowers downside tail risk while keeping upside dependent on macro easing and renewed risk appetite. In short: patient accumulation, selective sector rotation, and an environment where fundamentals matter more than momentum, at least for now.

Chain Use

Data

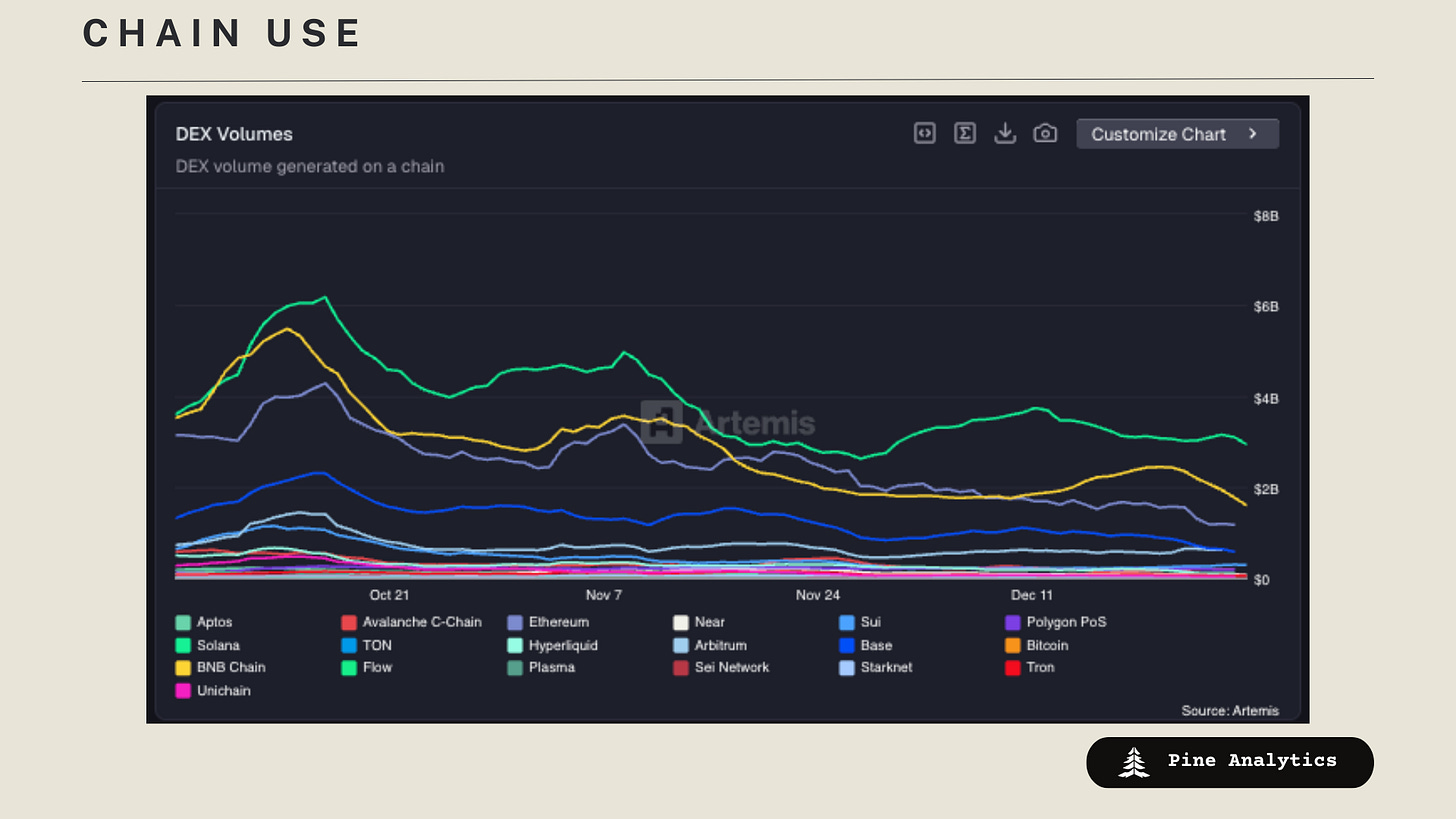

Chains by bridge flows: This week, there has been large outflows from Base, Arbitrum, and BNB, alongside a substantial inflow into Ethereum and Polygon.

Top chains by weekly fees: Hyperliquid $23.8M (–39.3%), BNB Chain $17.5M (–43.2%), Tron $9.1M (–32.6%), Ethereum $7.7M (–63.3%), Solana $5.4M (–20.1%), Base $1.91M (–38.7%), Osmosis $823.2K (–8.5%), Arbitrum $782.0K (–66.8%).

Top chains by DEX volume: Ethereum $37.8B (–11.5%), Solana $33.6B (–20.0%), BNB Chain $24.5B (–32.7%), Base $11.9B (–32.7%), Sui $5.48B (–29.0%), Hyperliquid $4.21B (–37.1%), Avalanche C-Chain $2.52B (–30.1%), Polygon PoS $2.03B (+10.3%).

Interpretations and Future Outlook

Chain activity is declining across most metrics and across most chains, with the notable exception of stablecoin transfer volume on Base.

