This Week in Crypto (Jan 19, 2025)

Crypto market weekly overview and updates

Executive Summary

Markets remain in a "restrictive but stable" macro regime—liquidity draining, real yields positive, and rates drifting higher—which favors BTC consolidation over a broad alt season. Institutional capital continues accumulating via ETFs ($1.9B weekly inflows) even as retail engagement hits 12-month lows, creating a floor under prices without catalyzing explosive upside. On-chain activity is picking up selectively on Solana, BNB, and Hyperliquid, though stablecoin supply growth has stalled and lending rates remain below risk-free levels, suggesting continued pressure until borrowing demand recovers. Meanwhile, TradFi-crypto convergence accelerates with NYSE's announced blockchain platform for 24/7 tokenized stock trading, and regulatory clarity efforts continue despite the CLARITY Act's temporary setback from industry pushback. The near-term bias is choppy, range-bound BTC price action with episodic, narrative-driven alt rallies until either macro conditions ease or retail participation reawakens.

Market Overview

Macro

There is no macro tailwind right now for a full risk-on melt-up, but there is also no signal of imminent systemic stress. Liquidity is still being drained, real yields are positive, and rates are drifting higher, which caps valuation expansion across long-duration assets. At the same time, volatility is low, inflation expectations are anchored, the dollar is stable, and financial conditions are not tightening fast enough to force broad deleveraging. This puts markets in a late-cycle, “restrictive but stable” regime where assets can grind higher, but explosive upside is unlikely without a clear turn toward easing.

For crypto, this environment tends to favor Bitcoin over the rest of the risk curve. BTC can continue to act as a macro hedge alongside gold and as a relative safe haven within crypto, while ETH and high-beta alts remain more sensitive to rates and liquidity and therefore more fragile. Unless yields decisively roll over or liquidity conditions ease, the next 1–3 months are more likely to be characterized by consolidation, rotation, and selective narrative-driven moves rather than a broad, leverage-fuelled alt season.

Crypto Market Summary

BTC Price Action: BTC is trading around $92,452 (-1.27% 24h, 1.4% 7d).

BTC/ETH Dominance: BTC is at 59.68% and ETH is at 12.39%. BTC dominance and ETH dominance are both up this week with BTC dominance up a bit more.

ETF Flows: ETFs saw net inflows after a weekly higher low of net inflows, with net inflows of $1.41B into BTC, $479.3M into ETH, and $47M into SOL.

Social/Search Trends: Interest in “Bitcoin” and “crypto” is near the bottom of its 12-month range, and has continued to decline.

