Understanding SIMD-0411

New Solana Network Upgrade

Introduction

Solana’s economic design has aimed to balance network security with long-term monetary sustainability. The original inflation curve—an 8% starting rate that gradually tapers toward a 1.5% terminal rate.

SIMD-0411, known as Double Disinflation Rate, proposes a targeted adjustment: double the speed at which inflation decays, cutting emissions far more rapidly while preserving the final 1.5% terminal rate that the ecosystem already aligns around. By modifying one parameter instead of redesigning the entire inflation system, SIMD-0411 offers a minimal, predictable, and low-risk way to strengthen Solana’s monetary policy without adding protocol complexity.

This upgrade stands in clear contrast to SIMD-0228, an earlier attempt to reduce emissions using a dynamic, stake-responsive formula. While SIMD-0228 aimed to make inflation adaptive, it introduced uncertainty, implementation overhead, and governance friction that ultimately derailed its adoption. SIMD-0411 achieves the same high-level objective—lowering inflation and improving capital efficiency—through a simpler and more easily governable path.

What SIMD-0411 Actually Does

Solana’s inflation schedule is defined by three parameters:

Initial inflation: 8%

Disinflation rate: −15% per year

Terminal inflation: 1.5%

Today, Solana sits at ~4.18% annual inflation.

Under the current curve, it will take 6.2 more years to reach the 1.5% floor.

SIMD-0411 proposes a single change:

Double the disinflation rate from −15% → −30%.

This accelerates how quickly inflation decays, without changing the terminal rate itself.

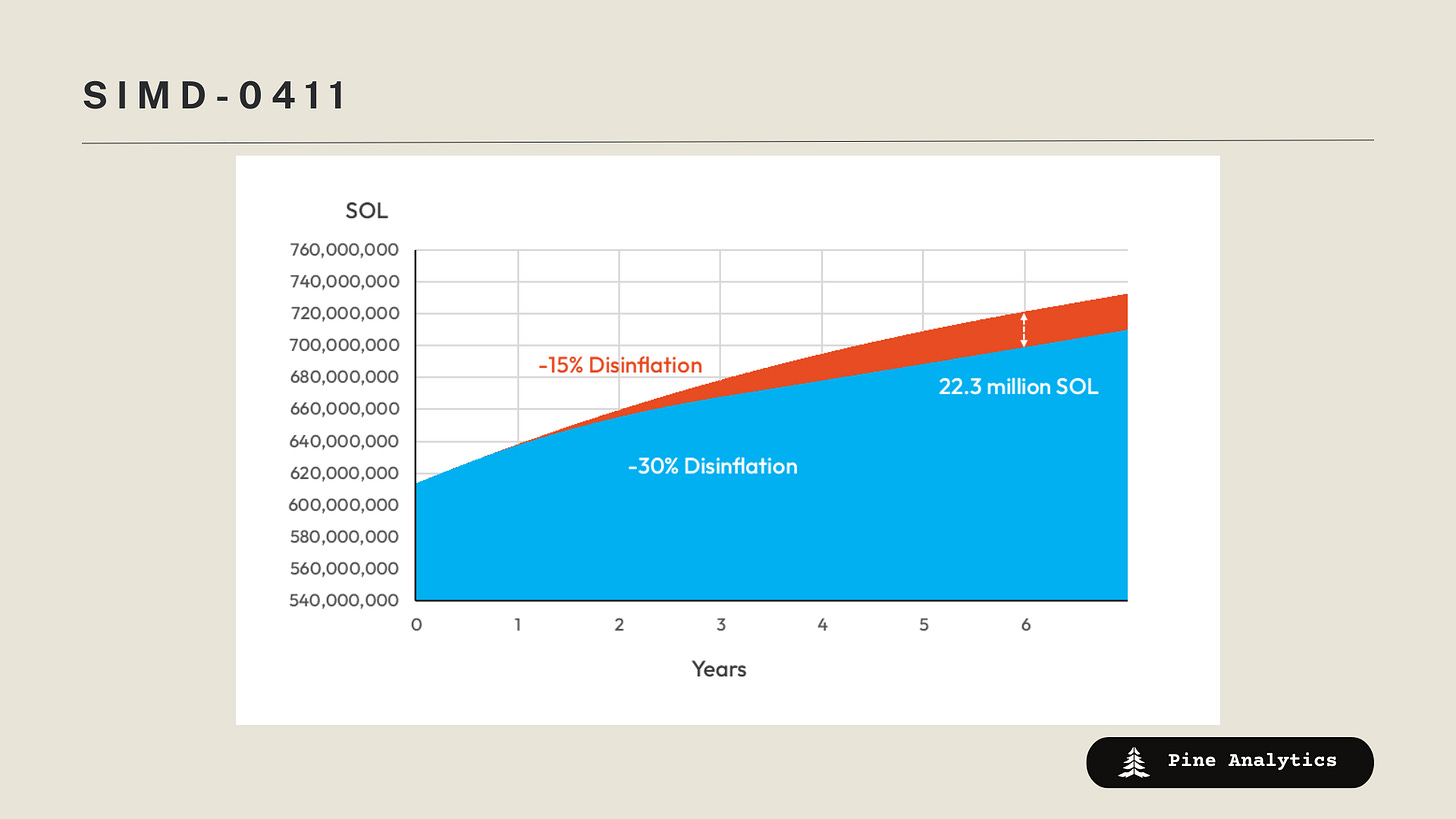

Outcomes of the change

Terminal inflation reached in 3.1 years, instead of 6.2

Emissions reduced by 22.3M SOL over six years (~$2.9B at current prices)

Nominal staking yields decline smoothly:

Year 1: ~5.04%

Year 2: ~3.48%

Year 3: ~2.42%

~10 validators become unprofitable in the first year.