Stablecoin Metrics

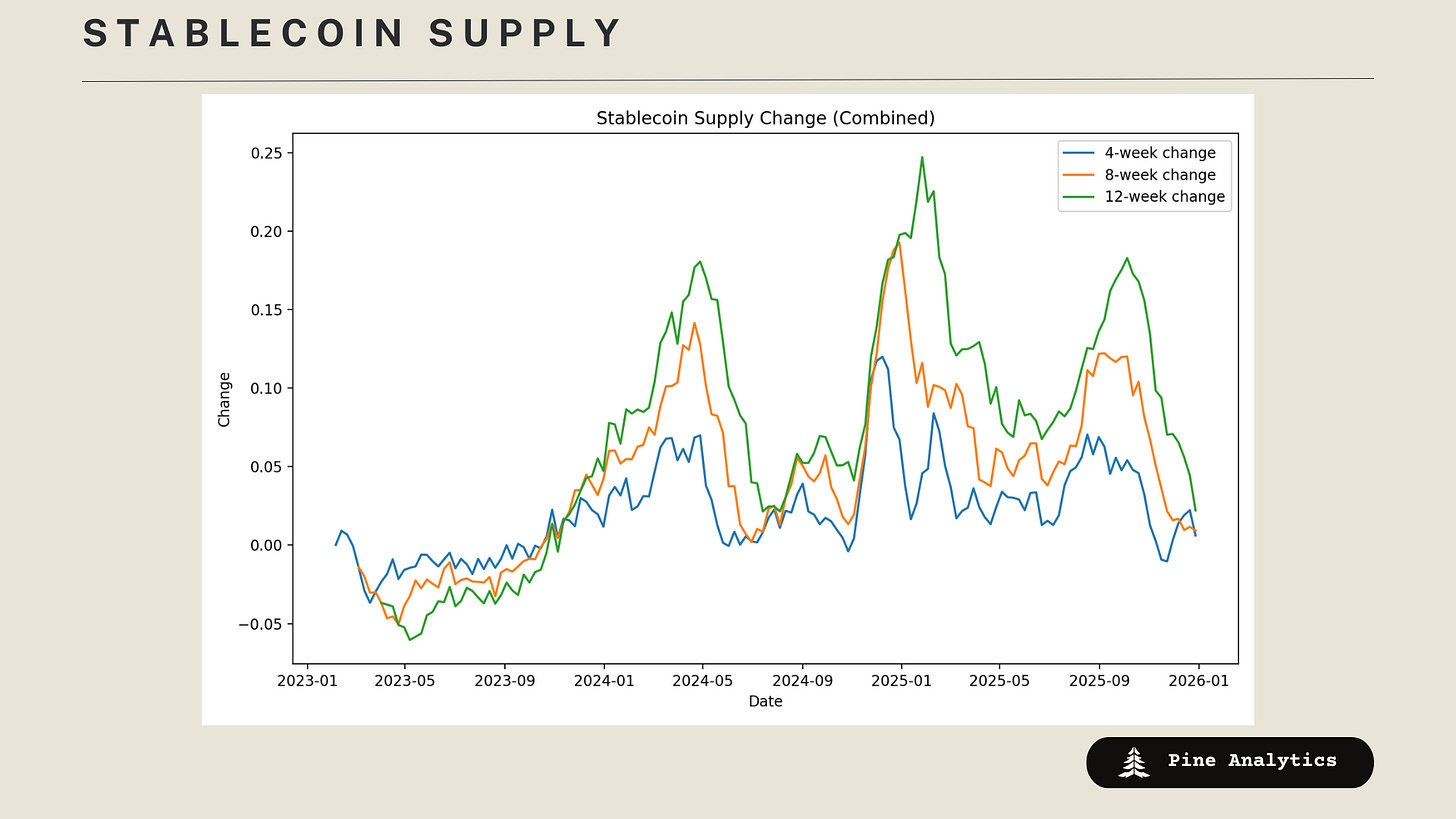

Market Capitalization: Stablecoin market cap stands at $305.2B, with supply down $3B week-over-week and $3.2B over the past 30 days. Stablecoin supply appears to be stalling after running up through mid-October.

Stablecoin Supply Rates:

• AAVE: 2.45%–3.10%

• Kamino: 1.8%–3%

• Save Finance: ~5.75%

• JustLend: 2.5%–3.7% (10% for USDD)

• Spark.fi: 4%

Chain-Specific Changes: Supply increased on BNB, while supply is down across most other chains.

Token-Specific Changes: USD1 and USYC experienced inflows, while most other stablecoins saw declines.

Interpretation and Outlook: The stablecoin supply has been stalling, while lending-market interest rates are falling below the risk-free rate in many markets. This suggests downward pressure will likely continue on stablecoin supply until borrowers are willing to pay higher rates.

CT Mindshare

USX stablecoin depegged

The Solana-based USX stablecoin, issued by Solstice Finance, experienced a sharp depeg on December 26, 2025, plunging as low as $0.10 due to a liquidity drain on decentralized exchanges during thin holiday trading. The team quickly injected liquidity to restore the peg near $1.00, emphasizing that the over-collateralized reserves remained fully intact and unaffected.

Uniswap Unification Proposal passed

Uniswap’s landmark “UNIfication” governance proposal passed with overwhelming 99.9% support on December 25, 2025, activating long-dormant protocol fees and initiating a massive 100 million UNI token burn. This overhaul aligns incentives across the ecosystem, consolidates operations under Uniswap Labs, and positions UNI as a deflationary, value-accruing asset tied to trading volume.

AAVE token unification proposal failed

Aave DAO rejected the contentious “Token Alignment Phase 1: Ownership” proposal on December 26, 2025, with 55% voting against transferring brand assets and IP from Aave Labs to DAO control amid governance tensions. The high-participation vote highlighted ongoing debates over decentralization and alignment between Labs and token holders, preserving the status quo for now.

HashKey Capital’s major fund close

HashKey Capital successfully closed the first round of its Fintech Multi-Strategy Fund IV on December 23-24, 2025, raising $250 million from institutional investors, family offices, and high-net-worth individuals. Targeting a total of $500 million, the fund focuses on blockchain infrastructure, real-world applications, and multi-strategy opportunities in public and private markets, boosting institutional confidence in crypto heading into 2026.