$WET Token Launch Sniping

Introduction

On December 4th, HumidiFi launched their WET token ICO on the Jupiter DTF launchpad. The launch was planned to have three phases, with the first two phases featuring an oversubscribed whitelist. In addition to the whitelist, all wallets had a 1K deposit cap, with the goal of creating a community-driven distribution for the ICO.

Instead of unfolding as planned, the token ICO was sniped within seconds, with entities using sophisticated execution techniques and many white-labeled addresses to capture a large share of the deposits. As a result, HumidiFi is planning to refund participants and give the community another chance at the ICO.

In this paper, we look at some of the top entities that sniped the ICO, how they did it, and the costs associated with their strategies.

Entity Methodology

In this analysis, we identify clusters of wallets by examining shared execution behavior, funding patterns, and transaction structure. Specifically, we group wallets that use the same priority fee or identical Jito tip amounts, display synchronized transaction timing, or originate from a common funding source such as a CEX. We also link wallets through on-chain flows, tracing how capital moves between addresses to reveal coordinated activity.

By combining execution-based signals with funding linkages, we can isolate distinct entities participating in the ICO and differentiate between independent retail deposits and organized groups using multi-wallet strategies to bypass the 1K cap. This methodology allows us to surface the actors that dominated the sale and understand the mechanisms they used to do so.

