Why $ONDO is Overvalued

Performance, Valuation, and Competition

Introduction

Despite ONDO's significant price decline since our last analysis, its recent price spike warrants renewed scrutiny of the protocol's fundamentals. While the token has retraced from previous highs, current valuations still appear disconnected from underlying metrics. This follow-up analysis examines ONDO's protocol activity, revenue generation, and market positioning, revealing why even at these lower levels, the token may be significantly overvalued. By comparing updated data with our previous findings, we'll demonstrate why recent price momentum appears unsupported by fundamental improvements in the protocol's business model or adoption metrics.

Project Overview

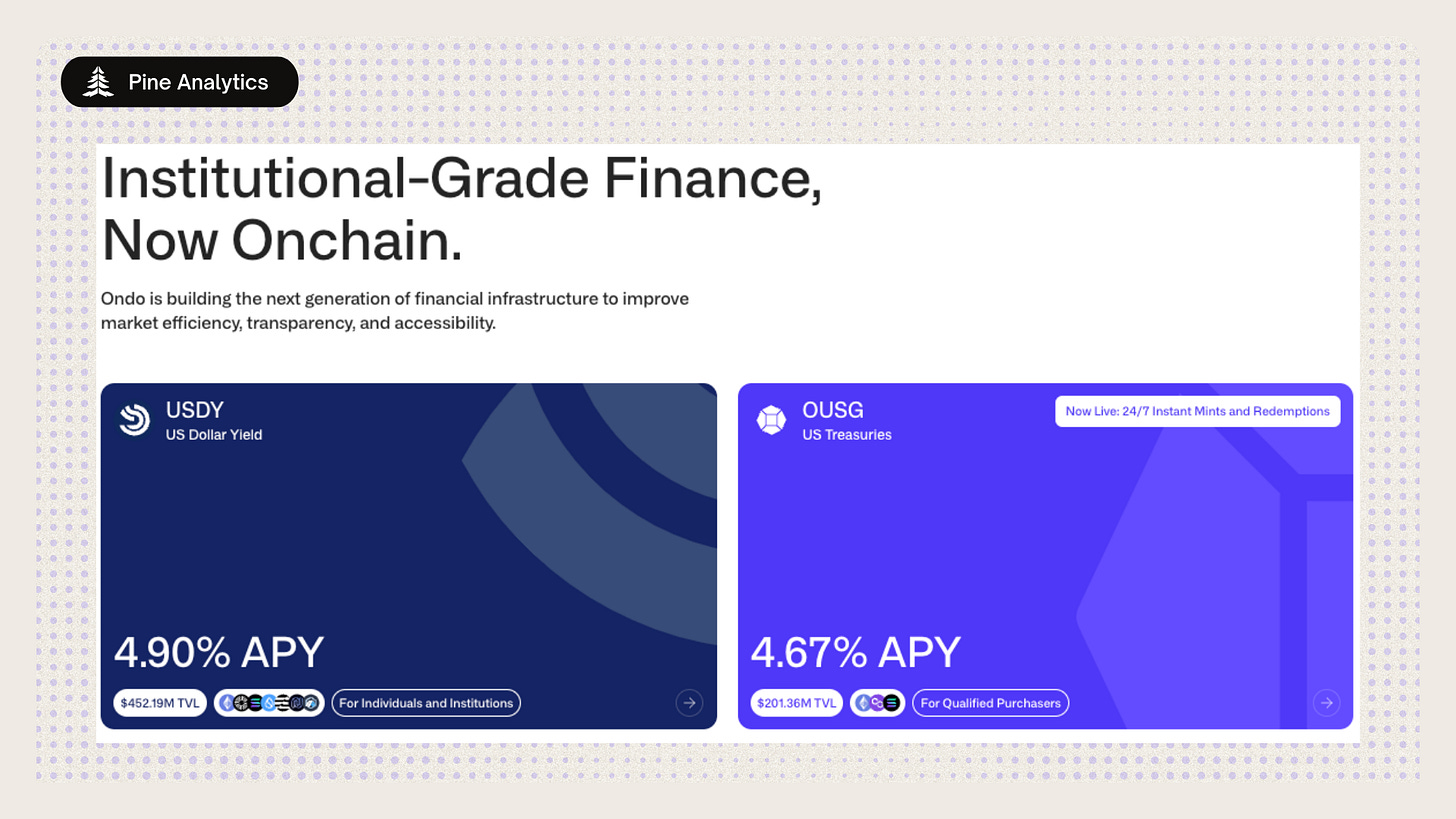

Ondo Finance offers two key financial products designed to merge the stability of traditional finance with the flexibility of DeFi:

USDY (US Dollar Yield Token): This tokenized note is secured by short-term US Treasuries and bank deposits, providing high-quality, USD-denominated yields. It is accessible to non-US investors and combines stablecoin accessibility with regulated financial security. The onboarding process includes KYC, followed by investment and token minting steps, with a redemption feature compliant with US regulations. Interestingly enough, if you are in the US, you can just buy the token without KYC from a DEX.

OUSG (Ondo Short-Term US Government Treasuries): This product offers liquid exposure to US Treasuries with 24/7 tokenized subscriptions and redemptions. OUSG comes in accumulating and rebasing versions, providing stable returns and flexibility for various investment strategies. It offers low-risk investment with deep liquidity and instant minting and redemption capabilities, suitable for both retail and institutional investors.