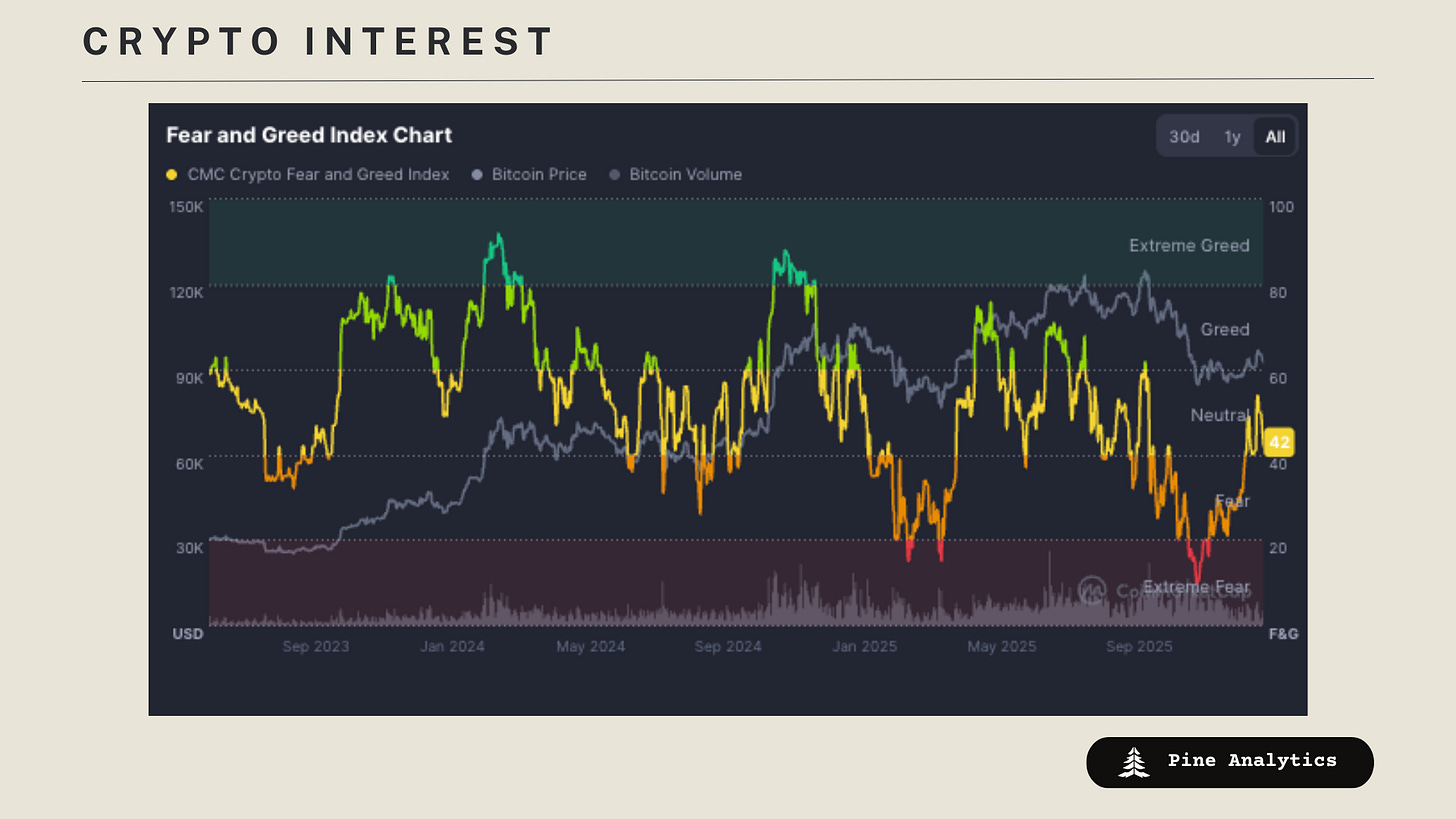

Fear & Greed Index: Currently at 45 (“Neutral”), up 4 points over the past week, indicating a mild continuation in sentiment recovery.

Interpretations and Future Outlook

The data paints a picture of institutional conviction diverging sharply from retail enthusiasm. ETF inflows are accelerating—$1.9B combined in a single week—while social and search interest scrapes 12-month lows. This is not the signature of a retail-driven speculative wave; it’s accumulation by longer-duration capital that doesn’t chase price or narratives. The “higher low” pattern in weekly ETF flows suggests persistent bid demand that could provide meaningful downside support, even if it lacks the momentum to drive explosive upside in the current macro regime.

BTC dominance grinding toward 60% while ETH holds its share reflects flight-to-quality dynamics within crypto itself. Capital is not rotating down the risk curve into alts—it’s concentrating at the top. This behavior is consistent with the macro backdrop: in a restrictive-but-stable regime, investors prefer assets with clearer fundamental anchors (BTC’s scarcity narrative, institutional adoption) over tokens that require liquidity expansion and narrative velocity to perform.

The Fear & Greed index sitting at neutral after moving up from fear is telling. Markets are neither capitulating nor euphoric—they’re waiting. This kind of sentiment reset, combined with low social engagement, historically precedes either a slow grind higher or a sharp move in either direction triggered by an external catalyst. The absence of leverage buildup and muted retail participation means the market is not positioned for a violent unwind, but it also lacks the dry powder and enthusiasm needed to sustain a rally without fresh narrative fuel.