How SIMD-0411 Differs From SIMD-0228

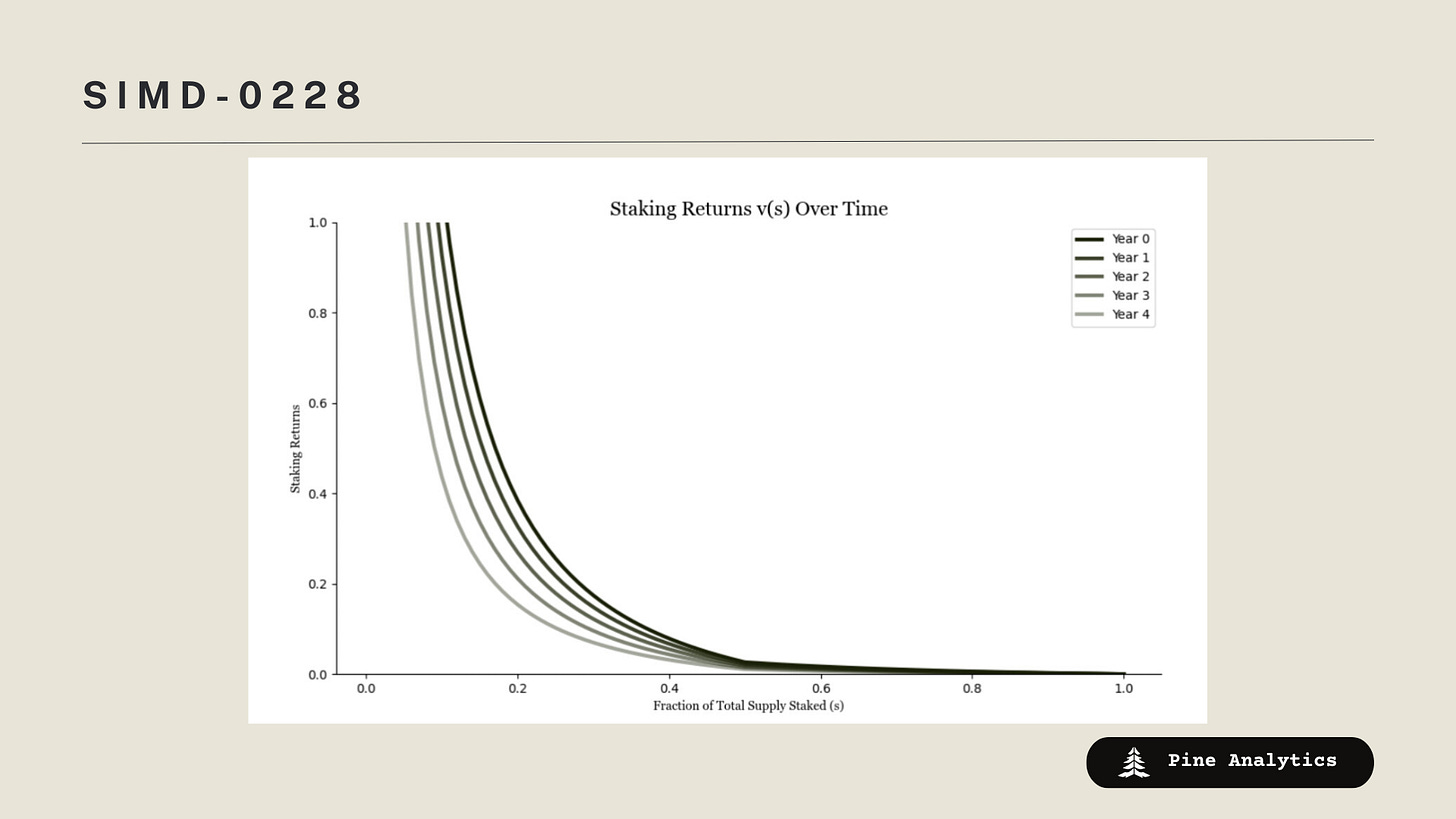

SIMD-0228 attempted something much more ambitious:

SIMD-0228: Dynamic, Market-Driven Emissions

It tied inflation to the % of SOL staked using an exponential function.

The design would increase emissions when staking participation got too low, and reduce emissions when staking was healthy.

Its goals were:

stabilize network security

optimize inflation

create a reactive, incentive-aligned system

How SIMD-0411 Improves on SIMD-0228

SIMD-0411 pursues the same core goal as SIMD-0228—materially reducing SOL emissions—but does it in a far simpler and lower-risk way. Where SIMD-0228 introduced a dynamic, stake-responsive formula that raised concerns about complexity, parameter tuning, and unpredictable outcomes, SIMD-0411 only changes a single, well-understood lever: it doubles the disinflation rate from –15% to –30%. That makes the effect deterministic and easy to model, avoids new edge cases or implementation risk, and is much easier to communicate to validators, stakers, and institutions. In short, it delivers a similar emissions-reduction end state while sidestepping the governance friction and uncertainty that caused SIMD-0228 to stall, all without changing Solana’s terminal inflation target.

Effects on the Network

Doubling the disinflation rate immediately reduces the amount of new SOL entering circulation each year, which lowers staking rewards across the network. As nominal yield declines, the APY earned by stakers falls in parallel, reducing validator profitability and pushing a small subset of lower-stake validators into unprofitability over the next several years. The economic tradeoff is clear: by cutting emissions, Solana issues 22 million fewer SOL over the next six years, meaning meaningfully less dilution for holders and less forced selling from stakers. A slower-growing supply strengthens the long-term value of SOL, improves monetary efficiency, and makes the token more attractive to both retail and institutional holders who benefit from reduced inflationary pressure.