Ondo Finance provides investors a way to earn yields comparable to the US risk-free rate. Both products allow investors to benefit from the stability and high-quality yields of US Treasuries.

Project Metrics

Currently, $657M has been deposited in Ondo, with about 70% in USDY and 30% in OUSG. Of this $657M in TVL, approximately $327M has been onboarded between the start of April and July of this year, showing significant growth during this period.

Holder Distribution

OUSG: 57 holders have over OUSG between Solana and Ethereum.

USDY: Around 3.8K wallets have held USDY across Ethereum and Solana, with the 3.5K of the holders on Solana.

TVL by Chain

Ethereum: 67%

Solana: 19.4%

Mantle: 3.3%

Arbitrum, Noble, Sui, and Aptos: 2.5% each

Overall, on-chain activity for these tokens started out limited due to the large redemption amounts required, and the necessity for at least $100K and KYC (Know Your Customer) verification. However, recently it has been gaining some adoption on Solana due to being able to buy it without KYC.

$ONDO Token Metrics

Use of ONDO Token

The ONDO token serves as the governance token for the Ondo DAO and Flux Finance. Holders of the token exercise control over the protocol by voting on on-chain governance proposals, which include changes to economic parameters and smart contract upgrades. The token ensures stakeholder engagement and decision-making through a structured governance process involving forum discussions and binding on-chain votes. With a total supply of 10 billion tokens and no planned inflation, the ONDO token's distribution and usage are critical for the DAO's operations and future development. Notably, there has not been a single Ondo governance tally vote since January of this year, and the last vote was to unlock $ONDO tokens.

Token Price/Market Cap

The ONDO token launched in February at around $0.20 and has experienced a significant uptrend, increasing by approximately 700% since then. Currently, the price of ONDO is $0.84, resulting in a market cap of $1.39B and a fully diluted market cap of $8.4B, with only 13.9% of the tokens circulating.

Token Unlock Schedule

The token unlock schedule reveals that approximately 8.6B tokens will be unlocked for ecosystem growth, protocol development, and private sales over the next five years. These tokens will be unlocked slightly faster than linearly, with the next major unlock cliff on January 16th 2025, which will more than double the circulating supply.

On-Chain Treasury Competition

The tokenized treasury market has become increasingly competitive, with the data showing total value locked (TVL) reaching $2.35B across 35 different products. Ondo Finance currently leads the market with their USDY and OUSG products commanding a combined TVL of approximately $657M ($427M in USDY and $201M in OUSG), though they face mounting competition from major traditional finance players who have entered the space.

Major traditional finance institutions have established significant positions, with BlackRock's USD Institutional Digital Liquidity Fund ($BUIDL) managing $542.5M in TVL and offering a 4.50% yield, while Franklin Templeton's On-Chain U.S. Government Money Fund ($FOBXX) manages approximately $410M with a 4.55% yield. These traditional finance giants bring institutional credibility and vast resources to the market, potentially challenging Ondo's growth trajectory.

The competitive landscape is particularly noteworthy given the yield differentials across products. Ondo's USDY offers among the highest yields at 4.90%, while their OUSG provides 4.84%, positioning them competitively in the yield-focused market. However, the entrance of established financial institutions has created a tight range of yields between 4.00-4.90% across most products, suggesting that competition may increasingly focus on factors beyond just yield, such as institutional relationships, regulatory compliance, and technological infrastructure.

Conclusion

Ondo Finance faces significant overvaluation concerns, particularly as its initial growth momentum has substantially decelerated and competition intensifies from traditional finance giants like BlackRock and Franklin Templeton. While Ondo maintains leadership in the tokenized treasury space, their market position faces mounting pressure from well-capitalized competitors with strong institutional relationships and established infrastructure.

Current market valuations appear particularly inflated when compared to mature DeFi protocols, especially given Ondo's stagnating growth. MakerDAO's market cap represents 17.9% of its TVL, while Ethena's market cap sits at approximately 50% of its TVL. In contrast, Ondo's fully diluted valuation of $8.4B represents nearly 13x its current TVL of $657M - a multiple that becomes harder to justify as growth plateaus. This disparity becomes even more pronounced when considering that tokenized treasury protocols inherently have lower profitability potential than lending protocols, as they must pay out the majority of yield to token holders, leaving minimal spread for protocol revenue.

If ONDO was valued using MakerDAO's TVL to market cap ratio of 17.9%, it would suggest a market cap of approximately $118M. Even applying a premium for future potential, the current $1.39B market cap ($8.4B fully diluted) appears severely disconnected from fundamentals. To justify these levels using traditional metrics like a 10 P/E ratio and assuming a 20% fee on treasury yields, Ondo would need to grow its TVL to over $93B - a 142x increase from current levels, which seems increasingly unrealistic given the slowing growth trajectory.

While the tokenized treasury market remains promising, Ondo faces significant challenges in justifying its current valuation. The protocol must not only reignite its growth but also successfully compete against established financial institutions, maintain yield advantages, and develop sustainable revenue streams - all while operating in a business model with inherently thinner margins than traditional DeFi protocols. These challenges, combined with the upcoming token unlocks that will more than double the circulating supply, suggest the current valuation remains significantly inflated.

Sources

https://flipsidecrypto.xyz/pine/2024-06-05-01-23-pm-_owwVT

https://coinmarketcap.com/

https://docs.ondo.finance/

https://defillama.com/

https://docs.ondo.foundation/ondo-dao

https://app.rwa.xyz/treasuries