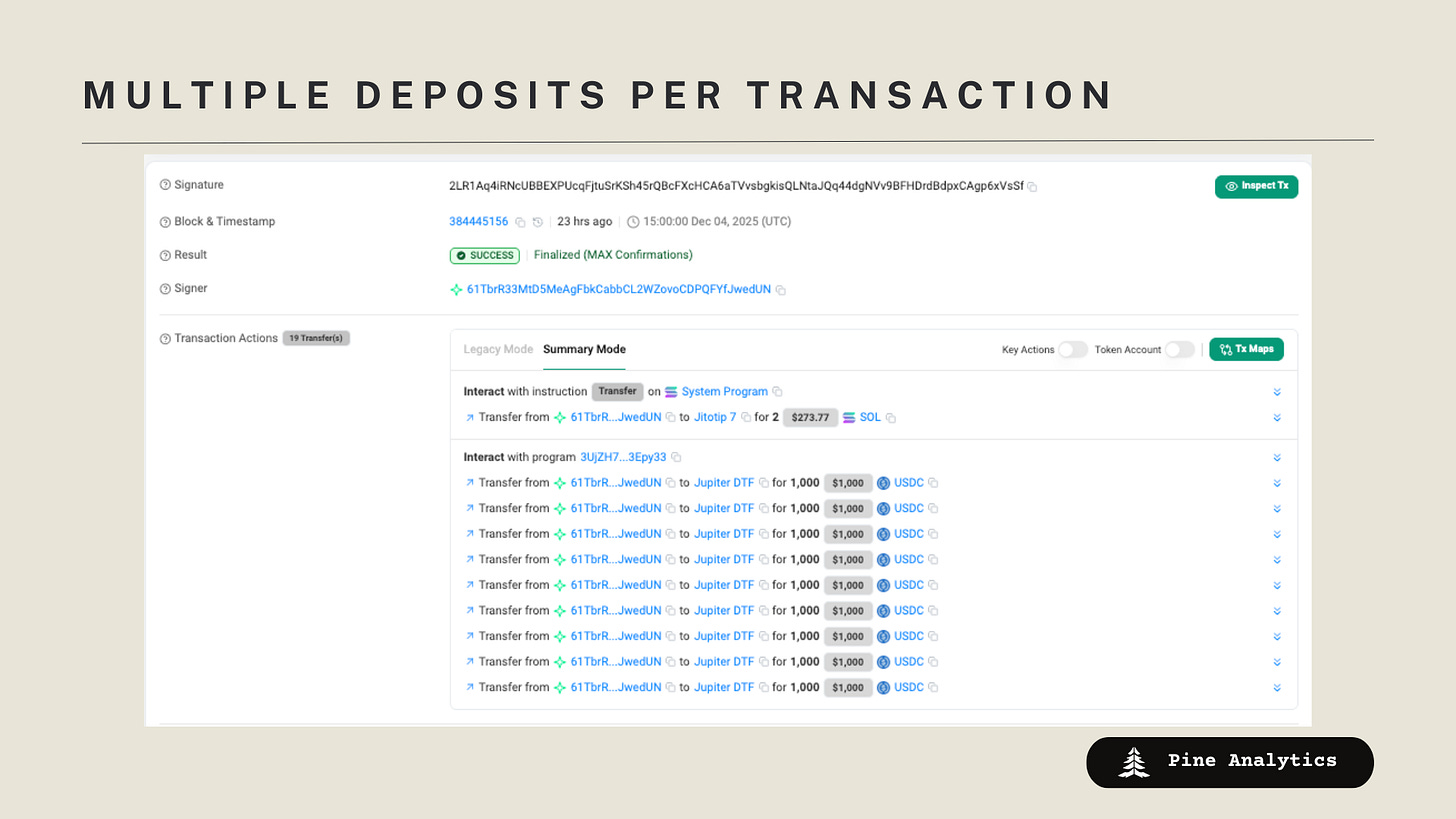

Entity 1 & 2 — Multiple Deposits per Transaction

Entity 1

Entity 1 managed to push $162K into the presale through 18 transactions, each bundling nine separate wallets depositing $1K apiece. Every one of these transactions included a 2 SOL Jito tip, adding up to 36 SOL (~$5,040) in execution costs.

Primary address:

61TbrR33MtD5MeAgFbkCabbCL2WZovoCDPQFYfJwedUN

Example snipe:

2k5Qz8TsyD2ip7387kxCbkmDqP5Fr5xcRLUe9SZj6jkKvCpWqn2yNgaRcF2yZEfei3mVfSWVmnB9BEiM8EYSYtwW

Entity 2

Entity 2 deposited $456K USDC into the presale across 76 transactions, each containing six different signers contributing $1K each. These transactions likely relied on Jito tips, since the on-chain priority fees are not large, but it’s hard to link the tips directly because they must come from a separate signer.

All wallets in this cluster were funded directly from Binance.

Example snipe:

5h1dyzeBdis5RFZBwWtQaJkyVXnRNcAcqPzFj2yyNaM9CmKDUQeqRUhqemK4wCPoXHHjVEHjxyMZokSJhgE8dtgW

Takeaway

these are the two most obvious snipers, as the transactions contain multiple deposits in one and are almost by definition abusing the intended launch mechanism. these two wallets managed to get over $600K in, or more than 30x the intended deposits for two people. it seems that by compacting these deposits into single transactions, they were pretty gas- and deposit-efficient.

