This Week in Crypto (Jan 5, 2025)

Crypto market weekly overview and updates

Executive Summary

Macro conditions remain cautiously supportive for risk assets, with equities trending higher, credit spreads tight, and the dollar easing — but the setup is clearly late-cycle. Liquidity expectations and ETF inflows into BTC, ETH, and SOL are quietly improving, while sentiment remains neutral, suggesting room for further participation without obvious exuberance. The base case over the next 1–3 months is a “grind higher with volatility,” though any macro surprise could tighten risk appetite quickly.

On-chain activity shows notable rotation rather than capital flight. Bridge flows moved away from Arbitrum and BNB toward Hyperliquid, Base, and Ethereum, while fees and DEX volume grew meaningfully on Solana, Hyperliquid, and Sui. Stablecoin supply has stalled, with lending yields slipping below risk-free rates — a signal that supply may continue softening until demand for leverage resurfaces. Meanwhile, major ecosystem developments — including Jupiter’s jupUSD launch, Bank of America’s crypto advisory roll-out, and MetaDAO’s buyback proposal — reinforce growing institutional acceptance and ongoing experimentation at the protocol level.

Overall, the environment favors ecosystems capturing liquidity, fees, and user activity, while chains losing flows may lag unless catalysts emerge. Positioning should assume constructive bias — but with respect for volatility and fast rotations.

Market Overview

Macro

Macro right now is broadly supportive but clearly late-cycle. Equities (SPY/QQQ) are grinding higher, credit spreads are tight, the dollar is weakening, and yields have stopped meaningfully rising — all signals that financial conditions have quietly loosened. At the same time, gold ripping and oil drifting lower point to a “soft-growth, disinflation” environment rather than crisis. The put/call ratio trending lower shows positioning has shifted from cautious to increasingly complacent, which works… until it doesn’t.

For risk assets like crypto over the next 1–3 months, that backdrop leans constructive but fragile. Looser credit, weaker USD, and steady equities usually pull capital toward longer-duration, speculative trades — dips likely get bought. But because positioning is crowded and spreads are already tight, any surprise (sticky inflation, hawkish Fed tone, or credit stress) could flip sentiment fast. Base case: sideways-to-up with volatility spikes — and watch credit spreads and the dollar as the first warning signs.

Crypto Market Summary

BTC Price Action: BTC is trading around $94,308 (3.28% 24h, 7.55% 7d).

BTC/ETH Dominance: BTC is at 59.46% and ETH is at 12.25%. ETH dominance is slightly up, while BTC dominance has been flat over the week.