Near-term, expect BTC to consolidate in a range defined by ETF-driven support below and macro-driven resistance above. Altcoin rallies will likely remain episodic and narrative-specific rather than broad-based. The key variables to monitor are (1) any shift in Fed rhetoric or Treasury issuance patterns that could ease liquidity conditions, (2) continuation or acceleration of ETF flow trends, and (3) whether retail engagement reawakens—the latter being a necessary (though not sufficient) ingredient for a true alt season. Until at least one of these shifts, the bias is toward choppy, range-bound price action with BTC continuing to outperform on a risk-adjusted basis.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Arbitrum, Ethereum, and Starknet, alongside a substantial inflow into Hyperliquid, Polygon, and Base.

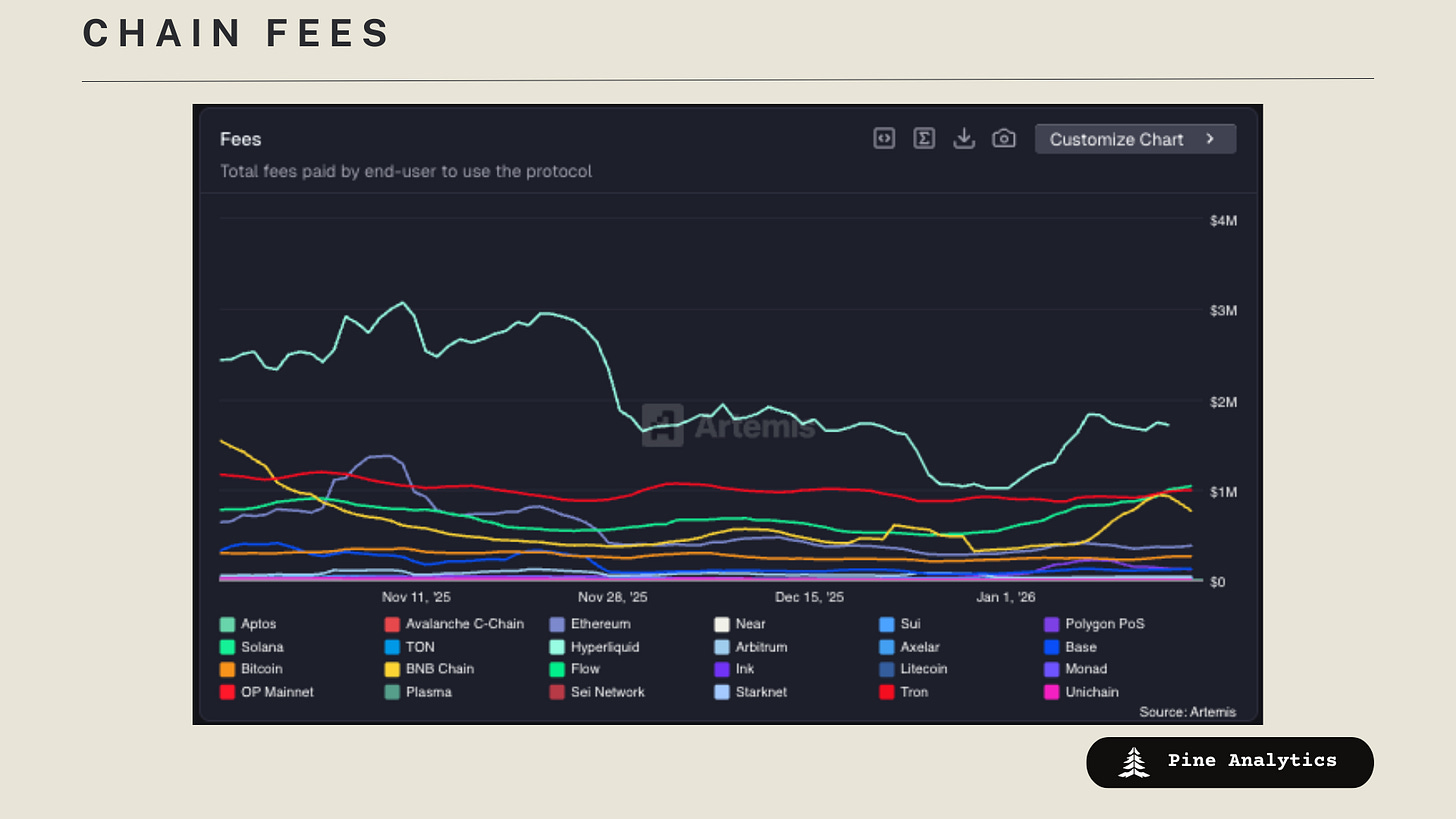

Top chains by weekly fees: Hyperliquid $1.70M (–5.6%), Tron $977.6K (+6.4%), Solana $998.3K (+21.5%), BNB Chain $924.9K (+111.4%), Ethereum $359.2K (–10.5%), Bitcoin $254.5K (+6.0%), Polygon PoS $122.5K (–42.9%), Base $111.4K (–7.9%), Arbitrum $33.2K (+18.6%), Sui $17.9K (–22.5%).

Interpretations and Future Outlook

On-chain activity has been heating up this week on Solana and BNB, while Hyperliquid has been experiencing inflows. Overall, this reflects a pickup in on-chain season.