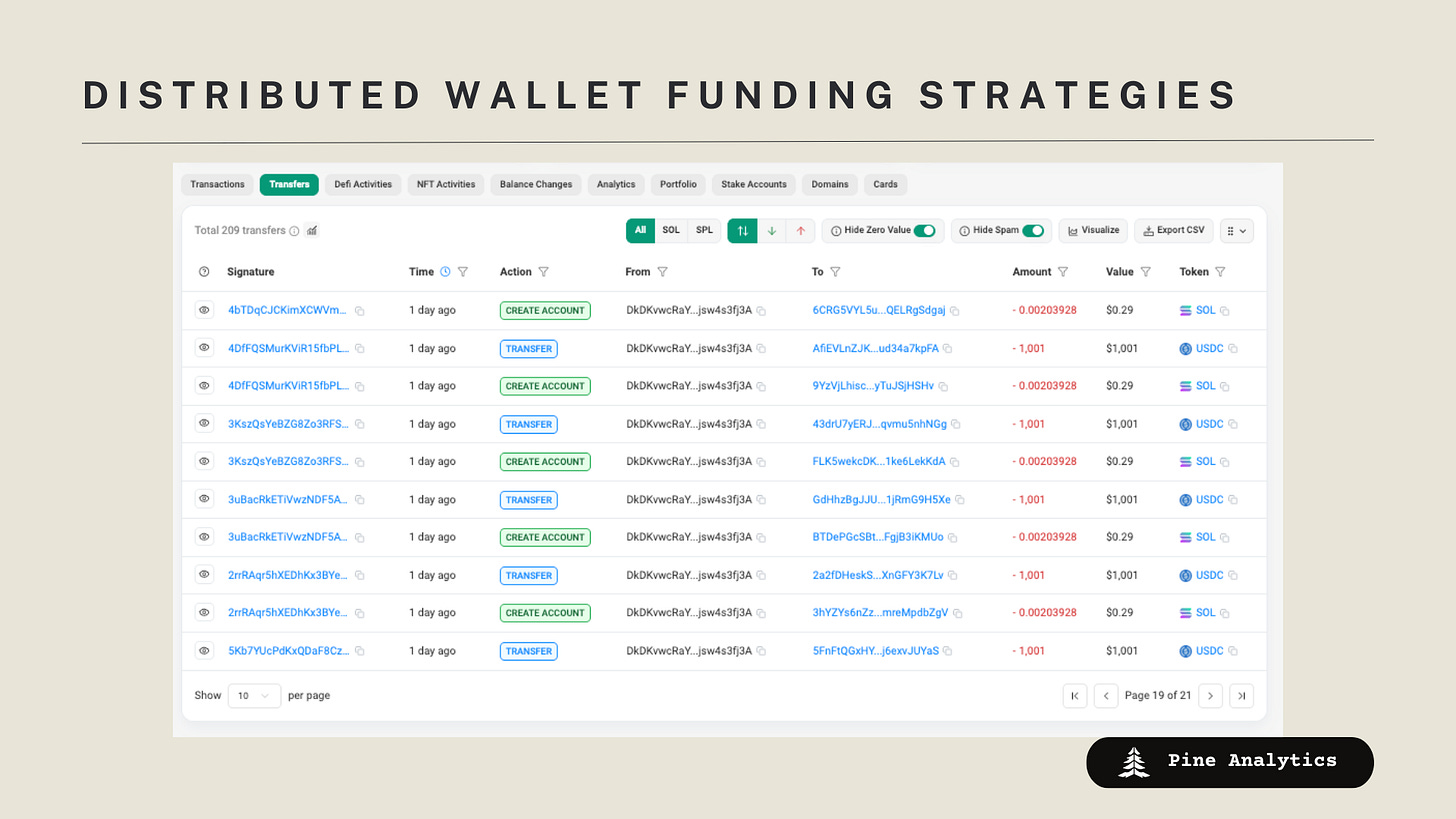

Entity Cluster 4–6 — Distributed Wallet Funding Strategies

Entity 4

Entity 4 used the wallet 7pdf1fDQgNjc5MnXoNS3dyUDMcURa1mjpATKDMVENqjD to fund 119 wallets, each depositing $1K into the presale. These deposits relied on 0.349 SOL priority fees per transaction, resulting in a total spend of roughly 42 SOL to push $119K into the launch. The funding origin for this wallet traces back to a fragmented cluster of Solana wallets that is difficult to clearly attribute, suggesting an attempt to obfuscate upstream capital.

Example Snipe: 61H37p3P7E5FgNjwYyiLdcfYuKTa5H7YCXqKRKtvNaES3Pa52fwnEE2WBXGCh4VhAMhSXRkp9epgij4FZhfN9NDA

Entity 5

Entity 5 operated similarly, using the wallet DkDKvwcRaYuNzj1pPc4SGjoBRtVCFbcDjTjsw4s3fj3A to seed 59 wallets, each contributing $1K. Execution relied on 0.633 SOL priority fees per deposit, totaling about 37.3 SOL to insert $59K into the presale. As with Entity 4, the origin wallet was funded by an opaque cluster of Solana wallets with no clear attribution.

Example Snipe: 61H37p3P7E5FgNjwYyiLdcfYuKTa5H7YCXqKRKtvNaES3Pa52fwnEE2WBXGCh4VhAMhSXRkp9epgij4FZhfN9NDA

Entity 6 — Coordinated Jito-Tip Cluster

Entity 6 stands out from other groups due to a highly specific and repeated Jito tip amount — exactly 1.030999999 SOL — used across all participating wallets and the wallets are funded with two transfers of 500 USDC. This distinctive execution pattern allows the cluster to be identified reliably even though the funding origins are partially obscured.