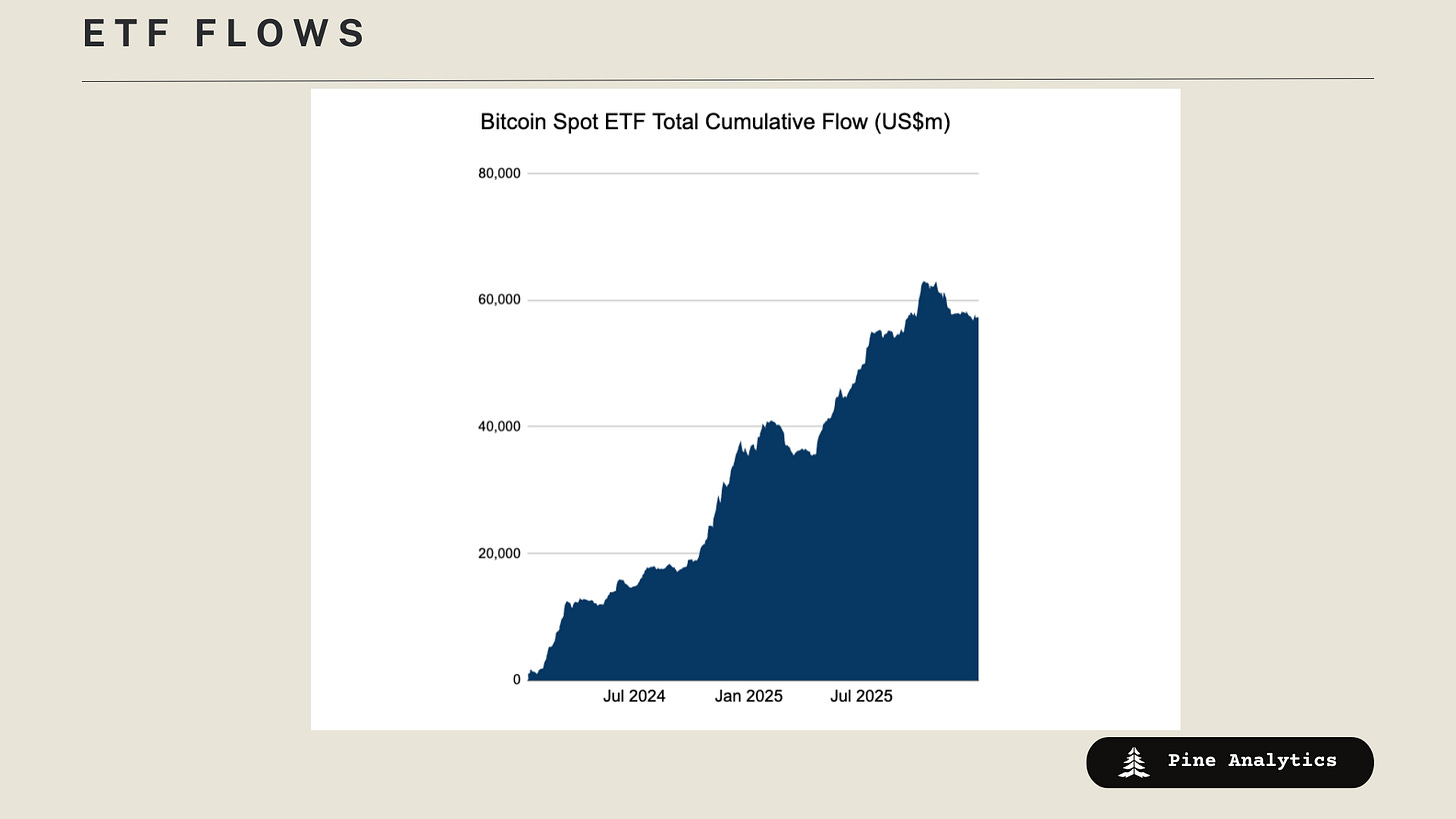

ETF Flows: ETFs saw inflows across the board after weeks of downtrends, with net inflows of $183M into BTC, $122M into ETH, and $20.1M into SOL.

Social/Search Trends: Interest in “Bitcoin” and “crypto” is near the bottom of its 12-month range, but is has ticked up slightly off the bottom.

Fear & Greed Index: Currently at 42 (“Neutral”), up 12 points over the past week, indicating ameliorating fear.

Interpretations and Future Outlook

Macro conditions remain supportive but late-cycle, which tends to favor crypto as long as liquidity expectations stay intact. Tight credit spreads, stable equities, and a weaker dollar suggest investors are comfortable taking risk, while muted search interest and neutral sentiment imply there is still room for participation to expand without the market being over-crowded. ETF inflows returning across BTC, ETH, and SOL reinforce the idea that institutional flows are quietly re-accelerating beneath the surface.

Over the next 1–3 months, this setup argues for a “grind higher with volatility” environment. BTC dominance holding steady while ETH ticks up hints at rotation rather than exit — a constructive sign for broader market breadth. If credit remains calm and the dollar stays weak, dips should find buyers and narratives tied to liquidity, L2s, and staking likely outperform. The main risk remains macro surprise: any resurgence in inflation or tightening in credit could compress risk appetite quickly. For now, the path of least resistance tilts upward — but with tighter stops and an expectation of sharp pullbacks along the way.