Stablecoin Metrics

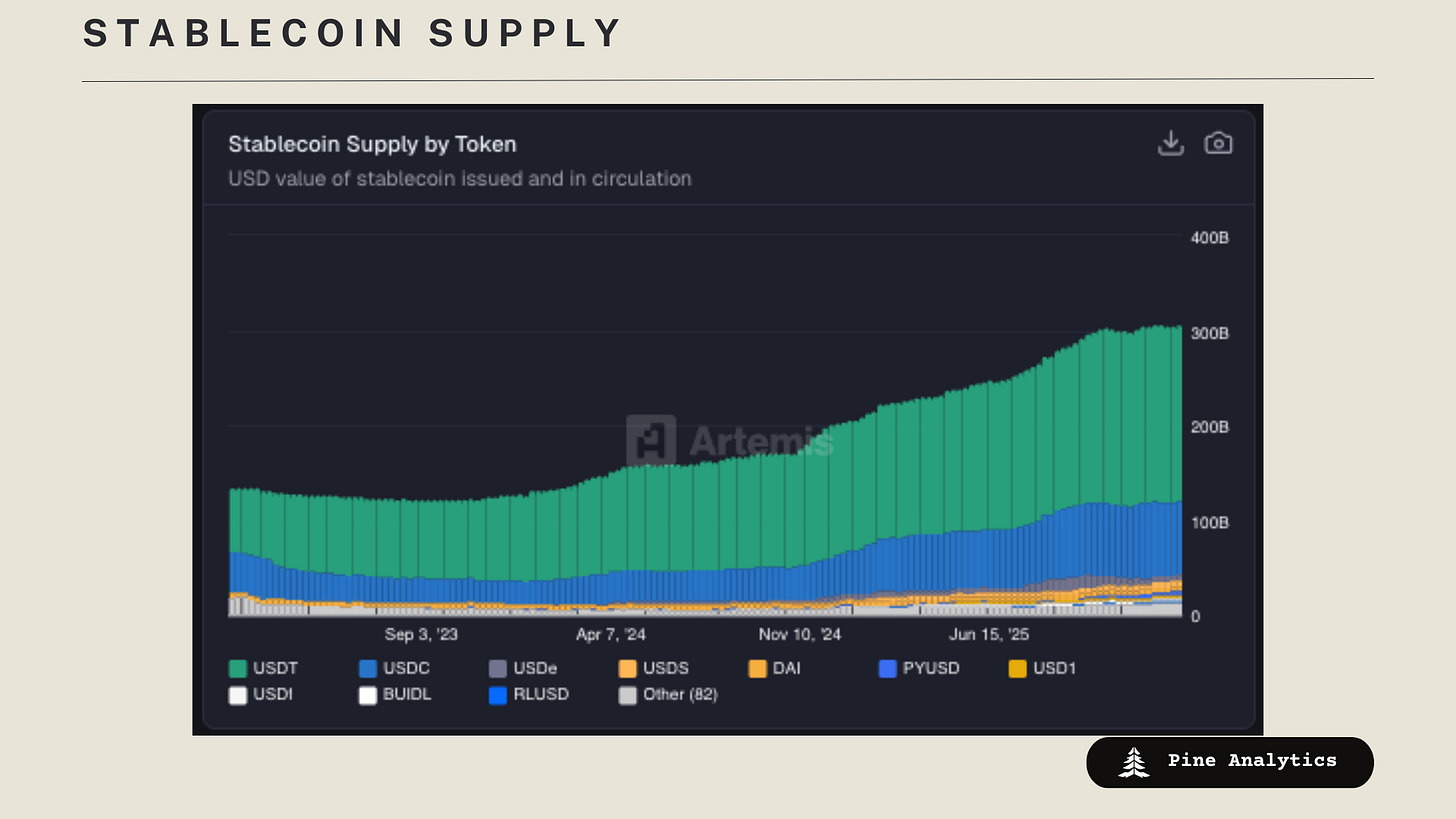

Market Capitalization: Stablecoin market cap stands at $307.3B, with supply up $1.8B week-over-week and $2.7B over the past 30 days. Stablecoin supply appears to be stalling after running up through mid-October.

Stablecoin Supply Rates:

• AAVE: 4.31%–4.95%

• Kamino: 0.9%–2.44%

• Save Finance: 2.48%-3.3%

• JustLend: 2.74%–4.61% (5.82% for USDD)

• Spark.fi: 4%

Chain-Specific Changes: Supply expanded on Tron, Ethereum, Base, and Solana, while BNB and Plasma saw net supply contraction.

Token-Specific Changes: USDC, USDD and USDT experienced inflows, while USDS and USYC saw declines.

Interpretation and Outlook: The stablecoin supply has been stalling, while lending-market interest rates are below the risk-free rate in many markets, though they are slightly higher than in previous weeks. This suggests that downward pressure on stablecoin supply will likely continue until borrowers are willing to pay higher rates.

CT Mindshare

NYSE Moving Towards 24/7 Stock Trading

The New York Stock Exchange (NYSE), through its parent Intercontinental Exchange, announced on January 19, 2026, that it is developing a new blockchain-based platform for trading tokenized U.S. stocks and ETFs. This platform aims to enable true 24/7 operations, instant on-chain settlement, dollar-sized orders, and stablecoin-based funding, pending regulatory approval, marking a major bridge between traditional finance and crypto infrastructure.

Saturn raised $800K