The entity is composed of multiple funding hubs:

Wallet A: 8fw13VPy8QvdHJh91wmHo2wv1APJDWpBzXkF6pZuaDDT

• Funded 75 wallets depositing $1K each

• Paid 1.030999999 SOL Jito tips per transaction

• Total execution cost: ~77 SOL, enabling $77K of deposits

Wallet B: 3WaHFhgk2oojwaD2xGQgLpV2ySjbQjD2BziBR7LfVj5C

• Funded 98 wallets

• Same 1.030999999 SOL Jito tip signature

• Spent just over 100 SOL to push $98K into the sale

Wallet C: 55whLMbHRwhSf1isyhGtGYTU7KMR7o4U7eZxEXeLoeDF

• Funded 101 wallets

• Same repeated 1.030999999 SOL Jito tip

• Total cost slightly above 103 SOL, corresponding to $101K deposited

A fourth large hub further expands this entity:

Wallet D: GfPkiZVBqY4E8FC3Jwg63Ro98pdnvQ6j7qCRtp8WvhA3

• Funded 297 wallets depositing $1K each

• Every deposit also used 1.030999999 SOL Jito tips

• Total cost: ~300 SOL, enabling $279K to enter the presale

• Upstream funding flowed from the USDC bridge and HyperUnit, suggesting institutional-grade liquidity

Across all four hubs, the identical Jito tip amount and synchronized funding structure make Entity 6 one of the clearest and most coordinated sniping groups observed in the launch.

Example Snipe: 2FN6GKhCXzYLLhRu6rLhR9ymwv28tvUzCWSy6de1MtErBJDcvfyPiSUJXmGY6gzgY7zDxWWSfgLzEiZUZPB9PxMH

Takeaway

Entities 4 and 5 follow a clear and common pattern: a single funding wallet seeding dozens of smaller wallets, each making a single $1K deposit. These clusters differ mainly in how much they were willing to pay in priority fees or tips, but structurally they look almost identical. In fact, most of the transactions that successfully entered the presale resemble these two clusters, just with slight variations in fee levels or wallet-funding paths.

Entity 6 appears as multiple hubs is because its funding wallets behave so similarly that they can be cleanly clustered together: each uses the exact same Jito tip amount—1.030999999 SOL—across hundreds of wallets and thousands of dollars of deposits. This level of execution uniformity is distinct from the broader set of clusters and is a strong indicator of tightly coordinated automation rather than loosely connected wallet farms.

Together, these groups show that most of the presale was dominated by replicated wallet structures—some broad and varied like Entities 4 and 5, others highly uniform like Entity 6. Whether through moderate priority fees or precise Jito-tip optimization, these clusters systematically bypassed the 1K cap and captured the majority of the sale.

Final Thoughts

One of the most striking conclusions from this analysis is that the behavior observed in the presale does not appear to come from a single sniper trying to disguise themselves with many styles of execution. Instead, the diversity of funding flows, fee patterns, wallet structures, and execution strategies strongly suggests that multiple independent actors were competing against each other to secure allocation.

Across the clusters, we see fundamentally different approaches: some relied on bundled multi-deposit transactions, others on large wallet farms with moderate priority fees, and others—like Entity 6—on extremely precise Jito tip strategies repeated across hundreds of wallets. These patterns don’t look manufactured or deliberately varied to confuse attribution. They look like separate groups deploying their own infrastructure and racing to capture a scarce opportunity.

This matters because it highlights the core limitation of a first-come, first-serve presale with strict per-wallet caps. When demand is high and allocation is scarce, the advantage naturally shifts to participants with automation, execution pipelines, and the ability to scale wallets horizontally. Even if the launch had filtered out one or two execution patterns, the majority of the sniping still would have occurred, because the actors weren’t relying on a single technique—they were competing with different ones.

In the end, this launch demonstrates that FCFS distribution creates an adversarial environment where sophisticated participants consistently outperform everyone else, regardless of how many surface-level heuristics are blocked. If the goal is genuine community distribution, the mechanism itself must evolve; otherwise, competitive botters will continue to dominate through whatever execution paths remain open.