Chain Use

Data

Chains by bridge flows: This week, there has been large outflows from Arbitrum, Ink, and BNB, alongside a substantial inflow into Hyperliquid, Base and Ethereum.

Top chains by weekly fees: Hyperliquid $1.20M (+9.1%), Tron $894.0K (+2.6%), Solana $632.0K (+24.3%), BNB Chain $373.7K (–22.1%), Ethereum $321.1K (+16.3%), Bitcoin $239.7K (+15.6%), Base $86.3K (+34.6%), Polygon PoS $77.3K (+~249.8%), Arbitrum $21.7K (–69.7%).

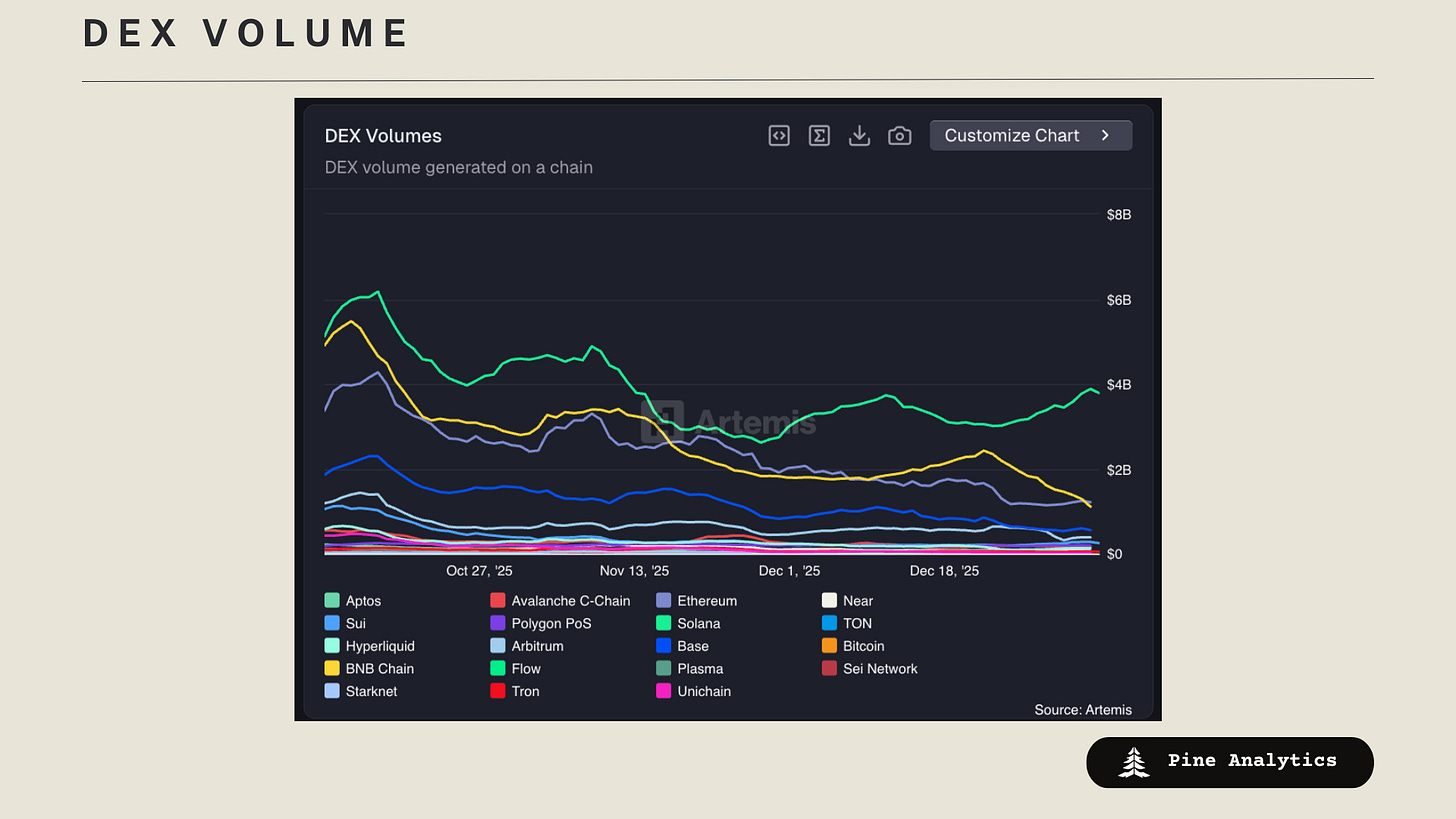

Top chains by DEX volume: Solana $3.9B (+21.9%), Ethereum $1.2B (~0.0%), BNB Chain $1.1B (–38.9%), Base $553.4M (–8.2%), Arbitrum $383.9M (–35.2%), Sui $274.2M (+32.9%), Polygon PoS $190.6M (+5.7%), Avalanche C-Chain $167.6M (–10.2%).

Interpretations and Future Outlook

Bridge flows show capital rotating — leaving Arbitrum and BNB while moving toward Hyperliquid, Base, and Ethereum. Rising fees and volume on Solana, Hyperliquid, and Sui point to real activity picking up, not just price action. Over the next few weeks, ecosystems attracting flows and generating fees likely outperform, while chains seeing persistent outflows may stay muted unless new catalysts appear.