Crypto project Saturn successfully raised $800K in an angel funding round led by YZi Labs and Sora Ventures, with participation from prominent angels, to build USDat—a yield-bearing stablecoin protocol targeting 11%+ yields. The stablecoin is backed by Strategy’s digital credit (tied to Bitcoin-related assets), unlocking institutional-grade credit access in DeFi and highlighting growing interest in high-yield, Bitcoin-linked stable assets.

Digital Asset Market Clarity Act contention

The bipartisan Digital Asset Market Clarity Act (CLARITY Act) faced a setback when Coinbase withdrew support in mid-January 2026 over contentious provisions like restrictions on stablecoin rewards, potential limits on tokenized equities, and DeFi regulations, leading the Senate Banking Committee to postpone its markup session. Despite the delay and ongoing industry pushback, negotiations continue with some concessions (such as carveouts for certain DeFi security measures and non-retroactive rules), and supporters remain optimistic about eventual passage to provide clearer SEC/CFTC oversight for digital assets.

Pump Fund Launch

Pump.fun announced the establishment of Pump Fund, a new investment division aimed at long-term support for startups and projects building within its Solana-based ecosystem. As its inaugural move, the fund is launching a $3 million “Build in Public” (BiP) Hackathon to back 12 selected projects with $250,000 each (at a $10 million valuation), plus mentorship from the founding team, where market participation and real momentum (like token launches and public building) will play a key role in selection rather than traditional VC judging—marking a shift toward empowering sustainable builders beyond pure memecoins.