Stablecoin Metrics

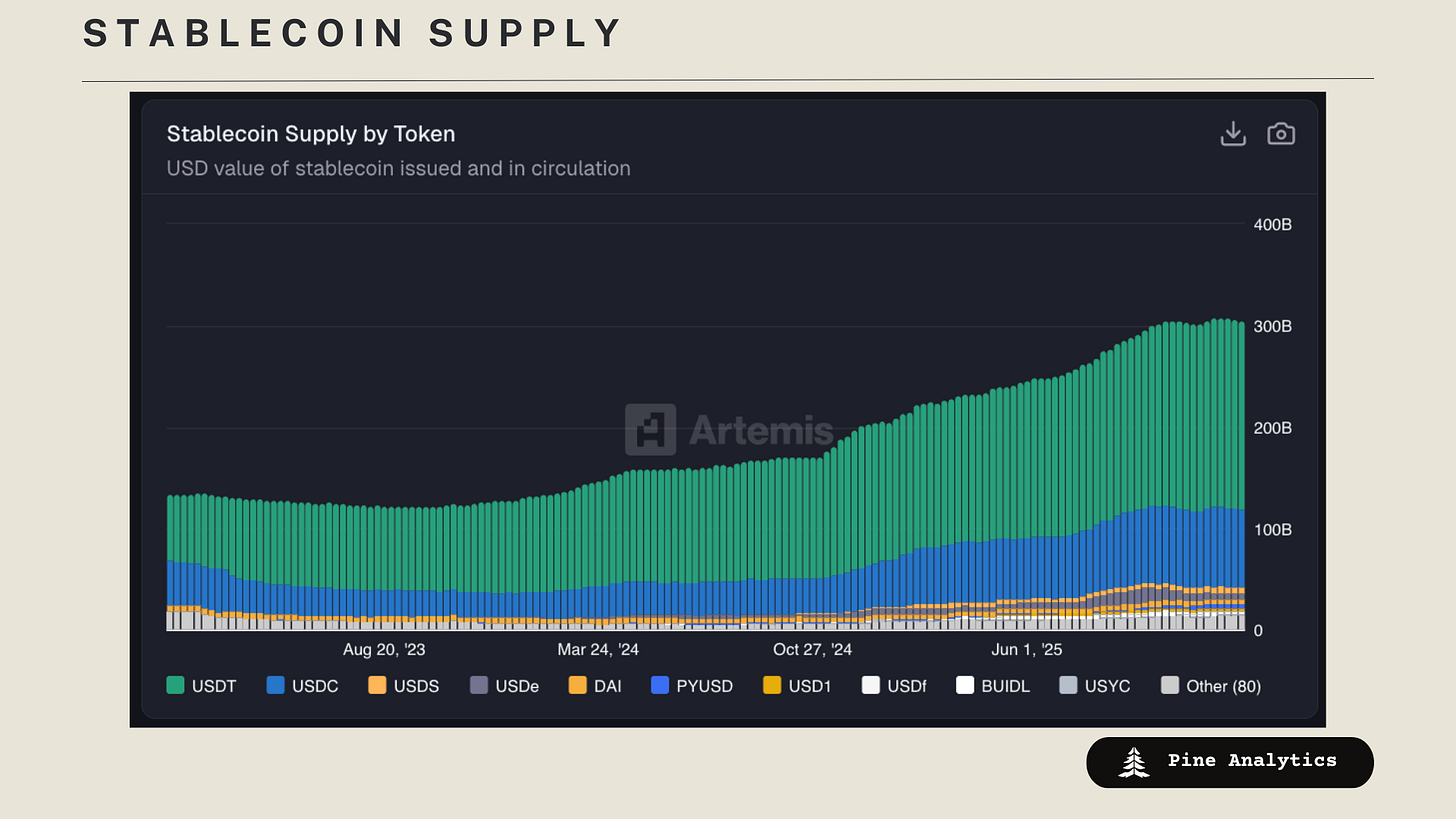

Market Capitalization: Stablecoin market cap stands at $306.2B, with supply down $0.7B week-over-week and $0.9B over the past 30 days. Stablecoin supply appears to be stalling after running up through mid-October.

Stablecoin Supply Rates:

• AAVE: 2.39%–3.26%

• Kamino: 1.41%–2.59%

• Save Finance: ~5.5%

• JustLend: 1.6%–3.3% (5.95% for USDD)

• Spark.fi: 4%

Chain-Specific Changes: Supply expanded on Tron, Plasma, and Arbitrum, while Solana and Ethereum saw net supply contraction.

Token-Specific Changes: USDT and USDS experienced inflows, while USDC and USYC saw declines.

Interpretation and Outlook: The stablecoin supply has been stalling, while lending-market interest rates are falling below the risk-free rate in many markets. This suggests downward pressure will likely continue on stablecoin supply until borrowers are willing to pay higher rates.

CT Mindshare

jupUSD Launched

Jupiter, the leading Solana-based DEX aggregator, officially launched its native stablecoin JupUSD on January 5, 2026. Backed primarily by BlackRock’s tokenized fund and USDC reserves through Ethena Labs’ infrastructure, JupUSD is designed as over-collateralized, transparent collateral for the entire Jupiter ecosystem, including lending, perpetuals, and automation tools.

Lighter token launch

The highly anticipated Lighter token (LIT) launched in late December 2025 following intense community speculation and points farming seasons. The Ethereum-settled zk-perps DEX distributed a significant portion to users via airdrop, quickly listing on major exchanges and achieving a market cap in the hundreds of millions as trading volume surged.

Bank of America Crypto Push

Bank of America has taken a major step into cryptocurrency by authorizing its wealth advisors to proactively recommend digital asset allocations starting January 5, 2026. The bank endorses a modest 1-4% portfolio exposure via regulated Bitcoin ETFs for suitable clients, signaling growing institutional acceptance of crypto as a thematic investment amid clearer regulations.

MetaDAO Buyback proposal went live

MetaDAO’s governance proposal to buy back its LOYAL tokens up to net asset value (NAV) has gone live on the platform. This futarchy-based mechanism aims to enhance token value and liquidity, reflecting the project’s ongoing efforts to align incentives in its market-driven DAO structure on Solana.